PMR Vs. RTH: Using Your Discretion

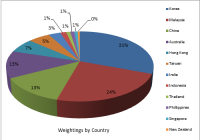

Consumer Cyclicals and Consumer Non-Cyclicals may be invested in separate ETFs. An alternative is to choose a ‘blended’ Consumer Cyclicals and Non-Cyclical funds. Blended funds happen to be top performers in their asset class. Consumers drive the economy of the United States. Household spending accounts for, roughly, 70% of the US economy. Some of that spending is done of necessity: food, clothing, transportation, home heating and medical costs to name a few. These fundamental things of life which one must purchase, as time goes by, are classified as ‘ non-discretionary ‘ items. On the other hand, consumer capital which remains after the bills have been paid may be spent as one chooses: entertainment, travel and leisure, home improvements or durable goods. This is classified as ‘discretionary spending’. So important are the differences between discretionary and non-discretionary spending, investment fund managers carefully delineate the two into different sectors. Further, the non-discretionary sector is considered a ‘defensive’ sector since consumers must continue to spend for goods and services produced by those companies which in that sector; whereas discretionary spending is considered cyclically sensitive , that is to say that consumers will spend less on certain items when the economy slows and consumers are uncertain about jobs and incomes. The question the potential investor might ask, especially in the light of economic global uncertainty, is it prudent to invest in the consumer discretionary sector if the economy might contract a bit? The answer is quite general: it is extraordinarily difficult to pick market tops or bottoms. The best any individual investor might do is to accumulate shares through disciplined investing and dollar cost averaging over both good and bad times. If so, does it make sense to have both types in a portfolio? Fortunately, a third alternative is available. There are retail ETF investment products which offer a blend of both consumer cyclical and non-cyclical companies. Two of these are top performers: the Market Vectors Retail ETF (NYSEARCA: RTH ) and the PowerShares Dynamic Retail Portfolio ETF (NYSEARCA: PMR ) . (click to enlarge) According to Van Eck Global , RTH tracks their own Market Vectors US Listed Retail 25 Index (MVRTHTR) , “… a rules based index intended to track the overall performance of 25 of the largest US listed, publicly traded retail companies …” The fund consists of 25 US listed retailers. According to Invesco , PMR is based on the Dynamic Retail Intellidex Index filtering companies based on “… price momentum, earnings momentum, quality, management action, and value …” The fund consists of 30 US listed retailers. Although the funds come under the heading of ‘Consumer Discretionary’ (using the Seeking Alpha ETF Hub filter ) , they are actually a blend of both. The Market Vectors Retail fund blends 55.8% of Consumer Discretionary, with 34.2% of Consumer Staples and some Health Care 9.9%. The PowerShares Dynamic Retail Portfolio is a blend of 50.09% Consumer Discretionary, 41.95% Consumer Staples, 2.75% Industrials, 2.65% IT and 2.54% Materials. Hence both funds are similar in the number of holdings but differ in the underlying tracking indexes; both funds have comparatively few holdings yet perform rather well. The table below lists four of best performing funds in this sector. Fund Name Number of Holdings 1-Month 1-Year 3 Year Type Market Vectors Retail ETF (RTH) 26 -2.75% 21.63% 75.13% Blend of cyclical, non-cyclical and HealthCare Consumer Discretionary Select Sector SPDR ETF (NYSEARCA: XLY ) 88 -2.71% 14.13% 69.11% Consumer Discretionary PowerShares Dynamic Retail Portfolio ETF (PMR) 30 -3.64% 12.79% 55.46% Blend of cyclical, non-cyclical, IT, Industrials and Materials Vanguard Consumer Discretionary ETF (NYSEARCA: VCR ) 385 -2.94% 12.67% 68.92% Consumer Discretionary Data from Seeking Alpha ETF Hub Since RTH leads the similarly constructed PMR, it would be interesting to make a side-by-side comparison and perhaps determine what makes the difference. Surprisingly, the funds have few companies in common. With the exception of Home Depot (NYSE: HD ) at 8.57% of RTH vs 4.93% of PMR, the weighting of the other companies in common, are roughly the same. RTH with Weightings RTH with Weightings PMR with Weightings PMR with Weightings Costco (NASDAQ: COST ) 5.07% Ltd Brands (NYSE: LB ) 3.07% Costco 5.033% Ltd Brands 5.41% CVS Caremark (NYSE: CVS ) 6.90% Target (NYSE: TGT ) 4.35% CVS Caremark 4.78% Target 4.913% Home Depot 8.57% Walgreen (NASDAQ: WBA ) 5.69% Home Depot 4.93% Walgreen 5.041% Kroger (NYSE: KR ) 4.43% Whole Foods (NASDAQ: WFM ) 1.47% Kroger 5.274% Whole Foods 2.71% Data from Van Eck and Invesco Next, since the top ten heaviest weighted companies affect the overall performance of a fund, the funds ten heaviest weightings should be compared. The bar charts below, demonstrates that PMR’s top ten heaviest weighted holdings are pretty much evenly distributed, and slightly biased towards Consumer Staples at about 56.253% of those top ten. It should also be noted that about 46.54% of the fund’s total holdings are concentrated in the top ten. Data from Invesco The next table demonstrates that RTH’s top ten heaviest weighted holdings are not as evenly distributed as PMR and has a Consumer Discretionary bias at 54.85% of the top ten. Further a large portion of that is concentrated in the top two holdings Amazon (NASDAQ: AMZN ) and Home Depot , accounting for 33.06% of the top ten and almost 22% of the funds entire holdings. Lastly, 65.63% of RTH’s total holdings are concentrated in those top ten holdings. Data from Van Eck Hence, it seems that RTH has a slightly more bias towards Consumer Cyclicals than PMR and is skewed towards its heaviest weighted holdings (as of September 18), and then towards two of those top ten. On the other hand, PMR has a more even distribution of its top ten holdings and those top ten holdings account for less than half of the portfolio’s total holdings. Lastly, a few ETF technical items need to be compared. Fund and Inception Date 30 day SEC Yield Shares Outstanding Net Assets Net Expense Ratio Price/ Earnings 3 year Beta Open Option Interest RTH 12/20/2011 1.19% (annual Distributions) 2,671,531 $204.2 million 0.35% capped until 2/1/2016 20.00 0.88 Yes PMR 10/26/2005 0.70% 650,000 $25.103 million 0.63% 20.83 0.89 Yes Data from Invesco and VanEck The entire point of the matter is this: for a disciplined investor with limited funds, building a well-diversified concise portfolio of ETFs with the long term in mind, there’s no need to allocate towards Consumer Cyclicals and Non-Cyclicals separately. Instead, by selecting one of the available funds with a blend of Consumer Cyclicals and Non-Cyclical, will result in a far more efficient way to invest, and by needing to allocate into one blended fund instead of two separate funds will save on management fees and commissions over the long term. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: CFDs, spreadbetting and FX can result in losses exceeding your initial deposit. They are not suitable for everyone, so please ensure you understand the risks. Seek independent financial advice if necessary. Nothing in this article should be considered a personal recommendation. It does not account for your personal circumstances or appetite for risk.