Scalper1 News

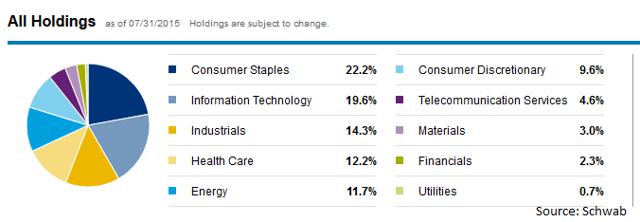

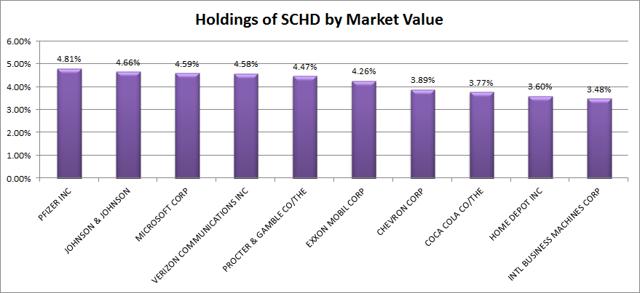

Summary SCHD is a great ETF with almost no utilities. Dividend growth investors are prone to liking utilities for reliable dividend growth. The holdings of SCHD offer great diversification across the other sectors at a very reasonable cost. The Schwab U.S. Dividend Equity ETF (NYSEARCA: SCHD ) offers investors a very interesting combination. As an ETF, it posts a fairly reasonable dividend yield of 2.88%; however, many dividend growth investors may turn their nose up at the weaker yield as their own portfolios are likely to produce a higher dividend yield. It is understandable that investors buying into a dividend ETF would have a strong focus on generating enough dividend yield to support their retirement. A Supplemental Holding While it is understandable that a 2.88% yield may be insufficient for investors that want to see their living expenses covered by dividends, it is still common for investors to need significant diversification in their holdings. When an investor builds a portfolio on the basis of high dividend yields, they may introduce a large amount of idiosyncratic risk because they will heavily overweight certain sectors. One common area for the dividend growth investors to focus on is the use of utility stocks. Using utility stocks as a major source of dividends is a fine strategy. Utilities can often benefit from having a regulated monopoly that protects their margins in tough times. If we look at risk factors from the perspective of the human in their entirety, we can say that higher utility prices are a natural risk for people. Owning the supplier of those utilities is a nice way to hedge against the risk of paying higher prices. When using SCHD to supplement a portfolio, the holdings of SCHD are a nice complement to what the investor might naturally pick. While the investor may focus on covering utility stocks, SCHD almost entirely excludes them. That means for the investor that is already holding utility stocks individually or holding a utility ETF, they will have significantly less duplication of holdings because SCHD is delivering the other dividend companies. The sector exposure is shown below: (click to enlarge) On The Other Hand While I love the way the portfolio is constructed and think it is a great complement to a portfolio that is heavy on utilities, investors should still be aware that if they are also picking stocks outside of the utility sector there could easily be some overlap. The top 10 individual holdings are demonstrated below: (click to enlarge) When you look at the top 10 companies, you’ll see many that may already be in your portfolio. That makes it a question of how much research you want to do into the individual large dividend payers. By focusing on the utilities an investor can effectively grab diversification through SCHD with an expense ratio of only .07%. For the cost, this is fairly solid diversification as long as the investor is not already holding several of the companies in their portfolio. A Third Option For investors that really want to make their portfolio entirely from scratch, SCHD has one last use. The holdings list creates a decent starting list for companies to research. One of the things that I like about the list is that they prominently feature gas companies in Exxon Mobil (NYSE: XOM ) and Chevron Corp. (NYSE: CVX ). While gas prices have become very low, they still remain a substantial risk factor for retirees. When gas prices are increasing, it means the investor will have to pay more to fill up their own car and the other companies that are transporting physical goods will be dealing with higher costs of transporting their inventory. Those factors make the oil companies natural holdings for an investor that wants to diversify against their own risk factors. Conclusion The Schwab U.S. Dividend Equity ETF is a great ETF for buying dividend yield. If an investor really wants to focus on dividend yield, they should be looking to use SCHD as a supplemental holding to diversify risk with a portfolio that holds more equity REITs and utilities. While I cover the mREITs frequently, I wouldn’t suggest investors buy into the sector until they know precisely what they are doing. Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in SCHD over the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Information in this article represents the opinion of the analyst. All statements are represented as opinions, rather than facts, and should not be construed as advice to buy or sell a security. Ratings of “outperform” and “underperform” reflect the analyst’s estimation of a divergence between the market value for a security and the price that would be appropriate given the potential for risks and returns relative to other securities. The analyst does not know your particular objectives for returns or constraints upon investing. All investors are encouraged to do their own research before making any investment decision. Information is regularly obtained from Yahoo Finance, Google Finance, and SEC Database. If Yahoo, Google, or the SEC database contained faulty or old information it could be incorporated into my analysis. Scalper1 News

Summary SCHD is a great ETF with almost no utilities. Dividend growth investors are prone to liking utilities for reliable dividend growth. The holdings of SCHD offer great diversification across the other sectors at a very reasonable cost. The Schwab U.S. Dividend Equity ETF (NYSEARCA: SCHD ) offers investors a very interesting combination. As an ETF, it posts a fairly reasonable dividend yield of 2.88%; however, many dividend growth investors may turn their nose up at the weaker yield as their own portfolios are likely to produce a higher dividend yield. It is understandable that investors buying into a dividend ETF would have a strong focus on generating enough dividend yield to support their retirement. A Supplemental Holding While it is understandable that a 2.88% yield may be insufficient for investors that want to see their living expenses covered by dividends, it is still common for investors to need significant diversification in their holdings. When an investor builds a portfolio on the basis of high dividend yields, they may introduce a large amount of idiosyncratic risk because they will heavily overweight certain sectors. One common area for the dividend growth investors to focus on is the use of utility stocks. Using utility stocks as a major source of dividends is a fine strategy. Utilities can often benefit from having a regulated monopoly that protects their margins in tough times. If we look at risk factors from the perspective of the human in their entirety, we can say that higher utility prices are a natural risk for people. Owning the supplier of those utilities is a nice way to hedge against the risk of paying higher prices. When using SCHD to supplement a portfolio, the holdings of SCHD are a nice complement to what the investor might naturally pick. While the investor may focus on covering utility stocks, SCHD almost entirely excludes them. That means for the investor that is already holding utility stocks individually or holding a utility ETF, they will have significantly less duplication of holdings because SCHD is delivering the other dividend companies. The sector exposure is shown below: (click to enlarge) On The Other Hand While I love the way the portfolio is constructed and think it is a great complement to a portfolio that is heavy on utilities, investors should still be aware that if they are also picking stocks outside of the utility sector there could easily be some overlap. The top 10 individual holdings are demonstrated below: (click to enlarge) When you look at the top 10 companies, you’ll see many that may already be in your portfolio. That makes it a question of how much research you want to do into the individual large dividend payers. By focusing on the utilities an investor can effectively grab diversification through SCHD with an expense ratio of only .07%. For the cost, this is fairly solid diversification as long as the investor is not already holding several of the companies in their portfolio. A Third Option For investors that really want to make their portfolio entirely from scratch, SCHD has one last use. The holdings list creates a decent starting list for companies to research. One of the things that I like about the list is that they prominently feature gas companies in Exxon Mobil (NYSE: XOM ) and Chevron Corp. (NYSE: CVX ). While gas prices have become very low, they still remain a substantial risk factor for retirees. When gas prices are increasing, it means the investor will have to pay more to fill up their own car and the other companies that are transporting physical goods will be dealing with higher costs of transporting their inventory. Those factors make the oil companies natural holdings for an investor that wants to diversify against their own risk factors. Conclusion The Schwab U.S. Dividend Equity ETF is a great ETF for buying dividend yield. If an investor really wants to focus on dividend yield, they should be looking to use SCHD as a supplemental holding to diversify risk with a portfolio that holds more equity REITs and utilities. While I cover the mREITs frequently, I wouldn’t suggest investors buy into the sector until they know precisely what they are doing. Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in SCHD over the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Information in this article represents the opinion of the analyst. All statements are represented as opinions, rather than facts, and should not be construed as advice to buy or sell a security. Ratings of “outperform” and “underperform” reflect the analyst’s estimation of a divergence between the market value for a security and the price that would be appropriate given the potential for risks and returns relative to other securities. The analyst does not know your particular objectives for returns or constraints upon investing. All investors are encouraged to do their own research before making any investment decision. Information is regularly obtained from Yahoo Finance, Google Finance, and SEC Database. If Yahoo, Google, or the SEC database contained faulty or old information it could be incorporated into my analysis. Scalper1 News

Scalper1 News