Scalper1 News

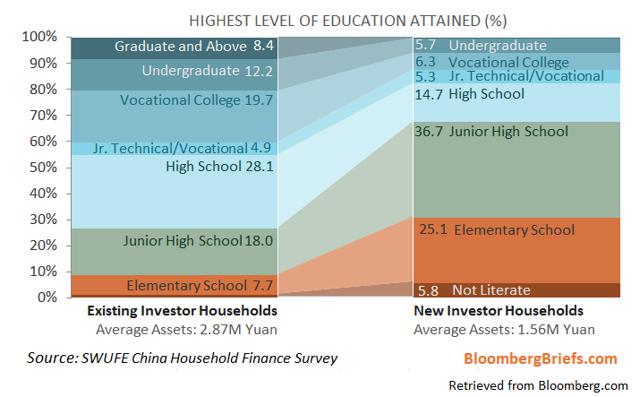

Summary The Chinese market looks very dangerous and that risk could severely damage SCHE for allocating 28% of equity to Chinese securities. The level of education attained by a new wave of domestic investors in China should be shocking. The only thing more bearish than investors buying securities they don’t understand is those same investors on margin. Driving the potential for a correction to come sooner rather than later is the potential for new regulations restricting margin trading. If the bubble pops, retail investors in China may face dramatic losses that would prevent them from buying goods and services. My international exposure comes from two ETFs. I’m holding the Vanguard Global Ex-U.S. Real Estate Index ETF (NASDAQ: VNQI ) and the Schwab International Equity ETF (NYSEARCA: SCHF ). In my opinion, SCHF is dramatically better positioned than the Schwab Emerging Markets Equity ETF (NYSEARCA: SCHE ). My perspective favoring SCHF is tied to the enormous position that SCHE is holding in Chinese equities. It is my belief that SCHE may have some substantial volatility and may face significantly worse performance over the next few years due to the large position in Chinese equities. The table below shows the strong allocation to China in SCHE. Why I’m bearish on China The Chinese market has been on fire hitting one high after another. I wasn’t bearish on the Chinese equity market before the valuations soared, but I’m not a fan of higher prices or the lack of fundamentals driving the growth in valuations. That sure sounds like a bubble I’d like to share an excerpt from the International Business Times . These are the kind of warnings that can easily be swept under the rug when investors are chasing the potential for huge returns. One resident, Liu Lianguo, told the channel that playing mahjong, the residents’ former spare time occupation, might lead people astray, into a life of gambling — whereas the government was ‘encouraging us to invest in the stock market.’ Some villagers were reported to have earned tens of thousands of U.S. dollars in just a few weeks. And with stories of students investing in shares, and a wave of novels about playing the markets now attracting readers, it’s no wonder that one Dragon TV news presenter said this week that, “if you’re not frying shares at the moment you feel embarrassed to talk to people, you don’t know what to talk about.” Remember that the domestic Chinese equity market is dominated by A-shares which have been restricted from foreign investment and which were previously very difficult for investors to short. The combination of a closed market, difficulty initiating shorts, and investors with more leverage than education is a recipe for disaster. It may sound like I’m being cruel when I suggest that investments are being fueled by those with low education, but I’m referencing data coming out of China. A survey of “New Investor Households” indicated that there was a substantial growth in investments made by people with less education. (click to enlarge) I’m going to be bearish whenever I see an enormous volume of investors without substantial training. How many people do you know with a Bachelor’s degree that you wouldn’t trust to change your oil? In my opinion, one of the biggest signs for a bubble is when people are investing without knowing what they are doing. Buying on margin If there is one thing that concerns me more than naive investors, it is naïve investors on margin. In 2010 the government opened up to trading on margin. The Wall Street Journal reports that Chinese regulators are amending rules on margin-trading. If margin trading is severely restricted, it could trigger the kind of selling events that would force other traders into margin calls and trigger more selling events. Euphoria combined with margins is a recipe for disaster, and I don’t have room for more disaster in my portfolio. I already have Freeport-McMoRan (NYSE: FCX ), so I’m pretty much full on disasters. Conclusion The investments in China are becoming more dangerous as the potential for a major correction heats up. Even if share price levels can be justified by fundamental analysis, a restriction on margins could create the collapse that would prevent Chinese investors from being Chinese consumers. If the domestic investors lose their shirts in the correction, the drop should be dramatic because the sales prospects and earnings potential of the companies should fall because their customers will be financially ruined by the loss on margins. My strategy is to stick to international investments that are underweight on China. My shares of VNQI have some exposure to China, with 8.28% of holdings in China. That’s about as much exposure to China as I want to stomach at this point. When I’m adding to my international holdings I’ll be using SCHF instead of VNQI to prevent China from gaining further exposure in my portfolio. I’m completely avoiding shares of SCHE because of the enormous exposure to China. In a nutshell: Sell SCHE to buy SCHF Disclosure: The author is long SCHF, VNQI. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Information in this article represents the opinion of the analyst. All statements are represented as opinions, rather than facts, and should not be construed as advice to buy or sell a security. Ratings of “outperform” and “underperform” reflect the analyst’s estimation of a divergence between the market value for a security and the price that would be appropriate given the potential for risks and returns relative to other securities. The analyst does not know your particular objectives for returns or constraints upon investing. All investors are encouraged to do their own research before making any investment decision. Information is regularly obtained from Yahoo Finance, Google Finance, and SEC Database. If Yahoo, Google, or the SEC database contained faulty or old information it could be incorporated into my analysis. Scalper1 News

Summary The Chinese market looks very dangerous and that risk could severely damage SCHE for allocating 28% of equity to Chinese securities. The level of education attained by a new wave of domestic investors in China should be shocking. The only thing more bearish than investors buying securities they don’t understand is those same investors on margin. Driving the potential for a correction to come sooner rather than later is the potential for new regulations restricting margin trading. If the bubble pops, retail investors in China may face dramatic losses that would prevent them from buying goods and services. My international exposure comes from two ETFs. I’m holding the Vanguard Global Ex-U.S. Real Estate Index ETF (NASDAQ: VNQI ) and the Schwab International Equity ETF (NYSEARCA: SCHF ). In my opinion, SCHF is dramatically better positioned than the Schwab Emerging Markets Equity ETF (NYSEARCA: SCHE ). My perspective favoring SCHF is tied to the enormous position that SCHE is holding in Chinese equities. It is my belief that SCHE may have some substantial volatility and may face significantly worse performance over the next few years due to the large position in Chinese equities. The table below shows the strong allocation to China in SCHE. Why I’m bearish on China The Chinese market has been on fire hitting one high after another. I wasn’t bearish on the Chinese equity market before the valuations soared, but I’m not a fan of higher prices or the lack of fundamentals driving the growth in valuations. That sure sounds like a bubble I’d like to share an excerpt from the International Business Times . These are the kind of warnings that can easily be swept under the rug when investors are chasing the potential for huge returns. One resident, Liu Lianguo, told the channel that playing mahjong, the residents’ former spare time occupation, might lead people astray, into a life of gambling — whereas the government was ‘encouraging us to invest in the stock market.’ Some villagers were reported to have earned tens of thousands of U.S. dollars in just a few weeks. And with stories of students investing in shares, and a wave of novels about playing the markets now attracting readers, it’s no wonder that one Dragon TV news presenter said this week that, “if you’re not frying shares at the moment you feel embarrassed to talk to people, you don’t know what to talk about.” Remember that the domestic Chinese equity market is dominated by A-shares which have been restricted from foreign investment and which were previously very difficult for investors to short. The combination of a closed market, difficulty initiating shorts, and investors with more leverage than education is a recipe for disaster. It may sound like I’m being cruel when I suggest that investments are being fueled by those with low education, but I’m referencing data coming out of China. A survey of “New Investor Households” indicated that there was a substantial growth in investments made by people with less education. (click to enlarge) I’m going to be bearish whenever I see an enormous volume of investors without substantial training. How many people do you know with a Bachelor’s degree that you wouldn’t trust to change your oil? In my opinion, one of the biggest signs for a bubble is when people are investing without knowing what they are doing. Buying on margin If there is one thing that concerns me more than naive investors, it is naïve investors on margin. In 2010 the government opened up to trading on margin. The Wall Street Journal reports that Chinese regulators are amending rules on margin-trading. If margin trading is severely restricted, it could trigger the kind of selling events that would force other traders into margin calls and trigger more selling events. Euphoria combined with margins is a recipe for disaster, and I don’t have room for more disaster in my portfolio. I already have Freeport-McMoRan (NYSE: FCX ), so I’m pretty much full on disasters. Conclusion The investments in China are becoming more dangerous as the potential for a major correction heats up. Even if share price levels can be justified by fundamental analysis, a restriction on margins could create the collapse that would prevent Chinese investors from being Chinese consumers. If the domestic investors lose their shirts in the correction, the drop should be dramatic because the sales prospects and earnings potential of the companies should fall because their customers will be financially ruined by the loss on margins. My strategy is to stick to international investments that are underweight on China. My shares of VNQI have some exposure to China, with 8.28% of holdings in China. That’s about as much exposure to China as I want to stomach at this point. When I’m adding to my international holdings I’ll be using SCHF instead of VNQI to prevent China from gaining further exposure in my portfolio. I’m completely avoiding shares of SCHE because of the enormous exposure to China. In a nutshell: Sell SCHE to buy SCHF Disclosure: The author is long SCHF, VNQI. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Information in this article represents the opinion of the analyst. All statements are represented as opinions, rather than facts, and should not be construed as advice to buy or sell a security. Ratings of “outperform” and “underperform” reflect the analyst’s estimation of a divergence between the market value for a security and the price that would be appropriate given the potential for risks and returns relative to other securities. The analyst does not know your particular objectives for returns or constraints upon investing. All investors are encouraged to do their own research before making any investment decision. Information is regularly obtained from Yahoo Finance, Google Finance, and SEC Database. If Yahoo, Google, or the SEC database contained faulty or old information it could be incorporated into my analysis. Scalper1 News

Scalper1 News