Scalper1 News

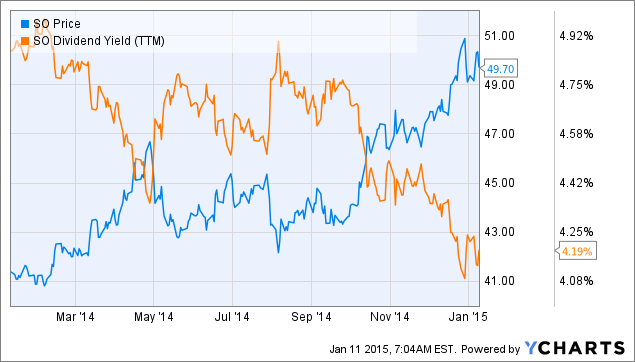

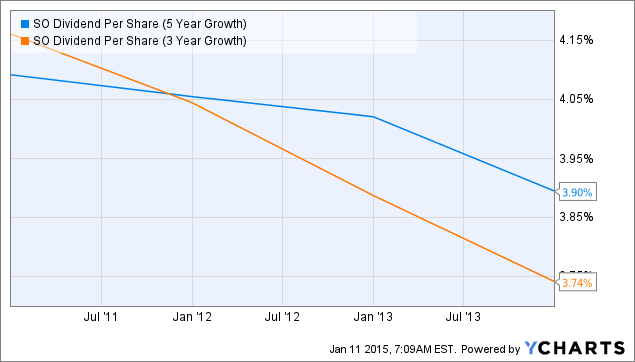

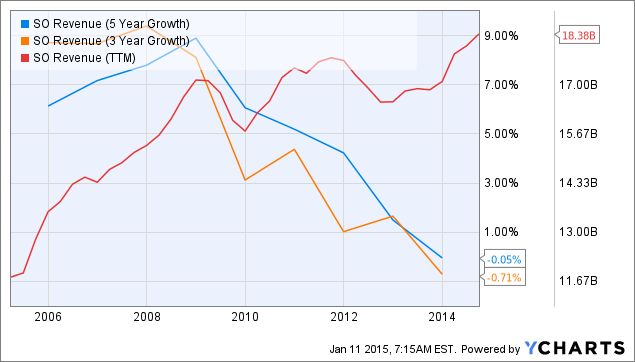

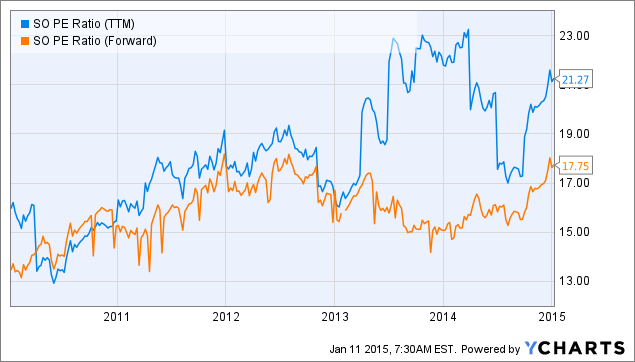

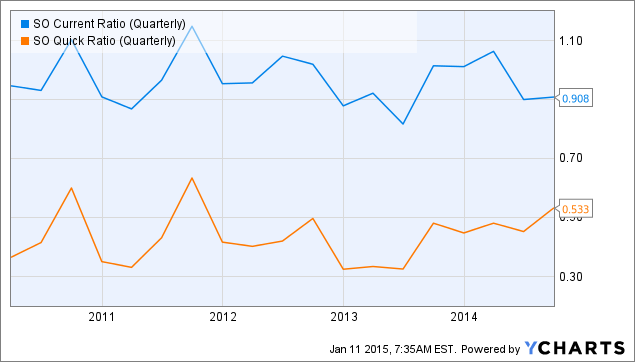

Summary I’ve recommended buying SO twice over the past 12 months, once at a dividend yield of 5.00% and once at 4.84%. At the current price per share of $49.70, shares are yielding only 4.19%, which I believe is too low, considering the slow rate of dividend growth. I will reconsider if the stock drops by 10% or more. Shares in Southern Company (NYSE: SO ) are currently trading at a price of $49.70, which is $8.32 or 20.1% higher than twelve months ago. I’ve recommended buying SO twice over the past 12 months, once in January of 2014, when the dividend yield reached 5.00%, and once in June, at a current yield of 4.84%. With the recent growth in share price however, the yield has gone down and investors getting in at the current level will get a yield on cost of only 4.19%. SO data by YCharts The dividend growth rate for SO is very low, at 3.74% over the past 3 years and 3.90% annually over the past 5 years. This means it would take 5 years to get back to the yield on cost of 5.0% investors could get 12 months ago. SO Dividend Per Share (5 Year Growth) data by YCharts SO’s revenue for the current fiscal year is expected to reach $18.17 billion, which is an increase of 6.9% to last year’s $17.09 billion. For next year, a further 3.1% increase to $18.73 billion is expected. The trailing twelve month revenues stand at $18.38 billion. The average price to sales ratio for SO over the past 5 years has been 2.2, which is well above the industry average of 1.5 . The current market cap is $44.72 billion. Here’s what SO’s p/s ratios look like at today’s prices: Dollar amounts Price to sales ratio % above 5 year average Price per share at p/s = 2.2 Trailing twelve month revenue $18.38 billion 2.43 10.5% $44.98 Current FY expected revenue $18.17 billion 2.46 11.8% $44.45 Next FY expected revenue $18.73 billion 2.39 8.6% $45.76 SO Revenue (5 Year Growth) data by YCharts Southern’s 5 year average p/e ratio stands at 18.7. If we aply this multiple to the trailing twelve month earnings per share of $2.34, we get a price per share of $43.76, which is well below the current price. Earnings per share for the current fiscal year are expected to be somewhat higher, at $2.80, putting the forward p/e ratio at 17.8. For next fiscal year, EPS is expected to grow a further 2.5%, to $2.87, which means the 1 year forward p/e ratio is 17.3. SO PE Ratio (NYSE: TTM ) data by YCharts SO Current Ratio (Quarterly) data by YCharts I usually look for current ratios in excess of 1.0, as this indicates current assets are larger than current liabilities. However, with utility companies such as SO, a slightly lower current ratio isn’t an immediate cause for concern, as income streams tend to be very steady and reliable. As we can see in the next graph, SO’s long term debt has slowly but surely been growing in recent years. Low interest rates mean the company is more than able to finance this debt, as net interest costs over the past 12 months were only $800 million, or 4.35% of the company’s trailing twelve month revenue. SO Total Long Term Debt (Quarterly) data by YCharts Conclusion: Buying SO at a dividend yield of 5.0% would have been a great idea. However, considering the company’s slow dividend growth rate, investors getting in now would likely have to wait for roughly 5 years to get to a yield on cost of 5%. Both on a p/e and p/s ratio basis, the company appears expensive compared to historical averages. The long term debt is growing, which isn’t a problem so long as interest rates stay low. I don’t see any reasons to buy at these levels, but may reconsider if the stock drops by 10% or more from its current price of $49.70. Disclaimer: I am not a registered investment advisor and do not provide specific investment advice. The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock you should do your own research and reach your own conclusion. It is up to investors to make the correct decision after necessary research. Investing includes risks, including loss of principal. Scalper1 News

Summary I’ve recommended buying SO twice over the past 12 months, once at a dividend yield of 5.00% and once at 4.84%. At the current price per share of $49.70, shares are yielding only 4.19%, which I believe is too low, considering the slow rate of dividend growth. I will reconsider if the stock drops by 10% or more. Shares in Southern Company (NYSE: SO ) are currently trading at a price of $49.70, which is $8.32 or 20.1% higher than twelve months ago. I’ve recommended buying SO twice over the past 12 months, once in January of 2014, when the dividend yield reached 5.00%, and once in June, at a current yield of 4.84%. With the recent growth in share price however, the yield has gone down and investors getting in at the current level will get a yield on cost of only 4.19%. SO data by YCharts The dividend growth rate for SO is very low, at 3.74% over the past 3 years and 3.90% annually over the past 5 years. This means it would take 5 years to get back to the yield on cost of 5.0% investors could get 12 months ago. SO Dividend Per Share (5 Year Growth) data by YCharts SO’s revenue for the current fiscal year is expected to reach $18.17 billion, which is an increase of 6.9% to last year’s $17.09 billion. For next year, a further 3.1% increase to $18.73 billion is expected. The trailing twelve month revenues stand at $18.38 billion. The average price to sales ratio for SO over the past 5 years has been 2.2, which is well above the industry average of 1.5 . The current market cap is $44.72 billion. Here’s what SO’s p/s ratios look like at today’s prices: Dollar amounts Price to sales ratio % above 5 year average Price per share at p/s = 2.2 Trailing twelve month revenue $18.38 billion 2.43 10.5% $44.98 Current FY expected revenue $18.17 billion 2.46 11.8% $44.45 Next FY expected revenue $18.73 billion 2.39 8.6% $45.76 SO Revenue (5 Year Growth) data by YCharts Southern’s 5 year average p/e ratio stands at 18.7. If we aply this multiple to the trailing twelve month earnings per share of $2.34, we get a price per share of $43.76, which is well below the current price. Earnings per share for the current fiscal year are expected to be somewhat higher, at $2.80, putting the forward p/e ratio at 17.8. For next fiscal year, EPS is expected to grow a further 2.5%, to $2.87, which means the 1 year forward p/e ratio is 17.3. SO PE Ratio (NYSE: TTM ) data by YCharts SO Current Ratio (Quarterly) data by YCharts I usually look for current ratios in excess of 1.0, as this indicates current assets are larger than current liabilities. However, with utility companies such as SO, a slightly lower current ratio isn’t an immediate cause for concern, as income streams tend to be very steady and reliable. As we can see in the next graph, SO’s long term debt has slowly but surely been growing in recent years. Low interest rates mean the company is more than able to finance this debt, as net interest costs over the past 12 months were only $800 million, or 4.35% of the company’s trailing twelve month revenue. SO Total Long Term Debt (Quarterly) data by YCharts Conclusion: Buying SO at a dividend yield of 5.0% would have been a great idea. However, considering the company’s slow dividend growth rate, investors getting in now would likely have to wait for roughly 5 years to get to a yield on cost of 5%. Both on a p/e and p/s ratio basis, the company appears expensive compared to historical averages. The long term debt is growing, which isn’t a problem so long as interest rates stay low. I don’t see any reasons to buy at these levels, but may reconsider if the stock drops by 10% or more from its current price of $49.70. Disclaimer: I am not a registered investment advisor and do not provide specific investment advice. The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock you should do your own research and reach your own conclusion. It is up to investors to make the correct decision after necessary research. Investing includes risks, including loss of principal. Scalper1 News

Scalper1 News