The Vanguard Short-Term Bond ETF Is A Great Replacement For Cash

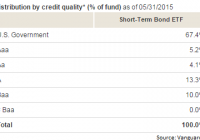

Summary The Vanguard Short-Term Bond ETF delivers excellent diversification benefits relative to the equity market without being as miserable as a savings account. The bonds in the Vanguard Short-Term Bond ETF are focused on very high credit quality but there is a small selection of lower rated bonds to enhance returns. The Vanguard Short-Term Bond ETF bond selections contain some diversification in maturity to give investors a focus on short term investments without giving up on yield. The Vanguard Short-Term Bond ETF (NYSEARCA: BSV ) is a solid bond fund for the very conservative investor that wants a place to park while earning a better return than a savings account will offer. Lately I’ve been concerned about the market being relatively highly valued. I don’t intend to retire for quite a while (measured in decades), so I’m willing to be more aggressive with my portfolio. Despite being willing to accept additional risk on my portfolio, I want to be compensated for taking risk. While I still like certain parts of the market (as shown by buying diversified REIT ETFs), I’m looking for ways to get better diversification in the portfolio. The desire for better diversification across asset classes has pushed me to make a few hard decisions. For instance, it is pushing me to slow my rate of purchases on additional equity so I can have more money on hand to buy in if we see a significant retreat in equity prices. Those expectations and desires bring to me look for some solid bond ETFs so I can at least get a little interest on the money that I would otherwise have to hold in cash. Low volatility and low correlation with the domestic stock market are major concerns, but I also want something with reasonable liquidity and low expense ratios. When the yields on bonds are terrible, and I believe that is a fair statement today, a high expense ratio would eat a substantial portion of the returns. In this case, the expense ratio is only .10%. It is in my nature to be cheap and I have to admit, that .10% sounds fair to me. It thoroughly beats many bond funds on expense ratio. How volatile is the Vanguard Short-Term Bond ETF? I started by checking for correlation with the SPDR S&P 500 Trust ETF (NYSEARCA: SPY ) by comparing the monthly changes in dividend adjusted closes over the last 8 years. The correlation was 3.34%, which is beautiful. By virtually any measure, incorporating BSV into a portfolio is going to materially reduce the risk of the portfolio. While SPY had a standard deviation of 4.6% in monthly returns, BSV only had a deviation of .777%. Low correlation and low volatility is exactly what we should expect for a fund invested in short-term high quality bonds, but it is always worth double checking. Sources of Return With the returns on short term maturities being very low, investors should consider having at least a little bit of credit risk or duration in their portfolio even if they want to focus on short term holdings. I checked both of those areas to see how the Vanguard Short-Term Bond ETF was doing on internal diversification. Credit The following chart shows the credit quality breakdown: In my opinion, this is a fairly reasonable allocation for an ETF that an investor might want to use as a substitute for cash in their portfolio if they expect to be holding that cash for a few months at a time. The ETF portfolio drops down to ratings as low as Baa but keeps the majority of their holdings in very high credit quality bonds. Maturity The next chart shows the maturity of the various bonds Again the maturity distribution looks good for short term holdings. By dividing the holdings between the different maturities rather than focusing them around a specific point there is more diversification across the short term yield curves which should produce a slight decrease in the expected level of volatility for the expected level of income. A Potential Cash Replacement Looking at the monthly returns over 8 years, I found there was only one month where the change in the dividend adjusted close was equal to 2% or greater. In that one month, it was precisely at 2%. Due to the positive returns from interest and low levels of duration and credit and risk the downside risk is fairly low. Of course, if an investor is using it as a replacement for cash they’ll need to use a brokerage that lets them buy and sell it with no commissions. Conclusion I like the portfolio for the Vanguard Short-Term Bond ETF. The yields are still weak, but that is an issue with high quality short term yields being very low rather than a problem with the underlying ETF. Given the low risk of the bond ETF, I like this fund as a source of diversification in the portfolio. It’s too bad free trading on the ETF is not more widely available, because this looks like a solid place to park cash when the market gets too rich or when investors are just looking for new options. The combination of a small amount of duration with a little credit risk makes this option more appealing to me than a fund that refused to take on any risk in those categories. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Information in this article represents the opinion of the analyst. All statements are represented as opinions, rather than facts, and should not be construed as advice to buy or sell a security. Ratings of “outperform” and “underperform” reflect the analyst’s estimation of a divergence between the market value for a security and the price that would be appropriate given the potential for risks and returns relative to other securities. The analyst does not know your particular objectives for returns or constraints upon investing. All investors are encouraged to do their own research before making any investment decision. Information is regularly obtained from Yahoo Finance, Google Finance, and SEC Database. If Yahoo, Google, or the SEC database contained faulty or old information it could be incorporated into my analysis.