Scalper1 News

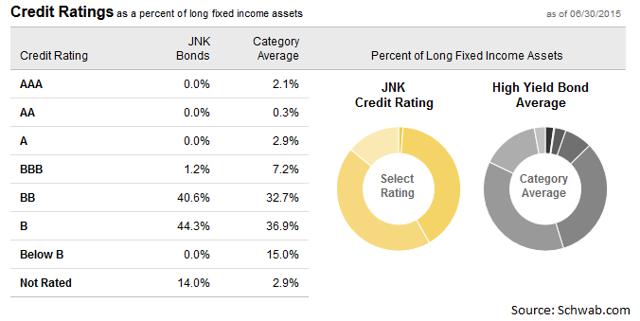

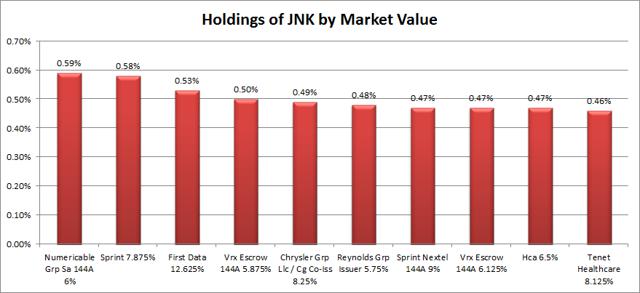

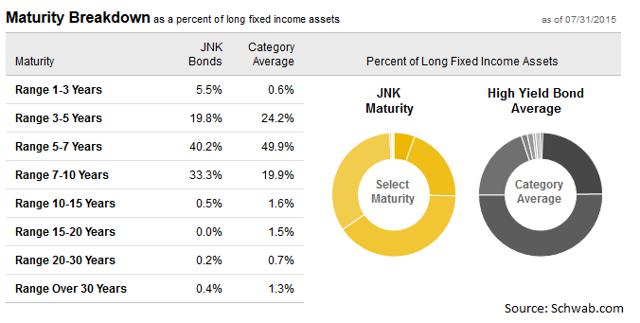

Summary The SPDR Barclays Capital High Yield Bond ETF is a junk bond fund that offers a fairly strong yield, around 6%. One concern is that 14% of the debt is not rated. The exposure to debt that is not rated may be an acceptable trade-off for the strong yields as long as the portfolio managers are doing their own due diligence. The maturities look fairly reasonable and holdings are not highly concentrated, so the overall portfolio construction looks solid. Investors should be using more than junk bonds in their investment portfolio. Correlation to the S&P 500 is a problem for junk bond ETFs. The SPDR Barclays Capital High Yield Bond ETF (NYSEARCA: JNK ) is a pretty good bond fund for exposure to securities ranging from BB to “Not Rated,” though nothing in the portfolio is actually rated anything less than B. The credit ratings won’t be stellar on a junk bond fund and the fund sure doesn’t try to hide it. Their ticker symbol of JNK is simply a play on “junk.” Every buy should know going in that they are buying credit sensitive debt securities. Credit Quality The allocation here seems is perfectly reasonable with the exception that a large amount of not rated bonds is slightly concerning: (click to enlarge) While I would like to have ratings on all or almost all of the debt being held, I can see how having debt that is not rated may be an advantage in producing higher yields if the portfolio managers are willing to do the due diligence to determine what the most likely rating would be if it were rated. In my opinion, this is an acceptable trade-off when most funds have weak yields and JNK is yielding around 6%. In a normal interest rate environment investors may expect materially higher yields, but in the weak yield environment we are all living through, this is one of the higher yielding debt options. Holdings I prepared the following chart showing the largest debt holdings of JNK. (click to enlarge) No problems are jumping out at me. Nothing was over .6% of the portfolio and within the top 10 I don’t see any duplication of the same issuers so I have no reason to expect a concentration of credit risk with individual issuers. Since about 14% of the portfolio was non-rated, it felt more important to double check for any large holdings that might be attributed to one non-rated company. Maturities I grabbed another chart to show the maturity ranges across the portfolio: (click to enlarge) The maturity profile for the SPDR Barclays Capital High Yield Bond ETF looks good for a junk bond fund. However, I must admit that the tiny allocations to the very long-term debt are interesting. Yes, there are generally lower than the category averages but I assume that the category averages may be influenced by a few funds classified into the category that have different investing strategies. Simply put, this is a little strange because it feels like the managers by operating outside of their area of expertise (evaluating short-term credit sensitive debt). On the other hand, these longer securities may simply be bargains they came across while doing their regular work. With it being such a small percentage of the portfolio, I don’t think it is worth worrying about. On the whole, JNK gets a solid rating on providing some diversification across the maturities without becoming too dispersed. There is not one “right” answer about how to structure the maturities, but I like the arrangement shown here. Risk The biggest risk factor from a portfolio standpoint that came up for me was a strong correlation (over 70%) in monthly returns with the S&P 500. Since one purpose of the bond portion of the portfolio is to provide diversification, it is a strike against junk bond funds that they tend to move with the market. That is a problem that should be impacting most junk bonds though, not a risk unique to JNK. When comparing JNK to other junk bond funds, this should not be held against it. Expense Ratio The expense ratio isn’t awful at .40%, however, I still want to keep looking for options where the ratio is lower. Given the relatively low yields on bonds currently and the need to buy junk bonds to get a solid yield, it really hurts to give up a significant portion of the assets to the expense ratio each year. Conclusion If an investor is looking at the role of the bond fund in their portfolio, it would be wise to consider having multiple bond funds if the first one is going to be investing in junk bonds. This kind of fund can offer some diversification benefits to investors, but it would be most productive in a portfolio that combines it with a few other bond funds with different duration exposures and higher credit ratings to enhance the diversification benefits that bonds bring to the investor’s portfolio. When it comes simply to selecting which junk bond fund an investor should use, JNK seems like a decent choice. I’ve still got quite a few funds to consider, but I’m not seeing any major failings here so far. I’m looking for a similar ETF with a very low expense ratio to really stand out as a junk bond fund champion. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Information in this article represents the opinion of the analyst. All statements are represented as opinions, rather than facts, and should not be construed as advice to buy or sell a security. Ratings of “outperform” and “underperform” reflect the analyst’s estimation of a divergence between the market value for a security and the price that would be appropriate given the potential for risks and returns relative to other securities. The analyst does not know your particular objectives for returns or constraints upon investing. All investors are encouraged to do their own research before making any investment decision. Information is regularly obtained from Yahoo Finance, Google Finance, and SEC Database. If Yahoo, Google, or the SEC database contained faulty or old information it could be incorporated into my analysis. Scalper1 News

Summary The SPDR Barclays Capital High Yield Bond ETF is a junk bond fund that offers a fairly strong yield, around 6%. One concern is that 14% of the debt is not rated. The exposure to debt that is not rated may be an acceptable trade-off for the strong yields as long as the portfolio managers are doing their own due diligence. The maturities look fairly reasonable and holdings are not highly concentrated, so the overall portfolio construction looks solid. Investors should be using more than junk bonds in their investment portfolio. Correlation to the S&P 500 is a problem for junk bond ETFs. The SPDR Barclays Capital High Yield Bond ETF (NYSEARCA: JNK ) is a pretty good bond fund for exposure to securities ranging from BB to “Not Rated,” though nothing in the portfolio is actually rated anything less than B. The credit ratings won’t be stellar on a junk bond fund and the fund sure doesn’t try to hide it. Their ticker symbol of JNK is simply a play on “junk.” Every buy should know going in that they are buying credit sensitive debt securities. Credit Quality The allocation here seems is perfectly reasonable with the exception that a large amount of not rated bonds is slightly concerning: (click to enlarge) While I would like to have ratings on all or almost all of the debt being held, I can see how having debt that is not rated may be an advantage in producing higher yields if the portfolio managers are willing to do the due diligence to determine what the most likely rating would be if it were rated. In my opinion, this is an acceptable trade-off when most funds have weak yields and JNK is yielding around 6%. In a normal interest rate environment investors may expect materially higher yields, but in the weak yield environment we are all living through, this is one of the higher yielding debt options. Holdings I prepared the following chart showing the largest debt holdings of JNK. (click to enlarge) No problems are jumping out at me. Nothing was over .6% of the portfolio and within the top 10 I don’t see any duplication of the same issuers so I have no reason to expect a concentration of credit risk with individual issuers. Since about 14% of the portfolio was non-rated, it felt more important to double check for any large holdings that might be attributed to one non-rated company. Maturities I grabbed another chart to show the maturity ranges across the portfolio: (click to enlarge) The maturity profile for the SPDR Barclays Capital High Yield Bond ETF looks good for a junk bond fund. However, I must admit that the tiny allocations to the very long-term debt are interesting. Yes, there are generally lower than the category averages but I assume that the category averages may be influenced by a few funds classified into the category that have different investing strategies. Simply put, this is a little strange because it feels like the managers by operating outside of their area of expertise (evaluating short-term credit sensitive debt). On the other hand, these longer securities may simply be bargains they came across while doing their regular work. With it being such a small percentage of the portfolio, I don’t think it is worth worrying about. On the whole, JNK gets a solid rating on providing some diversification across the maturities without becoming too dispersed. There is not one “right” answer about how to structure the maturities, but I like the arrangement shown here. Risk The biggest risk factor from a portfolio standpoint that came up for me was a strong correlation (over 70%) in monthly returns with the S&P 500. Since one purpose of the bond portion of the portfolio is to provide diversification, it is a strike against junk bond funds that they tend to move with the market. That is a problem that should be impacting most junk bonds though, not a risk unique to JNK. When comparing JNK to other junk bond funds, this should not be held against it. Expense Ratio The expense ratio isn’t awful at .40%, however, I still want to keep looking for options where the ratio is lower. Given the relatively low yields on bonds currently and the need to buy junk bonds to get a solid yield, it really hurts to give up a significant portion of the assets to the expense ratio each year. Conclusion If an investor is looking at the role of the bond fund in their portfolio, it would be wise to consider having multiple bond funds if the first one is going to be investing in junk bonds. This kind of fund can offer some diversification benefits to investors, but it would be most productive in a portfolio that combines it with a few other bond funds with different duration exposures and higher credit ratings to enhance the diversification benefits that bonds bring to the investor’s portfolio. When it comes simply to selecting which junk bond fund an investor should use, JNK seems like a decent choice. I’ve still got quite a few funds to consider, but I’m not seeing any major failings here so far. I’m looking for a similar ETF with a very low expense ratio to really stand out as a junk bond fund champion. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Information in this article represents the opinion of the analyst. All statements are represented as opinions, rather than facts, and should not be construed as advice to buy or sell a security. Ratings of “outperform” and “underperform” reflect the analyst’s estimation of a divergence between the market value for a security and the price that would be appropriate given the potential for risks and returns relative to other securities. The analyst does not know your particular objectives for returns or constraints upon investing. All investors are encouraged to do their own research before making any investment decision. Information is regularly obtained from Yahoo Finance, Google Finance, and SEC Database. If Yahoo, Google, or the SEC database contained faulty or old information it could be incorporated into my analysis. Scalper1 News

Scalper1 News