ONEOK Continues To Be Dragged Down By Its MLP

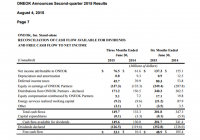

Summary ONEOK reports its Q2 2015 results. Numbers were inline with guidance. However, the stock still fell on the news. ONEOK will not recover until its MLP ONEOK Partners achieves sustainable levels of cash flows. As a holder of several large cap midstream MLPs and General Partners, the performance of ONEOK, Inc (NYSE: OKE ) has been extremely disappointing. When I bought the stock, it had just provided some very bullish Increase guidance for 2015 . Yet, due to the collapse seen in commodity prices late last year, the company slashed its dividend growth estimates considerably. Add to that the general market sell off, ONEOK has been a house of pain to hold. Last week, ONEOK reported its Q2 2015 results. All things considered, these were strong numbers. Net income was $76.5M, up 24% from $61.6M last year. On a per share level, net income was $0.36, up a similar 24% from $0.29 per share last year. Distributions declared from ONEOK Partners (NYSE: OKS ), which constitute the vast majority of ONEOK’s cash flows, were $171.2M, up 9% from $156.5M last year. As for Cash flow available for dividends, this key metric was $149.6M, up 15% from $130.0M last year. This left ~$23M in excess cash flow and resulted in a strong 1.18x dividend coverage ratio, versus ~$11M in excess cash flow and 1.09x coverage last year. (click to enlarge) Guidance remains unchanged As for ONEOK’s guidance, not much has changed. The company expects cash flow available for dividends to range from $570M to $650M (~$153M per quarter), and excess cash flows to range from $90M to $120M (~$26M per quarter). Given these are close to the numbers posted for the first half, this guidance does not seem very hard to achieve. Results from ONEOK Partners need to improve ASAP While ONEOK numbers were good, the same could not be said for the MLP ONEOK Partners. This is important given that the vast majority of ONEOK’s cash flows come from this unit. For the quarter, ONEOK Partners posted $387.3M in adjusted EBITDA, a key metric for profitability in MLPs, $276.9M in DCF, and a 0.88x coverage ratio. This compares to adjusted EBITDA of $360.9M, DCF of $272M, and a coverage ratio of 1.02x, last year. In other words, ONEOK Partners did not fully cover its distribution in Q2 2015, though it did see an improvement from the 0.60x coverage ratio for Q1 2015. This shortfall is largely a result of weak commodity price, mainly NGLs and natural gas. While the revenues for the MLP are mostly fee-based, the commodity margin based contracts have taken a beating, resulting in much weaker profits. ONEOK Partners is trying to grow its way out of its problem, hoping to expand volumes on its systems by bringing online flare gas and adding processing and gathering capacity to underserved fields. However, in order to grow, ONEOK Partners needs to spend money on its capital programs. This has forced the company to issue units via its ATM program, selling 5.5M units for $208.1M in the quarter. With the yield above 10%, this is some very expensive capital to raise. Nevertheless, ONEOK Partners is expecting its adjusted EBITDA to tick higher in the next few quarters, with the guidance range for the full year reaffirmed at $1.51B to $1.73B, or a midpoint of ~$405M per quarter, up 5% from the Q2 numbers. Assuming a similar DCF to adjusted EBITDA ratio, this increase should put the company closer to a 1.00x coverage ratio. Conclusion While the numbers from ONEOK were strong, ONEOK Partners is the reason the stock is not trading higher. As long as the MLP remains underwater with its distribution, the market will continue to price both with additional risk as shown by the near 7% yield for ONEOK and 10% yield for ONEOK Partners. One way ONEOK could solve its problems is via a consolidation similar to that of Kinder Morgan (NYSE: KMI ) or Williams Companies (NYSE: WMB ) (NYSE: WPZ ). However, I do not see a move like this coming anytime soon given the weak commodity price environment. Disclaimer: The opinions in this article are for informational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned. Please do your own due diligence before making any investment decision. Disclosure: I am/we are long OKE, OKS, WMB, KMI. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.