Apogee Enterprises, Inc. APOG with a market capitalization of $ 1.55 billion has been performing well, of late. The company is a leader in technologies for the design and development of value-added glass products, services and systems. Shares of this Zacks Rank #1 (Strong Buy) stock gained 23% in 2016 and carries a long-term earnings growth rate of 10%. If you haven’t taken advantage of the share price appreciation yet, the time is right for you to add the stock to portfolio as Apogee looks promising and is poised to carry the momentum ahead.

Strong Third Quarter

Apogee’s earnings per share of 78 cents in third-quarter fiscal 2017 reflected a 24% year-over-year increase and revenues of $ 274 million grew 15% year over year. Both the top and the bottom line witnessed strong growth in the quarter, on the back of its architectural businesses.

Positive Earnings Surprise History

The company has a positive record of earnings surprises in the past few quarters. Apogee delivered an average positive earnings surprise of 13.24% in the last four quarters.

Upbeat Guidance

Apogee raised its earnings per share outlook for fiscal 2017 to $ 2.85-$ 2.95 from the previous guidance of $ 2.80-$ 2.90. The upbeat guidance came on the back of solid execution of strategies to improve operational performance, productivity and project selection. The company maintained its outlook for revenue growth of approximately 10% for fiscal 2017. Further, it predicts gross margin to be around 26.7% and operating margin to be approximately 11.5% in fiscal 2017.

Apogee anticipates mid single-digit U.S. commercial construction market growth in fiscal 2017 and 2018, as market activity, the Architecture Billings Index (ABI), office employment and office vacancy rates have witnessed positive momentum. In fact, the ABI has been at 50 or better for 20 of the last 24 months signalling sustainable growth in architectural activity. With internal market visibility and external metrics showing positive signs, the company expects U.S. non-residential market to grow at least through fiscal 2020.

Healthy Growth Expectations

The Zacks Consensus Estimate for fiscal 2017 is at $ 2.87, reflecting a 29.28% year-over-year growth. The Zacks Consensus Estimate for fiscal 2018 is pegged at $ 3.65, reflecting 27.18% year-over-year growth.

Growth Efforts in Place

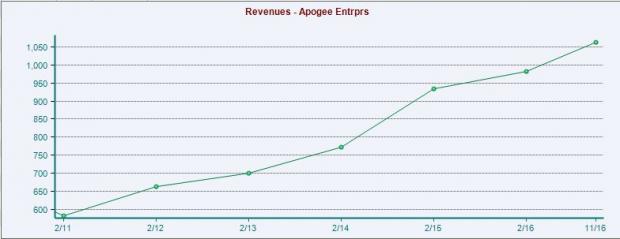

A look at Apogee’s revenue performance over the past five years exhibits a clear upward trend.

The momentum will continue given the company’s focus on achieving top-line growth, driven by product launches, expansion in both domestic and international markets along with entry into the new architectural markets.

Further, productivity improvement, cost control and improvements in volume, mix, project margins and operating leverage continues to aid margin expansion. This is evident in the company’s earnings performance in the past five years.

Recently, Apogee announced the acquisition of Sotawall Limited, a leading designer and fabricator of high-performance, unitized curtainwall systems for commercial construction projects in North America. This deal will help the company grow in Canada and increase its share of demand in certain U.S. markets where it did not have a strong presence, while adding unique curtainwall products to its offerings.

Apogee expects capital expenditures for the year at $ 70 million as the company continues to invest to increase capabilities, productivity and capacity. Further, it will focus on its merger and acquisition pipeline.

Ahead of the Industry

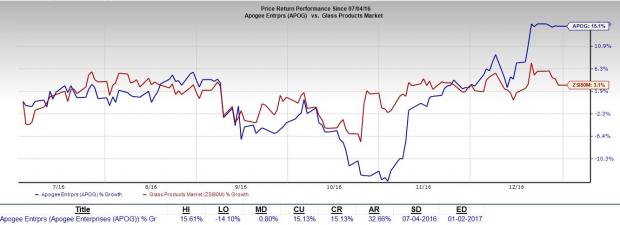

Apogee’s stock gained 23.1% in 2016, outperforming the Zacks categorized Glass Products subindustry, which witnessed a gain of 6.8% in the same time frame. The outperformance was driven by its strategies to grow through new geographies, new products and new markets, along with a focus on better project selection, productivity and operational improvements.

Attractive Valuation

Moreover, on a price-to-book basis, shares are trading at 3.4x, a discount to the industry average of 6.4x. The cheap valuation is well supported by its long-term estimated earnings growth rate of 10.00%. In view of the above positives, we believe that Apogee represents an attractive investment opportunity at current levels.

Stocks to Consider

Some better-ranked stocks in the same space include Altra Industrial Motion Corp. AIMC , Actuant Corporation ATU and Deere & Company DE . All three of these stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here .

Altra Industrial Motion has a positive average earnings surprise of 8.06% in the last four quarters. Actuant generated a positive average earnings surprise of 11.47% in the trailing four quarters. Deere has delivered an average positive earnings surprise of 15% over the last four quarters.

Zacks’ Top 10 Stocks for 2017

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2017? Who wouldn’t? As of early December, the 2016 Top 10 produced 5 double-digit winners including oil and natural gas giant Pioneer Natural Resources which racked up a stellar +50% gain. The new list is painstakingly hand-picked from 4,400 companies covered by the Zacks Rank. Be among the very first to see it>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

APOGEE ENTRPRS (APOG): Free Stock Analysis Report

ACTUANT CORP (ATU): Free Stock Analysis Report

DEERE & CO (DE): Free Stock Analysis Report

ALTRA INDUS MOT (AIMC): Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International