Scalper1 News

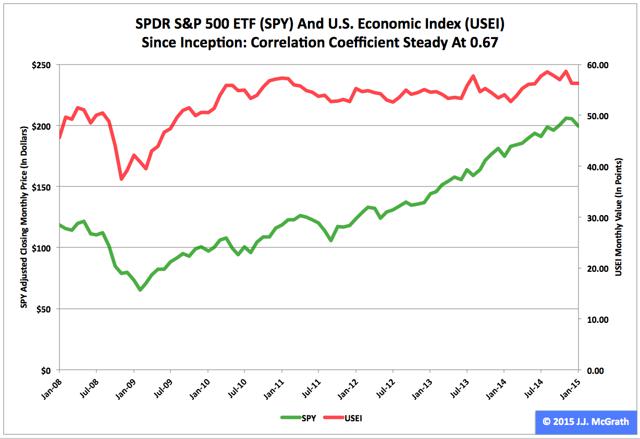

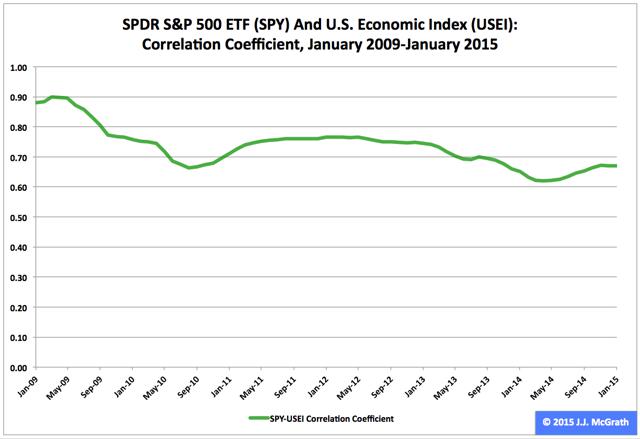

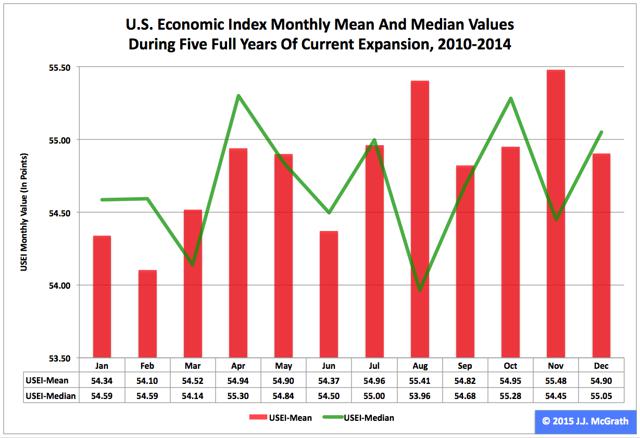

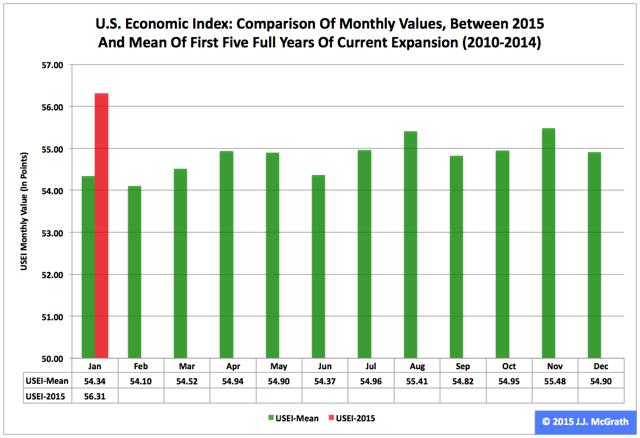

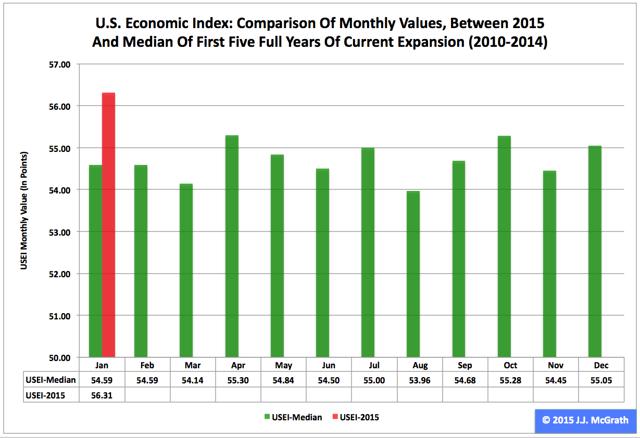

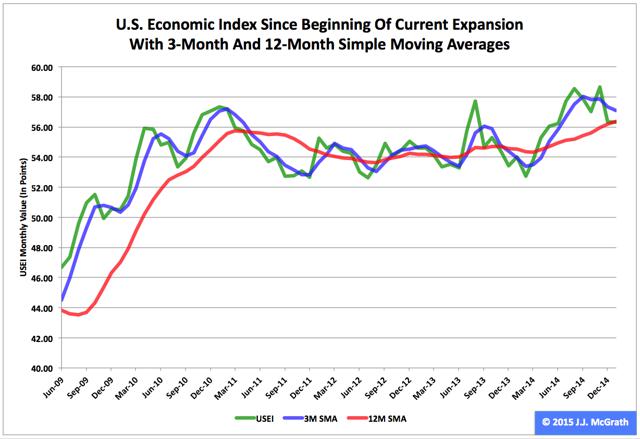

Summary The SPDR S&P 500 ETF and my U.S. Economic Index in January reversed their roles of a month earlier, as the former dropped and the latter dipped. The exchange-traded fund and my economic indicator moved in the same direction in each of the past three months. The correlation coefficient between them over the lifetime of their relationship held steady at 0.67. The SPDR S&P 500 Trust ETF (NYSEARCA: SPY ) and my U.S. Economic Index both headed south in January for the second straight month, but, as was the case in December, the magnitudes of their moves were quite different. SPY’s (quarterly) adjusted closing monthly share price slid to $199.45 from $205.54, a decline of -$6.09, or -2.96 percent, while the USEI’s (annually) adjusted level slipped to 56.31 from 56.33, a decline of -0.02 points, or -0.03 percent. Combining Institute for Supply Management manufacturing and nonmanufacturing figures with a special sauce, I assembled the USEI in an effort to capture all American economic activity in a single monthly number I can employ in guiding my investing and trading, as I mentioned when introducing the metric at J.J.’s Risky Business . Readers with an interest in my articles about the SPY-USEI relationship published during the past year are probably aware the SPY data series I employ historically has been adjusted quarterly. However, they are possibly unaware the three underlying USEI data series I use to calculate the index reading historically have been adjusted annually. Thanks to our ISM droogies bringing up-to-date their manufacturing and nonmanufacturing statistics this week, I was able to slather them with my special sauce, so the USEI’s annual adjustment in 2015 is complete. The most noticeable effect of this adjustment centers on the index’s value at its all-time high. Before the adjustment, the USEI peak was the 59.53 calculated for August 2014, followed by the 59.23 calculated for November 2014. After the adjustment, the index peak is the 58.65 calculated for last November, followed by the 58.54 calculated for last August. All the below data reflect the annual adjustment. Figure 1: SPY, USEI Monthly Values, January 2008-January 2015 (click to enlarge) Note: The SPY adjusted closing monthly share-price scale is on the left, and the USEI monthly value scale is on the right. Source: This J.J.’s Risky Business chart is based on proprietary analyses of ISM data and Yahoo Finance adjusted closing monthly share prices. ISM published its latest manufacturing data Monday and its latest nonmanufacturing data Wednesday. It has reported the relevant figures in the former series since January 1948, but the relevant numbers in the latter series since just January 2008. Thus, the complete data set for the USEI covers only 85 months (Figure 1). I calculate the SPY-USEI correlation coefficient as 0.67 during this period, the same as in each of previous two months. The comparable statistics were 0.66 for October, 0.65 for September, 0.64 for August, 0.63 for July and 0.61 for each of the four months between March and June. Therefore, the coefficient rose five months in a row until December. Figure 2: SPY-USEI Correlations, January 2009-January 2015 (click to enlarge) Note: My baseline conceptually consists of the first 12 SPY-USEI correlation coefficients, which are excluded here. Source: This J.J.’s Risky Business chart is based on proprietary analyses of ISM data and Yahoo Finance adjusted closing monthly share prices. For the USEI’s first 57 months (i.e., before the dawn of the U.S. Federal Reserve’s most recent quantitative-easing program, aka the Age of QE3+ ), I calculate the SPY-USEI correlation coefficient as 0.75. I interpret this number as evidence of a positive correlation between the equity market and the economy that was both stable and strong. For the index’s last 28 months (i.e., after the dawn of the Fed’s Age of QE3+), I calculate the SPY-USEI correlation coefficient as 0.57. I interpret this number as evidence of a breakdown in their relationship, indicating a disruption in the continuous feedback loop between the stock market and the economy. However, this disruption’s effects have been fading since the Fed began to significantly taper QE3+, as documented by the SPY-USEI correlation coefficient’s movement during the past seven months (Figure 2). This lengthy trend suggests substantial progress in the normalization of the relationship between the market and the economy. Figure 3: USEI Monthly Mean And Median Values, 2010-2014 (click to enlarge) Note: The current expansion began in June 2009, according to the Business Cycle Dating Committee of the National Bureau of Economic Research . Source: This J.J.’s Risky Business chart is based on proprietary analyses of ISM data. Neither the first quarter in general nor February in particular historically has been a great time for SPY, as documented elsewhere . Consistent with the ETF’s behavior and the interlocking nature of the SPY-USEI relationship, analysis of the seasonality of the USEI likewise indicates the same two periods have been among the weakest time frames of the annual cycles during the initial five full years of the current economic expansion from 2010 to 2014 (Figure 3). Figure 4: USEI Monthly Values, 2015 Versus 2010-2014 Mean (click to enlarge) Source: This J.J.’s Risky Business chart is based on proprietary analyses of ISM data. The USEI was an overachiever to a significant degree in January when compared with the relevant mean value compiled for the same month during the initial five full years of the current expansion (Figure 4). From January to February in this period, the index fell thrice and rose twice, once by a little (0.02 percent) and once by a lot (1.75 percent). Figure 5: USEI Monthly Values, 2015 Versus 2010-2014 Median (click to enlarge) Source: This J.J.’s Risky Business chart is based on proprietary analyses of ISM data. The USEI also was an overachiever to a significant degree in January when compared with the relevant median value compiled for the same month during the initial five full years of the current expansion (Figure 5). Statistically, the preponderance of the evidence suggests it is probable the index will be lower in February than it was in January. Figure 6: USEI Monthly Values With 3-Month And 12-Month SMAs (click to enlarge) Source: This J.J.’s Risky Business chart is based on proprietary analyses of ISM data. The conditions underlying the USEI’s current status should do nothing to create a roadblock for a Federal Open Market Committee on its way to announce its first interest-rate increase in eight-plus years as soon as April 29, six months after the Federal Reserve concluded asset purchases under QE3+ (Figure 6). And I suspect such an event would be a big deal, not only for the economy, as represented by the USEI, but also for the large-capitalization segment of the market, as represented by SPY. Disclaimer: The opinions expressed herein by the author do not constitute an investment recommendation, and they are unsuitable for employment in the making of investment decisions. The opinions expressed herein address only certain aspects of potential investment in any securities and cannot substitute for comprehensive investment analysis. The opinions expressed herein are based on an incomplete set of information, illustrative in nature, and limited in scope. In addition, the opinions expressed herein reflect the author’s best judgment as of the date of publication, and they are subject to change without notice. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary The SPDR S&P 500 ETF and my U.S. Economic Index in January reversed their roles of a month earlier, as the former dropped and the latter dipped. The exchange-traded fund and my economic indicator moved in the same direction in each of the past three months. The correlation coefficient between them over the lifetime of their relationship held steady at 0.67. The SPDR S&P 500 Trust ETF (NYSEARCA: SPY ) and my U.S. Economic Index both headed south in January for the second straight month, but, as was the case in December, the magnitudes of their moves were quite different. SPY’s (quarterly) adjusted closing monthly share price slid to $199.45 from $205.54, a decline of -$6.09, or -2.96 percent, while the USEI’s (annually) adjusted level slipped to 56.31 from 56.33, a decline of -0.02 points, or -0.03 percent. Combining Institute for Supply Management manufacturing and nonmanufacturing figures with a special sauce, I assembled the USEI in an effort to capture all American economic activity in a single monthly number I can employ in guiding my investing and trading, as I mentioned when introducing the metric at J.J.’s Risky Business . Readers with an interest in my articles about the SPY-USEI relationship published during the past year are probably aware the SPY data series I employ historically has been adjusted quarterly. However, they are possibly unaware the three underlying USEI data series I use to calculate the index reading historically have been adjusted annually. Thanks to our ISM droogies bringing up-to-date their manufacturing and nonmanufacturing statistics this week, I was able to slather them with my special sauce, so the USEI’s annual adjustment in 2015 is complete. The most noticeable effect of this adjustment centers on the index’s value at its all-time high. Before the adjustment, the USEI peak was the 59.53 calculated for August 2014, followed by the 59.23 calculated for November 2014. After the adjustment, the index peak is the 58.65 calculated for last November, followed by the 58.54 calculated for last August. All the below data reflect the annual adjustment. Figure 1: SPY, USEI Monthly Values, January 2008-January 2015 (click to enlarge) Note: The SPY adjusted closing monthly share-price scale is on the left, and the USEI monthly value scale is on the right. Source: This J.J.’s Risky Business chart is based on proprietary analyses of ISM data and Yahoo Finance adjusted closing monthly share prices. ISM published its latest manufacturing data Monday and its latest nonmanufacturing data Wednesday. It has reported the relevant figures in the former series since January 1948, but the relevant numbers in the latter series since just January 2008. Thus, the complete data set for the USEI covers only 85 months (Figure 1). I calculate the SPY-USEI correlation coefficient as 0.67 during this period, the same as in each of previous two months. The comparable statistics were 0.66 for October, 0.65 for September, 0.64 for August, 0.63 for July and 0.61 for each of the four months between March and June. Therefore, the coefficient rose five months in a row until December. Figure 2: SPY-USEI Correlations, January 2009-January 2015 (click to enlarge) Note: My baseline conceptually consists of the first 12 SPY-USEI correlation coefficients, which are excluded here. Source: This J.J.’s Risky Business chart is based on proprietary analyses of ISM data and Yahoo Finance adjusted closing monthly share prices. For the USEI’s first 57 months (i.e., before the dawn of the U.S. Federal Reserve’s most recent quantitative-easing program, aka the Age of QE3+ ), I calculate the SPY-USEI correlation coefficient as 0.75. I interpret this number as evidence of a positive correlation between the equity market and the economy that was both stable and strong. For the index’s last 28 months (i.e., after the dawn of the Fed’s Age of QE3+), I calculate the SPY-USEI correlation coefficient as 0.57. I interpret this number as evidence of a breakdown in their relationship, indicating a disruption in the continuous feedback loop between the stock market and the economy. However, this disruption’s effects have been fading since the Fed began to significantly taper QE3+, as documented by the SPY-USEI correlation coefficient’s movement during the past seven months (Figure 2). This lengthy trend suggests substantial progress in the normalization of the relationship between the market and the economy. Figure 3: USEI Monthly Mean And Median Values, 2010-2014 (click to enlarge) Note: The current expansion began in June 2009, according to the Business Cycle Dating Committee of the National Bureau of Economic Research . Source: This J.J.’s Risky Business chart is based on proprietary analyses of ISM data. Neither the first quarter in general nor February in particular historically has been a great time for SPY, as documented elsewhere . Consistent with the ETF’s behavior and the interlocking nature of the SPY-USEI relationship, analysis of the seasonality of the USEI likewise indicates the same two periods have been among the weakest time frames of the annual cycles during the initial five full years of the current economic expansion from 2010 to 2014 (Figure 3). Figure 4: USEI Monthly Values, 2015 Versus 2010-2014 Mean (click to enlarge) Source: This J.J.’s Risky Business chart is based on proprietary analyses of ISM data. The USEI was an overachiever to a significant degree in January when compared with the relevant mean value compiled for the same month during the initial five full years of the current expansion (Figure 4). From January to February in this period, the index fell thrice and rose twice, once by a little (0.02 percent) and once by a lot (1.75 percent). Figure 5: USEI Monthly Values, 2015 Versus 2010-2014 Median (click to enlarge) Source: This J.J.’s Risky Business chart is based on proprietary analyses of ISM data. The USEI also was an overachiever to a significant degree in January when compared with the relevant median value compiled for the same month during the initial five full years of the current expansion (Figure 5). Statistically, the preponderance of the evidence suggests it is probable the index will be lower in February than it was in January. Figure 6: USEI Monthly Values With 3-Month And 12-Month SMAs (click to enlarge) Source: This J.J.’s Risky Business chart is based on proprietary analyses of ISM data. The conditions underlying the USEI’s current status should do nothing to create a roadblock for a Federal Open Market Committee on its way to announce its first interest-rate increase in eight-plus years as soon as April 29, six months after the Federal Reserve concluded asset purchases under QE3+ (Figure 6). And I suspect such an event would be a big deal, not only for the economy, as represented by the USEI, but also for the large-capitalization segment of the market, as represented by SPY. Disclaimer: The opinions expressed herein by the author do not constitute an investment recommendation, and they are unsuitable for employment in the making of investment decisions. The opinions expressed herein address only certain aspects of potential investment in any securities and cannot substitute for comprehensive investment analysis. The opinions expressed herein are based on an incomplete set of information, illustrative in nature, and limited in scope. In addition, the opinions expressed herein reflect the author’s best judgment as of the date of publication, and they are subject to change without notice. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News