Scalper1 News

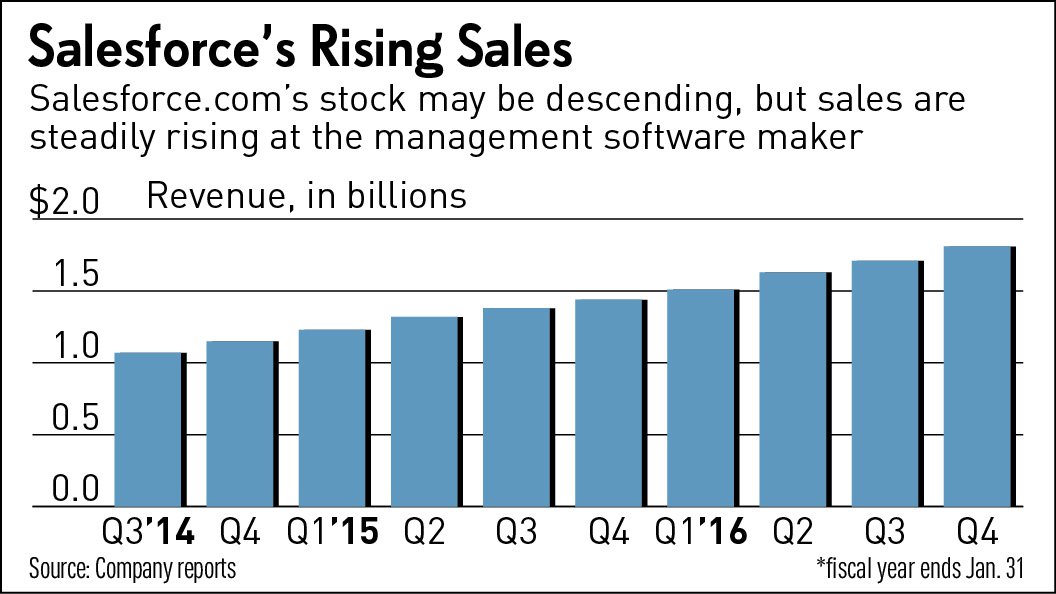

Salesforce.com ( CRM ) matched analyst forecasts on earnings and beat them on revenue with a record fourth quarter, but shares soared in late trade after the enterprise cloud pioneer raised its forecast for sales growth. Announcing earnings after the market close Wednesday, Salesforce said adjusted fourth-quarter earnings rose 36% to 19 cents per share on revenue that rose 25% to $1.81 billion. Earnings were right on the money, according to estimates from analysts polled by Thomson Reuters, but sales were better than the $1.79 billion revenue they had anticipated. The No. 1 developer of customer relationship management software, Salesforce raised full fiscal 2017 revenue guidance to a range of $8.08 billion to $8.12 billion, up from $8.0 billion to $8.1 guided after its third-quarter release. For its first fiscal quarter of 2017, which ends in April, Salesforce said it expects earnings per share of 23-24 cents, up 47% at the midpoint and ahead of analysts’ 21-cent consensus view. That’s on revenue up 25% to $1.89 billion, where analysts expected $1.86 billion, up 23%. Its results seemed to strengthen hope that Salesforce might trigger an upturn in software stocks, reversing Tableau Software ‘s ( DATA ) profitable but softer fourth quarter and weak guidance that triggered a 49.5% collapse in Tableau stock Feb. 5. Tableau’s misfortune also precipitated a 15% plunge in the entire IBD Computer Software-Database industry group, where legacy software developer Oracle ( ORCL ) also resides. Salesforce stock also fell 13% at the time, and the IBD Computer Software-Enterprise industry group where it lives fell 8%. Neither group has recovered, the most notable exception being steady Oracle, up slightly Wednesday to 36.63, 19% off a six-month high set June 17. Days after the Tableau debacle, Salesforce set a 16-month low at 52.60 on Feb. 8, before rising 19.5% through Tuesday’s close at 63.98. Salesforce ended the regular session down 0.6% to 62.50 in the stock market today . That was 24% off the stock’s all-time high of 82.90, hit Nov. 19, when Salesforce reported fiscal-third-quarter earnings up 50%. After Wednesday’s earnings release, Salesforce jumped more than 8% to 67.95 in after-hours trading. “By any measure, this was a spectacular finish to the year with 27% revenue growth in constant currency for the fourth quarter and for the full year,” Chief Executive Marc Benioff said in the earnings release. “We are raising our fiscal year 2017 revenue guidance to $8.12 billion at the high end of our range — unprecedented growth for a company of our size and scale.” Chief Financial Officer Mark Hawkins said its adjusted operating margin rose by 177 basis points, driving full-year operating cash flow up 37% to $1.6 billion during the fourth quarter. Said President and Chief Operating Officer Keith Block: “We hit an all-time high in large transactions in fiscal 2016,” adding that Salesforce’s cloud platform is growing sales “across every region, every cloud and every industry.” For full fiscal 2016, revenue rose 24% to $6.67 billion where analysts expected $6.65 billion. Salesforce said subscription and support revenue grew 24% to $6.21 billion and professional services and other revenue rose 28% to $462 million. The full-year adjusted earnings matched Wall Street at 75 cents. Salesforce managed to take a fourth-quarter unadjusted loss of 4 cents, better than the 6-cent loss expected by Wall Street. Beyond predicting Salesforce’s first $8 billion year in fiscal 2017, Benioff repeatedly assures that the company is “well on the path to reach $10 billion faster than any other enterprise software company.” RBC Capital Markets analyst Ross MacMillan said in a recent note to clients that the firm’s Salesforce1 platform for mobile-application development is driving fresh growth, although “there are many avenues to sustain growth, including service and marketing, the platform, and international and future initiatives.” MacMillan went on to say: “We think Salesforce can continue to drive premium growth for its size, and it remains an important strategic asset.” RBC maintains an outperform rating on Salesforce.com stock, with a price target of 80, as “one of the best positioned companies in large-cap software.” Image provided by Shutterstock . Scalper1 News

Salesforce.com ( CRM ) matched analyst forecasts on earnings and beat them on revenue with a record fourth quarter, but shares soared in late trade after the enterprise cloud pioneer raised its forecast for sales growth. Announcing earnings after the market close Wednesday, Salesforce said adjusted fourth-quarter earnings rose 36% to 19 cents per share on revenue that rose 25% to $1.81 billion. Earnings were right on the money, according to estimates from analysts polled by Thomson Reuters, but sales were better than the $1.79 billion revenue they had anticipated. The No. 1 developer of customer relationship management software, Salesforce raised full fiscal 2017 revenue guidance to a range of $8.08 billion to $8.12 billion, up from $8.0 billion to $8.1 guided after its third-quarter release. For its first fiscal quarter of 2017, which ends in April, Salesforce said it expects earnings per share of 23-24 cents, up 47% at the midpoint and ahead of analysts’ 21-cent consensus view. That’s on revenue up 25% to $1.89 billion, where analysts expected $1.86 billion, up 23%. Its results seemed to strengthen hope that Salesforce might trigger an upturn in software stocks, reversing Tableau Software ‘s ( DATA ) profitable but softer fourth quarter and weak guidance that triggered a 49.5% collapse in Tableau stock Feb. 5. Tableau’s misfortune also precipitated a 15% plunge in the entire IBD Computer Software-Database industry group, where legacy software developer Oracle ( ORCL ) also resides. Salesforce stock also fell 13% at the time, and the IBD Computer Software-Enterprise industry group where it lives fell 8%. Neither group has recovered, the most notable exception being steady Oracle, up slightly Wednesday to 36.63, 19% off a six-month high set June 17. Days after the Tableau debacle, Salesforce set a 16-month low at 52.60 on Feb. 8, before rising 19.5% through Tuesday’s close at 63.98. Salesforce ended the regular session down 0.6% to 62.50 in the stock market today . That was 24% off the stock’s all-time high of 82.90, hit Nov. 19, when Salesforce reported fiscal-third-quarter earnings up 50%. After Wednesday’s earnings release, Salesforce jumped more than 8% to 67.95 in after-hours trading. “By any measure, this was a spectacular finish to the year with 27% revenue growth in constant currency for the fourth quarter and for the full year,” Chief Executive Marc Benioff said in the earnings release. “We are raising our fiscal year 2017 revenue guidance to $8.12 billion at the high end of our range — unprecedented growth for a company of our size and scale.” Chief Financial Officer Mark Hawkins said its adjusted operating margin rose by 177 basis points, driving full-year operating cash flow up 37% to $1.6 billion during the fourth quarter. Said President and Chief Operating Officer Keith Block: “We hit an all-time high in large transactions in fiscal 2016,” adding that Salesforce’s cloud platform is growing sales “across every region, every cloud and every industry.” For full fiscal 2016, revenue rose 24% to $6.67 billion where analysts expected $6.65 billion. Salesforce said subscription and support revenue grew 24% to $6.21 billion and professional services and other revenue rose 28% to $462 million. The full-year adjusted earnings matched Wall Street at 75 cents. Salesforce managed to take a fourth-quarter unadjusted loss of 4 cents, better than the 6-cent loss expected by Wall Street. Beyond predicting Salesforce’s first $8 billion year in fiscal 2017, Benioff repeatedly assures that the company is “well on the path to reach $10 billion faster than any other enterprise software company.” RBC Capital Markets analyst Ross MacMillan said in a recent note to clients that the firm’s Salesforce1 platform for mobile-application development is driving fresh growth, although “there are many avenues to sustain growth, including service and marketing, the platform, and international and future initiatives.” MacMillan went on to say: “We think Salesforce can continue to drive premium growth for its size, and it remains an important strategic asset.” RBC maintains an outperform rating on Salesforce.com stock, with a price target of 80, as “one of the best positioned companies in large-cap software.” Image provided by Shutterstock . Scalper1 News

Scalper1 News