Scalper1 News

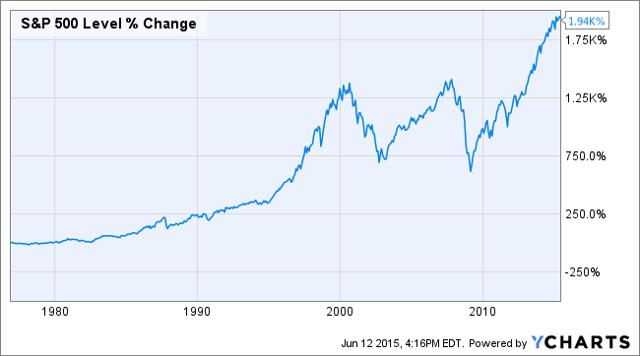

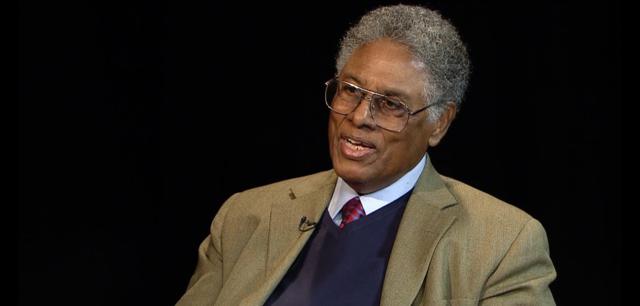

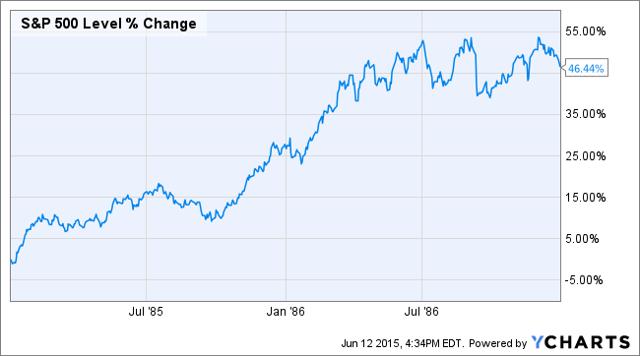

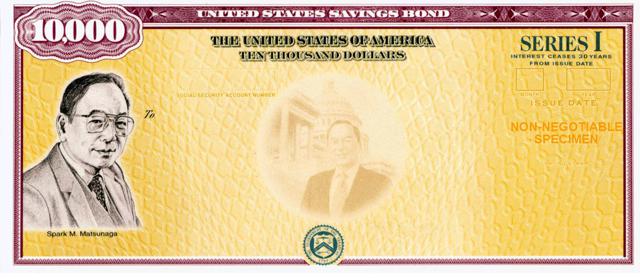

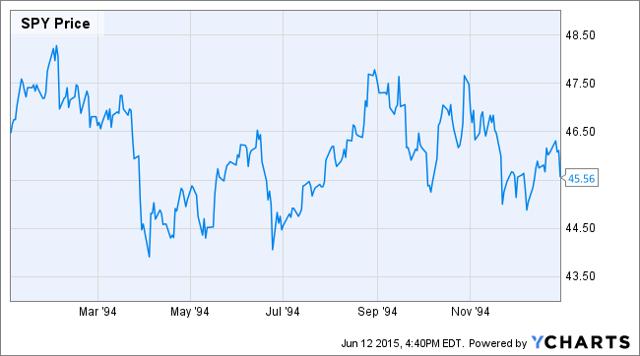

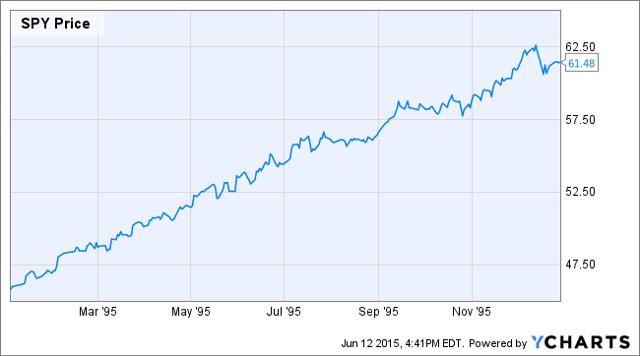

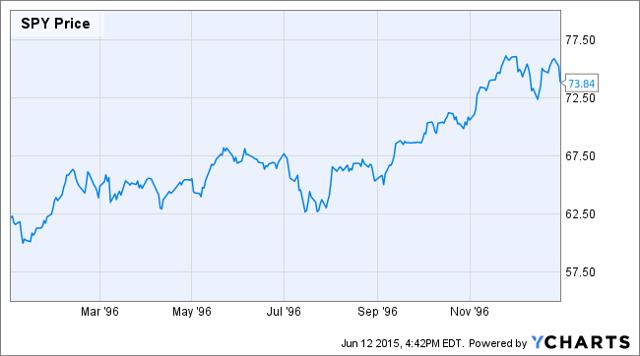

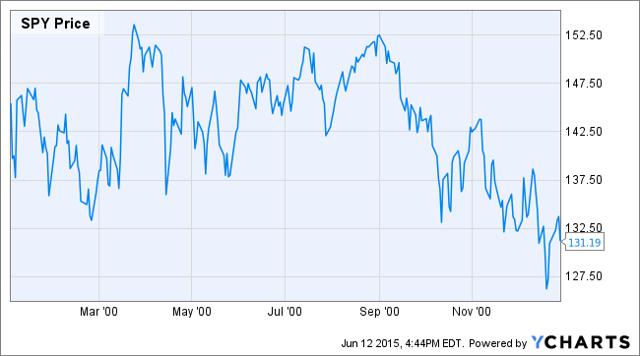

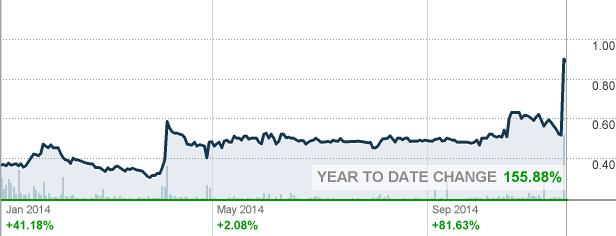

Summary This is my story. It is how I got my start. It is my search for a few misplaced bets. I am continuing this search on Sifting the World. If you have read about Seeking Alpha On Day 1 and still want to invest, then you have already answered the question, of, Are you ready to try to beat the market? Now, you can address the follow up question, Should you try? Here is what the S&P 500 has done in my lifetime: While the SPDR S&P 500 Trust ETF (NYSEARCA: SPY ) was not yet available when I began investing, one was able to invest in the S&P 500 via index funds. Here is how I decided to dedicate myself to beating the market, the S&P 500, and later the SPY. Discovering the Market I was named after my father, Christopher DeMuth Sr . A scholar from the Chicago School of Economics, he taught me the second most important lesson for my career: that markets work very well and certainly better than any alternative that man has so far imagined. From a very young age, I tried to consume a steady dose of market theory, starting with Economics in One Lesson: The Shortest and Surest Way to Understand Basic Economics by Henry Hazlitt. It made so much sense to me that it became hard to listen to political views of anyone who had not read it and understood it. The greatest living economist, Prof. Tom Sowell , visited my home once and my reaction was worshipful. In terms of an economic perspective on the world, his struck me as useful, relevant, and complete. I had nothing to add and eagerly dashed through the days and years of school so that I could get out and on with my life. It is hard to imagine a more stupid or more dangerous way of making decisions than by putting those decisions in the hands of people who pay no price for being wrong. – Thomas Sowell Free Markets are Wonderful… But Imperfect I became increasingly interested in the capital markets around fourth grade. I was not bound for academia – I was bound for the marketplace. The S&P 500 was strong in the early years of President Reagan’s second term. I tracked it daily and read all that I could on the subject. Markets can take on all comers. Compared to the alternatives, they lead to the greatest hope, growth, opportunity, prosperity, and justice. The second best thing I learned was that markets are that good. The best thing I ever learned is that they are imperfect . They have flaws and I could find where those flaws are located. This would be my life’s work, wading through markets in hot pursuit of their inefficiencies. What is it like to find one? Euphoria. Finding something that others missed, just sitting there for the taking is pure mirth. For some reason it is a kind of humor – if only funny to me, it is funny to me when prices are wrong. Taking money out of the broken corners of this system is an afterthought. It aids in keeping score and I like to win that game. But my love is for the game. This is the story of my discovery of that game. In search of a bankroll In 1987, the S&P 500 was off to a strong year until it crashed in October. I wanted to start investing. I had ideas and enthusiasm. I did not have any money. I needed something that would not demand any capital or risk but would pay well and quickly. My first step was to accept a half dozen credit card solicitations for cards with 0% interest in the first year. It seemed like a good place to start. Why they were eager to lend me money was a bit of a mystery. The solution might have been found in the similarity between my name and that of my more employed and credit-worthy father but it was not a question that I long pondered. To me, the important thing was to go from $0.00 to $0.00 with a line of credit. I discovered the bond market and loaded up my credit cards with purchases of treasury bonds. Just before the year was over, I sold them, took the early redemption penalty of the last quarter of interest, used the principal to pay off the cards in full, and pocketed $1,125 of interest. Then I did it again. And again. By Junior High School, I had my bankroll. Un beatable guarantee By 1994, SPY had launched and was starting to take market share from index funds. It had not done much that year. I was looking for an edge and found one at Circuit City. Circuit City’s Unbeatable Price Guarantee stated that, Circuit City is proud to offer the best prices on consumer electronics. Period. Buy a product from us and if, within 30 days of your purchase, you find a local competitor offering a lower advertised price for the same in-stock item, we’ll refund 110% of the difference. If you haven’t yet purchased the product, we’ll beat the competitor’s price by 10% of the difference between our price and theirs. Either way, you win. Yes you do. It was that extra 10% that I just couldn’t get out of my mind. I couldn’t stop thinking about it. I loitered around the stores where I got to know the salesmen and the sales schedule. President’s Day became one of my favorite holidays. The weekend before, I would stock up. It didn’t really matter what I bought. I bought everything and anything I could afford. The important thing was that they were not on sale and that they would be willing to hold them for me for just a week. They got my money and I got receipts. Their most expensive television cost me $15,000. Prices were dropping rapidly and it was marked down to $10,000 the next week. They honored their guarantee by rebating me $5,500 before I returned it for $10,000. I bought and returned that television enough times to be able to afford to keep it (not that I ever would). While unconventional, beating Circuit City’s guarantee beat SPY. Time to leave for college. Years later, I read that Circuit City discontinued their Unbeatable Price Guarantee in 2008 and filed for bankruptcy protection in 2009. Credit (Card) Arbitrage In 1995, SPY was much stronger. At this pace, I would have to come up with something new to beat the SPY. The credit card companies kept sending me offers and I kept accepting. Over time, my collection included one for my favorite clothing store, favorite bookstore, favorite airline program, and a couple for cash back. My combined credit limit breached a quarter of a million dollars. I set out to find a way to put it to work. I knew just what I wanted to buy but needed to find a seller. In search of one, I sent out four hundred identical letters to financial institutions asking if I could use my cards to invest in money markets. Most ignored me. A few bothered to say “no” in a tone that expressed surprise that I would have asked. But a few said “sure, why not” so I was able to get to work. That day, I put $250,000 in money markets. Before the end of the month, I paid off the cards with the balances in the money markets. For convenience, I was able to set up an automatic payment plan. The money would bounce back and forth from the credit cards to the money markets and back. Each month, I would collect several hundred dollars of interest in the money market accounts which would grow from month to month. Each month, I would collect $3,200 in cash back and gift certificates for clothing, books, and airline miles. I got status on various airlines, one of which is good for life. The IRS considered these payments to be rebates, so the tax rate was 0%. If only because it required no capital, credit card arbitrage beat the SPY. My life on the road SPY was strong again in 1996. While domestic markets were strong, I was looking abroad… After leaving home, my interests were interdisciplinary. I wanted to both seduce a pretty college girl and bum around Europe. I eventually succeeded at the first (now my long-suffering wife) and so was able to dedicate myself to my studies of the second. I needed to get there and needed to be able to sleep and eat somewhere. I wanted to do so in style and for free. I scraped together my flying budget as a part-time professional bumpee. This involved plotting ahead, using a combination of airline strike schedules and seating charts to determine the most constrained seating supply, which I would then buy. If an airline called a strike, I would buy seats on their competitors flying the same routes. Once I got to the gate, I would ask to be bumped in return for a hotel room, meal, and travel vouchers. After a while, they would take my offers to take a bump over the phone, so I didn’t even need to be in the departure city to collect. It works out to approximately $511,000 per year in vouchers for a couple of bumpees. I settled on a favorite hotel in London and another in Paris. I ended up just giving away flights to France when my stack of Air France vouchers grew too high. A favorite Asian airline has a frequent flyer program that allows its members to tap directly into their website’s master chart of flights and seats for all of their partner airlines. That was the key information that I needed to consistently secure bumps. A few years ago at 35,000 feet, my 3-year old son, sitting behind a few chocolate chip cookies and a glass of milk that they served in a martini glass, turned to me with a thoughtful expression and asked, Daddy, do all airplanes have bars? Forex Trading at Duty Free Shops 1997 was another strong year for SPY. While SPY enjoyed a good year, increasing attention was going to the internet-heavy Nasdaq. Half way through the year, I found myself at a duty free shop at a European airport, making a small purchase when the clerk asked what kind of change I wanted. He explained that as a convenience, they offered a range of currencies and it was the customer’s choice. I asked how frequently they updated the rate. “Monthly” he answered without expression. After briefly pawing through the store’s copy of the FT to check up on the recent activity within the foreign exchange markets, I asked for Norwegian Krone and received back in change as much as I had paid. I snatched up my paper, my purchase, and the change and was off to the bank. I picked up several Swiss franc notes, all denominated in thousands, so I could scale this up. I repeated the process each month right before the duty free shops reset their foreign exchange rates, so that I was transacting with the stalest possible rates. There was always some currency pair that had swung over a month, so I was able to clean out the cash registers of the appreciated currency. I would buy the smallest available bottle to keep the bill as low as possible. I was there for the change. I went from store to store doing the same. The proceeds were enough to pay for the next month’s fun before hitting the duty free shops once more. Today, foreign exchange arbitrage speeds are measured in tiny fractions of a second. But I had a one month advantage. After a summer of trading foreign exchange at the duty free shops, I headed home with bags full of tiny whiskey bottles and appreciated currency. Settling Down I managed to wrap up my school years in one of the worst times for the SPY. From this point onward, my efforts to beat the SPY’s return were increasingly focused on the capital market. After school, I settled into life at home and work. The kids keep hustling between selling lemonade and coffee out front. In their first antitrust violation, the owner of our town’s best coffee shop met with my six-year old to discuss pricing. By the end of the meeting, he convinced him to hike it from $1 to $2 because, customers in this area have become accustomed to premium coffee costing at least $2. The increase stuck. Today, if you would like to come by his stand for coffee, it will cost you $2. As for work, I get much of it done from our Maine office where the only noise is from the waves and the birds of prey. I focus my professional attention on the capital markets, but still search for the same advantages as my childhood antics. All I really want from the market is free money. I prefer getting it with as little capital, risk, or taxes as possible. I am happy to keep looking as long and hard as it takes. Are these advantaged opportunities all over the place? No, markets work as well as my father and Prof. Sowell say they do; however, every once in a while, you can find something. It is just a tiny glitch in the system. The price system breaks down. I will try to be ready. 2008 SPY was incredibly weak in 2008, making it easier than usual to beat the market. During the course of 2008, my favorite equity opportunity was Liberty Media (NASDAQ: LMCA ) (NASDAQ: LMCK ). Towards the end of the year, it was trading at a discount to the sum of its parts. It was one of the greatest price dislocations that I had ever seen. 2009 Heading into 2009, my best idea for beating SPY that year was the Pimco Floating Rate Fund (NYSE: PFN ). It suffered horribly in March, but recovered by June. Ultimately, PFN was able to outperform SPY. But that is not why I wanted to own it. I owned it because its components were senior secured loans that would have better recovery than equity in a total market collapse . Happily, one was averted. 2010 Approaching 2010, my candidate for beating SPY was Loral Space & Communications (NASDAQ: LORL ). As in the previous year, my pick stunk up the place at the beginning of the year. SPY enjoyed a smooth, positive year but LORL had an ugly start. Ultimately, however, it was able to return over 9x the SPY’s performance. 2011 SPY was basically sideways in 2011. It closed the year at a marginally lower level, but made up for that and then some with its dividend. Heading into 2011, my best idea for beating SPY was LaBranche, which had ticker LAB at the time. A month and a half into owning the position, it was bought for a 30% premium and the idea was closed out. 2012 Compared with 2011, SPY had a fine year in 2012. I turned to one of my favorite categories of investment opportunities – mutual conversion – for my best effort at beating SPY in 2012. Ocean Shore (NASDAQ: OSHC ) was my favorite idea that year. Its return was about three and a half times that of SPY. 2013 In 2013, SPY enjoyed another strong year, returning 29%. My best idea for 2013, Gramercy (NYSE: GPT ) was a financial crisis survivor with cash and trustworthy management. It closed out the year with a return over six and a half times that of SPY. 2014 After a weak start, SPY rebounded for a positive 2014. My idea to beat it was Sanofi (NYSE: SNY ) value rights (NASDAQ: GCVRZ ). Those rights ultimately returned over ten times the SPY return. 2015 So far, SPY has been modestly positive this year. Sadly for me, my idea to beat it has not. BNCCORP (OTCQX: BNCC ) is an extremely safe, cheap bank in North Dakota. Someone should buy it. Someone probably will. However, no one has yet. While my best ideas for beating SPY returned over three times the SPY’s returns since the beginning of 2009, that record has been somewhat lessened by this year so far. I expect better things from BNCC in the second half of the year. Conclusion You might be ready to pick stocks… but should you? A key to that question is whether you are seeking exposure or edge . If you simply want exposure, you can ride the impressively positive average long-term performance of SPY or a similar passive investment. There is no need to try to select individual securities. If, on the other hand, you want to beat SPY, then you will need an edge – variant information or judgment that will allow you to outperform over time. In my case, my interest in markets took the form of an early and intense effort to exploit structural anomalies. I wanted nothing to do with fair fights. Instead, I wanted to take advantage of pricing anomalies to beat SPY. I fully intend to dedicate all of my professional resources to this effort for the remainder of my life. What should you do? You should decide for yourself. However, I would offer this caution. Exposure via the SPY or similar is fine. Having a real edge that allows you to durably beat the SPY is fine. But casually wandering into the equity markets in areas where others have the edge is not fine. So, if you are going to select individual securities, ask yourself this question, What do I know that the rest of the market does not? Make certain that you have a convincing answer before you proceed any further. Editor’s Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks. Disclosure: The author is long BNCC, OSHC, LORL, GCVRZ, GPT. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Chris DeMuth Jr is a portfolio manager at Rangeley Capital. Rangeley invests with a margin of safety by buying securities at deep discounts to their intrinsic value and unlocking that value through corporate events. In order to maximize total returns for our investors, we reserve the right to make investment decisions regarding any security without further notification except where such notification is required by law. Scalper1 News

Summary This is my story. It is how I got my start. It is my search for a few misplaced bets. I am continuing this search on Sifting the World. If you have read about Seeking Alpha On Day 1 and still want to invest, then you have already answered the question, of, Are you ready to try to beat the market? Now, you can address the follow up question, Should you try? Here is what the S&P 500 has done in my lifetime: While the SPDR S&P 500 Trust ETF (NYSEARCA: SPY ) was not yet available when I began investing, one was able to invest in the S&P 500 via index funds. Here is how I decided to dedicate myself to beating the market, the S&P 500, and later the SPY. Discovering the Market I was named after my father, Christopher DeMuth Sr . A scholar from the Chicago School of Economics, he taught me the second most important lesson for my career: that markets work very well and certainly better than any alternative that man has so far imagined. From a very young age, I tried to consume a steady dose of market theory, starting with Economics in One Lesson: The Shortest and Surest Way to Understand Basic Economics by Henry Hazlitt. It made so much sense to me that it became hard to listen to political views of anyone who had not read it and understood it. The greatest living economist, Prof. Tom Sowell , visited my home once and my reaction was worshipful. In terms of an economic perspective on the world, his struck me as useful, relevant, and complete. I had nothing to add and eagerly dashed through the days and years of school so that I could get out and on with my life. It is hard to imagine a more stupid or more dangerous way of making decisions than by putting those decisions in the hands of people who pay no price for being wrong. – Thomas Sowell Free Markets are Wonderful… But Imperfect I became increasingly interested in the capital markets around fourth grade. I was not bound for academia – I was bound for the marketplace. The S&P 500 was strong in the early years of President Reagan’s second term. I tracked it daily and read all that I could on the subject. Markets can take on all comers. Compared to the alternatives, they lead to the greatest hope, growth, opportunity, prosperity, and justice. The second best thing I learned was that markets are that good. The best thing I ever learned is that they are imperfect . They have flaws and I could find where those flaws are located. This would be my life’s work, wading through markets in hot pursuit of their inefficiencies. What is it like to find one? Euphoria. Finding something that others missed, just sitting there for the taking is pure mirth. For some reason it is a kind of humor – if only funny to me, it is funny to me when prices are wrong. Taking money out of the broken corners of this system is an afterthought. It aids in keeping score and I like to win that game. But my love is for the game. This is the story of my discovery of that game. In search of a bankroll In 1987, the S&P 500 was off to a strong year until it crashed in October. I wanted to start investing. I had ideas and enthusiasm. I did not have any money. I needed something that would not demand any capital or risk but would pay well and quickly. My first step was to accept a half dozen credit card solicitations for cards with 0% interest in the first year. It seemed like a good place to start. Why they were eager to lend me money was a bit of a mystery. The solution might have been found in the similarity between my name and that of my more employed and credit-worthy father but it was not a question that I long pondered. To me, the important thing was to go from $0.00 to $0.00 with a line of credit. I discovered the bond market and loaded up my credit cards with purchases of treasury bonds. Just before the year was over, I sold them, took the early redemption penalty of the last quarter of interest, used the principal to pay off the cards in full, and pocketed $1,125 of interest. Then I did it again. And again. By Junior High School, I had my bankroll. Un beatable guarantee By 1994, SPY had launched and was starting to take market share from index funds. It had not done much that year. I was looking for an edge and found one at Circuit City. Circuit City’s Unbeatable Price Guarantee stated that, Circuit City is proud to offer the best prices on consumer electronics. Period. Buy a product from us and if, within 30 days of your purchase, you find a local competitor offering a lower advertised price for the same in-stock item, we’ll refund 110% of the difference. If you haven’t yet purchased the product, we’ll beat the competitor’s price by 10% of the difference between our price and theirs. Either way, you win. Yes you do. It was that extra 10% that I just couldn’t get out of my mind. I couldn’t stop thinking about it. I loitered around the stores where I got to know the salesmen and the sales schedule. President’s Day became one of my favorite holidays. The weekend before, I would stock up. It didn’t really matter what I bought. I bought everything and anything I could afford. The important thing was that they were not on sale and that they would be willing to hold them for me for just a week. They got my money and I got receipts. Their most expensive television cost me $15,000. Prices were dropping rapidly and it was marked down to $10,000 the next week. They honored their guarantee by rebating me $5,500 before I returned it for $10,000. I bought and returned that television enough times to be able to afford to keep it (not that I ever would). While unconventional, beating Circuit City’s guarantee beat SPY. Time to leave for college. Years later, I read that Circuit City discontinued their Unbeatable Price Guarantee in 2008 and filed for bankruptcy protection in 2009. Credit (Card) Arbitrage In 1995, SPY was much stronger. At this pace, I would have to come up with something new to beat the SPY. The credit card companies kept sending me offers and I kept accepting. Over time, my collection included one for my favorite clothing store, favorite bookstore, favorite airline program, and a couple for cash back. My combined credit limit breached a quarter of a million dollars. I set out to find a way to put it to work. I knew just what I wanted to buy but needed to find a seller. In search of one, I sent out four hundred identical letters to financial institutions asking if I could use my cards to invest in money markets. Most ignored me. A few bothered to say “no” in a tone that expressed surprise that I would have asked. But a few said “sure, why not” so I was able to get to work. That day, I put $250,000 in money markets. Before the end of the month, I paid off the cards with the balances in the money markets. For convenience, I was able to set up an automatic payment plan. The money would bounce back and forth from the credit cards to the money markets and back. Each month, I would collect several hundred dollars of interest in the money market accounts which would grow from month to month. Each month, I would collect $3,200 in cash back and gift certificates for clothing, books, and airline miles. I got status on various airlines, one of which is good for life. The IRS considered these payments to be rebates, so the tax rate was 0%. If only because it required no capital, credit card arbitrage beat the SPY. My life on the road SPY was strong again in 1996. While domestic markets were strong, I was looking abroad… After leaving home, my interests were interdisciplinary. I wanted to both seduce a pretty college girl and bum around Europe. I eventually succeeded at the first (now my long-suffering wife) and so was able to dedicate myself to my studies of the second. I needed to get there and needed to be able to sleep and eat somewhere. I wanted to do so in style and for free. I scraped together my flying budget as a part-time professional bumpee. This involved plotting ahead, using a combination of airline strike schedules and seating charts to determine the most constrained seating supply, which I would then buy. If an airline called a strike, I would buy seats on their competitors flying the same routes. Once I got to the gate, I would ask to be bumped in return for a hotel room, meal, and travel vouchers. After a while, they would take my offers to take a bump over the phone, so I didn’t even need to be in the departure city to collect. It works out to approximately $511,000 per year in vouchers for a couple of bumpees. I settled on a favorite hotel in London and another in Paris. I ended up just giving away flights to France when my stack of Air France vouchers grew too high. A favorite Asian airline has a frequent flyer program that allows its members to tap directly into their website’s master chart of flights and seats for all of their partner airlines. That was the key information that I needed to consistently secure bumps. A few years ago at 35,000 feet, my 3-year old son, sitting behind a few chocolate chip cookies and a glass of milk that they served in a martini glass, turned to me with a thoughtful expression and asked, Daddy, do all airplanes have bars? Forex Trading at Duty Free Shops 1997 was another strong year for SPY. While SPY enjoyed a good year, increasing attention was going to the internet-heavy Nasdaq. Half way through the year, I found myself at a duty free shop at a European airport, making a small purchase when the clerk asked what kind of change I wanted. He explained that as a convenience, they offered a range of currencies and it was the customer’s choice. I asked how frequently they updated the rate. “Monthly” he answered without expression. After briefly pawing through the store’s copy of the FT to check up on the recent activity within the foreign exchange markets, I asked for Norwegian Krone and received back in change as much as I had paid. I snatched up my paper, my purchase, and the change and was off to the bank. I picked up several Swiss franc notes, all denominated in thousands, so I could scale this up. I repeated the process each month right before the duty free shops reset their foreign exchange rates, so that I was transacting with the stalest possible rates. There was always some currency pair that had swung over a month, so I was able to clean out the cash registers of the appreciated currency. I would buy the smallest available bottle to keep the bill as low as possible. I was there for the change. I went from store to store doing the same. The proceeds were enough to pay for the next month’s fun before hitting the duty free shops once more. Today, foreign exchange arbitrage speeds are measured in tiny fractions of a second. But I had a one month advantage. After a summer of trading foreign exchange at the duty free shops, I headed home with bags full of tiny whiskey bottles and appreciated currency. Settling Down I managed to wrap up my school years in one of the worst times for the SPY. From this point onward, my efforts to beat the SPY’s return were increasingly focused on the capital market. After school, I settled into life at home and work. The kids keep hustling between selling lemonade and coffee out front. In their first antitrust violation, the owner of our town’s best coffee shop met with my six-year old to discuss pricing. By the end of the meeting, he convinced him to hike it from $1 to $2 because, customers in this area have become accustomed to premium coffee costing at least $2. The increase stuck. Today, if you would like to come by his stand for coffee, it will cost you $2. As for work, I get much of it done from our Maine office where the only noise is from the waves and the birds of prey. I focus my professional attention on the capital markets, but still search for the same advantages as my childhood antics. All I really want from the market is free money. I prefer getting it with as little capital, risk, or taxes as possible. I am happy to keep looking as long and hard as it takes. Are these advantaged opportunities all over the place? No, markets work as well as my father and Prof. Sowell say they do; however, every once in a while, you can find something. It is just a tiny glitch in the system. The price system breaks down. I will try to be ready. 2008 SPY was incredibly weak in 2008, making it easier than usual to beat the market. During the course of 2008, my favorite equity opportunity was Liberty Media (NASDAQ: LMCA ) (NASDAQ: LMCK ). Towards the end of the year, it was trading at a discount to the sum of its parts. It was one of the greatest price dislocations that I had ever seen. 2009 Heading into 2009, my best idea for beating SPY that year was the Pimco Floating Rate Fund (NYSE: PFN ). It suffered horribly in March, but recovered by June. Ultimately, PFN was able to outperform SPY. But that is not why I wanted to own it. I owned it because its components were senior secured loans that would have better recovery than equity in a total market collapse . Happily, one was averted. 2010 Approaching 2010, my candidate for beating SPY was Loral Space & Communications (NASDAQ: LORL ). As in the previous year, my pick stunk up the place at the beginning of the year. SPY enjoyed a smooth, positive year but LORL had an ugly start. Ultimately, however, it was able to return over 9x the SPY’s performance. 2011 SPY was basically sideways in 2011. It closed the year at a marginally lower level, but made up for that and then some with its dividend. Heading into 2011, my best idea for beating SPY was LaBranche, which had ticker LAB at the time. A month and a half into owning the position, it was bought for a 30% premium and the idea was closed out. 2012 Compared with 2011, SPY had a fine year in 2012. I turned to one of my favorite categories of investment opportunities – mutual conversion – for my best effort at beating SPY in 2012. Ocean Shore (NASDAQ: OSHC ) was my favorite idea that year. Its return was about three and a half times that of SPY. 2013 In 2013, SPY enjoyed another strong year, returning 29%. My best idea for 2013, Gramercy (NYSE: GPT ) was a financial crisis survivor with cash and trustworthy management. It closed out the year with a return over six and a half times that of SPY. 2014 After a weak start, SPY rebounded for a positive 2014. My idea to beat it was Sanofi (NYSE: SNY ) value rights (NASDAQ: GCVRZ ). Those rights ultimately returned over ten times the SPY return. 2015 So far, SPY has been modestly positive this year. Sadly for me, my idea to beat it has not. BNCCORP (OTCQX: BNCC ) is an extremely safe, cheap bank in North Dakota. Someone should buy it. Someone probably will. However, no one has yet. While my best ideas for beating SPY returned over three times the SPY’s returns since the beginning of 2009, that record has been somewhat lessened by this year so far. I expect better things from BNCC in the second half of the year. Conclusion You might be ready to pick stocks… but should you? A key to that question is whether you are seeking exposure or edge . If you simply want exposure, you can ride the impressively positive average long-term performance of SPY or a similar passive investment. There is no need to try to select individual securities. If, on the other hand, you want to beat SPY, then you will need an edge – variant information or judgment that will allow you to outperform over time. In my case, my interest in markets took the form of an early and intense effort to exploit structural anomalies. I wanted nothing to do with fair fights. Instead, I wanted to take advantage of pricing anomalies to beat SPY. I fully intend to dedicate all of my professional resources to this effort for the remainder of my life. What should you do? You should decide for yourself. However, I would offer this caution. Exposure via the SPY or similar is fine. Having a real edge that allows you to durably beat the SPY is fine. But casually wandering into the equity markets in areas where others have the edge is not fine. So, if you are going to select individual securities, ask yourself this question, What do I know that the rest of the market does not? Make certain that you have a convincing answer before you proceed any further. Editor’s Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks. Disclosure: The author is long BNCC, OSHC, LORL, GCVRZ, GPT. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Chris DeMuth Jr is a portfolio manager at Rangeley Capital. Rangeley invests with a margin of safety by buying securities at deep discounts to their intrinsic value and unlocking that value through corporate events. In order to maximize total returns for our investors, we reserve the right to make investment decisions regarding any security without further notification except where such notification is required by law. Scalper1 News

Scalper1 News