Scalper1 News

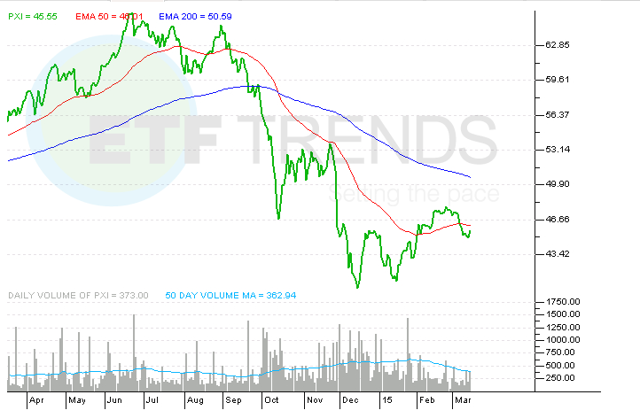

Summary Low oil has weighed on the energy sector. Refiner-heavy ETF offers a value play for investors. Why focus on refiners. With oil prices making new lows on an almost daily basis, energy equities and the corresponding exchange traded funds appear unappealing. Falling stock prices coupled with declining earnings have the beaten up energy sector looking pricey on valuation, but one of the sector’s sturdiest industry groups is presenting investors with good value. Attractive valuations among oil refiners can be accessed with the PowerShares DWA Energy Momentum Portfolio ETF (NYSEARCA: PXI ) . “After stripping out the implied MLP-related valuations, we find the multiples to be far more reasonable with the group currently trading at ~5.0x, in line with average levels seen in late 2013-early 2014. More importantly, revisions are likely to remain a steady tailwind, with nearly 10% upside to 2015 Street EBITDA estimates on our forecast,” said Deutsche Bank in a note posted by Ben Levisohn of Barron’s . In lieu of a dedicated refiners ETF, the $161.6 million PXI acts as a solid alternative. At least six of the ETF’s top 10 holdings, a group that combines for over 43% of the fund’s weight, are refiners. PXI tracks the DWA Energy Technical Leaders Index, which attempts to identify energy sector constituents displaying positive relative strength characteristics. With refiners among the energy sector ‘s relative strength leaders at the moment, PXI features robust refiner exposure. Refiners can prove durable when oil prices decline because those falling prices boost refining margins. PXI has made good on that theory. Over the past three months, the ETF has traded modestly higher while the Energy Select Sector SPDR ETF (NYSEARCA: XLE ) has lost 6.3%. The United States Oil ETF (NYSEARCA: USO ) has plunged 26.6% over that period. Citing “an overall healthy refining backdrop (post turnaround risk there but crude dynamics supportive for now), a healthy 1Q EPS setup (estimates look low) and higher investor appreciation for the retail business,” among other catalysts, Deutsche Bank sees more upside for refiners, according to Barron’s. The bank is bullish on Valero Energy (NYSE: VLO ), Marathon Petroleum (NYSE: MPC ), Tesoro (NYSE: TSO ) and Phillips 66 (NYSE: PSX ). All four of those stocks are top 10 holdings in PXI and the quartet combines for 15.7% of the ETF’s weight. PowerShares DWA Energy Momentum Portfolio (click to enlarge) Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it. The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary Low oil has weighed on the energy sector. Refiner-heavy ETF offers a value play for investors. Why focus on refiners. With oil prices making new lows on an almost daily basis, energy equities and the corresponding exchange traded funds appear unappealing. Falling stock prices coupled with declining earnings have the beaten up energy sector looking pricey on valuation, but one of the sector’s sturdiest industry groups is presenting investors with good value. Attractive valuations among oil refiners can be accessed with the PowerShares DWA Energy Momentum Portfolio ETF (NYSEARCA: PXI ) . “After stripping out the implied MLP-related valuations, we find the multiples to be far more reasonable with the group currently trading at ~5.0x, in line with average levels seen in late 2013-early 2014. More importantly, revisions are likely to remain a steady tailwind, with nearly 10% upside to 2015 Street EBITDA estimates on our forecast,” said Deutsche Bank in a note posted by Ben Levisohn of Barron’s . In lieu of a dedicated refiners ETF, the $161.6 million PXI acts as a solid alternative. At least six of the ETF’s top 10 holdings, a group that combines for over 43% of the fund’s weight, are refiners. PXI tracks the DWA Energy Technical Leaders Index, which attempts to identify energy sector constituents displaying positive relative strength characteristics. With refiners among the energy sector ‘s relative strength leaders at the moment, PXI features robust refiner exposure. Refiners can prove durable when oil prices decline because those falling prices boost refining margins. PXI has made good on that theory. Over the past three months, the ETF has traded modestly higher while the Energy Select Sector SPDR ETF (NYSEARCA: XLE ) has lost 6.3%. The United States Oil ETF (NYSEARCA: USO ) has plunged 26.6% over that period. Citing “an overall healthy refining backdrop (post turnaround risk there but crude dynamics supportive for now), a healthy 1Q EPS setup (estimates look low) and higher investor appreciation for the retail business,” among other catalysts, Deutsche Bank sees more upside for refiners, according to Barron’s. The bank is bullish on Valero Energy (NYSE: VLO ), Marathon Petroleum (NYSE: MPC ), Tesoro (NYSE: TSO ) and Phillips 66 (NYSE: PSX ). All four of those stocks are top 10 holdings in PXI and the quartet combines for 15.7% of the ETF’s weight. PowerShares DWA Energy Momentum Portfolio (click to enlarge) Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it. The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News