Scalper1 News

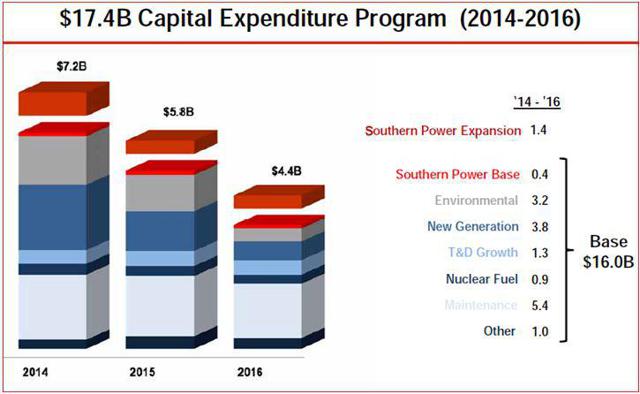

Summary Southern Company’s near-term may remain overshadowed due to ongoing construction projects. Ongoing capital expenditures will fuel rate base and long-term earnings growth. Attractive dividend yield of 4.1% makes SO a good investment for dividend-seeking investors. Southern Company (NYSE: SO ) is one of the leading energy companies in the U.S. utility sector. The company’s solid fundamental outlook is supported by its accelerated capital expenditures for several energy projects. In the near term, the company’s stock price can come under pressure due to its risk in delay and cost overruns for its ongoing projects, Kemper and Vogtle. But in the long run, once these projects are completed, they will help the company grow its rate base and fuel earnings growth. Also, as the company’s capital expenditures have been fueling its EPS growth, it will also fuel dividend growth for the company in the future. Currently, the stock has a dividend yield of 4.1%, which makes it attractive for dividend investors. Also, the low treasury yield environment will support the utility sector and SO’s performance in 2015. The following graph shows the low U.S. 10-year treasury yield. (click to enlarge) Source: Yahoo Finance Investors Have a Secure Long-Term with SO The company has been making capital expenditures to strengthen its electricity generation portfolio. Capital expenditures, which the company is making, are focused towards regulated operations, which will provide stability to its cash flows and earnings. The capital expenditures will also fuel long-term earnings growth for the company. As far as SO’s 582MW Kemper project is concerned, the project has been subjected to ongoing cost revisions and delays, and the issues of delays and cost overruns still prevail. As per the revised estimates, the project’s total cost will now reach $6.1 billion, an increase of $330 million as compared to previous estimates. However, the project is near completion and is expected to be completed by the end of 1H’15. In addition, the company is in the process of building two new nuclear power plants, Vogtle 3 and 4, with a power generation capacity of 2,200MW . These nuclear projects were previously estimated to be in running condition by the end of 2017 or 2018, but as per recent revisions, these projects are also expected to face operational delays. The Vogtle project is expected to experience a one-year delay and cost an additional $730 million to the company. Owing to these ongoing delays and expected cost increases, I believe the project will remain an overhang on its stock price performance in the near term. But in the long run, these projects will uplift SO’s production capacity and optimize its generational portfolio, which will help grow its rate base and earnings. In addition to these power generation projects, the company is bidding on the growth potentials of solar energy projects. SO is building a 131MW solar farm in Georgia, which is expected to be operational in 2016. The value of building this farm lies in generating healthy earnings growth for the company, by selling generated electricity to corporations through long-term power purchase contracts. Moreover, the company’s subsidiary Southern Power has accelerated acquisitions to improve the overall power generation capacity and to fuel its long-term earnings base growth. Southern Power won a bid for 100MW of solar projects in Georgia, and the subsidiary acquired the 150MW Solar Gen2 and 50MW Macho Spring solar facility. The company’s robust capital expenditures for future years will add to its rate base and long-term earnings growth. The company has plans to make capital expenditures of $17.4 billion from 2014-2016. The following chart shows the company’s expected capital expenditures for future. (click to enlarge) Source: Company’s Quarterly Earnings Report The company’s efforts to expand and strengthen its electricity generation portfolio will portend well for its long-term operational performance, and the capital expenditures will fuel its long-term earnings growth. Analysts are expecting a decent next five-year earnings growth rate of 3.63% for the company. Rewarding Investors SO has a strong history of rewarding its shareholders through healthy dividend payments. The company has a solid cash flow base to support its ongoing dividend increases. SO has recently announced a quarterly dividend payment of 52.50 cents . Currently, SO offers a high dividend yield of 4.10% , which is well covered by its cash flows, as indicated by the company’s strong dividend coverage ratio (Operating cash flows/ Annual Dividends) below. Based on the growth potentials of ongoing capital expenditures and large scale dependence on regulated operations, SO’s cash flow base will continue to grow at a decent pace. And owing to the company’s secure cash flow base, I believe SO’s dividends are secure and sustainable in the long run. The following table shows the company’s healthy dividend per share, dividend coverage and dividend payout ratio in the past three years, and for 2014 and 2015, based on estimates. Dividend Per Share Dividend Payout Ratio Dividend Coverage 2011 $1.87 73% 1.4x 2012 $1.94 73% 1.4x 2013 $2.01 75% 1.3x 2014(NYSE: E ) $2.10 74% 1.3x 2015( E ) $2.17 74% 1.3x Source: Company’s Annual Reports and Equity Watch Estimates Risks The company’s earnings growth faces risks of regulatory restrictions at the federal or state level, and an increase in environmental expenditure as directed by the EPA. Also, an increase in interest rates poses a risk to the stock price. Moreover, economic weaknesses in SO’s service territory are causing lower demand growth. Significant cost increases and delays due to the construction of Kemper and Vogtle plants, and unfavorable weather are key risks to the company’s future stock price performance. Conclusion The company’s near-term may remain overshadowed due to ongoing construction projects, but in the long run, as the construction projects will be completed and its generational portfolio will improve, its operational performance and stock price will be positively affected. The ongoing capital expenditures will fuel its rate base and long-term earnings growth. And as the company has significant regulated operations, it will portend well for its earnings and cash flows stability. Also, an attractive dividend yield of 4.1% makes it a good investment for dividend-seeking investors. Due to the aforementioned factors, I remain bullish on this stock. Scalper1 News

Summary Southern Company’s near-term may remain overshadowed due to ongoing construction projects. Ongoing capital expenditures will fuel rate base and long-term earnings growth. Attractive dividend yield of 4.1% makes SO a good investment for dividend-seeking investors. Southern Company (NYSE: SO ) is one of the leading energy companies in the U.S. utility sector. The company’s solid fundamental outlook is supported by its accelerated capital expenditures for several energy projects. In the near term, the company’s stock price can come under pressure due to its risk in delay and cost overruns for its ongoing projects, Kemper and Vogtle. But in the long run, once these projects are completed, they will help the company grow its rate base and fuel earnings growth. Also, as the company’s capital expenditures have been fueling its EPS growth, it will also fuel dividend growth for the company in the future. Currently, the stock has a dividend yield of 4.1%, which makes it attractive for dividend investors. Also, the low treasury yield environment will support the utility sector and SO’s performance in 2015. The following graph shows the low U.S. 10-year treasury yield. (click to enlarge) Source: Yahoo Finance Investors Have a Secure Long-Term with SO The company has been making capital expenditures to strengthen its electricity generation portfolio. Capital expenditures, which the company is making, are focused towards regulated operations, which will provide stability to its cash flows and earnings. The capital expenditures will also fuel long-term earnings growth for the company. As far as SO’s 582MW Kemper project is concerned, the project has been subjected to ongoing cost revisions and delays, and the issues of delays and cost overruns still prevail. As per the revised estimates, the project’s total cost will now reach $6.1 billion, an increase of $330 million as compared to previous estimates. However, the project is near completion and is expected to be completed by the end of 1H’15. In addition, the company is in the process of building two new nuclear power plants, Vogtle 3 and 4, with a power generation capacity of 2,200MW . These nuclear projects were previously estimated to be in running condition by the end of 2017 or 2018, but as per recent revisions, these projects are also expected to face operational delays. The Vogtle project is expected to experience a one-year delay and cost an additional $730 million to the company. Owing to these ongoing delays and expected cost increases, I believe the project will remain an overhang on its stock price performance in the near term. But in the long run, these projects will uplift SO’s production capacity and optimize its generational portfolio, which will help grow its rate base and earnings. In addition to these power generation projects, the company is bidding on the growth potentials of solar energy projects. SO is building a 131MW solar farm in Georgia, which is expected to be operational in 2016. The value of building this farm lies in generating healthy earnings growth for the company, by selling generated electricity to corporations through long-term power purchase contracts. Moreover, the company’s subsidiary Southern Power has accelerated acquisitions to improve the overall power generation capacity and to fuel its long-term earnings base growth. Southern Power won a bid for 100MW of solar projects in Georgia, and the subsidiary acquired the 150MW Solar Gen2 and 50MW Macho Spring solar facility. The company’s robust capital expenditures for future years will add to its rate base and long-term earnings growth. The company has plans to make capital expenditures of $17.4 billion from 2014-2016. The following chart shows the company’s expected capital expenditures for future. (click to enlarge) Source: Company’s Quarterly Earnings Report The company’s efforts to expand and strengthen its electricity generation portfolio will portend well for its long-term operational performance, and the capital expenditures will fuel its long-term earnings growth. Analysts are expecting a decent next five-year earnings growth rate of 3.63% for the company. Rewarding Investors SO has a strong history of rewarding its shareholders through healthy dividend payments. The company has a solid cash flow base to support its ongoing dividend increases. SO has recently announced a quarterly dividend payment of 52.50 cents . Currently, SO offers a high dividend yield of 4.10% , which is well covered by its cash flows, as indicated by the company’s strong dividend coverage ratio (Operating cash flows/ Annual Dividends) below. Based on the growth potentials of ongoing capital expenditures and large scale dependence on regulated operations, SO’s cash flow base will continue to grow at a decent pace. And owing to the company’s secure cash flow base, I believe SO’s dividends are secure and sustainable in the long run. The following table shows the company’s healthy dividend per share, dividend coverage and dividend payout ratio in the past three years, and for 2014 and 2015, based on estimates. Dividend Per Share Dividend Payout Ratio Dividend Coverage 2011 $1.87 73% 1.4x 2012 $1.94 73% 1.4x 2013 $2.01 75% 1.3x 2014(NYSE: E ) $2.10 74% 1.3x 2015( E ) $2.17 74% 1.3x Source: Company’s Annual Reports and Equity Watch Estimates Risks The company’s earnings growth faces risks of regulatory restrictions at the federal or state level, and an increase in environmental expenditure as directed by the EPA. Also, an increase in interest rates poses a risk to the stock price. Moreover, economic weaknesses in SO’s service territory are causing lower demand growth. Significant cost increases and delays due to the construction of Kemper and Vogtle plants, and unfavorable weather are key risks to the company’s future stock price performance. Conclusion The company’s near-term may remain overshadowed due to ongoing construction projects, but in the long run, as the construction projects will be completed and its generational portfolio will improve, its operational performance and stock price will be positively affected. The ongoing capital expenditures will fuel its rate base and long-term earnings growth. And as the company has significant regulated operations, it will portend well for its earnings and cash flows stability. Also, an attractive dividend yield of 4.1% makes it a good investment for dividend-seeking investors. Due to the aforementioned factors, I remain bullish on this stock. Scalper1 News

Scalper1 News