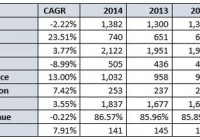

Summary Arizona/Nevada are currently weak markets but will marginally outperform long-term. The Non-Utility business is incredibly strong and provides some geographically-diversified earnings. Expect the dividend to be increased aggressively in the coming years, growing into a more healthy yield. Southwest Energy (NYSE: SWX ) is engaged in the business of purchasing, distributing, and transporting natural gas for customers in portions of Arizona, Nevada, and California. Arizona and Nevada are the primary markets for Southwest Energy, where the company operates as the largest supplier of natural gas to residential consumers and businesses. While the business model may seem simple (buying gas and transporting to the end customer) the reality is the company must operate an intricate network of transmission mains, peak shaving/storage stations, and a web of pipelines to get natural gas from point A to point B efficiently. As you may expect, businesses like Southwest Energy are regulated by state authorities much in the same way power-generating utilities are. Like other utilities, Southwest Energy offers a safe, predictable stream of cash flow and a healthy dividend. But is the company best-of-breed? Historical Operating Results (click to enlarge) What should jump out at investors first is the growth in non-utility revenue. Long-term investors likely first entered the company for the stable income stream from the Utility business but the company has increasingly diversified its revenue base. The Non-Utility Revenue segment derives its income from a handful of operating subsidiary companies (NPL Construction, Link-Line Contractors, W.S. Nicholls Construction, and Brigadier Pipelines) that are broadly referred to as the Centuri segment. Through these subsidiaries, Southwest Energy primarily serves the hook-up needs of other energy service companies (for instance, planning and installing the natural gas lines for a new residential community). This part of the business is geographically-diversified, serving customers across the United States and parts of Canada. Unlike some utilities that run such businesses, parent company Southwest Energy is not responsible for a large portion of these revenues, making up only 12% of Centuri revenue in fiscal 2014. Given the relatively weak economic outlook for Nevada and Arizona (unemployment and net population growth remain stubbornly weak compared to national averages), it is likely that future revenue growth will likely come from this segment outside of years that see exceptional weather-related demand for natural gas. So while this operating segment is still a small contributor to profits (13% of net income in 2014), investors would be wise to keep an eye out for continued growth here. Due to recent acquisitions and solid organic growth, revenue in 2015 from this segment is set to touch $1B, a year/year revenue increase of 35%. Also of note is that Southwest Energy has been significantly increasing its investments in its business in relations to maintenance. There have been stronger scrutiny lately at a both a state and federal level relating to pipeline safety and system reliability which has led the company to significantly increase investment from 2010 levels. Contributing to this ramp-up in spending is the pending filing for a rate increase in Arizona in 2016. Accelerated capital expenditures leading into a rate increase filing is fairly commonplace within the utility industry so that the company can note the increased capital expenditure costs prior to filing. Thus, this trend isn’t changing anytime soon so don’t expect significant improvement on this line item in 2015 or 2016. The Dividend The company currently yields approximately 3% on a 50% payout ratio. This gives the company plenty of room to raise the dividend more in-line with the peer average (60-70%), which is management’s target. With a three-year dividend growth rate of over 10% currently and no slowdown expected, I think it is likely we will see the dividend growth stick to that level at a bare minimum, with annual increases averaging 12% over the next three years more likely. As with all dividend investments, I urge long-term dividend investors to look forward ten years from now or further in their planning. So while shares might not be sporting the yield of utility stalwarts like Duke Energy (NYSE: DUK ) currently, Duke has only increased the dividend 2% a year on average for the past three/five years and that is unlikely to change. Investing in a smaller company with growth ahead of it like Southwest may allow you to see your yield on cost pass Duke Energy’s in the long run. Compounding returns and accelerated dividend increases can close that gap much quicker than you may think. Conclusion At the moment, this is a long-term play. I wouldn’t buy the company for the yield today, but I certainly would consider buying it for the returns I would likely receive on my investment ten years from now. While the American Southwest is not my preferred investment region in North America, it is my second favorite. The company’s primary markets have had a tough time of it coming out of the recession, and while that story is unlikely to change short-term, I do think there will be outsized improvement here in the coming years. The Southwest remains a long-term favorite of Americans seeking lower cost-of-living and the job market has begun to show some green shoots of improvements. Broadly, my investment decisions assume continued population loss from the Northeast and Western regions and a move to the Southwest and Southeast, a trend that is solidly anchored in recent and projected data. As such, I think this is a solid play for dividend investors and the current price of about $72/share, like many utilities, represents a significant discount to what investors were paying mere months before. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.