Scalper1 News

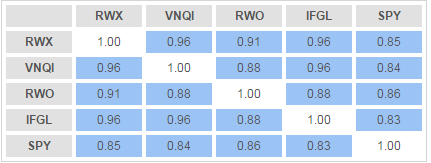

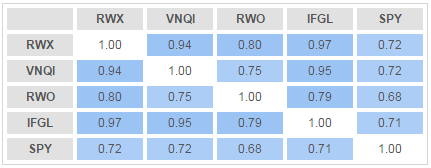

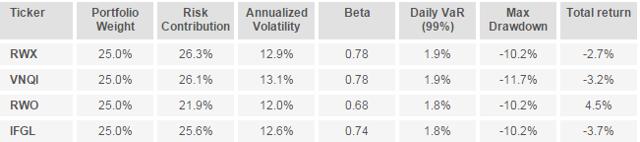

Correlations with S&P 500 have declined to around 0.70 in the last year. International REIT ETFs appear to be more correlated to S&P 500 than their counterparts investing solely in the U.S. Largest international REIT ETFs share almost identical risk profile. In a separate article last week I took a look at how U.S. real estate investment trust (“REIT”) ETFs affect the overall portfolio risk and tried to assess the extent of the diversification benefit they offer. This time I would like to extend the analysis to international REIT ETFs and scrutinize them from the risk perspective. For the purpose of this article the focus will be on the four largest and most established global REIT ETFs: the SPDR Dow Jones International Real Estate ETF (NYSEARCA: RWX ), the Vanguard Global ex-U.S. Real Estate ETF (NASDAQ: VNQI ), the SPDR DJ Wilshire Global Real Estate ETF (NYSEARCA: RWO ), and the iShares International Developed Real Estate ETF (NASDAQ: IFGL ). All of these funds manage at least $950m of assets and have been around for a while, giving us enough historical data for meaningful analysis (the most junior one is VNQI launched in November 2010). To begin with, I inspect the correlation matrix of these ETFs including the SPDR S&P 500 Trust ETF (NYSEARCA: SPY ) as a proxy for the broader equity market. The calculations were carried out on InvestSpy using almost 5 years of historical data (truncated to VNQI’s inception date): The table above shows that global REIT ETFs are fairly highly correlated between each other with coefficients ranging from 0.88 to 0.96. Not surprisingly, the least correlated with others is RWO, which is the only one offering exposure to the U.S. market with a substantial 58% country weighting. Perhaps more unexpected observation is that international REIT ETFs have higher correlations with SPY than their U.S. counterparts. As outlined in my previous article , global REIT ETFs had correlation coefficients with SPY below 0.80 over the same period. To verify if the findings above hold true in a more recent period, I checked correlation coefficients for the last 12 months: RWX, VNQI and IFGL remained highly correlated between each other (coefficients of 0.94-0.97), however RWO drifted away significantly, highlighting diverging performances of international and U.S. REITs. Furthermore, correlations with S&P 500 weakened across the board in the last year although the effect was yet again not as pronounced as in local U.S. REITs. The fact that international REITs are more correlated with S&P 500 than REITs investing in the U.S. only looks a bit like a mystery as intuitively one would expected exactly the opposite to be true. I can only speculate about potential drivers of this effect. The first thought that springs to my mind is that currency movement could be accountable for this. Indeed, simplistic factor analysis reveals that a basket of currency ETFs could have explained about 40% of movement in RWX. However, this is a fairly average number for an internationally diversified fund and thus does not imply anything unusual. Alternative explanations could be more of fundamental nature: e.g. U.S. investors understand the local real estate market better and see it more like a standalone asset class, whilst international real estate is put in the same bucket with stocks. Correlations aside, the table below depicts further risk metrics of the global REIT ETFs utilizing last 12 months data: (click to enlarge) Annualized volatility, beta and maximum drawdown readings are comparable for RWX, VNQI and IFGL. Meanwhile, RWO realized considerably lower beta and annualized volatility, once again presenting itself as a middle option between international and U.S. REIT ETFs. Summing up, international REIT ETFs appear to be more correlated to S&P 500 than their counterparts investing solely in the U.S. Somewhat surprisingly, this means that global REIT ETFs offer lower diversification benefit to a U.S. investor. Furthermore, three of the largest international REIT ETFs (RWX, VNQI and IFGL) share almost identical risk profile, thus an investor needs to look more closely at other ETF features such as expense ratio and bid-ask spread. RWO sits somewhere in the middle between international and local REITs and may be a good choice for someone who wants a bit of worlds. Last but not least, correlations do change over time and a smart investor will monitor them periodically to achieve the intended outcome. Disclosure: I am/we are long VNQI. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Correlations with S&P 500 have declined to around 0.70 in the last year. International REIT ETFs appear to be more correlated to S&P 500 than their counterparts investing solely in the U.S. Largest international REIT ETFs share almost identical risk profile. In a separate article last week I took a look at how U.S. real estate investment trust (“REIT”) ETFs affect the overall portfolio risk and tried to assess the extent of the diversification benefit they offer. This time I would like to extend the analysis to international REIT ETFs and scrutinize them from the risk perspective. For the purpose of this article the focus will be on the four largest and most established global REIT ETFs: the SPDR Dow Jones International Real Estate ETF (NYSEARCA: RWX ), the Vanguard Global ex-U.S. Real Estate ETF (NASDAQ: VNQI ), the SPDR DJ Wilshire Global Real Estate ETF (NYSEARCA: RWO ), and the iShares International Developed Real Estate ETF (NASDAQ: IFGL ). All of these funds manage at least $950m of assets and have been around for a while, giving us enough historical data for meaningful analysis (the most junior one is VNQI launched in November 2010). To begin with, I inspect the correlation matrix of these ETFs including the SPDR S&P 500 Trust ETF (NYSEARCA: SPY ) as a proxy for the broader equity market. The calculations were carried out on InvestSpy using almost 5 years of historical data (truncated to VNQI’s inception date): The table above shows that global REIT ETFs are fairly highly correlated between each other with coefficients ranging from 0.88 to 0.96. Not surprisingly, the least correlated with others is RWO, which is the only one offering exposure to the U.S. market with a substantial 58% country weighting. Perhaps more unexpected observation is that international REIT ETFs have higher correlations with SPY than their U.S. counterparts. As outlined in my previous article , global REIT ETFs had correlation coefficients with SPY below 0.80 over the same period. To verify if the findings above hold true in a more recent period, I checked correlation coefficients for the last 12 months: RWX, VNQI and IFGL remained highly correlated between each other (coefficients of 0.94-0.97), however RWO drifted away significantly, highlighting diverging performances of international and U.S. REITs. Furthermore, correlations with S&P 500 weakened across the board in the last year although the effect was yet again not as pronounced as in local U.S. REITs. The fact that international REITs are more correlated with S&P 500 than REITs investing in the U.S. only looks a bit like a mystery as intuitively one would expected exactly the opposite to be true. I can only speculate about potential drivers of this effect. The first thought that springs to my mind is that currency movement could be accountable for this. Indeed, simplistic factor analysis reveals that a basket of currency ETFs could have explained about 40% of movement in RWX. However, this is a fairly average number for an internationally diversified fund and thus does not imply anything unusual. Alternative explanations could be more of fundamental nature: e.g. U.S. investors understand the local real estate market better and see it more like a standalone asset class, whilst international real estate is put in the same bucket with stocks. Correlations aside, the table below depicts further risk metrics of the global REIT ETFs utilizing last 12 months data: (click to enlarge) Annualized volatility, beta and maximum drawdown readings are comparable for RWX, VNQI and IFGL. Meanwhile, RWO realized considerably lower beta and annualized volatility, once again presenting itself as a middle option between international and U.S. REIT ETFs. Summing up, international REIT ETFs appear to be more correlated to S&P 500 than their counterparts investing solely in the U.S. Somewhat surprisingly, this means that global REIT ETFs offer lower diversification benefit to a U.S. investor. Furthermore, three of the largest international REIT ETFs (RWX, VNQI and IFGL) share almost identical risk profile, thus an investor needs to look more closely at other ETF features such as expense ratio and bid-ask spread. RWO sits somewhere in the middle between international and local REITs and may be a good choice for someone who wants a bit of worlds. Last but not least, correlations do change over time and a smart investor will monitor them periodically to achieve the intended outcome. Disclosure: I am/we are long VNQI. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News