Lindsay Corporation LNN , the leading designer and manufacturer of self-propelled center pivot and lateral move irrigation systems has been disappointing investors of late. The company continues to grapple with lower irrigation demand due to lower commodity prices.

Disappointing Fiscal First Quarter

Lindsay reported first-quarter fiscal 2017 (ended Nov 30, 2016) adjusted earnings of 8 cents per share, plunging 87% from 62 cents per share in the prior-year quarter. First-quarter performance in the irrigation segment was negatively impacted by low volume and resulting cost deleverage in the company’s operations.

Negative Earnings Surprise History

Lindsay’s earnings in the last reported quarter fell short of the Zacks Consensus Estimate, a negative earnings surprise of 87%. The company has fallen short of the Zacks Consensus Estimate in three of the last four quarters, with an average negative earnings surprise of 14.05%.

Weak Guidance

Lindsay Corporation is not expecting any meaningful improvement in the overall irrigation market in fiscal 2017 as lower commodity prices and reduced farm income will affect farmer sentiment regarding capital goods purchases. Further, as individual states proceed to adopt the new testing standard for road safety products, Lindsay will incur increased costs and is likely to witness some near-term variability in the road safety product revenues.

Estimates Moving South

The company’s estimates for the fiscal second-quarter 2017, fiscal 2017 and fiscal 2018, have moved south in the past 30 days, reflecting the negative outlook of analysts on the stock. For the current quarter, there have been four downward estimate revisions in the past 30 days with no upward movement. For fiscal 2017 we have seen five estimates moving down in the past 30 days, compared with no upward revisions. Similarly for fiscal 2018, four estimates have been revised downwards.

This trend has caused the consensus estimate to trend lower, going from 53 cents a share a month ago to its current level of 38 cents per share for the fiscal second-quarter 2017. For fiscal 2017, the Zacks Consensus Estimate has moved down 25% to $ 2.10 per share. For fiscal 2018, the estimate has gone down 6% to $ 3.06 per share.

Negative Growth Expectations

The Zacks Consensus Estimate for 2017 of $ 2.10 reflects a 20.30% year-over-year decline. The Zacks Consensus Estimate for second-quarter fiscal 2017 at 38 cents per share also exhibits a 10.71% year-over-year decline.

Irrigation Markets Will Remain Weak

A look at Lindsay’ revenue and earnings performance in the past three years exhibit a clear downward trend. Estimated record production for both corn and soybeans from the fall harvest in the U.S. will continue to exert downward pressure on commodity prices. Lower commodity prices and reduced farm income continue to affect farmer sentiments regarding capital goods purchases. Thus there will be no meaningful improvement in the overall irrigation market in fiscal 2017.

As individual states proceed to adopt the new testing standard for road safety products, called MASH, the company will incur increased cost for product development and testing to in order to ensure that its products are in compliance with the new standards. Lindsay will have to reapply for state certification with MASH-compliant products. This reapplication process may cause some near-term variability in the road safety product revenues.

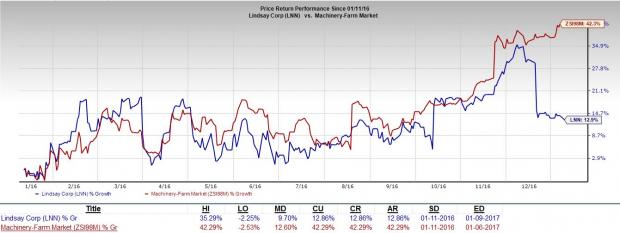

Lagging the Industry

The Lindsay stock has grossly underperformed the Zacks categorized Machinery-Farm industry in the past one year. The Lindsay stock has gained 12.9%, falling way behind the Zacks subindustry’s increase of 42.3% over the said timeframe. In fact, the stock has dipped 2.2% since its fiscal first-quarter 2017 results in contrast to the 3.4% rise logged by the subindustry.

Expensive Valuation

Shares of this Zacks Rank #5 (Strong Sell) stock has an expensive valuation. In terms of forward P/E ratio, Lindsay trades at 35.5, a substantial premium to the industry average of 23.3.

Stocks to Consider

Some better-ranked stocks in the same space include Altra Industrial Motion Corp. AIMC , Actuant Corporation ATU and Deere & Company DE . All of these stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Altra Industrial Motion has a positive average earnings surprise of 8.06% in the last four quarters. Actuant generated a positive average earnings surprise of 11.47% in the trailing four quarters. Deere has delivered an average positive earnings surprise of 58.17% in the last four quarters.

Zacks’ Top 10 Stocks for 2017

In addition to the stocks discussed above, would you like to know about our 10 finest tickers for the entirety of 2017? Who wouldn’t? These 10 are painstakingly hand-picked from 4,400 companies covered by the Zacks Rank. They are our primary picks to buy and hold. Be among the very first to see them >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Actuant Corporation (ATU): Free Stock Analysis Report

Deere & Company (DE): Free Stock Analysis Report

Lindsay Corporation (LNN): Free Stock Analysis Report

Altra Industrial Motion Corp. (AIMC): Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International