Image source: Getty Images.

You don’t become a billionaire investing in the markets without considerable skill. Hedge fund billionaire Stanley Druckenmiller has the necessary skill and while his trading-driven approach to investing isn’t how we do things at The Motley Fool, looking to Druckenmiller’s unique past is still both interesting and educational.

Billionaire investor Stanley Druckenmiller, who founded and led Duquesne Capital and was a protege and longtime colleague of superinvestor George Soros, has established a long track record of profiting from macroeconomic trends, and his presentation on U.S. monetary policy from earlier this year, “The Endgame,” has generated controversy worldwide.

Zerohedge.com said Druckenmiller’s presentation “may have been his most bearish fire and brimstone sermon yet … Druckenmiller said that while the Fed and policymakers have no endgame, markets do — hinting that one is rapidly approaching … ” Forbes reported that Druckenmiller recommended gold.

Investors will want a peek at the stocks Druckenmiller holds, but before we get to that, let’s examine the path he took to minting his hedge fund billions.

Inside Druckenmiller’s investing style

Druckenmiller’s journey to investing greatness certainly didn’t follow a traditional path. After graduating from Bowdoin College with a degree in economics, Druckenmiller left his studies toward a Ph.D. in economics at the University of Michigan in 1977 for a position as an oil analyst at Pittsburgh National Bank, the forerunner of today’s PNC Financial Services Group .

A star in the making, Druckenmiller rose to become the bank’s head of research within a year of joining the company. From there, Druckenmiller founded Duquesne Capital in 1981, the hedge fund he would oversee in various capacities until his official retirement from professional money management in 2010. In 1988, Druckenmiller began his professional relationship with George Soros at the latter’s Quantum Fund, for which Soros is best-known.

Soros and Druckenmiller employ a similar top-down style of investing. In its most basic form, top-down investing involves trading long or short positions in stocks, bonds, futures, and currencies based on one’s views of likely macroeconomic changes. By far, the best-known example of Druckenmiller and Soros’ top-down investing style was their combined effort to short the British pound sterling in 1992. This single trade, in which the inherent instability of the fixed exchange rate between the British pound and the German deutschmank was broken by short-selling from hedge funds, reportedly netted Soros a $ 1 billion personal gain.

Druckenmiller also served as the portfolio manager for other notable short-selling efforts, including correct bets against many East Asian currencies ahead of the Asian financial crisis in 1997.

Analyzing Druckenmiller’s portfolio

Even though Druckenmiller retired from professional fund management years ago, the hedge fund guru still maintains a family office to manage his fortune. Per SEC rules, any fund with over $ 100 million in assets under management must file a Form 13F each quarter. Given Druckenmiller’s personal fortune is estimated at $ 4.4 billion, his Duquesne Family Office provides investors with a snapshot into Druckenmiller’s investing thinking. Here are his top 10 long public equity holdings as of the end of June.

|

Company |

Duquesne Family Office Position Size |

|---|---|

|

|

$ 119.8 million |

|

Halliburton |

$ 102.5 million |

|

AbbVie |

$ 81.5 million |

|

iShares MSCI Emerging Markets Trust |

$ 78.4 million |

|

Freeport-McMoRan |

$ 33.7 million |

|

Deere & Company |

$ 31.2 million |

|

Barrick Gold |

$ 30.0 million |

|

Alcoa |

$ 29.9 million |

|

Amazon.com |

$ 28.9 million |

|

Zoetis |

$ 24.4 million |

Data source: SEC filings.

It’s critical to note that Druckenmiller’s macroeconomics-driven investment style involves using a mix of securities and long and short exposure. Thus, you should assume that this is not a complete representation of his investment views or positions. Some of these long equity positions could easily be part of more sophisticated trades.

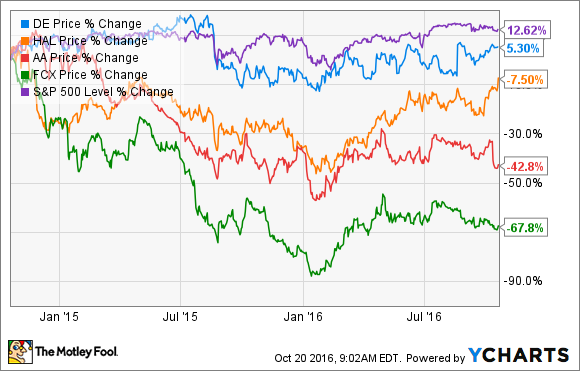

That being said, the overarching theme that shines through here is Druckenmiller’s bullishness on beaten-down commodity stocks. In fact, Halliburton (NYSE: HAL) , Freeport-McMoRan (NYSE: FCX) , Deere & Company (NYSE: DE) , and Alcoa (NYSE: AA) are all cyclical stocks that have underperformed the S&P 500 to varying degrees over the past two years.

However, the first-half rebound in many commodity prices has helped ignite a rally in shares of cyclical, commodity-driven companies. On average, shares of Halliburton, Alcoa, Deere & Co., and Freeport-McMoRan have risen 23.4% year to date.

This analysis also merits a brief word of caution. Druckenmiller’s investing style is that of a top-down trader, someone who moves in and out of his holdings as opportunities dictate. The Form 13F that detailed Druckenmiller’s above holdings represents a snapshot of his portfolio over three months ago. Druckenmiller could have already sold his stakes in Deere, Halliburton, Alcoa, Freeport-McMoRan, or any of the other stocks detailed here.

Either way, the fact that Druckenmiller was able to identify and presumably profit from this year’s rally in commodity prices is just one more example of a unique skill set that made this macro trader a billionaire. His investing style doesn’t necessarily jive with The Motley Fool’s long-term buy-and-hold approach, but it is certainly interesting to explore.

A secret billion-dollar stock opportunity

The world’s biggest tech company forgot to show you something, but a few Wall Street analysts and the Fool didn’t miss a beat: There’s a small company that’s powering their brand-new gadgets and the coming revolution in technology. And we think its stock price has nearly unlimited room to run for early in-the-know investors! To be one of them, just click here .

Andrew Tonner has no position in any stocks mentioned. The Motley Fool owns shares of and recommends AMZN and FB. The Motley Fool owns shares of FCX and HAL. The Motley Fool is short DE. Try any of our Foolish newsletter services free for 30 days . We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy .

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International