Scalper1 News

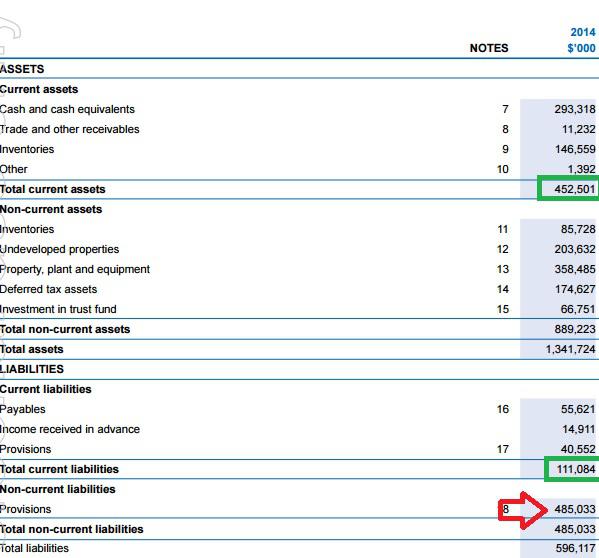

Summary Energy Resources of Australia lost almost US$500M in market capitalization after deciding not to go ahead with the Rangers 3 Deeps zone. The company is currently processing low-grade stockpile which should keep the lights on. The company is now an excellent call option on the uranium price as it has existing infrastructure and is trading at less than $2 per pound in the ground. Introduction I’m a believer in uranium and whilst I don’t think we’ll see substantially higher prices this year or even next year, I’d still like to be positioned to benefit from an expected uptick in the sexiness of uranium-related investments. I can be patient and have been keeping an eye on several uranium companies. Energy Resources of Australia (OTCPK: EGRAF ) is one of them, and the share price has tumbled after major shareholder Rio Tinto (NYSE: RIO ) decided not to get ahead with providing financial support for the development of the Ranger 3 Deeps zone. That’s a pity, but maybe there’s an opportunity here for people who are patient. Energy Resources of Australia is a – surprise, surprise- Australian company and I’d strongly recommend you to trade in the company’s shares through the facilities of the Australian Stock Exchange where it’s listed with ERA as its ticker symbol . The average daily volume is 2.2 million shares. The company is still processing stockpiles but won’t develop the underground mine In the second quarter of this year, Energy Resources produced 390 tonnes of uranium (861,000 pounds) which would generate almost $40M in revenue based on today’s spot price. That’s still pretty decent but not a lot and that’s due to the fact ERA is basically just processing its (low-grade) stockpiles. The average grade of the processed ore in the second quarter was just 0.09% (10% lower compared to the previous quarter) whilst the total amount of ore it milled also decreased due to a planned mill shutdown. Source: annual report This is part of the plan to wind down operations at the Ranger mines and connected to the rehabilitation plan for the area. As part of its original agreement with the governments, ERA was operating the mine under the ‘Ranger Authority’ agreement which is expiring in 2021. Unfortunately this is one of the stumble blocks for the company to even consider developing the Ranger 3 Deep zone. Earlier this year, ERA has halted all development activities at the underground uranium resource as the uranium price was too low to justify spending any more cash on that part of the project. On top of that, partner Rio Tinto also pulled out, stating the project no longer meets its investment criteria. (click to enlarge) Source: annual report A real double-whammy for Energy Resources of Australia, and as you can imagine its market capitalization fell off a cliff and whereas the company was worth A$800M just three months ago, it lost 75% of that value since then! And that’s a pity, as there’s a lot of uranium down there It’s understandable nobody wants to throw tens and hundreds of millions of dollars at an underground uranium mine at a moment the uranium price is so low even the open pit mines are struggling to stay afloat. So, yes, I do understand the reasoning behind the decision to not advance the Ranger 3 Deeps zone as the result of the previously published pre-feasibility study was disappointing. The pre-feasibility study was based on an updated resource estimate using a cutoff grade of 0.11% uranium compared to a previously used cut-off grade of 0.15% U3O8. Yes, the lower cut-off grade has indeed increased the total resource base of the project which now contains 96.5 million pounds of uranium, but unfortunately this also caused a sharp 20% reduction in the average grade which dropped to 0.224%. Source: annual report This was quite disappointing as everybody knows in this investment climate it’s all about generating returns on investments and keeping the payback period short. In the past it used to be a game of ‘my resource estimate is bigger than yours’, but that era is over and investors are focusing on decent internal rate of returns. The Rangers 3 Deeps zone might not be mined in the near future, but fortunately the uranium resources aren’t running away. According to its most recent financial statements, ERA had a working capital position of A$350M (more than its current market capitalization) and this should keep the company afloat for a little bit longer. The average rock value per tonne of ore is $175/t based on the spot price and almost $250/t based on the long-term uranium price. That’s the equivalent of almost 7 g/t gold so I do believe there is value down there (literally). Investment thesis Buying shares of Energy Resources of Australia is buying a call option on the uranium price as the Rangers 3 Deeps project definitely won’t be developed at the current uranium price. It doesn’t mean the project is worthless and ERA might just ‘sit’ on it until the outlook for uranium improves again. ERA is now valued at US$1.75 per pound of uranium in the ground and that’s not expensive, considering the resource is located in a safe region. I might initiate a very small position in the next few days or weeks as a speculative bet on the uranium price. Keep in mind this company has a higher than average risk profile and even though I do think this mine will eventually be developed, there’s no way I can guarantee it will indeed happen. Editor’s Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks. Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in EGRAF over the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary Energy Resources of Australia lost almost US$500M in market capitalization after deciding not to go ahead with the Rangers 3 Deeps zone. The company is currently processing low-grade stockpile which should keep the lights on. The company is now an excellent call option on the uranium price as it has existing infrastructure and is trading at less than $2 per pound in the ground. Introduction I’m a believer in uranium and whilst I don’t think we’ll see substantially higher prices this year or even next year, I’d still like to be positioned to benefit from an expected uptick in the sexiness of uranium-related investments. I can be patient and have been keeping an eye on several uranium companies. Energy Resources of Australia (OTCPK: EGRAF ) is one of them, and the share price has tumbled after major shareholder Rio Tinto (NYSE: RIO ) decided not to get ahead with providing financial support for the development of the Ranger 3 Deeps zone. That’s a pity, but maybe there’s an opportunity here for people who are patient. Energy Resources of Australia is a – surprise, surprise- Australian company and I’d strongly recommend you to trade in the company’s shares through the facilities of the Australian Stock Exchange where it’s listed with ERA as its ticker symbol . The average daily volume is 2.2 million shares. The company is still processing stockpiles but won’t develop the underground mine In the second quarter of this year, Energy Resources produced 390 tonnes of uranium (861,000 pounds) which would generate almost $40M in revenue based on today’s spot price. That’s still pretty decent but not a lot and that’s due to the fact ERA is basically just processing its (low-grade) stockpiles. The average grade of the processed ore in the second quarter was just 0.09% (10% lower compared to the previous quarter) whilst the total amount of ore it milled also decreased due to a planned mill shutdown. Source: annual report This is part of the plan to wind down operations at the Ranger mines and connected to the rehabilitation plan for the area. As part of its original agreement with the governments, ERA was operating the mine under the ‘Ranger Authority’ agreement which is expiring in 2021. Unfortunately this is one of the stumble blocks for the company to even consider developing the Ranger 3 Deep zone. Earlier this year, ERA has halted all development activities at the underground uranium resource as the uranium price was too low to justify spending any more cash on that part of the project. On top of that, partner Rio Tinto also pulled out, stating the project no longer meets its investment criteria. (click to enlarge) Source: annual report A real double-whammy for Energy Resources of Australia, and as you can imagine its market capitalization fell off a cliff and whereas the company was worth A$800M just three months ago, it lost 75% of that value since then! And that’s a pity, as there’s a lot of uranium down there It’s understandable nobody wants to throw tens and hundreds of millions of dollars at an underground uranium mine at a moment the uranium price is so low even the open pit mines are struggling to stay afloat. So, yes, I do understand the reasoning behind the decision to not advance the Ranger 3 Deeps zone as the result of the previously published pre-feasibility study was disappointing. The pre-feasibility study was based on an updated resource estimate using a cutoff grade of 0.11% uranium compared to a previously used cut-off grade of 0.15% U3O8. Yes, the lower cut-off grade has indeed increased the total resource base of the project which now contains 96.5 million pounds of uranium, but unfortunately this also caused a sharp 20% reduction in the average grade which dropped to 0.224%. Source: annual report This was quite disappointing as everybody knows in this investment climate it’s all about generating returns on investments and keeping the payback period short. In the past it used to be a game of ‘my resource estimate is bigger than yours’, but that era is over and investors are focusing on decent internal rate of returns. The Rangers 3 Deeps zone might not be mined in the near future, but fortunately the uranium resources aren’t running away. According to its most recent financial statements, ERA had a working capital position of A$350M (more than its current market capitalization) and this should keep the company afloat for a little bit longer. The average rock value per tonne of ore is $175/t based on the spot price and almost $250/t based on the long-term uranium price. That’s the equivalent of almost 7 g/t gold so I do believe there is value down there (literally). Investment thesis Buying shares of Energy Resources of Australia is buying a call option on the uranium price as the Rangers 3 Deeps project definitely won’t be developed at the current uranium price. It doesn’t mean the project is worthless and ERA might just ‘sit’ on it until the outlook for uranium improves again. ERA is now valued at US$1.75 per pound of uranium in the ground and that’s not expensive, considering the resource is located in a safe region. I might initiate a very small position in the next few days or weeks as a speculative bet on the uranium price. Keep in mind this company has a higher than average risk profile and even though I do think this mine will eventually be developed, there’s no way I can guarantee it will indeed happen. Editor’s Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks. Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in EGRAF over the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News