Tag Archives: acpw

Active Power: An Analyst Catalyst Candidate?

ACPW reported an impressive Q2 which put the finishing touches on a further impressive 1H. The analyst community has taken notice. With changing estimate trend lines is ACPW an Analyst Catalyst candidate? Seeking Alpha readers who follow my writings understand just how lucrative identifying this can be. It looks like analysts are beginning to see a good story and a story in which they are collectively getting more and more confident in when it comes to Active Power (NASDAQ: ACPW ). After the company’s Q2/15 reporting confirmed what is shaping up to be an inflection point for operations analysts have come to modeling Active Power more bullish than prior and, importantly, more bullish in trend than prior. This matters in a big, big way for getting some volume into the name and for getting some valuation multiple expansion. I detailed the Active Power quarter reported in an initiation note in which I concluded the same as apparently what is now becoming a very consensus analyst opinion -Active Power is finally on its way to healthier income statement performances. Still, to see analysts turn estimate trends positive is encouraging and could, with a quarter or two of further execution, turn into the phenomenon I’ve called the Analyst Catalyst. I’ve detailed this before for Seeking Alpha readers in other names near inflection points of several varieties (growth rates, cash flow positive, EBITDA positive, etc.). It’s been a long, long time since Active Power was the recipient of such faith from the markets and that is reflected in its share price. A change would be welcomed by shareholders and is something that shareholders should pay close attention to. Active Power is currently modeled for steady increases to revenue, EBITDA, and fully diluted EPS to end full year 2015. Through 1H/15 the company remains well on pace to hit these marks. These would be higher highs put in for the noted metrics after the company bottomed in each category in full year 2014. Full year 2014 marked Active Power’s third consecutive year of posting lower lows for the line items – something that drove its stock price lower, investor sentiment to all-time lows, and analyst faith to a point of non-existence. Obviously the modeling change to growth in these categories for full year 2015 and for full year 2016 speaks to the turnaround at the company in progress: You can see in the table above that Active Power is expected to achieve the all-important EBITDA breakeven at full year 2015 reporting with the company going on to report its first EBITDA positive year in four years at full year 2016 reporting. That will be a huge milestone for the company and one that I think will open the name up to significant investment from institutions and other asset managers that can’t or choose not to invest in non-EBITDA positive names. This is more common than most understand. Also, it’s excellent to see that Active Power is modeled to reach near breakeven for EPS in full year 2016 reporting. Again though, maybe the best part of all this is that Active Power has now established positive estimate trends across these categories. In beating estimates, Active Power has essentially validated the reporting analysts’ models – which makes them look smart, which they like. As a natural consequence of both, analysts have had to positively revise estimates at each quarter reported based on the previous beat. I believe these positive revisions, which take place early to mid-quarter, help propel volume and upward share price movement between quarterly reporting. This cumulative effect of analysts powering shares higher at early or mid-quarter AND company quarterly reporting powering shares higher works to create a constant cycle of volume and higher pricing. In general I refer to this as the Analyst Catalyst. You can see in the charts below Active Power might be on the brink of such a bullish cycle: (click to enlarge) (click to enlarge) (click to enlarge) (click to enlarge) I believe that we should see a continued Analyst Catalyst take shape at Active Power as the company continues to impress at quarterly reporting. Active Power is showing excellent trend lines for income statement line items and for key metrics reported as a result of its maturing sales team (which the cumulative effect of this is hard to model) and its growing more well-known value prop. Both should make sure that Active Power continues in its turnaround success and in reshaping its total income statement. I’ll provide updates as I see estimates positively or negatively revise. Good luck everybody. Editor’s Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Active Power: At An Inflection Point?

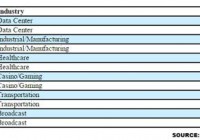

ACPW is a name that has long been a disappointment. But it appears that new management is showing to have an effect on shaping operations at the company – ACPW just reported its sixth quarter of greater than 1:1 book/bill. ACPW is also growing sales while managing higher gross margins – this had the effect of reducing overall cash burn, always a concern for microcaps. If ACPW can sustain its operating momentum it should scale up market cap with each quarter reported as the niche has a well-established EV/revenue multiple. Active Power (NASDAQ: ACPW ) is an interesting name that I came across recently. The company’s headquarters is coincidentally located just a few blocks away from my home. After passing by its offices time and time again, and this is a name that I’ve seen trend in the social arenas a few times over the last year, I decided to take a look into the filings. What I found looks like a company that might be at an inflection point that has long been in the making. First, ACPW is “engaged in designing, manufacturing and selling of flywheel-based uninterruptible power supply (“UPS”) products and modular infrastructure solutions (SOURCE: ACPW 10-K)”. Put simply, the company helps regulate power to facilities and entities that can ill afford to not have a steady power flow; and provides essential infrastructure to facilities and entities that want greater control over microgrids. The latter functionality taps into the burgeoning market for off-grid power production from a single or multiple sources of alternative energy production (e.g. solar power installations, wind power farms, etc.). Both UPS power regulation and microgrid applications are growing more evident value-props in 1) an increasingly stressed electrical infrastructure (international electrical infrastructures are already stressed) and 2) an infrastructure in which microgrids (read: hospitals, university campuses, massive server host facilities, etc.) are becoming more valuable. While these are long term, secular trends to be sure – there is no denying that the visibility of the necessity for equipment and services provided by ACPW is increasing. In that the value prop and visibility of value prop are set up in this instance to be longer term, I’m viewing ACPW as strictly a long-term buy and hold opportunity. Shares of ACPW likely will not trade sharply higher overnight, but I believe they will trade higher steadily over extended durations. (click to enlarge) In saying that, through 1H/15 reporting ACPW is showing to have steadily improving operations and a more consistently stable overall model. Trading at less than one times EV/revenue (TTM) and trading 30 bps below a peer group EV/revenue multiple average of 1X (consisting of Capstone Turbine (NASDAQ: CPST ), FuelCell Energy (NASDAQ: FCEL ), Maxwell Technologies (NASDAQ: MXWL ) and PowerSecure International (NYSE: POWR )), now might be a good time to consider initiating a position in ACPW. ACPW has generated ~$58 million in TTM revenues, showing a healthy revenue base for a microcap – certainly having such revenues allows the company certain flexibilities not inherent in pre/low revenue microcap models, and is on pace to achieve approximately the same figure in full year 2015 (annualizing 1H/15 performance – it should be noted that ACPW does report lumpy revenues from time to time). The company also recently posted its first quarter of positive Adjusted EBITDA in quite some time and greatly closed its long-standing net loss and negative EPS: (click to enlarge) When coupling this income statement performance with the fact that the company has ~$10.6 million in C&CE on its balance sheet, $37.4 million in assets, $19.8 million in liabilities, and $5.5 million in debt, I consider the company to not be at any near-term structural risk. ACPW’s cash, which is always important to monitor in this market cap space, should last at least the next 12 months. I anticipate the cash balance will likely last much longer, basing this assumption on ACPW’s 10-K filing and cash burn generally associated with total net loss. I could realistically see full year 2015, which through 1H/15 ACPW has shown roughly half the total cash burn as 1H/14, being the lowest cash burn print in 4 years . If ACPW can prove out 2015 to be at or near cash flow breakeven, management has not given guidance to this, this would materially move forward the bull case. Typically with microcaps, dilution and/or a reliance on debt as a result of high rates of cash burn is at or near the top of the risk list. ACPW, depending on sales ramp, might be close to negating this risk. In regards to sales at ACPW, upon reviewing the company’s 10-K filing for the year ended 12/31/14 this was a red flag to me in considering ACPW for a bullish recommendation. I noticed that the company had, as of its now 6-month-old 10-K filing, a history of falling sales on flat operating expenses – which was particularly concerning. I also knew that ACPW had changed management teams less than two years ago and the lack of progress visible on the topline was adding to my initial concerns. However, when viewing the current year’s Q1 and Q2 10-Q filings, of course, I saw the data illustrated in the image above which speaks quite to the contrary of the performance in the 10-K. ACPW appears to have turned a corner in selling as of the first two quarters of 2015. Still, even knowing this, it was encouraging to see that ACPW broke out its sales in its August Investor Deck into book to bill ratios. ACPW, as of Q2/15, reported its sixth consecutive quarter of a greater than 1.0 book to bill ratio – this has led to a much healthier trend line: (click to enlarge) Again, this increased consistency and overall scale has led to a return to positive Adjusted EBITDA for ACPW as well as increasing gross margins – another sign of increasing operating health: (click to enlarge) Finally, it should be noted that ACPW has fragmented and diversified both its geographical revenue dependence as well as its dependence on any singular revenue channel – yet more reasons to believe that the increased book to bill ratio is sustainable under the new regime: (click to enlarge) All told I believe ACPW is deserving of a hard look at this point in its development by those interested in securing an ownership in electrical grid and microgrid management. I don’t believe there is any denying that there are secular growth trends supporting both a need and desire for these types of services. ACPW, while being largely a disappointment since its IPO many years ago, appears to be changing course under new management. The story at ACPW has been slowly progressing – to management’s credit this does have quite a bit to do with the fact that ACPW is a capital equipment company – but it is now having a positive effect on the company’s health. If ACPW is at an inflection point, which I’m leaning heavily into the fact that it is, it should be able to grow its market cap. Despite improved financial performance in the first half of the year, the stock has not moved. The realization of a continuation of greater than 1:1 book to bill ratios bodes well for the company and its shares. Good luck everybody. Editor’s Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.