Scalper1 News

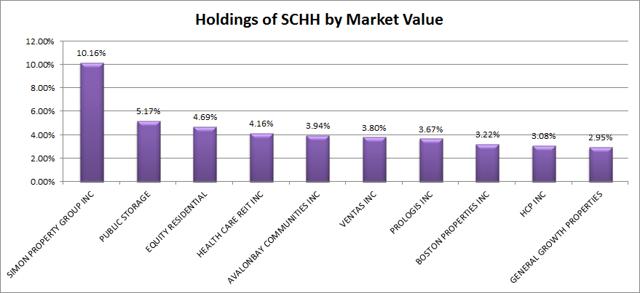

Summary SCHH is trading lower at the same time as treasury yields are falling. When SCHH falls under $38.00 per share, I become interested in buying more. As of my writing I have a buy limit order in place for my personal accounts. I would like to see less SPG in the portfolio to improve diversification, however the rest of the portfolio is beautifully diversified. The Schwab U.S. REIT ETF (NYSEARCA: SCHH ), also known as “Schwab Strategic Trust” on Google, fell today (August 6th, 2015) in early trading and was down by .78% within the first couple hours. The drop in SCHH is interesting because it came while treasury yields were falling. When treasury yields are weak, income investors are more inclined to take on the risks of investing in an equity REIT index to achieve higher yields. As an investor, I love equity REIT indexes and I am long SCHH and the Vanguard REIT Index ETF (NYSEARCA: VNQ ) in my retirement accounts. Why Both? The first equity REIT index that really attracted me was VNQ and I began buying into it. Since then I began the process of moving my brokerage over to Charles Schwab and have free trading on SCHH which makes it more desirable for new allocations. Buying Strategy If I were to simplify my views on SCHH as far as possible it would be like this: Under $38.00 SCHH is a solid deal. The lower it goes, the better the deal. Seeing SCHH fall under $38.00 I decided to place some limit buy orders on SCHH. Since the ETF is so thoroughly diversified (within equity REITs), I’m confident about the underlying fundamentals of the fund. Even though I’m already heavily invested in SCHH and VNQ, I view price drops as favorable because I’m holding some cash and looking to buy more every time the price falls. I got lucky enough to buy in late June when prices were hitting at least a temporary bottom. I would love to say it was pure skill in timing the recovery, but that is absurd. I got home from a vacation, saw cheap shares, and put in a limit buy order. Holdings The holdings are shown in the chart below: (click to enlarge) There is only one meaningful concern I have about buying into SCHH. I feel that their allocation to Simon Property Group (NYSE: SPG ) is simply too large. It hurts the diversification of the portfolio to have 10% invested into a single equity REIT. Regardless of how the portfolio managers feel about this allocation, I don’t like it. I would rather see this allocation dropped to around 5%. Retail REITs The largest sector holding for SCHH is the retail REIT sector. My preferred part of the equity REIT market is the residential REITs, but when it comes down to building a portfolio the diversification into the different parts of the REIT market offer superior risk adjusted returns over the long haul. Simon Property Group I have no current business relationships with Simon Property Group. However, quite a while ago I ended a business relationship with one of their properties. I ended that relationship for two reasons. One is that I was moving farther away from the location and the other is that their system was not friendly to those leasing property. When I was dealing with one of their leasing managers they were too focused on establishing rental rates and sales expectations on a “per square foot” metric. That was a problem because they were offering breaks on expectations for leasing larger amounts of space which turned into breaks for customers were willing to play the game by adjusting square foot usage through building taller displays. The spaces I was leasing were adjacent to customer traffic pathways and were otherwise nearly useless due to how small they were. Of course, my experience is only that of one customer dealing with the leasing manager for one mall. However, getting a feel for the way the leasing business was structured left me feeling concerned that the strategy was less than optimal. Dividend Yield The dividend yield on SCHH is only 2.27% which is incredibly low for an equity REIT index. With reasonably similar holdings VNQ is offering a 3.89% dividend yield. Because the holdings are very similar, I consider SCHH and VNQ to be very comparable when placed inside a tax advantaged retirement account with no plans to withdraw in the next couple decades. On the other hand, if an investor was living off the dividends they would have a solid reason for preferring VNQ over SCHH. If Prices Fall Further The more prices fall, the more limit buy orders I plan to place. My retirement accounts right now contain a meaningful allocation of cash. The return on cash and equivalents is terrible, but I’m holding the cash so I can look for some bargain prices on my favorite investments. If prices fell as low as $36 or $35 my cash position would be mostly gone as I would keep going back to get more shares. Max Allocation Many investors appear to think (judging from comments on my articles) that allocating more than 20% of a portfolio to domestic equity REITs is too heavy. I’m willing to see my allocations go as high as around 40% on domestic equity REIT indexes. The volatility on a diversified REIT index like SCHH is fairly reasonable when compared to other major investments like total stock market indexes or the S&P 500. Due to moderate levels of correlation, the total risk level on the equity portion of the portfolio can often improve as allocations move up towards 40% to 50%. Note that this is referring only to allocation within the equity portion of the portfolio. Clearly replacing cash or high quality short duration bond funds with SCHH or VNQ will result in more portfolio risk. Conclusion I love SCHH as an investment vehicle. I’m long both SCHH and VNQ and I have a buy limit order on SCHH at $37.85. Disclosure: I am/we are long SCHH. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Information in this article represents the opinion of the analyst. All statements are represented as opinions, rather than facts, and should not be construed as advice to buy or sell a security. Ratings of “outperform” and “underperform” reflect the analyst’s estimation of a divergence between the market value for a security and the price that would be appropriate given the potential for risks and returns relative to other securities. The analyst does not know your particular objectives for returns or constraints upon investing. All investors are encouraged to do their own research before making any investment decision. Information is regularly obtained from Yahoo Finance, Google Finance, and SEC Database. If Yahoo, Google, or the SEC database contained faulty or old information it could be incorporated into my analysis. Scalper1 News

Summary SCHH is trading lower at the same time as treasury yields are falling. When SCHH falls under $38.00 per share, I become interested in buying more. As of my writing I have a buy limit order in place for my personal accounts. I would like to see less SPG in the portfolio to improve diversification, however the rest of the portfolio is beautifully diversified. The Schwab U.S. REIT ETF (NYSEARCA: SCHH ), also known as “Schwab Strategic Trust” on Google, fell today (August 6th, 2015) in early trading and was down by .78% within the first couple hours. The drop in SCHH is interesting because it came while treasury yields were falling. When treasury yields are weak, income investors are more inclined to take on the risks of investing in an equity REIT index to achieve higher yields. As an investor, I love equity REIT indexes and I am long SCHH and the Vanguard REIT Index ETF (NYSEARCA: VNQ ) in my retirement accounts. Why Both? The first equity REIT index that really attracted me was VNQ and I began buying into it. Since then I began the process of moving my brokerage over to Charles Schwab and have free trading on SCHH which makes it more desirable for new allocations. Buying Strategy If I were to simplify my views on SCHH as far as possible it would be like this: Under $38.00 SCHH is a solid deal. The lower it goes, the better the deal. Seeing SCHH fall under $38.00 I decided to place some limit buy orders on SCHH. Since the ETF is so thoroughly diversified (within equity REITs), I’m confident about the underlying fundamentals of the fund. Even though I’m already heavily invested in SCHH and VNQ, I view price drops as favorable because I’m holding some cash and looking to buy more every time the price falls. I got lucky enough to buy in late June when prices were hitting at least a temporary bottom. I would love to say it was pure skill in timing the recovery, but that is absurd. I got home from a vacation, saw cheap shares, and put in a limit buy order. Holdings The holdings are shown in the chart below: (click to enlarge) There is only one meaningful concern I have about buying into SCHH. I feel that their allocation to Simon Property Group (NYSE: SPG ) is simply too large. It hurts the diversification of the portfolio to have 10% invested into a single equity REIT. Regardless of how the portfolio managers feel about this allocation, I don’t like it. I would rather see this allocation dropped to around 5%. Retail REITs The largest sector holding for SCHH is the retail REIT sector. My preferred part of the equity REIT market is the residential REITs, but when it comes down to building a portfolio the diversification into the different parts of the REIT market offer superior risk adjusted returns over the long haul. Simon Property Group I have no current business relationships with Simon Property Group. However, quite a while ago I ended a business relationship with one of their properties. I ended that relationship for two reasons. One is that I was moving farther away from the location and the other is that their system was not friendly to those leasing property. When I was dealing with one of their leasing managers they were too focused on establishing rental rates and sales expectations on a “per square foot” metric. That was a problem because they were offering breaks on expectations for leasing larger amounts of space which turned into breaks for customers were willing to play the game by adjusting square foot usage through building taller displays. The spaces I was leasing were adjacent to customer traffic pathways and were otherwise nearly useless due to how small they were. Of course, my experience is only that of one customer dealing with the leasing manager for one mall. However, getting a feel for the way the leasing business was structured left me feeling concerned that the strategy was less than optimal. Dividend Yield The dividend yield on SCHH is only 2.27% which is incredibly low for an equity REIT index. With reasonably similar holdings VNQ is offering a 3.89% dividend yield. Because the holdings are very similar, I consider SCHH and VNQ to be very comparable when placed inside a tax advantaged retirement account with no plans to withdraw in the next couple decades. On the other hand, if an investor was living off the dividends they would have a solid reason for preferring VNQ over SCHH. If Prices Fall Further The more prices fall, the more limit buy orders I plan to place. My retirement accounts right now contain a meaningful allocation of cash. The return on cash and equivalents is terrible, but I’m holding the cash so I can look for some bargain prices on my favorite investments. If prices fell as low as $36 or $35 my cash position would be mostly gone as I would keep going back to get more shares. Max Allocation Many investors appear to think (judging from comments on my articles) that allocating more than 20% of a portfolio to domestic equity REITs is too heavy. I’m willing to see my allocations go as high as around 40% on domestic equity REIT indexes. The volatility on a diversified REIT index like SCHH is fairly reasonable when compared to other major investments like total stock market indexes or the S&P 500. Due to moderate levels of correlation, the total risk level on the equity portion of the portfolio can often improve as allocations move up towards 40% to 50%. Note that this is referring only to allocation within the equity portion of the portfolio. Clearly replacing cash or high quality short duration bond funds with SCHH or VNQ will result in more portfolio risk. Conclusion I love SCHH as an investment vehicle. I’m long both SCHH and VNQ and I have a buy limit order on SCHH at $37.85. Disclosure: I am/we are long SCHH. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Information in this article represents the opinion of the analyst. All statements are represented as opinions, rather than facts, and should not be construed as advice to buy or sell a security. Ratings of “outperform” and “underperform” reflect the analyst’s estimation of a divergence between the market value for a security and the price that would be appropriate given the potential for risks and returns relative to other securities. The analyst does not know your particular objectives for returns or constraints upon investing. All investors are encouraged to do their own research before making any investment decision. Information is regularly obtained from Yahoo Finance, Google Finance, and SEC Database. If Yahoo, Google, or the SEC database contained faulty or old information it could be incorporated into my analysis. Scalper1 News

Scalper1 News