Scalper1 News

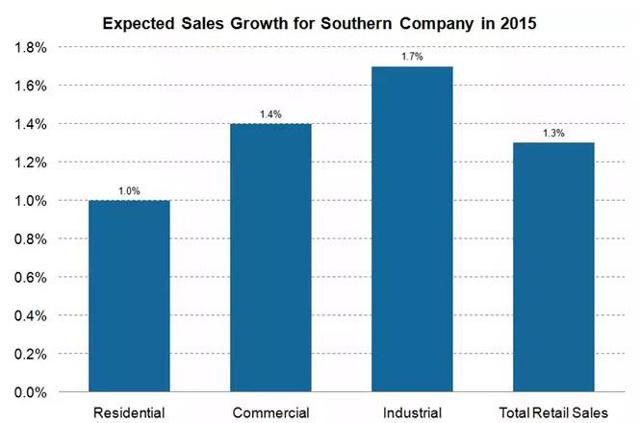

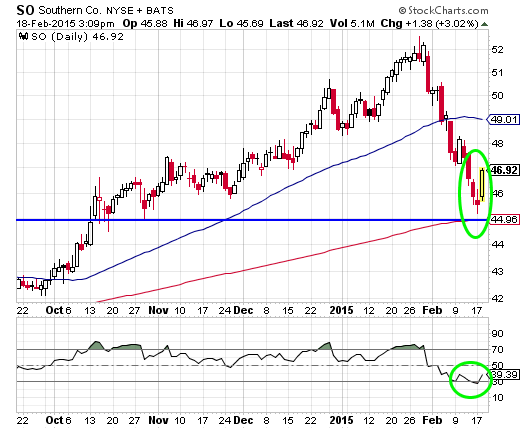

Utility stocks have gone from “hero” to “zero” in a month. Southern Company shows a historical pullback. Despite disappointing earnings, shares of Southern Company look poised to bounce from here. It’s hard to believe, I know, but the strongest sector among U.S. stocks last year was the utilities sector. The normally staid and stuffy Utilities Index returned over 30% in 2014, including dividends. Utility stocks, traditionally a safe haven for risk adverse, long-term investors, were suddenly the go-to place for a very different kind of financial animal: the “momentum stock” trader… at least for a while. All that ended in January this year. We’ve seen a substantial correction in the utilities sector so far this year, with many of the key players trading off 10% or more from their year-to-date highs. Analysts are laying blame on the strong rebound in treasury bond interest rates, which itself has been caused by the end of the Fed’s quantitative easing program (among other things). As rates climb, those looking for income and safety tend to pull money out of interest bearing stocks and put that money to work into safe havens like bonds and treasuries. This is why a chart of the 10-year yield with the utility stock index overlaid, shows a clear tendency of the two asset classes to mirror each other: [Source: MarketWatch ] I’m in the camp that counts this pullback in utilities as a great buying opportunity. Nothing has changed in the fundamentals of the underlying companies; and the lower share price makes their dividends all the more attractive. Right now, you’ll pay less for more utility yield, than at any time in the past 6 months. Among domestic utilities, there are 5 big players: NextEra Energy ( NEP , $46B), Dominion Resources ( D , $42B), Southern Company ( SO , $42B), American Electric ( AEP , $28B), and PG&E ( PCG , $26B). All 5 companies are trading around -10% below their 52-week highs. And all 5 companies have seen their dividend rates climb at least 50 basis points so far this year, making them attractive places to park cash for those looking for discounted income. My favorite among the big 5 is Southern Company . This utility company generates electricity through coal, nuclear, oil, gas, and hydro and distributes it in the states of Alabama, Georgia, Florida and Mississippi. Since peaking at $53.16 in late January as investors sought the relative safety of utilities, the stock has fallen about 14% in less than three weeks’ time, the largest pullback of the top 5. That is a move of statistical importance: it hasn’t been matched since the tail-end of the Great Recession, a time with a very different economic context. Shares are therefore ripe for a bounce from here. As of February 18th, the dividend yield of SO is 4.61%, which is currently about 110 basis points above the large-cap utilities index average. This is also the largest dividend payout among the top 5 utility companies, as the chart below demonstrates: As investors in the company know too well, at the last earnings announcement on February 4th, Southern reported quarterly revenues about 20% lower year on year, but they were, nevertheless, better than what analysts expected ( $4.1B actual vs. $3.7B expected). Quarterly earnings per share were in line with analyst estimates (0.38, adjusted for non-recurring costs, vs. 0.48 the previous year), and fiscal year 2014 showed a modest 3.7% rise in overall e.p.s., but shares still traded lower the next day by 2.6%. The reason for the selloff was that the company also lowered the range of its forward guidance; not by much, but enough to create disappointment. The causes of the drawdown in earnings were higher operating and maintenance costs, which jumped 33.4% to $1.3B, while the company’s total operating expenses for the period were over 10% higher than the prior year. There were also charges related to delays in the building of an $8 billion nuclear plant in Georgia, along with a drop in residential sales. The good news, however, is that industrial sales were up 3.3% quarter on quarter, and forward projected growth for the same is pegged at 1.7%. Both figures are much higher than industry average of 0.6%. The slowdown in retail sales, which hampered sales growth last quarter, is expected to rebound by 1.3% this next year: (click to enlarge) There are 22 Wall Street analysts who cover Southern Company. The majority of those, rate the company as either a “hold” (11) or a “sell” (10). There is only one “buy” rating on the stock (Argus). The consensus 12-month price target for SO is only $48, a mere 4.5% above current trading prices. With expectations so low, it won’t take much of a beat to generate a number of upgrades. As has been pointed out elsewhere, Southern’s management is extremely accurate in forecasting its next quarter’s earnings. In fact, Southern has not missed a forecast in ten years; and it typically predicts the narrowest guidance range in the industry. In the last announcement, the range was $0.08 on earnings of $2.80. The company nailed the top end of the range. With the guidance now lower than expected, it seems an easy task – given that track record – to show a nice upside beat. As the chart below shows, SO is in a deeply oversold condition. Shares have already completed a 61.8% Fibonacci retrenchment of its August to January run. They are also touching its 200-day moving average, which coincides with an area of former price support. The Relative Strength Index (RSI – 13) is printing a rare oversold reading below 30. All the above combine to make Southern Company a compelling buy for long-term investors, especially those looking for income. I consider shares to be attractive at this level, and I expect a rebound toward the 50-day moving average (currently: $49) over the next few weeks. If you buy the shares, you can collect the 4.6% dividend after 12 months. But in the Dr. Stoxx Options Letter, we have a way of collecting even more than that in half the time. Our put-write strategy allows us to collect a 5.5% dividend in 6 months, which annualizes to a 11% yield. This is a low-risk way of adding income to our investing capital, and if we are put the shares, we can always sell calls against the shares to lower our cost basis even further. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Utility stocks have gone from “hero” to “zero” in a month. Southern Company shows a historical pullback. Despite disappointing earnings, shares of Southern Company look poised to bounce from here. It’s hard to believe, I know, but the strongest sector among U.S. stocks last year was the utilities sector. The normally staid and stuffy Utilities Index returned over 30% in 2014, including dividends. Utility stocks, traditionally a safe haven for risk adverse, long-term investors, were suddenly the go-to place for a very different kind of financial animal: the “momentum stock” trader… at least for a while. All that ended in January this year. We’ve seen a substantial correction in the utilities sector so far this year, with many of the key players trading off 10% or more from their year-to-date highs. Analysts are laying blame on the strong rebound in treasury bond interest rates, which itself has been caused by the end of the Fed’s quantitative easing program (among other things). As rates climb, those looking for income and safety tend to pull money out of interest bearing stocks and put that money to work into safe havens like bonds and treasuries. This is why a chart of the 10-year yield with the utility stock index overlaid, shows a clear tendency of the two asset classes to mirror each other: [Source: MarketWatch ] I’m in the camp that counts this pullback in utilities as a great buying opportunity. Nothing has changed in the fundamentals of the underlying companies; and the lower share price makes their dividends all the more attractive. Right now, you’ll pay less for more utility yield, than at any time in the past 6 months. Among domestic utilities, there are 5 big players: NextEra Energy ( NEP , $46B), Dominion Resources ( D , $42B), Southern Company ( SO , $42B), American Electric ( AEP , $28B), and PG&E ( PCG , $26B). All 5 companies are trading around -10% below their 52-week highs. And all 5 companies have seen their dividend rates climb at least 50 basis points so far this year, making them attractive places to park cash for those looking for discounted income. My favorite among the big 5 is Southern Company . This utility company generates electricity through coal, nuclear, oil, gas, and hydro and distributes it in the states of Alabama, Georgia, Florida and Mississippi. Since peaking at $53.16 in late January as investors sought the relative safety of utilities, the stock has fallen about 14% in less than three weeks’ time, the largest pullback of the top 5. That is a move of statistical importance: it hasn’t been matched since the tail-end of the Great Recession, a time with a very different economic context. Shares are therefore ripe for a bounce from here. As of February 18th, the dividend yield of SO is 4.61%, which is currently about 110 basis points above the large-cap utilities index average. This is also the largest dividend payout among the top 5 utility companies, as the chart below demonstrates: As investors in the company know too well, at the last earnings announcement on February 4th, Southern reported quarterly revenues about 20% lower year on year, but they were, nevertheless, better than what analysts expected ( $4.1B actual vs. $3.7B expected). Quarterly earnings per share were in line with analyst estimates (0.38, adjusted for non-recurring costs, vs. 0.48 the previous year), and fiscal year 2014 showed a modest 3.7% rise in overall e.p.s., but shares still traded lower the next day by 2.6%. The reason for the selloff was that the company also lowered the range of its forward guidance; not by much, but enough to create disappointment. The causes of the drawdown in earnings were higher operating and maintenance costs, which jumped 33.4% to $1.3B, while the company’s total operating expenses for the period were over 10% higher than the prior year. There were also charges related to delays in the building of an $8 billion nuclear plant in Georgia, along with a drop in residential sales. The good news, however, is that industrial sales were up 3.3% quarter on quarter, and forward projected growth for the same is pegged at 1.7%. Both figures are much higher than industry average of 0.6%. The slowdown in retail sales, which hampered sales growth last quarter, is expected to rebound by 1.3% this next year: (click to enlarge) There are 22 Wall Street analysts who cover Southern Company. The majority of those, rate the company as either a “hold” (11) or a “sell” (10). There is only one “buy” rating on the stock (Argus). The consensus 12-month price target for SO is only $48, a mere 4.5% above current trading prices. With expectations so low, it won’t take much of a beat to generate a number of upgrades. As has been pointed out elsewhere, Southern’s management is extremely accurate in forecasting its next quarter’s earnings. In fact, Southern has not missed a forecast in ten years; and it typically predicts the narrowest guidance range in the industry. In the last announcement, the range was $0.08 on earnings of $2.80. The company nailed the top end of the range. With the guidance now lower than expected, it seems an easy task – given that track record – to show a nice upside beat. As the chart below shows, SO is in a deeply oversold condition. Shares have already completed a 61.8% Fibonacci retrenchment of its August to January run. They are also touching its 200-day moving average, which coincides with an area of former price support. The Relative Strength Index (RSI – 13) is printing a rare oversold reading below 30. All the above combine to make Southern Company a compelling buy for long-term investors, especially those looking for income. I consider shares to be attractive at this level, and I expect a rebound toward the 50-day moving average (currently: $49) over the next few weeks. If you buy the shares, you can collect the 4.6% dividend after 12 months. But in the Dr. Stoxx Options Letter, we have a way of collecting even more than that in half the time. Our put-write strategy allows us to collect a 5.5% dividend in 6 months, which annualizes to a 11% yield. This is a low-risk way of adding income to our investing capital, and if we are put the shares, we can always sell calls against the shares to lower our cost basis even further. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News