Investors Turn Away From Municipal Bond Mutual Funds

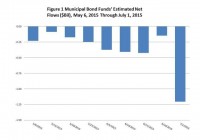

By Patrick Keon Municipal bond mutual funds have suffered nine consecutive weeks of net outflows. During this time period municipal bond fund have had approximately $3.3 billion leave their coffers. This streak of negative flows comes on the heels of sixteen straight months of positive flows during which time the group took in $31.9 billion in net new money. The lion’s share of the outflows (-$2.5 billion) during the last nine weeks have come from funds in Lipper’s national municipal fund classifications. Amongst those, high yield municipal debt funds (-$1.5 billion) and short-term municipal debt funds (-$0.5 billion) have experienced the largest negative flows. Some of the funds with the largest outflows over the last nine weeks include Nuveen High Yield Municipal Bond Fund ( NHMAX) (-$636 million), Invesco High Yield Municipal Fund (MUTF: ACTHX ) (-$178 million) and Oppenheimer Rochester High Yield Municipal Fund (MUTF: ORNAX ) (-$162 million). Over a third of the total net outflows (-$1.2 billion) for municipal bond flows occurred last week and once again high yield municipal debt funds were responsible for the largest chunk (-$0.47 billion) of the activity. It is possible that the Puerto Rico debt crisis may have been a factor in last week’s spike in outflows from high yield municipal debt funds as both the Oppenheimer Rochester High Yield Municipal Fund and Invesco High Yield Municipal Fund have significant holdings in Puerto Rico municipal debt. (click to enlarge) Share this article with a colleague