The Manitowoc Company, Inc. MTW has disappointed investors lately. The leading global manufacturer of cranes and lift solutions, continues to grapple with lower demand for its cranes due to the current world-wide economic environment. Shares of this Zacks Rank #5 (Strong Sell) stock tanked 61% in 2016.

Disappointing Third Quarter

Manitowoc’s third-quarter 2016 adjusted loss per share was at 28 cents per share, wider than the year-ago quarter’s loss of 26 cents. The company posted a negative earnings surprise of 7.69% in the last quarter. Revenues declined 20% to $ 350 million in the reported quarter as the mobile crane market continued its downward trend in the quarter. The weak global oil and gas market, along with lower used equipment prices had a negative effect on demand.

Weak Guidance

Manitowoc anticipates revenues to decline approximately 25-30% year over year in fourth-quarter 2016. Adjusted operating loss margin is expected to be between 4% and 6%. The fourth-quarter outlook reflects the impact from the weak mobile crane market and the negative impact on planned absorption from the reduced build schedules.

Estimates Moving South

The estimates for the company for the fourth quarter of 2016, fiscal 2016 and fiscal 2017, have moved south in the past 90 days, reflecting the negative outlook of analysts on the company. For the fourth quarter, the expected loss per share has gone down from one cent per share to 17 cents per share over the past 90 days.

For fiscal 2016, the loss per share has widened from the prior expectation of eight cents per share to 45 cents per share. For fiscal 2017, the estimate has gone down from a profit per share of eight cents per share to a loss of 14 cents per share.

Negative Growth Expectations

The Zacks Consensus Estimate for 2016 is at a loss of 45 cents per share, reflecting a 163.57% year-over-year decline. The Zacks Consensus Estimate for fiscal 2017 is pegged at a loss of 14 cents per share.

Crane Demand at Historic Low Levels

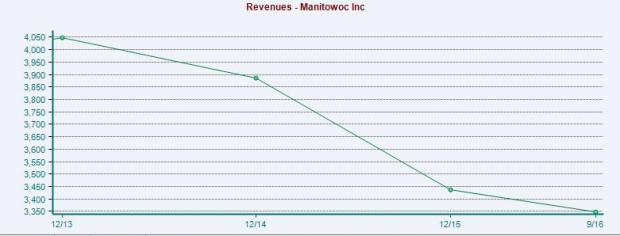

A look at Manitowoc’s revenue and earnings performance over the past three years exhibits a clear downward trend. Overall crane business is likely to be very weak and low. Based on current activity levels, particularly in mobile cranes, the company is unlikely to recover in global demand for cranes in the near term.

Uncertainty among customers is mounting due to emerging market peers, apprehensions related to China’s growth outlook, persistently depressed oil prices and sluggish domestic growth. The company is witnessing particularly soft demand for mobile cranes, primarily due to repressed market performance, especially in the U.S. and the Middle East from a weak oil and gas sector.

Further, with almost half of sales from international markets, the effect of a strong US dollar has hurt Manitowoc’s earnings. This has also adversely impacted Manitowoc’s competitive position against other international manufacturers.

Falling Behind the Industry

Manitowoc’s stock has tanked 58.5% in the past one year, falling way behind the Zacks categorized Machinery-Construction/Mining subindustry, which witnessed a gain of 47.2% in the same time frame.

Stocks to Consider

Some better-ranked stocks in the same space include Altra Industrial Motion Corp. AIMC , Actuant Corp. ATU and Deere & Company DE . All three of these stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Altra Industrial Motion has a positive average earnings surprise of 8.06% in the last four quarters. Actuant generated a positive average earnings surprise of 11.47% in the trailing four quarters. Deere has delivered an average positive earnings surprise of 58.17% over the last four quarters.

Where Do Zacks’ Investment Ideas Come From?

You are welcome to download the full, up-to-the-minute list of 220 Zacks Rank #1 “Strong Buy” stocks free of charge. There is no better place to start your own stock search. Plus you can access the full list of must-avoid Zacks Rank #5 “Strong Sells” and other private research. See the stocks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Actuant Corporation (ATU): Free Stock Analysis Report

Manitowoc Company, Inc. (The) (MTW): Free Stock Analysis Report

Deere & Company (DE): Free Stock Analysis Report

Altra Industrial Motion Corp. (AIMC): Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International