Scalper1 News

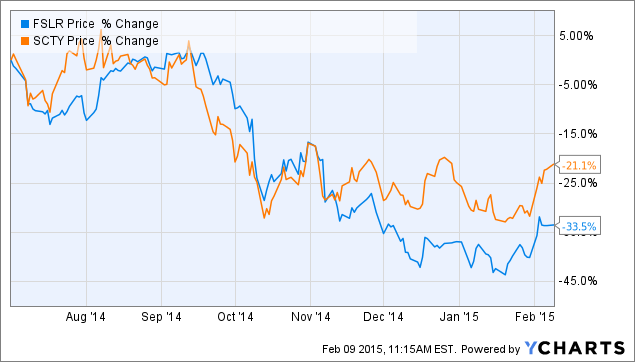

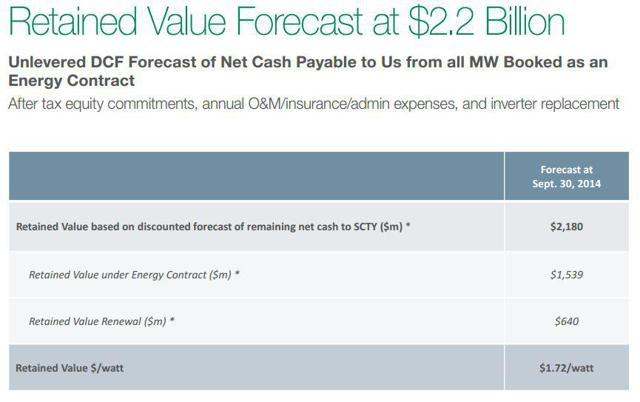

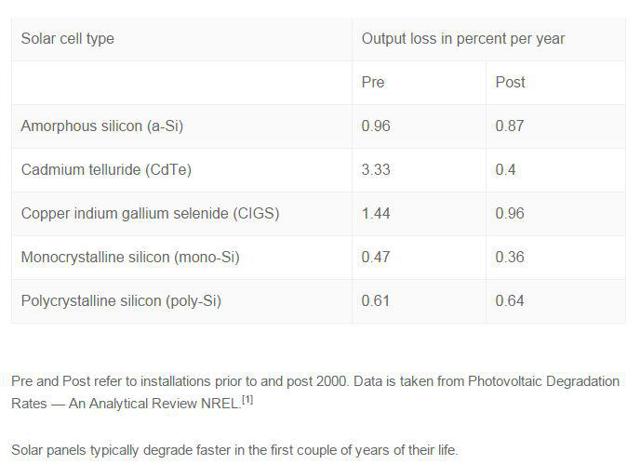

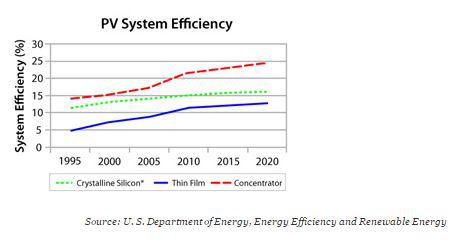

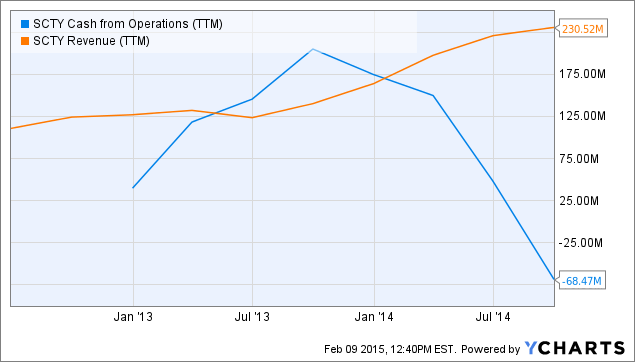

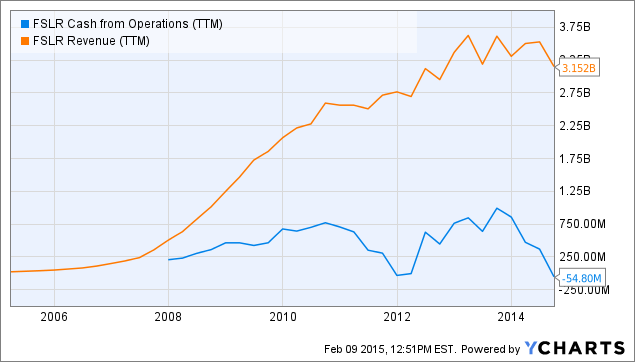

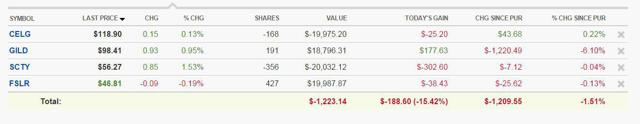

Summary SolarCity and First Solar stocks were highly correlated at the start of the fossil fuel price crash of 2014, but decoupled a few months ago. There may be an opportunity to hedge one stock against the other. SolarCity is highly speculative and will not make any profits for many years — if ever. First Solar is an established company with earnings. A pair trade could be a low-risk way to play FSLR and SCTY. Growth in solar energy has been tremendous and will almost surely be strong for the next several decades. According to seig.org (Solar Energy Industries Association): Today, the U.S. has an estimated 20 gigawatts [GW] of installed solar capacity nationwide, enough to effectively power nearly 4 million homes in the United States – or every single home in a state the size of Massachusetts or New Jersey – with another 20 GW in the pipeline for 2015 and 2016, according to SEIA and GTM Research projections. However, there have been major hiccups along the way including (but certainly not limited to) the whimsies of politics and fossil fuel prices. What if there was a way to invest in a solar stock that takes out the uncertainty of those hiccups and even the uncertainty of the overall market? There is a way. Last week I began a new mock portfolio here on Seeking Alpha: the Pairs Trade Portfolio; today I continue it with trades on SolarCity (NASDAQ: SCTY ) and First Solar (NASDAQ: FSLR ). A pair trade is a market-neutral hedge in which an investor essentially pits one company against another. Getting a return on a pair trade is not dependent upon a particular stock rising or falling necessarily, but dependent upon the relative price moves between two stocks (or other financial instruments). I won’t go into details about the hows and whys of pair trading here, as I have already described the theory in detail in a previous article. Please take a look at the link for more information on why pair trades might be a good investment. Correlation Since the start of the oil – and more importantly, natural gas – price crash, we can see from the chart below that First Solar and SolarCity stock prices had a high correlation for a few months before decoupling in early November as Solar City headed pretty much sideways while First Solar dipped substantially more. FSLR data by YCharts The change in correlation gives us our first clue that there might be an opportunity for a pair trade with these two stocks. Should SolarCity have outperformed First Solar? Time to dig a little deeper and see if we think FSLR is a relative bargain compared to SCTY. While the two companies are in the same industry and the stocks have had a high degree of correlation recently, the strategies of the companies could not be more different. SolarCity is pursuing fast growth financed by debt in the residential space while First Solar is a profitable vertically integrated manufacturer and utility-scale operator. Despite the differences in the companies, the macro events that often drive the stocks of most solar companies apply to both. The obvious recent example is the severe drop in fossil fuel prices, but there have been other factors in the past and there will undoubtedly be numerous factors in the future that affect both of these companies. Again, the pair trade largely insulates an investor from external macro events and focuses on one thing only: will one stock outperform the other? I think over the long haul First Solar will outperform SolarCity and below are some reasons. SolarCity: Show Me the Money When and how will SolarCity make money? That’s a big question for anyone interested in the stock and it is an impossible question to answer. At this point, the stock is pure speculation and the company is not expected to post a profit for many, many years. Well, how does one value the company then? SolarCity itself would like investors to focus on “retained value”. In a recent letter to shareholders a retained value number is prominently displayed as one of the highlights of the third quarter. In a presentation used in the third quarter conference call, the company had this slide to show: (click to enlarge) So what is retained value? SolarCity defines it as a discounted cash flow forecast from all megawatts booked as a contract. I won’t go into all of the assumptions that SolarCity makes to compute the retained value figure (much of which is unknown to the public), but I will hit some highlights. First, SolarCity assumes all contracts currently in place or booked to be installed will be renewed after 20 years. This is an outstanding assumption that is obviously flawed. 100% renewals will simply not happen, nor will all bookings even be installed. Second, the company assumes a discount rate of 6%. That is actually high at the moment, so one could argue that the retained value figure should, in fact, be higher than $2.2 billion. However, at some point rates will likely rise – perhaps substantially – and the 6% assumption could be far too low. Third, the company assumes that the technology will be current enough to warrant renewal for 10 years after the initial 20 year period. SolarCity states that the life expectancy of the equipment (not counting inverter replacement) used in its systems is “typically 30 years or more”. I’m going to go into that third point a bit more as I think it is particularly suspect. For one thing, solar panels degrade over time as the following shows: (click to enlarge) (Source: energyinformative.org ) Exact numbers over a long period of time are hard to come by since the vast majority of solar panels in existence have been installed quite recently. Based on my reading, I would estimate that the typical SolarCity customer could expect at least a 10% – 15% drop in power production at the end of 20 years. But more important is that the homeowner’s system will simply be obsolete in 20 years. Efficiency has increased dramatically in the last 20 years and will certainly continue to do so. I would not quite compare a 2015 solar system to using a computer from 1995…perhaps more like 2005. The hypothetical homeowner in 2035 is likely to be better off upgrading a system rather than renewing a lease on an outdated one. SolarCity wants investors to value the company based on this rather dubious metric of Retained Value. The simple fact that there are so many question marks around the computation makes me very nervous about it. Therefore, in my opinion, SolarCity’s retained value metric should be ignored and the company’s assumptions of future cash flows are highly speculative. The risks to the stock are huge. While shareholder’s in SCTY don’t seem to be too concerned about the present situation, let’s look at a more time-honored metric – current cash flow: SCTY Cash from Operations (NYSE: TTM) data by YCharts The above chart shows that the company has grown revenue at a rapid clip since going public but has also been burning through more and more money. Debt has increased substantially recently and will of course continue to do so for the foreseeable future. Right now SolarCity’s debt is financed at very low interest rates, but that could change over the next few years. And perhaps more importantly (and often overlooked by equity investors), it is debt holders that hold the reins to the company as pointed out in Barron’s : Founded in 2006, SolarCity has been consistently unprofitable. Most of its tax benefits and a portion of its future cash flows have been pledged to financing partners whose claims on the company are often senior to common shareholders’. If and when SolarCity begins to have positive cash flow, much of that money is pledged to go to the debt of the company. SolarCity received financing based upon its contract revenue and it has certain obligations to fulfill that exclude stockholders. First Solar: Oh, You Make Money? How Novel! Following up on the cash flow metric charted above, here’s a look at First Solar’s numbers: FSLR Cash from Operations ( TTM) data by YCharts First Solar is not exactly swimming in cash, but it has demonstrated a reasonable track record at generating some decent positive cash flow. In Q3 2014, the company posted an earnings per share of $0.87 and posted full-year guidance of $2.40 – $2.80. Based on 2015 analyst estimates of $4.52 per share, FSLR trades at a forward P/E of only 10.4. Conclusion SolarCity is certainly an interesting speculative play, but the key word there is “speculative”. Actually, the word “interesting” is somewhat key as well, as I prefer my investments to be as boring and predictable as possible. SolarCity is a wild card that may not come to fruition for decades, if ever. First Solar is clearly the lower risk play here. SolarCity is growing far faster, but is not making money doing so and might not ever make a profit. Here’s an interesting tidbit: in Q3 2014, SolarCity posted revenue of $58 million and First Solar posted revenue of $889 million — yet Solar City has a slightly higher market capitalization than First Solar. By going long FSLR and short SCTY, my strategy makes the viability of the solar industry as a whole a largely moot point. If the industry goes into the doldrums for the next 10 years it does not matter as long as FSLR outperforms SCTY. If the market tanks and takes these two stocks down to the single digits, it does not matter; as long as FSLR outperforms SCTY my trade will make money. The Portfolio I’m putting my fake money where my mouth is and buying FSLR and shorting SCTY in my Seeking Alpha portfolio as of about 1:20 pm Eastern Time on Feb 9. Here is what the mock portfolio looks like so far after one week (note that I plan on adjusting, adding, and updating this for years): (click to enlarge) Not much of note yet, but there will be more to come. Be sure to click “follow” if you would like to get real-time alerts on my future articles. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary SolarCity and First Solar stocks were highly correlated at the start of the fossil fuel price crash of 2014, but decoupled a few months ago. There may be an opportunity to hedge one stock against the other. SolarCity is highly speculative and will not make any profits for many years — if ever. First Solar is an established company with earnings. A pair trade could be a low-risk way to play FSLR and SCTY. Growth in solar energy has been tremendous and will almost surely be strong for the next several decades. According to seig.org (Solar Energy Industries Association): Today, the U.S. has an estimated 20 gigawatts [GW] of installed solar capacity nationwide, enough to effectively power nearly 4 million homes in the United States – or every single home in a state the size of Massachusetts or New Jersey – with another 20 GW in the pipeline for 2015 and 2016, according to SEIA and GTM Research projections. However, there have been major hiccups along the way including (but certainly not limited to) the whimsies of politics and fossil fuel prices. What if there was a way to invest in a solar stock that takes out the uncertainty of those hiccups and even the uncertainty of the overall market? There is a way. Last week I began a new mock portfolio here on Seeking Alpha: the Pairs Trade Portfolio; today I continue it with trades on SolarCity (NASDAQ: SCTY ) and First Solar (NASDAQ: FSLR ). A pair trade is a market-neutral hedge in which an investor essentially pits one company against another. Getting a return on a pair trade is not dependent upon a particular stock rising or falling necessarily, but dependent upon the relative price moves between two stocks (or other financial instruments). I won’t go into details about the hows and whys of pair trading here, as I have already described the theory in detail in a previous article. Please take a look at the link for more information on why pair trades might be a good investment. Correlation Since the start of the oil – and more importantly, natural gas – price crash, we can see from the chart below that First Solar and SolarCity stock prices had a high correlation for a few months before decoupling in early November as Solar City headed pretty much sideways while First Solar dipped substantially more. FSLR data by YCharts The change in correlation gives us our first clue that there might be an opportunity for a pair trade with these two stocks. Should SolarCity have outperformed First Solar? Time to dig a little deeper and see if we think FSLR is a relative bargain compared to SCTY. While the two companies are in the same industry and the stocks have had a high degree of correlation recently, the strategies of the companies could not be more different. SolarCity is pursuing fast growth financed by debt in the residential space while First Solar is a profitable vertically integrated manufacturer and utility-scale operator. Despite the differences in the companies, the macro events that often drive the stocks of most solar companies apply to both. The obvious recent example is the severe drop in fossil fuel prices, but there have been other factors in the past and there will undoubtedly be numerous factors in the future that affect both of these companies. Again, the pair trade largely insulates an investor from external macro events and focuses on one thing only: will one stock outperform the other? I think over the long haul First Solar will outperform SolarCity and below are some reasons. SolarCity: Show Me the Money When and how will SolarCity make money? That’s a big question for anyone interested in the stock and it is an impossible question to answer. At this point, the stock is pure speculation and the company is not expected to post a profit for many, many years. Well, how does one value the company then? SolarCity itself would like investors to focus on “retained value”. In a recent letter to shareholders a retained value number is prominently displayed as one of the highlights of the third quarter. In a presentation used in the third quarter conference call, the company had this slide to show: (click to enlarge) So what is retained value? SolarCity defines it as a discounted cash flow forecast from all megawatts booked as a contract. I won’t go into all of the assumptions that SolarCity makes to compute the retained value figure (much of which is unknown to the public), but I will hit some highlights. First, SolarCity assumes all contracts currently in place or booked to be installed will be renewed after 20 years. This is an outstanding assumption that is obviously flawed. 100% renewals will simply not happen, nor will all bookings even be installed. Second, the company assumes a discount rate of 6%. That is actually high at the moment, so one could argue that the retained value figure should, in fact, be higher than $2.2 billion. However, at some point rates will likely rise – perhaps substantially – and the 6% assumption could be far too low. Third, the company assumes that the technology will be current enough to warrant renewal for 10 years after the initial 20 year period. SolarCity states that the life expectancy of the equipment (not counting inverter replacement) used in its systems is “typically 30 years or more”. I’m going to go into that third point a bit more as I think it is particularly suspect. For one thing, solar panels degrade over time as the following shows: (click to enlarge) (Source: energyinformative.org ) Exact numbers over a long period of time are hard to come by since the vast majority of solar panels in existence have been installed quite recently. Based on my reading, I would estimate that the typical SolarCity customer could expect at least a 10% – 15% drop in power production at the end of 20 years. But more important is that the homeowner’s system will simply be obsolete in 20 years. Efficiency has increased dramatically in the last 20 years and will certainly continue to do so. I would not quite compare a 2015 solar system to using a computer from 1995…perhaps more like 2005. The hypothetical homeowner in 2035 is likely to be better off upgrading a system rather than renewing a lease on an outdated one. SolarCity wants investors to value the company based on this rather dubious metric of Retained Value. The simple fact that there are so many question marks around the computation makes me very nervous about it. Therefore, in my opinion, SolarCity’s retained value metric should be ignored and the company’s assumptions of future cash flows are highly speculative. The risks to the stock are huge. While shareholder’s in SCTY don’t seem to be too concerned about the present situation, let’s look at a more time-honored metric – current cash flow: SCTY Cash from Operations (NYSE: TTM) data by YCharts The above chart shows that the company has grown revenue at a rapid clip since going public but has also been burning through more and more money. Debt has increased substantially recently and will of course continue to do so for the foreseeable future. Right now SolarCity’s debt is financed at very low interest rates, but that could change over the next few years. And perhaps more importantly (and often overlooked by equity investors), it is debt holders that hold the reins to the company as pointed out in Barron’s : Founded in 2006, SolarCity has been consistently unprofitable. Most of its tax benefits and a portion of its future cash flows have been pledged to financing partners whose claims on the company are often senior to common shareholders’. If and when SolarCity begins to have positive cash flow, much of that money is pledged to go to the debt of the company. SolarCity received financing based upon its contract revenue and it has certain obligations to fulfill that exclude stockholders. First Solar: Oh, You Make Money? How Novel! Following up on the cash flow metric charted above, here’s a look at First Solar’s numbers: FSLR Cash from Operations ( TTM) data by YCharts First Solar is not exactly swimming in cash, but it has demonstrated a reasonable track record at generating some decent positive cash flow. In Q3 2014, the company posted an earnings per share of $0.87 and posted full-year guidance of $2.40 – $2.80. Based on 2015 analyst estimates of $4.52 per share, FSLR trades at a forward P/E of only 10.4. Conclusion SolarCity is certainly an interesting speculative play, but the key word there is “speculative”. Actually, the word “interesting” is somewhat key as well, as I prefer my investments to be as boring and predictable as possible. SolarCity is a wild card that may not come to fruition for decades, if ever. First Solar is clearly the lower risk play here. SolarCity is growing far faster, but is not making money doing so and might not ever make a profit. Here’s an interesting tidbit: in Q3 2014, SolarCity posted revenue of $58 million and First Solar posted revenue of $889 million — yet Solar City has a slightly higher market capitalization than First Solar. By going long FSLR and short SCTY, my strategy makes the viability of the solar industry as a whole a largely moot point. If the industry goes into the doldrums for the next 10 years it does not matter as long as FSLR outperforms SCTY. If the market tanks and takes these two stocks down to the single digits, it does not matter; as long as FSLR outperforms SCTY my trade will make money. The Portfolio I’m putting my fake money where my mouth is and buying FSLR and shorting SCTY in my Seeking Alpha portfolio as of about 1:20 pm Eastern Time on Feb 9. Here is what the mock portfolio looks like so far after one week (note that I plan on adjusting, adding, and updating this for years): (click to enlarge) Not much of note yet, but there will be more to come. Be sure to click “follow” if you would like to get real-time alerts on my future articles. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News