After being the victim of negative trends in past few years, shares of Deere & Company DE have been performing well of late, gaining 35% in 2016. Deere, with a market capitalization of $ 33.24 billion is engaged in the production and distribution of agricultural and forestry equipment, construction equipment and engines worldwide. If you haven’t taken advantage of the share price appreciation yet, the time is right for you to add the stock to portfolio as Deere looks promising and is poised to carry the momentum ahead.

Strong Fiscal 2016

Deere & Company’s fourth-quarter fiscal 2016 (ended Oct 31, 2016) earnings declined 17% year over year to 90 cents per share. Nevertheless, Deere’s net income of $ 1.5 billion in fiscal 2016 was highest in the last 10 years. Despite weak global agricultural and construction sectors, the company has benefited from adept execution of its operating plans and disciplined cost management as well as on the back of its broad product portfolio.

Positive Earnings Surprise History

The company has a positive record of earnings surprises in the past few quarters. Deere has delivered positive earnings surprises in all the last four quarters, the average being 58.17%.

Estimates moving up

The company’s estimates for the fiscal 2017 and fiscal 2018, have moved north in the past 60 days, reflecting the positive outlook of analysts on the stock. For the current fiscal, there have been nine upward estimate revisions in the past 60 days with only one downward movement. For fiscal 2018, we have seen three estimates moving down in the past 60 days, compared with one downward revision.

This trend has caused the consensus estimate to trend higher, going up 14% to the current level of $ 4.39 per share for the fiscal 2017 over the past 60 days. For fiscal 2018, the Zacks Consensus Estimate has moved up 13% to $ 5.35 per share.

Growth Prospects

Deere remains committed to its target to reduce structural costs by $ 500 million by fiscal 2018. It will be driven by indirect and direct material cost reduction by leveraging supplier relationships, resourcing and product redesign. Further, reduced headcount, chiefly on the back of voluntary separation initiatives, changes to variable pay structure, lower R&D spending and decreased depreciation related to lower capital investment will lead to lower costs.

The construction industry has now entered a more mature phase of its expansion, and construction spending can be anticipated to see moderate gains through 2017 and beyond. Given that Deere is the second-largest seller of construction machinery in the U.S, and is a major supplier to the equipment rental industry, it stands to benefit from the U.S housing recovery.

In India, the economy is growing and the government continues to focus on driving growth in the agricultural sector and improving farm incomes. The value of agricultural production is expected to increase as a result of normal monsoon season after two years of below-average monsoons. These factors are expected to boost industry demand in India. In Asia, India is expected to be the main catalyst. Machinery demand is showing signs of recovery in Brazil, following a slowing macro and political uncertainty.

In the long term, the company stands to gain from favorable trends, supported by increasing population and rising living standards.

Deere carries a long-term earnings growth rate of 7.67%.

Ahead of the Industry

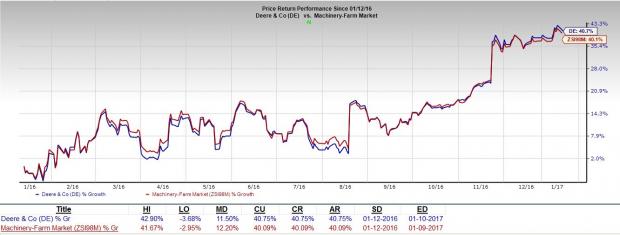

A look at the company’s share price movement reveals an impressive one-year return of approximately 40.7%, better than the Zacks categorized Machinery-Farm industry’s rise of 40.1% over the same time frame.

Zacks Rank & Stocks to Consider

Deere currently carries a Zacks Rank #1 (Strong Buy)

Some other favorable stocks in the same space include Altra Industrial Motion Corp. AIMC , Actuant Corporation ATU and Apogee Enterprises, Inc. APOG . All three of these stocks sport a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Altra Industrial Motion has a positive average earnings surprise of 8.06% in the last four quarters. Actuant generated a positive average earnings surprise of 11.47% in the trailing four quarters. Apogee has delivered an average positive earnings surprise of 13.24% in the last four quarters.

Zacks’ Top 10 Stocks for 2017

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2017? Who wouldn’t? As of early December, the 2016 Top 10 produced 5 double-digit winners including oil and natural gas giant Pioneer Natural Resources which racked up a stellar +50% gain. The new list is painstakingly hand-picked from 4,400 companies covered by the Zacks Rank. Be among the very first to see it>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Apogee Enterprises, Inc. (APOG): Free Stock Analysis Report

Actuant Corporation (ATU): Free Stock Analysis Report

Deere & Company (DE): Free Stock Analysis Report

Altra Industrial Motion Corp. (AIMC): Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International