Scalper1 News

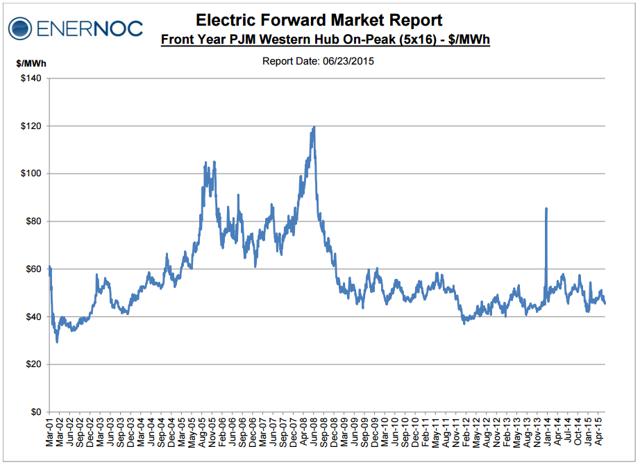

Southern Company and Exelon could outperform the anticipated average annual total return of 6% to 8% for the electric utility sector. Southern Company’s historic strength is a strong balance sheet and friendly regulatory environment. A return to these attributes will drive share prices higher. Exelon’s return to above average growth lays in future power prices in the Northeast and Midwest. Slide guitar aficionado Ry Cooder released a version of Snooky Young’s “Why Don’t You Try Me?” in 1980 that is beyond outstanding. Ry Cooder was ranked eighth on Rolling Stone’s 2003 list of “The 100 Greatest Guitarists of All Time.” The song’s refrain could ring true for some utility investors looking for a bit more potential oomph from their utility selections: I ain’t saying I’m all you need, but If your regular man ain’t treating’ you right Why don’t you try a man like me tonight? Some investors seem to get lulled to complacency with the dull and boring regular returns usually associated with utility investments. Steadily increasing and inflation-matching dividends coupled with slowly rising share prices lack the fireworks excitement of the next tech fad, but can provide long-term rewards for patient investors. Based on today’s valuations, many analysts are anticipating a 6% to 8% annual total return for long-term holdings of utility stocks. However, if you are willing to take on a bit more risk and controversy, Southern Company (NYSE: SO ) and Exelon (NYSE: EXC ) could end up treatin’ you better, just like Ry Cooder says. The story line for Southern Co. is its two large power generation projects, one utilizing first of its kind technology of “clean coal” and the other constructing two new nuclear power units. For some investors, the uncertainly of these projects offset the historically positive regulatory environment of their service territory. The news from both projects has not been encouraging. The chameleon transformation from a dirty and cheap coal-fired power producer to an efficient lower-carbon footprint has not been quick or low cost. The complex and new technology of recycling and sequestering of carbon emissions at the Kemper plant has been plagued by cost overruns, earnings charges and delays. The expansion of their nuclear capacity is one of the first projects of its kind after a 30-year nuclear plant construction hiatus. There are plenty of issues to be discouraged about, if an investor chooses to focus on them. However, management is moving ahead towards completion of the Kemper clean coal plant and it should be fully operational within the next year (which is what was said a year ago as well). With the recent departure of one of its equity partners, the economics of the plant may shift to a higher merchant power profile than its original regulated production profile. The resulting higher merchant power risk could pan out with higher profits as well, as Southern Company has a successful merchant power business, Southern Power, with 26 plants in nine states generating 9,800Mw. Southern Power contributed $1.5 billion in 2014 revenues and $172 million in before-tax earnings. Southern Company offers higher exposure to overall economic improvements than some of its peers. Population is growing in the southeast, and an overall business-friendly environment is expanding the south’s economic base. SO traditionally trades at a sector premium due to a strong balance sheet and a supportive regulatory environment, but the uncertainty of its two large construction projects is reducing current market valuations. With the retirement of its soon-to-be uneconomical coal generating capacity, this investment cycle for SO should last only a few more years. Investor attention will then focus again on the underlying attributes of SO’s management and geography. The investment story for Exelon focuses on a recovery of power prices in the Mid-Atlantic and Northeast in addition to the company’s increasing exposure to the stability of regulated income vs commodity merchant power pricing. With the completion of its recent mergers, EXC will generate over 50% of its earnings from regulated business, up from about 20% pre-financial crisis. As power prices are substantially below 2007-2008 levels, merchant power margins have been reduced reflected in lower earnings and a cut in the dividend several years back. Below is a chart of power prices going back to 2001, courtesy of sriverconsulting.com: (click to enlarge) Unlike its merchant power peers in the south and west who use 20-year power purchase agreements, the service area for EXC is mainly controlled by 3-year rolling auctions, supervised by PJM, a quasi-government regional regulatory agency responsible for electricity reliability and distribution. Eighteen months ago, the polar vortex caused havoc with coal and natural gas power generation, exposing risks to the NE electric grid as an unbelievable 22% of the region’s generating capacity was shutdown. The Jan 2014 price spike is a result of the severe supply problems exposed with very cold weather. As the largest nuclear plant operator, EXC also has the benefit of being one of the most reliable PJM merchant power providers. PJM has recently approved a revised “premium” for reliability, which will favor EXC, for the 2018/2019 auction scheduled for this August. According to Bloomberg, the reliability “pay-for-performance” plan could substantially increase wholesale market prices from $50 to $60 a megawatt per day for those plants not meeting the reliability standard to upwards of $120 to $140 for those that do. The longer-term impact, while delayed until 2018, could be quite positive as a bottoming of power prices should be at hand. Power pricing is partially driven by costs of competitive fuel supplies, such as natural gas. As gas prices increase over time, so will the price of power generation in PJM markets. EXC’s power costs are not dependent on low gas prices for profitability and rising natural gas markets favor EXC’s steadier-cost nuclear power margins. The auction process is a double-edged sword. Last May, three of EXC’s nuclear plants in Illinois and New Jersey bid higher than competitors bid and were not selected as base-load power providers for the 2017/2018 auction. Known as a “failure to clear,” the company will not provide about 4,500Mw out of 25,000Mw of generating capacity using the auction capacity payment program. EXC will not see regulated revenues for these plants from June 2017 to May 2018 but may contract the capacity during this time using spot pricing to any willing buyer. However, revenues could fall short of similar auction capacity sales, leading to discussions of closing these three plants on a permanent basis. Southern Company offers a current 5.1% dividend yield, outsized to the average 3.5% of utility ETFs. To match the anticipated utility long-term average total return of 6% to 8%, share prices need to move by only 1% to 3% above current price. As the uncertainly clears with the completion of the capacity addition, this would be a minor hurdle for investors. Exelon offers a sector average 3.8% yield with the prospect of improving power prices driving total earnings faster than some of its peers. While potentially higher risk than some of their competitors, utility investors might consider Ry Cooder’s lyrics : “Do yourself a favor, why don’t you try me?” Note: Please review disclosure in author’s profile. Disclosure: I am/we are long EXC, SO. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Southern Company and Exelon could outperform the anticipated average annual total return of 6% to 8% for the electric utility sector. Southern Company’s historic strength is a strong balance sheet and friendly regulatory environment. A return to these attributes will drive share prices higher. Exelon’s return to above average growth lays in future power prices in the Northeast and Midwest. Slide guitar aficionado Ry Cooder released a version of Snooky Young’s “Why Don’t You Try Me?” in 1980 that is beyond outstanding. Ry Cooder was ranked eighth on Rolling Stone’s 2003 list of “The 100 Greatest Guitarists of All Time.” The song’s refrain could ring true for some utility investors looking for a bit more potential oomph from their utility selections: I ain’t saying I’m all you need, but If your regular man ain’t treating’ you right Why don’t you try a man like me tonight? Some investors seem to get lulled to complacency with the dull and boring regular returns usually associated with utility investments. Steadily increasing and inflation-matching dividends coupled with slowly rising share prices lack the fireworks excitement of the next tech fad, but can provide long-term rewards for patient investors. Based on today’s valuations, many analysts are anticipating a 6% to 8% annual total return for long-term holdings of utility stocks. However, if you are willing to take on a bit more risk and controversy, Southern Company (NYSE: SO ) and Exelon (NYSE: EXC ) could end up treatin’ you better, just like Ry Cooder says. The story line for Southern Co. is its two large power generation projects, one utilizing first of its kind technology of “clean coal” and the other constructing two new nuclear power units. For some investors, the uncertainly of these projects offset the historically positive regulatory environment of their service territory. The news from both projects has not been encouraging. The chameleon transformation from a dirty and cheap coal-fired power producer to an efficient lower-carbon footprint has not been quick or low cost. The complex and new technology of recycling and sequestering of carbon emissions at the Kemper plant has been plagued by cost overruns, earnings charges and delays. The expansion of their nuclear capacity is one of the first projects of its kind after a 30-year nuclear plant construction hiatus. There are plenty of issues to be discouraged about, if an investor chooses to focus on them. However, management is moving ahead towards completion of the Kemper clean coal plant and it should be fully operational within the next year (which is what was said a year ago as well). With the recent departure of one of its equity partners, the economics of the plant may shift to a higher merchant power profile than its original regulated production profile. The resulting higher merchant power risk could pan out with higher profits as well, as Southern Company has a successful merchant power business, Southern Power, with 26 plants in nine states generating 9,800Mw. Southern Power contributed $1.5 billion in 2014 revenues and $172 million in before-tax earnings. Southern Company offers higher exposure to overall economic improvements than some of its peers. Population is growing in the southeast, and an overall business-friendly environment is expanding the south’s economic base. SO traditionally trades at a sector premium due to a strong balance sheet and a supportive regulatory environment, but the uncertainty of its two large construction projects is reducing current market valuations. With the retirement of its soon-to-be uneconomical coal generating capacity, this investment cycle for SO should last only a few more years. Investor attention will then focus again on the underlying attributes of SO’s management and geography. The investment story for Exelon focuses on a recovery of power prices in the Mid-Atlantic and Northeast in addition to the company’s increasing exposure to the stability of regulated income vs commodity merchant power pricing. With the completion of its recent mergers, EXC will generate over 50% of its earnings from regulated business, up from about 20% pre-financial crisis. As power prices are substantially below 2007-2008 levels, merchant power margins have been reduced reflected in lower earnings and a cut in the dividend several years back. Below is a chart of power prices going back to 2001, courtesy of sriverconsulting.com: (click to enlarge) Unlike its merchant power peers in the south and west who use 20-year power purchase agreements, the service area for EXC is mainly controlled by 3-year rolling auctions, supervised by PJM, a quasi-government regional regulatory agency responsible for electricity reliability and distribution. Eighteen months ago, the polar vortex caused havoc with coal and natural gas power generation, exposing risks to the NE electric grid as an unbelievable 22% of the region’s generating capacity was shutdown. The Jan 2014 price spike is a result of the severe supply problems exposed with very cold weather. As the largest nuclear plant operator, EXC also has the benefit of being one of the most reliable PJM merchant power providers. PJM has recently approved a revised “premium” for reliability, which will favor EXC, for the 2018/2019 auction scheduled for this August. According to Bloomberg, the reliability “pay-for-performance” plan could substantially increase wholesale market prices from $50 to $60 a megawatt per day for those plants not meeting the reliability standard to upwards of $120 to $140 for those that do. The longer-term impact, while delayed until 2018, could be quite positive as a bottoming of power prices should be at hand. Power pricing is partially driven by costs of competitive fuel supplies, such as natural gas. As gas prices increase over time, so will the price of power generation in PJM markets. EXC’s power costs are not dependent on low gas prices for profitability and rising natural gas markets favor EXC’s steadier-cost nuclear power margins. The auction process is a double-edged sword. Last May, three of EXC’s nuclear plants in Illinois and New Jersey bid higher than competitors bid and were not selected as base-load power providers for the 2017/2018 auction. Known as a “failure to clear,” the company will not provide about 4,500Mw out of 25,000Mw of generating capacity using the auction capacity payment program. EXC will not see regulated revenues for these plants from June 2017 to May 2018 but may contract the capacity during this time using spot pricing to any willing buyer. However, revenues could fall short of similar auction capacity sales, leading to discussions of closing these three plants on a permanent basis. Southern Company offers a current 5.1% dividend yield, outsized to the average 3.5% of utility ETFs. To match the anticipated utility long-term average total return of 6% to 8%, share prices need to move by only 1% to 3% above current price. As the uncertainly clears with the completion of the capacity addition, this would be a minor hurdle for investors. Exelon offers a sector average 3.8% yield with the prospect of improving power prices driving total earnings faster than some of its peers. While potentially higher risk than some of their competitors, utility investors might consider Ry Cooder’s lyrics : “Do yourself a favor, why don’t you try me?” Note: Please review disclosure in author’s profile. Disclosure: I am/we are long EXC, SO. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News