Scalper1 News

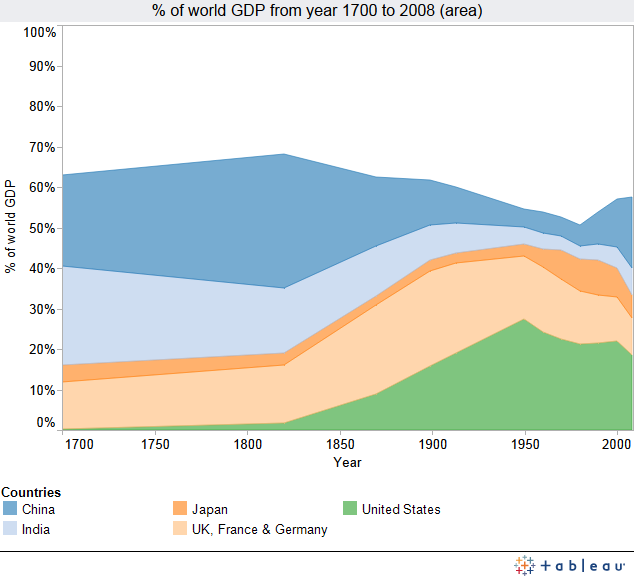

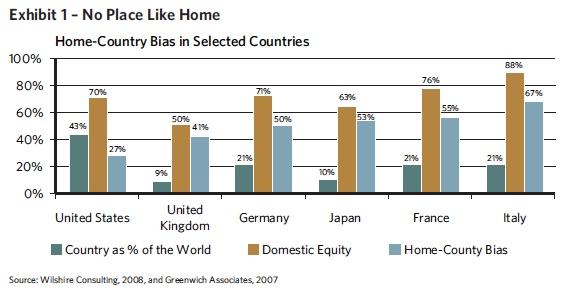

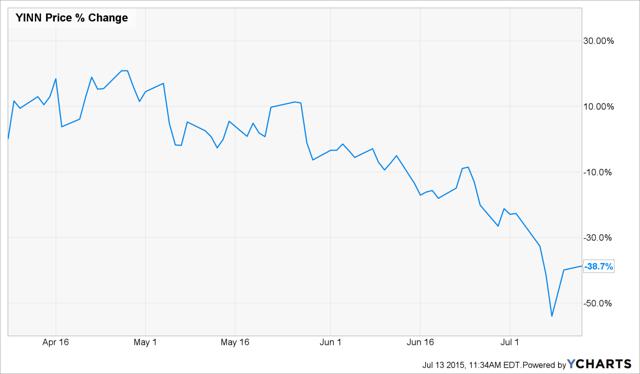

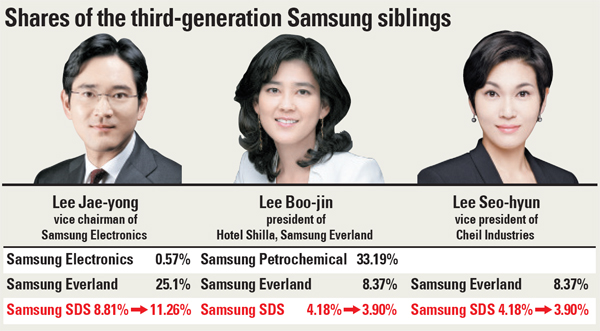

Summary Today, investing ideas outside of the US are underrepresented. Seeking Alpha should adopt a more international focus. Opportunities abound from Russia, to China and South Korea. I love my country. I have had family members fight, bleed, and die in every one of America’s wars since the founding. While I enjoy travelling as much as possible, I am always grateful to come home (okay except from New Zealand, but almost always grateful to come home). StW members come from around the world; so should our investments. As much as I love America, fixating on the US market when it comes to investing can be an expensive mistake. Additionally, since launching Sifting the World , I have gotten to know dozens of members from around the world who would be interested in discussing more international investing ideas. Today Seeking Alpha is US-centric in terms of editorial focus and technological ability to, for example, accept foreign tickers. A more global aperture is one of the exciting new directions that it can grow in under the new leadership . America in Context In terms of the opportunity set, it is worth placing the US in context. It represents about 2% of Earth’s surface area and 7% of its land. We are 5% of the population. The market cap is between a third and a half of the world equity market cap. But the gross domestic product is only about a fifth of the world’s combined GDP. So in terms of the pursuit of investing ideas, it might be reasonable to look for at least half abroad. In fact, it might make sense to go for the 80% that is proportionate to the non-US GDP of the rest of the world. There are opportunities there today. Also, country share of the world GDP is hardly static. So having a geographically diverse portfolio can avoid overweighting dominant markets when they eventually decline, as they all eventually have done in the past. Home Country Bias Investors around the world overweight exposure to companies in their home countries. This lack of diversification is caused in part by the preference to be exposed to the familiar. But investors should try to be rational and the home country bias is ubiquitous but not rational. Like the children in Lake Wobegon, we cannot all be “above average”. This illusory superiority results from a dangerous and expensive cognitive bias. Comparing countries I compare country markets on the basis of economic freedom, corruption, currency, courts, and legal systems. These are the factors that form my basis of an opinion on whether my rights as an investor will be protected. When I invest, I actively engage with boards and managements to ensure that they are maximizing shareholder value. Often, this is a collaborative, mutually beneficial process. Occasionally, it is confrontational and litigious. So, it is important to know ahead of time whether my rights can be enforced. I analyze transparency before fundamentals, because there is little use in finding a bargain if the numbers are false. For example, as recently as 2011, over 60% of my short ideas were Chinese. Had their numbers been real (they were fraudulent), they would have been among my favorite long ideas. But before one valued them, it was worth a deep investigation into the fact that they were lying in their financials and that there was little that an American investor could do about it. Once country markets are weighted by the above attributes, I turn to fundamental valuation metrics. I blend a combination of price relative to earnings, cash flow (with an emphasis on cash flow from operations), book value, and sales. I also look at dividend yield and the cyclically adjusted PE ratio/CAPE. None of these metrics gives me an answer, but a blend gives me a bracket in which to place individual countries. International Opportunities What recent opportunities have arisen? I would start by answering that question by saying that the answer based upon transparency and fundamentals had little overlap with my intuition. One measures in part because intuition is so often faulty. I have shorted equities in countries that I love (I am a lifelong Sinophile with an admiration for Chinese history and culture that surpasses most of my Chinese friends) and bought equities in countries where I have deep reservations (Russia’s government has horribly persecuted friends of mine). I subjected each country around the world to analysis, isolating a number of promising candidates for extra scrutiny. Additionally, I have spent more time on countries with equities at particular bargains. In the course of this analysis, I moved beyond my daily focus on securities in North America ( Canada , a market that I love, being so close and familiar that it hardly feels foreign). Three that particularly stood out were Russia, China, and South Korea. Over the course of the past year, I have dedicated extra research to those three. Russia Russia has been a favorite long idea of mine since last December. My primary tool for implementing this thesis has been shorting the leveraged inverse Russian ETF RUSS . I discussed the idea in December and again in February . To date, it is down over 70% and will probably decline further over time. Specific actionable securities Prospectively, what is the best way to get Russian exposure? My current favorite is EOS Russia (ISIN-code: SE 0002016261). Shares of this fund, which are primarily dedicated to Russian electric distribution, cost 1.4x EV/EBITDA, 1.8x P/E, and 10% of book value. China China has been a favorite short idea of mine since April . I shorted the leveraged ETF, YINN . It has declined by over 30% since then but could fall further as Chinese companies allow halted securities to trade freely. Specific actionable securities In addition to shorting YINN via equity or options, you may consider a long in one of the more promising Chinese ADRs with takeover offers as a YINN hedge. My favorites include Taomee (NYSE: TAOM ) and YY (NASDAQ: YY ). South Korea My favorite country market is South Korea . For Korean exposure without having to pick through individual securities, I have a high level of confidence in Weiss Korea Opportunity Fund ( OTCPK:WISKF ). Specific actionable securities A favorite South Korean equity of mine which might be worth your consideration is Ilsung Pharma (003120). Ilsung is a small but profitable pharma company with a pile of cash and 2% ownership in Samsung C&T (000830 KS). It cost about two-thirds the value of its liquid cash and securities and about half of its book value. It is worth book. Samsung C&T is part of the Samsung chaebol which owns stakes in various businesses, the most valuable of which is Samsung Electronics. The Lee family that controls Samsung is trying to merge Cheil Industries with Samsung C&T. Elliott Associates owns over 7% of Samsung C&T and opposes the deal. The vote is on Friday July 17 and it will be a close one. If it goes through, it will strengthen the hand of heir apparent Lee Jae-yong. Based upon his position as Vice Chairman of Samsung Electronics and his economic stakes in the chaebol’s components, he is likely to emerge as the family leader in the future. Elliott’s concerns appear to be wholly valid. The transaction appears to be a form of self-dealing that massively understates the value of Samsung C&T in absolute terms and relative to Cheil. The key question is whether or not Elliott’s form of activism will work in Korea this time. The vote requires the support of two-thirds of votes cast. The National Pension Service, which owns eleven percent, has dutifully closed ranks in favor of the deal. Elliott will probably need to convince another fifteen percent to vote against the deal in order to block it. As of today, the deal and Samsung generally appear to be firmly in Lee control. But if that changes, there could be additional value for Samsung C&T holders. Whether or not Elliott wins (and I hope that they do as their victory would enrich all fellow Samsung C&T holders and further open up Samsung and Korea generally to shareholder scrutiny), Samsung C&T is quite cheap at a discount to NAV of over 40%. Conclusion We can each be as patriotic about our home as we like, and while it can be a strong feeling, patriotism is an emotion. Investing is about thinking. The marketplace should be a meritocracy in which the best ideas, products, and investments win. To that end, we should constantly search the world for foreign opportunities that are better than what we have at home. Disclosure: I am/we are short YINN. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Chris DeMuth Jr is a portfolio manager at Rangeley Capital. Rangeley invests with a margin of safety by buying securities at deep discounts to their intrinsic value and unlocking that value through corporate events. In order to maximize total returns for our investors, we reserve the right to make investment decisions regarding any security without further notification except where such notification is required by law. Scalper1 News

Summary Today, investing ideas outside of the US are underrepresented. Seeking Alpha should adopt a more international focus. Opportunities abound from Russia, to China and South Korea. I love my country. I have had family members fight, bleed, and die in every one of America’s wars since the founding. While I enjoy travelling as much as possible, I am always grateful to come home (okay except from New Zealand, but almost always grateful to come home). StW members come from around the world; so should our investments. As much as I love America, fixating on the US market when it comes to investing can be an expensive mistake. Additionally, since launching Sifting the World , I have gotten to know dozens of members from around the world who would be interested in discussing more international investing ideas. Today Seeking Alpha is US-centric in terms of editorial focus and technological ability to, for example, accept foreign tickers. A more global aperture is one of the exciting new directions that it can grow in under the new leadership . America in Context In terms of the opportunity set, it is worth placing the US in context. It represents about 2% of Earth’s surface area and 7% of its land. We are 5% of the population. The market cap is between a third and a half of the world equity market cap. But the gross domestic product is only about a fifth of the world’s combined GDP. So in terms of the pursuit of investing ideas, it might be reasonable to look for at least half abroad. In fact, it might make sense to go for the 80% that is proportionate to the non-US GDP of the rest of the world. There are opportunities there today. Also, country share of the world GDP is hardly static. So having a geographically diverse portfolio can avoid overweighting dominant markets when they eventually decline, as they all eventually have done in the past. Home Country Bias Investors around the world overweight exposure to companies in their home countries. This lack of diversification is caused in part by the preference to be exposed to the familiar. But investors should try to be rational and the home country bias is ubiquitous but not rational. Like the children in Lake Wobegon, we cannot all be “above average”. This illusory superiority results from a dangerous and expensive cognitive bias. Comparing countries I compare country markets on the basis of economic freedom, corruption, currency, courts, and legal systems. These are the factors that form my basis of an opinion on whether my rights as an investor will be protected. When I invest, I actively engage with boards and managements to ensure that they are maximizing shareholder value. Often, this is a collaborative, mutually beneficial process. Occasionally, it is confrontational and litigious. So, it is important to know ahead of time whether my rights can be enforced. I analyze transparency before fundamentals, because there is little use in finding a bargain if the numbers are false. For example, as recently as 2011, over 60% of my short ideas were Chinese. Had their numbers been real (they were fraudulent), they would have been among my favorite long ideas. But before one valued them, it was worth a deep investigation into the fact that they were lying in their financials and that there was little that an American investor could do about it. Once country markets are weighted by the above attributes, I turn to fundamental valuation metrics. I blend a combination of price relative to earnings, cash flow (with an emphasis on cash flow from operations), book value, and sales. I also look at dividend yield and the cyclically adjusted PE ratio/CAPE. None of these metrics gives me an answer, but a blend gives me a bracket in which to place individual countries. International Opportunities What recent opportunities have arisen? I would start by answering that question by saying that the answer based upon transparency and fundamentals had little overlap with my intuition. One measures in part because intuition is so often faulty. I have shorted equities in countries that I love (I am a lifelong Sinophile with an admiration for Chinese history and culture that surpasses most of my Chinese friends) and bought equities in countries where I have deep reservations (Russia’s government has horribly persecuted friends of mine). I subjected each country around the world to analysis, isolating a number of promising candidates for extra scrutiny. Additionally, I have spent more time on countries with equities at particular bargains. In the course of this analysis, I moved beyond my daily focus on securities in North America ( Canada , a market that I love, being so close and familiar that it hardly feels foreign). Three that particularly stood out were Russia, China, and South Korea. Over the course of the past year, I have dedicated extra research to those three. Russia Russia has been a favorite long idea of mine since last December. My primary tool for implementing this thesis has been shorting the leveraged inverse Russian ETF RUSS . I discussed the idea in December and again in February . To date, it is down over 70% and will probably decline further over time. Specific actionable securities Prospectively, what is the best way to get Russian exposure? My current favorite is EOS Russia (ISIN-code: SE 0002016261). Shares of this fund, which are primarily dedicated to Russian electric distribution, cost 1.4x EV/EBITDA, 1.8x P/E, and 10% of book value. China China has been a favorite short idea of mine since April . I shorted the leveraged ETF, YINN . It has declined by over 30% since then but could fall further as Chinese companies allow halted securities to trade freely. Specific actionable securities In addition to shorting YINN via equity or options, you may consider a long in one of the more promising Chinese ADRs with takeover offers as a YINN hedge. My favorites include Taomee (NYSE: TAOM ) and YY (NASDAQ: YY ). South Korea My favorite country market is South Korea . For Korean exposure without having to pick through individual securities, I have a high level of confidence in Weiss Korea Opportunity Fund ( OTCPK:WISKF ). Specific actionable securities A favorite South Korean equity of mine which might be worth your consideration is Ilsung Pharma (003120). Ilsung is a small but profitable pharma company with a pile of cash and 2% ownership in Samsung C&T (000830 KS). It cost about two-thirds the value of its liquid cash and securities and about half of its book value. It is worth book. Samsung C&T is part of the Samsung chaebol which owns stakes in various businesses, the most valuable of which is Samsung Electronics. The Lee family that controls Samsung is trying to merge Cheil Industries with Samsung C&T. Elliott Associates owns over 7% of Samsung C&T and opposes the deal. The vote is on Friday July 17 and it will be a close one. If it goes through, it will strengthen the hand of heir apparent Lee Jae-yong. Based upon his position as Vice Chairman of Samsung Electronics and his economic stakes in the chaebol’s components, he is likely to emerge as the family leader in the future. Elliott’s concerns appear to be wholly valid. The transaction appears to be a form of self-dealing that massively understates the value of Samsung C&T in absolute terms and relative to Cheil. The key question is whether or not Elliott’s form of activism will work in Korea this time. The vote requires the support of two-thirds of votes cast. The National Pension Service, which owns eleven percent, has dutifully closed ranks in favor of the deal. Elliott will probably need to convince another fifteen percent to vote against the deal in order to block it. As of today, the deal and Samsung generally appear to be firmly in Lee control. But if that changes, there could be additional value for Samsung C&T holders. Whether or not Elliott wins (and I hope that they do as their victory would enrich all fellow Samsung C&T holders and further open up Samsung and Korea generally to shareholder scrutiny), Samsung C&T is quite cheap at a discount to NAV of over 40%. Conclusion We can each be as patriotic about our home as we like, and while it can be a strong feeling, patriotism is an emotion. Investing is about thinking. The marketplace should be a meritocracy in which the best ideas, products, and investments win. To that end, we should constantly search the world for foreign opportunities that are better than what we have at home. Disclosure: I am/we are short YINN. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Chris DeMuth Jr is a portfolio manager at Rangeley Capital. Rangeley invests with a margin of safety by buying securities at deep discounts to their intrinsic value and unlocking that value through corporate events. In order to maximize total returns for our investors, we reserve the right to make investment decisions regarding any security without further notification except where such notification is required by law. Scalper1 News

Scalper1 News