Scalper1 News

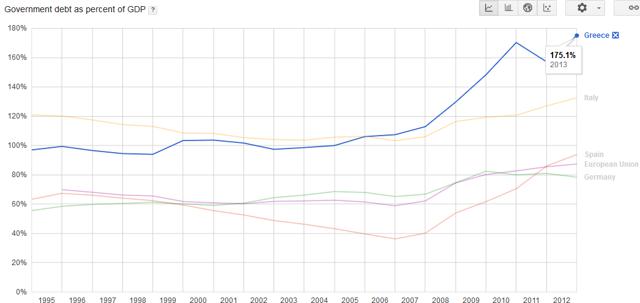

Background of the difficult economic conditions of the eurozone and the threat of Syriza’s victory in Greece. GLD has already priced in the threat of Syriza since November 2014 and has been rising steadily. Those who wants the safe habour of gold has already gone in. Risk of Syriza overtipping its hand for a quick fix to high debt with a primary budget surplus even though there are indications that Syriza will be moderate in power. Time to hold for those with GLD exposure and observe future developments and for those without exposure to initiate it. Difficult Times For The Eurozone Gold has been used been used as a medium of exchange since historic times and especially in times of turmoil. In modern times, with the creation of bank notes and the 1971 closing of the gold window, paper money is the medium of exchange and its power lies in the ‘full faith and credit of’ whichever government that is issuing the note. Now the full faith and credit of the United States Government is still valid in the market especially in a time where the U.S. economy is growing strongly (11 year high of 5% GDP growth in the third quarter of 2014), the U.S. Dollar (USD) is strong and most importantly the state of the union is strong. However the same attributes cannot be said for the eurozone. The eurozone economy is faltering at 0.2% growth for the same third quarter 2014 when the U.S. is growing strongly. The euro, as represented by the CurrencyShare Euro Trust ETF (NYSEARCA: FXE ), has declined by 23% since 05 May 2014 as seen in the chart below and this decline has accelerated since October 2014 which coincided with a dovish European Central Bank (ECB) decision. (click to enlarge) Lastly there is the issue regarding the state of the eurozone. The integrity of the eurozone had been tested in 2012 when Greece almost elected Syriza who came in second into government. This sparks the famous line by ECB President Draghi to ‘do whatever it takes’ to preserve the euro. The Rise and Threat of Syriza on Eurozone Now with the snap General Election on 25 January 2015, Syriza has defeated the previous government New Democracy to form the next government of Greece and its firebrand leader Alexis Tsipras would be youngest Greek Prime Minister at age 40 in 150 years. The whole reason that Syriza poses an existential threat to the whole eurozone project is quite simply because it does not want to pay its huge external debts. Its policy platform is anti-austerity, the repudiation of debt in essence and more social spending. This is what got it in power in the very first place which pleased the Greek population and at the same time send an earthquake to the rest of the eurozone. This whole political instability came about from the failed election of President of Greece. The President of Greece is a largely ceremonial role held currently by the incumbent Karolos Papoulias for 2 terms of 5 years each. His second term is set to end in March 2015. The President of Greece is elected by the Hellenic Parliament in Greece and has to be done latest 1 month before he is set to leave office as decreed by the Greek Constitution. The Prime Minister of Greece Samaras brought it forward to December 2014 but he was unable to secure a 2/3 majority of parliament vote for his candidate on the first 2 rounds of voting on the 17th and 23rd. The third round of voting on the 27th also failed to produce the reduced 3/5 majority of 180 votes which triggered the election for a new parliament on 25 January 2015. The new parliament will have to vote for the new president again by February 2015. Safe Harbor of GLD If you are a rich or middle class citizen (with enough money beyond the hand to mouth existence to be worried) in Europe and you are faced with the possibility that the euro note you hold can either be worthless or in the more optimistic case, be exchanged back at a steep discount to the national currency, what will your natural options be? You will avoid European equities and bonds because they are denominated in euros. You might want to change into a currency like the USD that will hold its value or you might want to buy physical gold which is harder to devalue or you might want to invest into a gold ETF denominated in the USD like GLD to avoid the storage and insurance costs. This is why we can see that the value of gold, as seen in the SDPR Gold Trust ETF (NYSEARCA: GLD ), has rose steadily since 03 November 2014 whenever there is a hint of potential political instability in Greece. (click to enlarge) As we can see, the market is forward looking and has began to price in the Greek instability before the formal vote in the Hellenic Parliament. Gold investors started to buy when the rumor of the a potential change in government given the weakness of the current Greek coalition government. This is why we are unlikely to see a sudden spike up in GLD now because the market has sufficient time to build their long position. Even for those who are less connected, they will have seen in coming last month when the rounds of Presidential election failed in Parliament. History of Debt Concession However now that Syriza has formed the new government,it remains to be seen how far its leader Tsprais will go to fulfill his campaign promises. It is clear that he will want to extract some sort of concession from the Troika. The prior Greek government managed to extend the loan repayment period from the original 7 years to 15 years in July 2011 and interest rates were cut to 3.5% for a mega loan of $109 billion euros loan package. This is the start of the second and ongoing Economic Adjustment Program for Greece after the first program which saw loans of $110 billion euros from May 2010 to June 2011. It is also in this period where we saw a soft default on a debt restructuring deal which concluded on 09 March 2012 on $205.5 billion euro of debt. This caused the ISDA to call a Credit Event which triggered $3.5 billion of credit default swaps and let Fitch to downgrade Greek debt from ‘CCC’ to ‘Restricted Default’. All in all, through this soft default option, Greek debt holders lost a massive $107 billion euros, a record for sovereign debt losses. Is this the calm before or after the Storm? As far as the market is concerned, the eurozone has survived this crisis of soft default with the help of the ECB when other organization were unable to convince the market. This soft default option is therefore unlikely to affect the market drastically. In other words, the extent and pretend scheme coupled with significant haircut works to preserve the eurozone even if it caused dismay to bond holders. Now the market is waiting to see if Syriza will actually dare to defy the Troika and simply walk away from its debt given the consequences. As this Reuters report shows, even as early as 04 November 2014 (coinciding with the rise of gold prices), when Syriza gets closer to power, it has proceeded to soften its stance from the choice of hard default to renegotiation. The German/ Creditor’s position is clear. They are willing to accept a debt restructuring but they will not accept a hard default or any cancellation of debt. This will weaken their position with other debtor countries like Poland, Ireland and Spain. The only risk now is that Syriza will overtip its hand when asking for concessions to the point where it is unacceptable to the Creditors. This is a possibility given the nature of his fiery speech and the expectations of quick relief from the Greek public. (click to enlarge) Source: Google There is a possibility that he will be too engrossed about the quick fix of Greek 175% debt to GDP ratio, which is higher than the rest of Europe. There is also the temptation to turn the Greek’s primary budget surplus of $3.3 billion euros for year 2015 to a current account surplus if they don’t pay off their external debts. The real risk is that Tsprias might then be too willing to leave the eurozone and underestimate the possibility of the hyperinflation tragedy. This might happen when the drachma is reintroduced at a point where the international market has no confidence in it shortly after a massive debt default. Conclusion GLD has appreciated way before the actual victory of Syriza and those who wanted to hold gold already has gold exposure in their portfolio. These are the cautious ones. For the vast majority of the public, it is the fear for systemic unrest on the scale of Lehman Brother collapse that will bring them into gold in doves. This fear will only occur when there are clearer signs of a disorderly Greece Exit (or Grexit). While we believe that Syriza was only posturing to gain power and it might be slightly more aggressive than the outgoing New Democracy government, there is also a serious risk that the inexperienced Syriza will overturn its hand and oversee the expulsion of Greece from the eurozone under its watch. There might be other forces that might tilt the balance inside and outside Syriza towards a cold calculation of benefits and costs that might result in unexpected results. There is still market confidence in the USD and GLD. For those who are upset about the lack of audit for GLD, consider it from the faith and credit angle. Based on the market capitalization of $30.78 billion and last known daily volume of 6.27 million, it is clear that there is market confidence in GLD and you can liquidate it quickly when you need it. However for those in Europe who are worried about capital controls, then it will make sense for them to hold physical gold but they will have to incur cost for storage and insurance. Then there is also the security risk for holding gold against theft or worst. For them, in today’s world without capital controls in Europe, GLD will be a good way to hold their wealth. For investors in general, they would do well to hold onto their GLD holdings especially for those who heeded my earlier advice to buy GLD in my earlier article, The SNB Catalyst For GLD . That article also explored the potential European instability from a different perspective. For those who have nil exposure to GLD, this will be a good time to gain exposure when there will be a brief lull in prices as the market wait and observe the actions of the new Greek government and the official response from the Troika who represent the Creditors. Scalper1 News

Background of the difficult economic conditions of the eurozone and the threat of Syriza’s victory in Greece. GLD has already priced in the threat of Syriza since November 2014 and has been rising steadily. Those who wants the safe habour of gold has already gone in. Risk of Syriza overtipping its hand for a quick fix to high debt with a primary budget surplus even though there are indications that Syriza will be moderate in power. Time to hold for those with GLD exposure and observe future developments and for those without exposure to initiate it. Difficult Times For The Eurozone Gold has been used been used as a medium of exchange since historic times and especially in times of turmoil. In modern times, with the creation of bank notes and the 1971 closing of the gold window, paper money is the medium of exchange and its power lies in the ‘full faith and credit of’ whichever government that is issuing the note. Now the full faith and credit of the United States Government is still valid in the market especially in a time where the U.S. economy is growing strongly (11 year high of 5% GDP growth in the third quarter of 2014), the U.S. Dollar (USD) is strong and most importantly the state of the union is strong. However the same attributes cannot be said for the eurozone. The eurozone economy is faltering at 0.2% growth for the same third quarter 2014 when the U.S. is growing strongly. The euro, as represented by the CurrencyShare Euro Trust ETF (NYSEARCA: FXE ), has declined by 23% since 05 May 2014 as seen in the chart below and this decline has accelerated since October 2014 which coincided with a dovish European Central Bank (ECB) decision. (click to enlarge) Lastly there is the issue regarding the state of the eurozone. The integrity of the eurozone had been tested in 2012 when Greece almost elected Syriza who came in second into government. This sparks the famous line by ECB President Draghi to ‘do whatever it takes’ to preserve the euro. The Rise and Threat of Syriza on Eurozone Now with the snap General Election on 25 January 2015, Syriza has defeated the previous government New Democracy to form the next government of Greece and its firebrand leader Alexis Tsipras would be youngest Greek Prime Minister at age 40 in 150 years. The whole reason that Syriza poses an existential threat to the whole eurozone project is quite simply because it does not want to pay its huge external debts. Its policy platform is anti-austerity, the repudiation of debt in essence and more social spending. This is what got it in power in the very first place which pleased the Greek population and at the same time send an earthquake to the rest of the eurozone. This whole political instability came about from the failed election of President of Greece. The President of Greece is a largely ceremonial role held currently by the incumbent Karolos Papoulias for 2 terms of 5 years each. His second term is set to end in March 2015. The President of Greece is elected by the Hellenic Parliament in Greece and has to be done latest 1 month before he is set to leave office as decreed by the Greek Constitution. The Prime Minister of Greece Samaras brought it forward to December 2014 but he was unable to secure a 2/3 majority of parliament vote for his candidate on the first 2 rounds of voting on the 17th and 23rd. The third round of voting on the 27th also failed to produce the reduced 3/5 majority of 180 votes which triggered the election for a new parliament on 25 January 2015. The new parliament will have to vote for the new president again by February 2015. Safe Harbor of GLD If you are a rich or middle class citizen (with enough money beyond the hand to mouth existence to be worried) in Europe and you are faced with the possibility that the euro note you hold can either be worthless or in the more optimistic case, be exchanged back at a steep discount to the national currency, what will your natural options be? You will avoid European equities and bonds because they are denominated in euros. You might want to change into a currency like the USD that will hold its value or you might want to buy physical gold which is harder to devalue or you might want to invest into a gold ETF denominated in the USD like GLD to avoid the storage and insurance costs. This is why we can see that the value of gold, as seen in the SDPR Gold Trust ETF (NYSEARCA: GLD ), has rose steadily since 03 November 2014 whenever there is a hint of potential political instability in Greece. (click to enlarge) As we can see, the market is forward looking and has began to price in the Greek instability before the formal vote in the Hellenic Parliament. Gold investors started to buy when the rumor of the a potential change in government given the weakness of the current Greek coalition government. This is why we are unlikely to see a sudden spike up in GLD now because the market has sufficient time to build their long position. Even for those who are less connected, they will have seen in coming last month when the rounds of Presidential election failed in Parliament. History of Debt Concession However now that Syriza has formed the new government,it remains to be seen how far its leader Tsprais will go to fulfill his campaign promises. It is clear that he will want to extract some sort of concession from the Troika. The prior Greek government managed to extend the loan repayment period from the original 7 years to 15 years in July 2011 and interest rates were cut to 3.5% for a mega loan of $109 billion euros loan package. This is the start of the second and ongoing Economic Adjustment Program for Greece after the first program which saw loans of $110 billion euros from May 2010 to June 2011. It is also in this period where we saw a soft default on a debt restructuring deal which concluded on 09 March 2012 on $205.5 billion euro of debt. This caused the ISDA to call a Credit Event which triggered $3.5 billion of credit default swaps and let Fitch to downgrade Greek debt from ‘CCC’ to ‘Restricted Default’. All in all, through this soft default option, Greek debt holders lost a massive $107 billion euros, a record for sovereign debt losses. Is this the calm before or after the Storm? As far as the market is concerned, the eurozone has survived this crisis of soft default with the help of the ECB when other organization were unable to convince the market. This soft default option is therefore unlikely to affect the market drastically. In other words, the extent and pretend scheme coupled with significant haircut works to preserve the eurozone even if it caused dismay to bond holders. Now the market is waiting to see if Syriza will actually dare to defy the Troika and simply walk away from its debt given the consequences. As this Reuters report shows, even as early as 04 November 2014 (coinciding with the rise of gold prices), when Syriza gets closer to power, it has proceeded to soften its stance from the choice of hard default to renegotiation. The German/ Creditor’s position is clear. They are willing to accept a debt restructuring but they will not accept a hard default or any cancellation of debt. This will weaken their position with other debtor countries like Poland, Ireland and Spain. The only risk now is that Syriza will overtip its hand when asking for concessions to the point where it is unacceptable to the Creditors. This is a possibility given the nature of his fiery speech and the expectations of quick relief from the Greek public. (click to enlarge) Source: Google There is a possibility that he will be too engrossed about the quick fix of Greek 175% debt to GDP ratio, which is higher than the rest of Europe. There is also the temptation to turn the Greek’s primary budget surplus of $3.3 billion euros for year 2015 to a current account surplus if they don’t pay off their external debts. The real risk is that Tsprias might then be too willing to leave the eurozone and underestimate the possibility of the hyperinflation tragedy. This might happen when the drachma is reintroduced at a point where the international market has no confidence in it shortly after a massive debt default. Conclusion GLD has appreciated way before the actual victory of Syriza and those who wanted to hold gold already has gold exposure in their portfolio. These are the cautious ones. For the vast majority of the public, it is the fear for systemic unrest on the scale of Lehman Brother collapse that will bring them into gold in doves. This fear will only occur when there are clearer signs of a disorderly Greece Exit (or Grexit). While we believe that Syriza was only posturing to gain power and it might be slightly more aggressive than the outgoing New Democracy government, there is also a serious risk that the inexperienced Syriza will overturn its hand and oversee the expulsion of Greece from the eurozone under its watch. There might be other forces that might tilt the balance inside and outside Syriza towards a cold calculation of benefits and costs that might result in unexpected results. There is still market confidence in the USD and GLD. For those who are upset about the lack of audit for GLD, consider it from the faith and credit angle. Based on the market capitalization of $30.78 billion and last known daily volume of 6.27 million, it is clear that there is market confidence in GLD and you can liquidate it quickly when you need it. However for those in Europe who are worried about capital controls, then it will make sense for them to hold physical gold but they will have to incur cost for storage and insurance. Then there is also the security risk for holding gold against theft or worst. For them, in today’s world without capital controls in Europe, GLD will be a good way to hold their wealth. For investors in general, they would do well to hold onto their GLD holdings especially for those who heeded my earlier advice to buy GLD in my earlier article, The SNB Catalyst For GLD . That article also explored the potential European instability from a different perspective. For those who have nil exposure to GLD, this will be a good time to gain exposure when there will be a brief lull in prices as the market wait and observe the actions of the new Greek government and the official response from the Troika who represent the Creditors. Scalper1 News

Scalper1 News