Scalper1 News

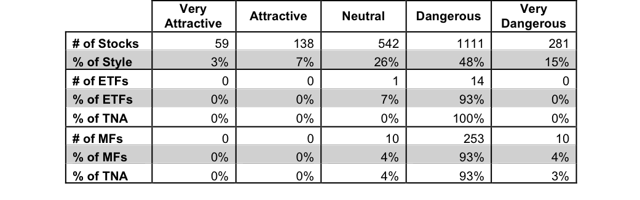

Summary In this report, we focus on how much Small Cap Value style fund managers allocate to the best stocks compared to how many good stocks are available in the style. Many ETFs and mutual fund managers do a poor job identifying quality stocks for their funds. These funds are not worth owning at any cost. The emphasis that traditional research places on low costs is a positive for investors, but low fees alone do not drive performance. Only good holdings can. This report shows how well Small Cap Value ETFs and mutual fund managers pick stocks. We juxtapose our Portfolio Management Rating on funds, which grades managers based on the quality of the stocks they choose, with the number of good stocks available in the style. This analysis shows whether or not ETF providers and mutual fund managers deserve their fees. For example, if a fund has a poor Portfolio Management Rating in a style where there are lots of good stocks, that fund does not deserve the fees it charges, and investors are much better off putting money in a passively-managed fund or investing directly in the style’s good stocks. On the other hand, if a fund has a good Portfolio Management Rating in a style where there are lots of bad stocks, then investors should put money in that fund, assuming the fund’s costs are competitive . Figure 1 compares the number of good stocks in the Small Cap Value style to the number of good funds. 197 out of the 2131 stocks (over 10% of the market value) in Small Cap Value ETFs and mutual funds get an Attractive-or-better rating. Zero out 15 Small Cap Value ETFs allocate enough to quality stocks to earn an Attractive-or-better Portfolio Management Rating. Mutual fund managers have not fared any better. Zero out of 273 Small Cap Value mutual funds allocate enough of their assets to quality stocks to earn an Attractive-or better Portfolio Management Rating. ETF providers and mutual fund managers need to do a better job to justify their fees. With no high quality funds available, 100% of investor assets in Small Cap Value ETFs are invested in ETFs with Dangerous Portfolio Management Ratings. Investors have almost no choice in this style with only one ETF even receiving better than a Dangerous Portfolio Management Rating. The picture is no better for mutual fund investors as 96% of investor assets are allocated to mutual funds with Dangerous-or-worse Portfolio Management Ratings. Figure 1: Small Cap Value Style: Comparing Quality of Stock Picking to Quality of Stocks Available (click to enlarge) Sources: New Constructs, LLC and company filings The First Trust Mid Cap Value AlphaDEX ETF (NYSEARCA: FNK ) has the highest Portfolio Management Rating of all Small Cap Value ETFs and earns my Neutral Portfolio Management Rating. The Prudential Small-Cap Value Fund (MUTF: PZVAX ) has the highest Portfolio Management Rating of all Small Cap Value mutual funds and earns my Neutral Portfolio Management Rating. The iShares Russell 2000 Value ETF (NYSEARCA: IWN ) has the lowest Portfolio Management Rating of all Small Cap Value ETFs and earns my Dangerous Portfolio Management Rating. The Aston/River Road Independent Value Fund (MUTF: ARVIX ) has the lowest Portfolio Management Rating of all Small Cap Value mutual funds and earns my Very Dangerous Portfolio Management Rating. Schweitzer-Mauduit International (NYSE: SWM ) is one of my favorite stocks held by Small Cap Value ETFs and mutual funds and earns my Attractive rating. Over the past ten years, Schweitzer has grown after-tax profit ( NOPAT ) by 13% compounded annually. Schweitzer also currently earns a top-quintile return on invested capital ( ROIC ) of 16%. Despite this outstanding profit growth, Schweitzer remains undervalued. At its current price of ~$44/share, SWM has a price to economic book value ( PEBV ) ratio of 1.1. This ratio implies that the market expects Schweitzer to grow NOPAT by only 10% from its current levels over the remainder of its corporate life. This expectation is rather low given the double-digit NOPAT growth achieved for the past decade. Unit Corporation (NYSE: UNT ) is one of my least favorite stocks held by Small Cap Value ETFs and mutual funds and earns my Very Dangerous rating. Over the past eight years, Unit’s NOPAT has declined by 1% compounded annually. The company currently earns a bottom-quintile ROIC of 5%, down from 19% in 2005. Unit has generated positive economic earnings in just one of the last 16 years covered by our model. Despite its lack of profit growth, UNT is rather overvalued. To justify its current price of ~$46, UNT must grow NOPAT by 9% compounded annually for the next 11 years. Such a high profit growth expectation seems overly optimistic given this company’s track record of declining profits. Kyle Guske II contributed to this report. Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, style, or theme. Scalper1 News

Summary In this report, we focus on how much Small Cap Value style fund managers allocate to the best stocks compared to how many good stocks are available in the style. Many ETFs and mutual fund managers do a poor job identifying quality stocks for their funds. These funds are not worth owning at any cost. The emphasis that traditional research places on low costs is a positive for investors, but low fees alone do not drive performance. Only good holdings can. This report shows how well Small Cap Value ETFs and mutual fund managers pick stocks. We juxtapose our Portfolio Management Rating on funds, which grades managers based on the quality of the stocks they choose, with the number of good stocks available in the style. This analysis shows whether or not ETF providers and mutual fund managers deserve their fees. For example, if a fund has a poor Portfolio Management Rating in a style where there are lots of good stocks, that fund does not deserve the fees it charges, and investors are much better off putting money in a passively-managed fund or investing directly in the style’s good stocks. On the other hand, if a fund has a good Portfolio Management Rating in a style where there are lots of bad stocks, then investors should put money in that fund, assuming the fund’s costs are competitive . Figure 1 compares the number of good stocks in the Small Cap Value style to the number of good funds. 197 out of the 2131 stocks (over 10% of the market value) in Small Cap Value ETFs and mutual funds get an Attractive-or-better rating. Zero out 15 Small Cap Value ETFs allocate enough to quality stocks to earn an Attractive-or-better Portfolio Management Rating. Mutual fund managers have not fared any better. Zero out of 273 Small Cap Value mutual funds allocate enough of their assets to quality stocks to earn an Attractive-or better Portfolio Management Rating. ETF providers and mutual fund managers need to do a better job to justify their fees. With no high quality funds available, 100% of investor assets in Small Cap Value ETFs are invested in ETFs with Dangerous Portfolio Management Ratings. Investors have almost no choice in this style with only one ETF even receiving better than a Dangerous Portfolio Management Rating. The picture is no better for mutual fund investors as 96% of investor assets are allocated to mutual funds with Dangerous-or-worse Portfolio Management Ratings. Figure 1: Small Cap Value Style: Comparing Quality of Stock Picking to Quality of Stocks Available (click to enlarge) Sources: New Constructs, LLC and company filings The First Trust Mid Cap Value AlphaDEX ETF (NYSEARCA: FNK ) has the highest Portfolio Management Rating of all Small Cap Value ETFs and earns my Neutral Portfolio Management Rating. The Prudential Small-Cap Value Fund (MUTF: PZVAX ) has the highest Portfolio Management Rating of all Small Cap Value mutual funds and earns my Neutral Portfolio Management Rating. The iShares Russell 2000 Value ETF (NYSEARCA: IWN ) has the lowest Portfolio Management Rating of all Small Cap Value ETFs and earns my Dangerous Portfolio Management Rating. The Aston/River Road Independent Value Fund (MUTF: ARVIX ) has the lowest Portfolio Management Rating of all Small Cap Value mutual funds and earns my Very Dangerous Portfolio Management Rating. Schweitzer-Mauduit International (NYSE: SWM ) is one of my favorite stocks held by Small Cap Value ETFs and mutual funds and earns my Attractive rating. Over the past ten years, Schweitzer has grown after-tax profit ( NOPAT ) by 13% compounded annually. Schweitzer also currently earns a top-quintile return on invested capital ( ROIC ) of 16%. Despite this outstanding profit growth, Schweitzer remains undervalued. At its current price of ~$44/share, SWM has a price to economic book value ( PEBV ) ratio of 1.1. This ratio implies that the market expects Schweitzer to grow NOPAT by only 10% from its current levels over the remainder of its corporate life. This expectation is rather low given the double-digit NOPAT growth achieved for the past decade. Unit Corporation (NYSE: UNT ) is one of my least favorite stocks held by Small Cap Value ETFs and mutual funds and earns my Very Dangerous rating. Over the past eight years, Unit’s NOPAT has declined by 1% compounded annually. The company currently earns a bottom-quintile ROIC of 5%, down from 19% in 2005. Unit has generated positive economic earnings in just one of the last 16 years covered by our model. Despite its lack of profit growth, UNT is rather overvalued. To justify its current price of ~$46, UNT must grow NOPAT by 9% compounded annually for the next 11 years. Such a high profit growth expectation seems overly optimistic given this company’s track record of declining profits. Kyle Guske II contributed to this report. Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, style, or theme. Scalper1 News

Scalper1 News