Scalper1 News

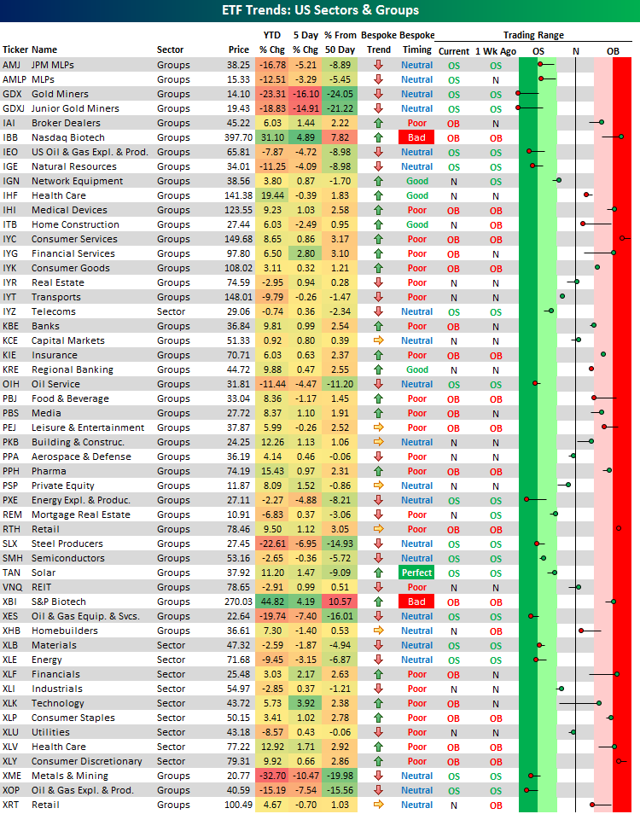

Earlier we posted our review of key global ETF performance. We also look at ETFs on a variety of other angles in our daily ETF Trends Report . Today’s report features US Sector and Group ETFs. Below we show the trading range screen for this slice of the ETF market we track. The main thing that jumped out to us? Absurd dispersion in the trends for the ETFs. As shown in the trading range at the far right side of the graph, ETFs are all over the place, ranging from as oversold as it comes ( GDX , GDXJ ) to just bad ( IEO , IGE , XES , XOP , XLE , XME ). But there are tons of very neutral trends: KCE , PKB , and PPA are all wildly different ETFs trading very close to their 50-DMAs. Finally, in overbought territory there are names like IBB and XLF . While XLK isn’t overbought yet, massive moves last week from Google (NASDAQ: GOOGL ) (NASDAQ: GOOG ) and Apple (NASDAQ: AAPL ) have it soaring upwards within its trend. The bottom line here: if you can pick your spots well, this has been a phenomenal year in the markets, with huge differences inside the broad market indices despite relatively modest gains overall for the US equity market. Opportunities abound on both the long and the short side, despite quite low volatility at the broad market level. It truly is a sector picker’s market! (click to enlarge) Share this article with a colleague Scalper1 News

Earlier we posted our review of key global ETF performance. We also look at ETFs on a variety of other angles in our daily ETF Trends Report . Today’s report features US Sector and Group ETFs. Below we show the trading range screen for this slice of the ETF market we track. The main thing that jumped out to us? Absurd dispersion in the trends for the ETFs. As shown in the trading range at the far right side of the graph, ETFs are all over the place, ranging from as oversold as it comes ( GDX , GDXJ ) to just bad ( IEO , IGE , XES , XOP , XLE , XME ). But there are tons of very neutral trends: KCE , PKB , and PPA are all wildly different ETFs trading very close to their 50-DMAs. Finally, in overbought territory there are names like IBB and XLF . While XLK isn’t overbought yet, massive moves last week from Google (NASDAQ: GOOGL ) (NASDAQ: GOOG ) and Apple (NASDAQ: AAPL ) have it soaring upwards within its trend. The bottom line here: if you can pick your spots well, this has been a phenomenal year in the markets, with huge differences inside the broad market indices despite relatively modest gains overall for the US equity market. Opportunities abound on both the long and the short side, despite quite low volatility at the broad market level. It truly is a sector picker’s market! (click to enlarge) Share this article with a colleague Scalper1 News

Scalper1 News