Scalper1 News

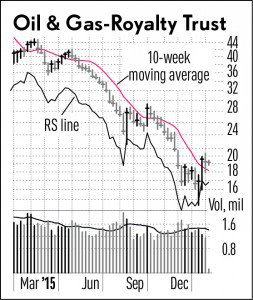

With five full weeks of trading completed in 2016, it’s crystal-clear that investors have preferred defensive sectors over high-growth ones. As highlighted in the previous IBD Industry Themes column , the Mining-Gold/Silver/Gems industry group has been a top gainer. Through Thursday’s action, the group rallied more than 9% since Jan. 1. On Friday, it heaped on even more gains as the major indexes melted lower. Investors typically seek gold and silver assets as stores of value, particularly when inflation is running rampant. Yet as the commodity and equity markets around the world show today, inflation is not the prime concern — deflation is. And with the U.S. economy still rebounding at a slower-than-normal rate, the theory that investors wish to counteract deflation with dividends is looking solid. Among IBD’s 197 industry groups, at least eight are showing year-to-date gains of 5% or more; four are from the utility sector, which ranks No. 1 in IBD’s stock research tables among 33 sectors. Diversified utilities, water utilities, gas distributors and electric power companies are the standouts. On top of these four utility subgroups, the dividend-rich Oil & Gas-Royalty Trust group is advancing. Through Thursday, it was up 8.7%, spanking the Dow Jones industrials (down 7% through Friday’s close). Oil royalty trusts are specialized corporations that are not taxed at the usual rates, so long as they pay out most of their profits in the form of cash dividends to shareholders. These trusts do not have physical operations or actual employees, but they still own rights to money-producing assets, including oil wells and mines. As seen in the accompanying chart, these stocks have fallen sharply in the stock market, mirroring the big slide in both crude oil and the shares of energy exploration companies. As a result, their yields have skyrocketed. BP Prudhoe Bay Royalty Trust ( BPT ), the largest by market value in the royalty trust group, currently shows an annualized yield of 14%. Yet BP Prudhoe Bay and Sabine Royalty Trust ( SBR ) (5% yield) are showing declining annualized dividends in the long term, based on analysis by IBD sister company William O’Neil + Co. The fluctuating price of crude oil, as well as daily production, will likely affect the amount of dividends paid. Scalper1 News

With five full weeks of trading completed in 2016, it’s crystal-clear that investors have preferred defensive sectors over high-growth ones. As highlighted in the previous IBD Industry Themes column , the Mining-Gold/Silver/Gems industry group has been a top gainer. Through Thursday’s action, the group rallied more than 9% since Jan. 1. On Friday, it heaped on even more gains as the major indexes melted lower. Investors typically seek gold and silver assets as stores of value, particularly when inflation is running rampant. Yet as the commodity and equity markets around the world show today, inflation is not the prime concern — deflation is. And with the U.S. economy still rebounding at a slower-than-normal rate, the theory that investors wish to counteract deflation with dividends is looking solid. Among IBD’s 197 industry groups, at least eight are showing year-to-date gains of 5% or more; four are from the utility sector, which ranks No. 1 in IBD’s stock research tables among 33 sectors. Diversified utilities, water utilities, gas distributors and electric power companies are the standouts. On top of these four utility subgroups, the dividend-rich Oil & Gas-Royalty Trust group is advancing. Through Thursday, it was up 8.7%, spanking the Dow Jones industrials (down 7% through Friday’s close). Oil royalty trusts are specialized corporations that are not taxed at the usual rates, so long as they pay out most of their profits in the form of cash dividends to shareholders. These trusts do not have physical operations or actual employees, but they still own rights to money-producing assets, including oil wells and mines. As seen in the accompanying chart, these stocks have fallen sharply in the stock market, mirroring the big slide in both crude oil and the shares of energy exploration companies. As a result, their yields have skyrocketed. BP Prudhoe Bay Royalty Trust ( BPT ), the largest by market value in the royalty trust group, currently shows an annualized yield of 14%. Yet BP Prudhoe Bay and Sabine Royalty Trust ( SBR ) (5% yield) are showing declining annualized dividends in the long term, based on analysis by IBD sister company William O’Neil + Co. The fluctuating price of crude oil, as well as daily production, will likely affect the amount of dividends paid. Scalper1 News

Scalper1 News