Syngenta AG’s SYT full-year 2016, diluted earnings per share, excluding restructuring and impairment charges, came in at $ 17.03 per share (or $ 3.4 per ADR), down 4.2% from $ 17.78 reported in the year-ago period.

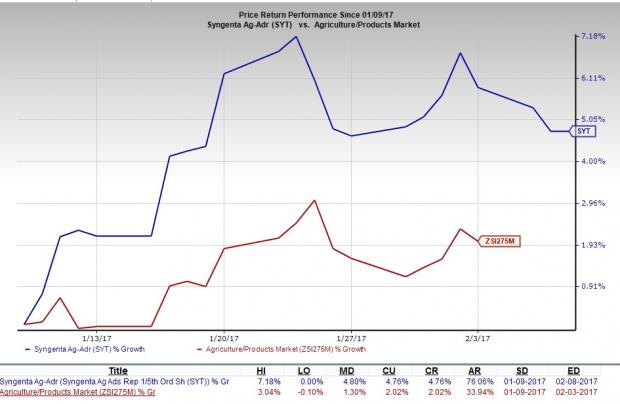

However, over the last one month, shares of this Zacks Rank #3 (Hold) stock recorded a return of 4.76% – outperforming 2.02% return provided by the Zacks categorized Agriculture/Products industry. The company is poised to grow on the back of greater operational efficacy and ChemChina’s buyout offer.

Revenues

Total group sales for fourth-quarter 2016 were $ 3,172 million, marginally down by 0.3% year over year.

Full-year 2016 group sales were $ 12,790 million compared to $ 13,411 million at the end of 2015.

Revenue Details

Revenues of Europe, Africa, and the Middle East region came in at $ 572 million, up 16% year over year.

North American revenues were $ 656 million, down 17% year over year.

Latin American revenues were up 2% year over year to $ 1,253 million.

Sales of Asia Pacific region were $ 504 million in the quarter, up 9.3% year over year.

Revenues of Lawn and Garden during the quarter were $ 187 million, marginally down by 1% year over year.

Margins

At the end of 2016, earnings before interest, tax, depreciation and amortization (EBITDA) margin was 20.8%, up 10 basis points year over year. Operating margin was 12.9% compared with 13.7% at the end of 2015.

Cash Flow

At the end of 2016, Syngenta’s free cash flow came in at $ 1.4 billion as against $ 806 million recorded in the prior-year period. Business working capital, as a percentage of sales, was 40% compared with 38% at the end of the 2015. Capital expenditure (fixed inclusive of intangibles) was $ 575 million at the end of the year, while net debt totaled $ 2.3 billion.

Outlook

Syngenta believes that its successful buyout by ChemChina would mitigate issues associated with the turbulent market conditions and make it more competent to operate amid all headwinds. Amid industry consolidation, ChemChina’s buyout of Syngenta would cushion it against the impact of low grain prices and scarcity of credit plaguing the Latin American farmers.

Syngenta anticipates to close its deal with ChemChina by the end of first-half 2017. Moreover, the takeover is likely to reinforce Syngenta’s investments in innovation. This, in turn, would enhance its product portfolio. Other than this, the company intends to generate more savings on the back of its ongoing accelerating operational leverage (AOL) program. This program is estimated to help the company reap savings worth $ 1 billion, by the end of 2018.

Syngenta AG Price, Consensus and EPS Surprise

Syngenta AG Price, Consensus and EPS Surprise | Syngenta AG Quote

Stocks to Consider

Some better-ranked stocks within the industry are listed below:

Albemarle Corporation ALB has a positive average earnings surprise of 27.13% for the trailing four quarters and currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here .

Arconic Inc. ARNC presently carries a Zacks Rank #2 and has a whopping positive average earnings surprise of 79.97% for the last four quarters.

Ashland Global Holdings Inc. ASH also holds a Zacks Rank #2 and has a positive average earnings surprise of 2.61% for the past four quarters.

Just Released – Driverless Cars: Your Roadmap to Mega-Profits Today

In this latest Special Report, Zacks’ Aggressive Growth Strategist Brian Bolan explores a full-blown technological breakthrough in the making – autonomous cars. He also spotlights 8 stocks with tremendous gain potential to feed off this phenomenon. Click to see the stocks right now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ashland Global Holdings Inc. (ASH): Get Free Report

Albemarle Corporation (ALB): Get Free Report

Syngenta AG (SYT): Get Free Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International