Scalper1 News

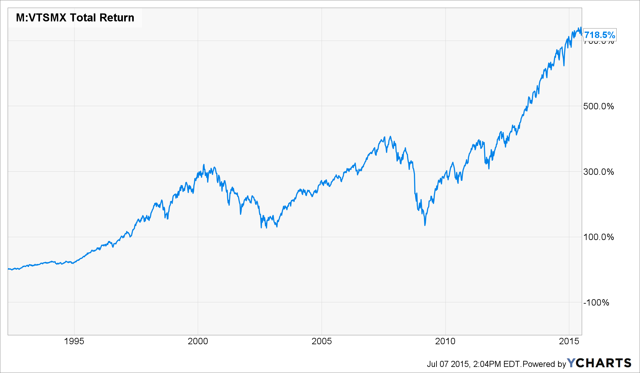

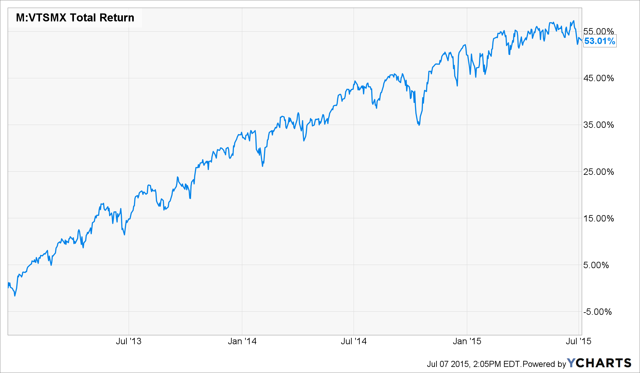

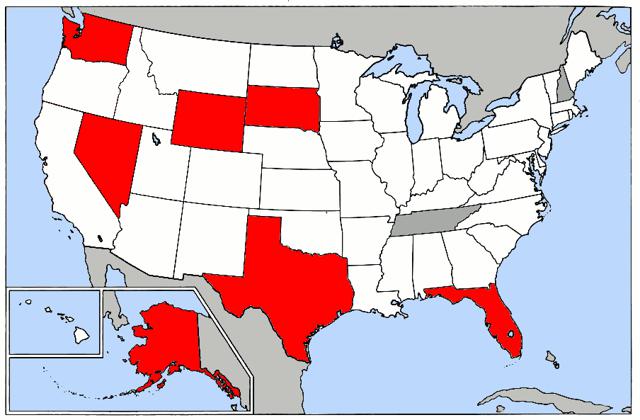

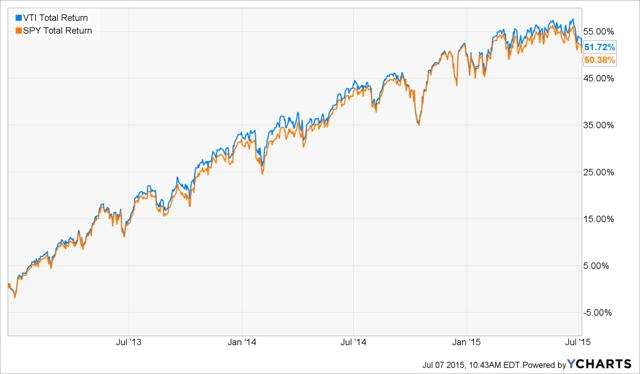

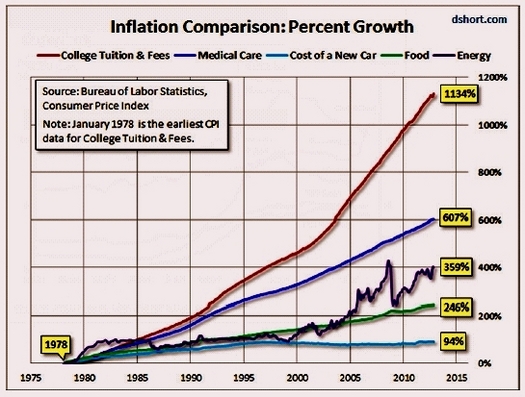

Summary I own Vanguard’s Total Stock Market Portfolio in their 529. Here is why I own it and why everyone should consider it. You can make a tax-advantaged contribution at a significant scale. #1 Passive Fund in the World I have always mixed active investing ideas with some amount of passive market exposure. Passive exposure is cheap, simple, and tax-efficient. It also provides me with a little insurance against the results of my active ideas. My #1 favorite place to get market exposure with these benefits is Vanguard’s Total Stock Market Portfolio (MUTF: VTSMX ) within Vanguard’s 529. It has done well since inception: It is up over 50% since I discussed it as a long idea: Management Vanguard claims that, We hire top investment professionals with the experience and expertise you’d expect from Vanguard. But this is an unmanaged fund, so as long as they can keep the books straight, they could also, hire psychotic crack fiends with the experience and expertise I’d expect from San Quentin. for all that I would care. Service Their service is fine. You get 25 free trades per year if you keep over $1 million and you get 500 free trades per year if you keep over $10 million at Vanguard. They are quite generous about this status as they count the entire family’s balance towards the requisite total. In addition to the free trades, they also give you the name and phone number of a competent representative who typically can solve problems associated with such accounts. 529s A 529 savings plan is an investment account intended for college and other higher-education costs. They are sponsored by individual states and offer various tax benefits. Earnings are deferred from federal taxes. Withdrawals for qualified higher-education expenses are also tax-free. You can make up to five years’ worth of contributions at one time without triggering gift tax. The uses are pretty generous – you can use the money for tuition, room and board, books, and other expenses. Why Nevada? Nevada is one of the few remaining states without any income tax. If you have flexibility as to where you live, these are probably states worth considering. Of the bunch, Wyoming is my favorite. If one lives in Wyoming close enough to Montana to shop there, you can pay Wyoming’s zero percent income tax and Montana’s zero percent sales tax. As for Nevada, since they lack a state income tax, they cannot lure Nevadans to their 529 with promises of avoiding state income tax. Instead, they have offered every other type of inducement. Their contribution limit of $370,000 is high. Funds are removed from your estate and are exempt from creditors’ claims. They are lenient about any requirement to withdraw funds. Why Vanguard? Compared to the alternative in Nevada, Vanguard’s 529 allows you to invest in Vanguard funds. The alternative fund costs from 0.29-0.89%, while the expense ratio on my favorite Vanguard fund is 0.21%. Vanguard’s minimum initial contribution is $3,000 instead of $250, but the whole idea with this investment is to make a large investment and to hold it for a very long time. There are no enrollment fees for either Vanguard or the one alternative to Vanguard in Nevada. Why the Total Stock Market Portfolio? While this fund is highly correlated with the S&P 500 (NYSEARCA: SPY ), it is somewhat more diversified. It includes smaller capitalization companies. In doing so, it avoids some of the turnover associated with companies entering and exiting the S&P 500. That reconstitution generates trading fees and taxes. Companies included in the S&P 500 trade at a premium, which one has to pay every time one buys an S&P 500 index fund or ETF. Owning a broader based fund avoids such expenses. But whether or not you agree with my rationale, the difference is trivial: Scale This is a tax-advantaged fund 67x your IRA contribution limit. For 2015, the IRA contribution limit is $5,500 ($6,500 for people 50 or older). One might as well fund it, but the scale is small. The 529 limit is $370,000. If you are married, you can each invest $370,000 with oneself as the owner and beneficiary. At that scale, this investment has already been worth over $1.1 million since inception and over $391,000 since I last discussed it. This is an ideal vehicle for long-term tax-free compounding. Withdrawals This investment idea works well regardless of your intention for the proceeds. It works best when invested for at least a generation or longer. However, regardless of your time-horizon, it is more flexible than it first appears. There are at least five great ways to use the proceeds. 1) College for your kids and grandkids First, one can use it for its intended purpose: college, presumably for your kids or grandkids. It is easy to transfer money from one beneficiary to another. You can transfer assets in increments of $70,000 once every five years without any gift tax. Higher education is expensive and getting more expensive. It should be no surprise that we suffer under the highest inflation where there are the most third party payers. The government enters the bid side of a market with no price-sensitivity and it… increases prices: Is the expense more worrisome or is the fact that politicians fail to see the connection between their behavior and prices? In any event, it is likely that you will have higher education bills in your future. 2) College for yourself Secondly, you can spend the money on yourself. Whether or not you have kids or grandkids (or have any inclination to subsidize said kids/grandkids), you can still save the money in a 529 and spend it on… your own bad self. Courses in wine tasting and golf in an idyllic college town would not be terrible. 3) College as philanthropy Thirdly, you can give the money away. Even if you do not want to spend it on either your progeny or yourself, this would make a perfect foundation for your philanthropic educational efforts. Whether or not you will have college bills to pay, someone certainly will. You will be able to help them. 4) Future expanded usage Fourth, it is reasonably likely that the hodgepodge of tax-advantaged accounts will be simplified and consolidated in the future. If this one is consolidated with others intended for retirement or healthcare, then the limitations on usage will have effectively disappeared. Over the next fifty years, this is highly likely. 5) Just pay the penalty… you will still come out ahead Fifth and finally, you can simply pay the penalty. But here is where this idea gets really interesting, in fact dominant as a strategy: the penalty is too small . Federal law imposes a 10% penalty on earnings for non-qualified distributions. While I never plan to pay this penalty, the value of 10% of the earnings on the back end will probably be far less than the value of compounding tax-free in the interim decades. Even if you intend to spend the money on wine, women, and song (and fail to find an anthropology course “Wine, Women & Song 101”), then you can compound tax-free, pay the penalty, and still end up ahead. Scholarship Encouragement If your kids fully expect that you will pay for college, it can be harder to encourage them to find scholarships. There are piles of scholarship dollars everywhere for almost every type of kid. The key is for them to be motivated to find it and get it. If they receive a scholarship, then the penalty for withdrawing money from a 529 is waived. My hope is that my kids attend military academies (also that my daughter elopes). If the plan succeeds, then there are decades ahead of tax-free compounding without any restriction on some withdrawals. In order to interest them, I am offering each kid half of whatever they earn in scholarship money. Conclusion If you max out your 529 contribution and then wait for a long time, you will benefit from tax-free compounding at a significant scale. At the same time, the cost of the limitations on withdrawals is manageable. With that base of passive market exposure, one can turn to active ideas. My best ones are here . Disclosure: I am/we are long VTSMX. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Chris DeMuth Jr is a portfolio manager at Rangeley Capital. Rangeley invests with a margin of safety by buying securities at deep discounts to their intrinsic value and unlocking that value through corporate events. In order to maximize total returns for our investors, we reserve the right to make investment decisions regarding any security without further notification except where such notification is required by law. Scalper1 News

Summary I own Vanguard’s Total Stock Market Portfolio in their 529. Here is why I own it and why everyone should consider it. You can make a tax-advantaged contribution at a significant scale. #1 Passive Fund in the World I have always mixed active investing ideas with some amount of passive market exposure. Passive exposure is cheap, simple, and tax-efficient. It also provides me with a little insurance against the results of my active ideas. My #1 favorite place to get market exposure with these benefits is Vanguard’s Total Stock Market Portfolio (MUTF: VTSMX ) within Vanguard’s 529. It has done well since inception: It is up over 50% since I discussed it as a long idea: Management Vanguard claims that, We hire top investment professionals with the experience and expertise you’d expect from Vanguard. But this is an unmanaged fund, so as long as they can keep the books straight, they could also, hire psychotic crack fiends with the experience and expertise I’d expect from San Quentin. for all that I would care. Service Their service is fine. You get 25 free trades per year if you keep over $1 million and you get 500 free trades per year if you keep over $10 million at Vanguard. They are quite generous about this status as they count the entire family’s balance towards the requisite total. In addition to the free trades, they also give you the name and phone number of a competent representative who typically can solve problems associated with such accounts. 529s A 529 savings plan is an investment account intended for college and other higher-education costs. They are sponsored by individual states and offer various tax benefits. Earnings are deferred from federal taxes. Withdrawals for qualified higher-education expenses are also tax-free. You can make up to five years’ worth of contributions at one time without triggering gift tax. The uses are pretty generous – you can use the money for tuition, room and board, books, and other expenses. Why Nevada? Nevada is one of the few remaining states without any income tax. If you have flexibility as to where you live, these are probably states worth considering. Of the bunch, Wyoming is my favorite. If one lives in Wyoming close enough to Montana to shop there, you can pay Wyoming’s zero percent income tax and Montana’s zero percent sales tax. As for Nevada, since they lack a state income tax, they cannot lure Nevadans to their 529 with promises of avoiding state income tax. Instead, they have offered every other type of inducement. Their contribution limit of $370,000 is high. Funds are removed from your estate and are exempt from creditors’ claims. They are lenient about any requirement to withdraw funds. Why Vanguard? Compared to the alternative in Nevada, Vanguard’s 529 allows you to invest in Vanguard funds. The alternative fund costs from 0.29-0.89%, while the expense ratio on my favorite Vanguard fund is 0.21%. Vanguard’s minimum initial contribution is $3,000 instead of $250, but the whole idea with this investment is to make a large investment and to hold it for a very long time. There are no enrollment fees for either Vanguard or the one alternative to Vanguard in Nevada. Why the Total Stock Market Portfolio? While this fund is highly correlated with the S&P 500 (NYSEARCA: SPY ), it is somewhat more diversified. It includes smaller capitalization companies. In doing so, it avoids some of the turnover associated with companies entering and exiting the S&P 500. That reconstitution generates trading fees and taxes. Companies included in the S&P 500 trade at a premium, which one has to pay every time one buys an S&P 500 index fund or ETF. Owning a broader based fund avoids such expenses. But whether or not you agree with my rationale, the difference is trivial: Scale This is a tax-advantaged fund 67x your IRA contribution limit. For 2015, the IRA contribution limit is $5,500 ($6,500 for people 50 or older). One might as well fund it, but the scale is small. The 529 limit is $370,000. If you are married, you can each invest $370,000 with oneself as the owner and beneficiary. At that scale, this investment has already been worth over $1.1 million since inception and over $391,000 since I last discussed it. This is an ideal vehicle for long-term tax-free compounding. Withdrawals This investment idea works well regardless of your intention for the proceeds. It works best when invested for at least a generation or longer. However, regardless of your time-horizon, it is more flexible than it first appears. There are at least five great ways to use the proceeds. 1) College for your kids and grandkids First, one can use it for its intended purpose: college, presumably for your kids or grandkids. It is easy to transfer money from one beneficiary to another. You can transfer assets in increments of $70,000 once every five years without any gift tax. Higher education is expensive and getting more expensive. It should be no surprise that we suffer under the highest inflation where there are the most third party payers. The government enters the bid side of a market with no price-sensitivity and it… increases prices: Is the expense more worrisome or is the fact that politicians fail to see the connection between their behavior and prices? In any event, it is likely that you will have higher education bills in your future. 2) College for yourself Secondly, you can spend the money on yourself. Whether or not you have kids or grandkids (or have any inclination to subsidize said kids/grandkids), you can still save the money in a 529 and spend it on… your own bad self. Courses in wine tasting and golf in an idyllic college town would not be terrible. 3) College as philanthropy Thirdly, you can give the money away. Even if you do not want to spend it on either your progeny or yourself, this would make a perfect foundation for your philanthropic educational efforts. Whether or not you will have college bills to pay, someone certainly will. You will be able to help them. 4) Future expanded usage Fourth, it is reasonably likely that the hodgepodge of tax-advantaged accounts will be simplified and consolidated in the future. If this one is consolidated with others intended for retirement or healthcare, then the limitations on usage will have effectively disappeared. Over the next fifty years, this is highly likely. 5) Just pay the penalty… you will still come out ahead Fifth and finally, you can simply pay the penalty. But here is where this idea gets really interesting, in fact dominant as a strategy: the penalty is too small . Federal law imposes a 10% penalty on earnings for non-qualified distributions. While I never plan to pay this penalty, the value of 10% of the earnings on the back end will probably be far less than the value of compounding tax-free in the interim decades. Even if you intend to spend the money on wine, women, and song (and fail to find an anthropology course “Wine, Women & Song 101”), then you can compound tax-free, pay the penalty, and still end up ahead. Scholarship Encouragement If your kids fully expect that you will pay for college, it can be harder to encourage them to find scholarships. There are piles of scholarship dollars everywhere for almost every type of kid. The key is for them to be motivated to find it and get it. If they receive a scholarship, then the penalty for withdrawing money from a 529 is waived. My hope is that my kids attend military academies (also that my daughter elopes). If the plan succeeds, then there are decades ahead of tax-free compounding without any restriction on some withdrawals. In order to interest them, I am offering each kid half of whatever they earn in scholarship money. Conclusion If you max out your 529 contribution and then wait for a long time, you will benefit from tax-free compounding at a significant scale. At the same time, the cost of the limitations on withdrawals is manageable. With that base of passive market exposure, one can turn to active ideas. My best ones are here . Disclosure: I am/we are long VTSMX. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Chris DeMuth Jr is a portfolio manager at Rangeley Capital. Rangeley invests with a margin of safety by buying securities at deep discounts to their intrinsic value and unlocking that value through corporate events. In order to maximize total returns for our investors, we reserve the right to make investment decisions regarding any security without further notification except where such notification is required by law. Scalper1 News

Scalper1 News