Scalper1 News

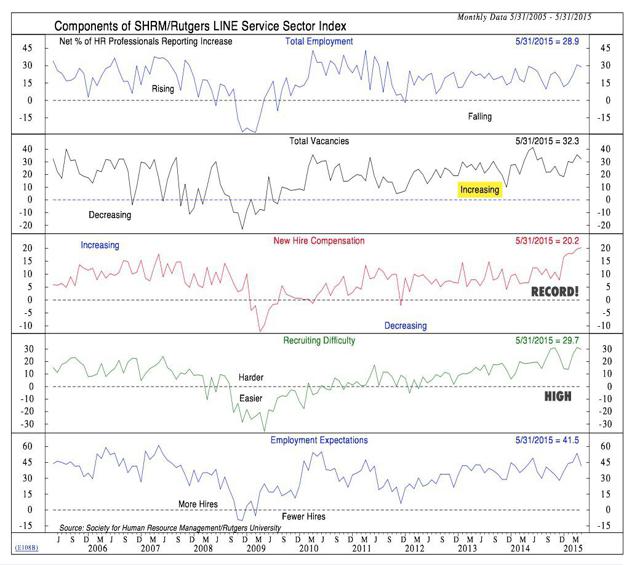

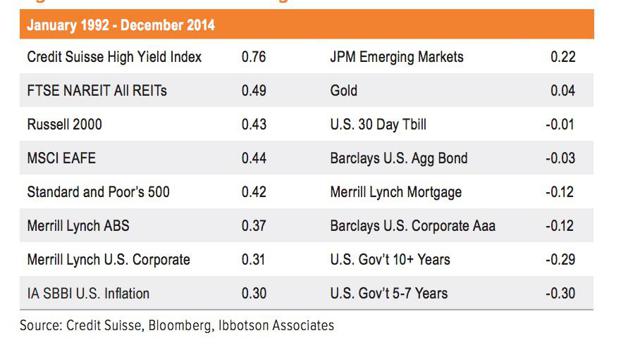

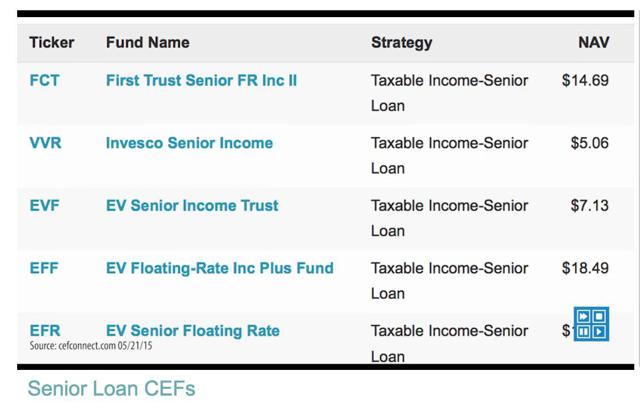

Instability in Greece and China further emphasizes the ‘asynchronous recovery’ where the US might decouple from the reset of the world. In this scenario, investors would want to prepare for mild to moderate increase in US interest rates, and diversify towards rising interest rate assets. Blackstone Strategic Credit (BGB) is one such opportunistic play with a total yield value proposition worth considering. Investing is a confusing thing these days. There’s a pundit for every theory. There’s Jeff Gundlach and Bill Gross talking about the Bond ‘freight train’ and how interest rates are going to rise. There are pundits talking about how Greece and China are going to fall off the cliff (so interest rates fall further), or how secular stagnation is going to be a long-term malaise on the world economy. You can prepare for the two extremes by investing in bonds and commodities, but what about the muddle in the middle? How do you deal with the Asynchronous Global Recovery where the US trends gently higher while the rest of the world grapples with issues that are behind us? This muddle – slow(er) growth than past recoveries but higher interest rates than we have today, is something your portfolio should have an allocation to. This is where Bank Loan (or Senior Loan) funds come in. Bank Loans do better as the economy does better, but in ways that are unique to their asset class. Since they are an out-of-favor asset, buying a closed end fund or CEF gives you the additional pop of a NAV discount that will turn into a NAV premium at a future point. The right CEF thus gives you asset exposure at a discount, and therefore protection on the downside and returns on the upside. US is in (Gentle) Recovery Mode. We could argue endlessly for any of many sides (deflation, recession to be, recovery) based on the indicators we pick, but the hiring and compensation market (see Figure) suggests a gentle recovery to be the most likely possibility. Indirect data suggest that end market conditions that are interpreted as recessionary (e.g. housing starts) are a sign of labor shortage, not low demand. Asset Class Div ersification. The adjoining figure from Credit Suisse shows you the correlations between Bank Loan funds and a number of other common asset classes over the last 20 years. While Bank Loans have had a moderate correlations to High Yield over that period, they provide Asset Class diversification against most of the other traditional asset classes. High Yield has some unique near-term concerns including withdrawal risk (a matter Carl Icahn took a megaphone to in the recent past) and duration exposure, so I believe the current correlation to be notably below the 20 year correlation. Many Choices, Some Better than Others. The adjoining figure provides you a list of options within the Senior Loan CEF category. If you eyeball their charts – you will notice their performance to be highly correlated, and uniformly uninspiring over the last 2 years. But the future isn’t the past. The future is a Wall Street expectation of at least a gentle recovery, global unrest notwithstanding. You would probably do reasonably picking any one of these earning a 6-7% interest while you wait. A number of these funds are trading at a NAV discount of 10-12%, having traded at premiums to NAV in times past. So there is another shared element of the upside. But I favor Blackstone Global Credit (NYSE: BGB ) within the category for a couple of reasons. First, Senior Loans are at the ‘spicy’ end of fixed income, with a risk (and return) that is greater than stodgier asset categories such as Treasuries. I prefer to go with fund managers who have a Private Equity background and do ‘spicy’ as a matter of routine. If there are liquidity issues as Mr. Icahn raises as an issue, Blackstone has successfully navigated rockier waters than most. Second, hedge fund manager SABA Capital (which has a long history of outperforming the indices) took a 5% stake in BGB . BGB is the only Senior Loan Fund on SABA’s portfolio, and is perhaps their testament to the veteran management team in a specialized space. It is worth mentioning that Senior Loan funds are tied to what’s called the LIBOR floor . With rates below the LIBOR floor, interest might not trend upward until interest rates go up 50 to 75 basis points. But with a 6-7% interest and 10% NAV discount, there is a total return thesis that gives you income, NAV return and inflation protection. Disclosure: I am/we are long BGB. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Instability in Greece and China further emphasizes the ‘asynchronous recovery’ where the US might decouple from the reset of the world. In this scenario, investors would want to prepare for mild to moderate increase in US interest rates, and diversify towards rising interest rate assets. Blackstone Strategic Credit (BGB) is one such opportunistic play with a total yield value proposition worth considering. Investing is a confusing thing these days. There’s a pundit for every theory. There’s Jeff Gundlach and Bill Gross talking about the Bond ‘freight train’ and how interest rates are going to rise. There are pundits talking about how Greece and China are going to fall off the cliff (so interest rates fall further), or how secular stagnation is going to be a long-term malaise on the world economy. You can prepare for the two extremes by investing in bonds and commodities, but what about the muddle in the middle? How do you deal with the Asynchronous Global Recovery where the US trends gently higher while the rest of the world grapples with issues that are behind us? This muddle – slow(er) growth than past recoveries but higher interest rates than we have today, is something your portfolio should have an allocation to. This is where Bank Loan (or Senior Loan) funds come in. Bank Loans do better as the economy does better, but in ways that are unique to their asset class. Since they are an out-of-favor asset, buying a closed end fund or CEF gives you the additional pop of a NAV discount that will turn into a NAV premium at a future point. The right CEF thus gives you asset exposure at a discount, and therefore protection on the downside and returns on the upside. US is in (Gentle) Recovery Mode. We could argue endlessly for any of many sides (deflation, recession to be, recovery) based on the indicators we pick, but the hiring and compensation market (see Figure) suggests a gentle recovery to be the most likely possibility. Indirect data suggest that end market conditions that are interpreted as recessionary (e.g. housing starts) are a sign of labor shortage, not low demand. Asset Class Div ersification. The adjoining figure from Credit Suisse shows you the correlations between Bank Loan funds and a number of other common asset classes over the last 20 years. While Bank Loans have had a moderate correlations to High Yield over that period, they provide Asset Class diversification against most of the other traditional asset classes. High Yield has some unique near-term concerns including withdrawal risk (a matter Carl Icahn took a megaphone to in the recent past) and duration exposure, so I believe the current correlation to be notably below the 20 year correlation. Many Choices, Some Better than Others. The adjoining figure provides you a list of options within the Senior Loan CEF category. If you eyeball their charts – you will notice their performance to be highly correlated, and uniformly uninspiring over the last 2 years. But the future isn’t the past. The future is a Wall Street expectation of at least a gentle recovery, global unrest notwithstanding. You would probably do reasonably picking any one of these earning a 6-7% interest while you wait. A number of these funds are trading at a NAV discount of 10-12%, having traded at premiums to NAV in times past. So there is another shared element of the upside. But I favor Blackstone Global Credit (NYSE: BGB ) within the category for a couple of reasons. First, Senior Loans are at the ‘spicy’ end of fixed income, with a risk (and return) that is greater than stodgier asset categories such as Treasuries. I prefer to go with fund managers who have a Private Equity background and do ‘spicy’ as a matter of routine. If there are liquidity issues as Mr. Icahn raises as an issue, Blackstone has successfully navigated rockier waters than most. Second, hedge fund manager SABA Capital (which has a long history of outperforming the indices) took a 5% stake in BGB . BGB is the only Senior Loan Fund on SABA’s portfolio, and is perhaps their testament to the veteran management team in a specialized space. It is worth mentioning that Senior Loan funds are tied to what’s called the LIBOR floor . With rates below the LIBOR floor, interest might not trend upward until interest rates go up 50 to 75 basis points. But with a 6-7% interest and 10% NAV discount, there is a total return thesis that gives you income, NAV return and inflation protection. Disclosure: I am/we are long BGB. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News