Scalper1 News

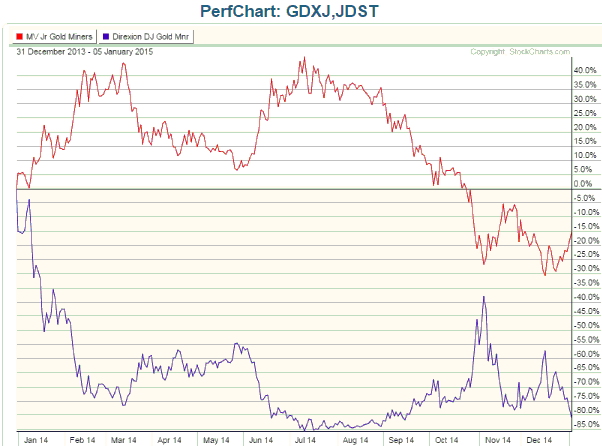

Editor’s note: Originally published at tsi-blog.com on January 6, 2015. My 3rd November blog post explained why leveraged ETFs should only ever be used for short-term trades. To set the scene, here is an excerpt from this earlier post: The crux of the matter is that leveraged ETFs are designed to move by 2 or 3 times the DAILY percentage changes of the target indexes. They are NOT designed to move by 2 or 3 times the percentage change of the target indexes over periods of longer than one day. Due to the effects of compounding, their percentage changes over periods of much longer than one day will usually be less – and sometimes substantially less – than 2-times (in the case of a 2X ETF) or 3-times (in the case of a 3X ETF) the percentage changes in the target indexes. In the earlier post, I presented tables to show that the greater the volatility of an index and the greater the leverage provided by an ETF linked to the index, the worse the likely performance of the leveraged ETF over extended periods. The worse, that is, relative to the performance superficially implied by the daily percentage change relationship between the index and the leveraged ETF. I concluded that leveraged ETFs are only suitable for short-term trades and that a trade should be very short term if it involves a 3X ETF and/or a volatile market. To illustrate how badly a leveraged ETF can perform relative to the performance superficially implied by the daily percentage change relationship between the leveraged ETF and the market to which it is linked, here is a chart comparing the performances of the Market Vectors Junior Gold Miners ETF ( GDXJ) and the Direxion Daily Junior Gold Miners Index Bear 3X Shares ETF ( JDST) since the end of 2013. JDST is designed to have a daily percentage change that is roughly three times the INVERSE of GDXJ’s daily percentage change, so it is an ETF that someone would buy if they were bearish on GDXJ. For example, on a day when GDXJ lost 5%, JDST would gain about 15%, and on a day when GDXJ gained 5%, JDST would lose about 15%. Given that GDXJ is presently about 15% lower than it was at the end of 2013, people who are unfamiliar with how leveraged ETFs work would likely jump to the conclusion that a JDST position purchased at the end of 2013 and held through to the present would show a healthy profit. However, this conclusion could not be further from the truth, because JDST has lost 81% of its value over the period in question. The dismal performance of JDST is a trap for the novice trader, but it is not a design flaw. As outlined in my 3rd November post, it is a mathematical function of how the leverage works and simply means that this type of ETF should only ever be used in trades with time frames of no more than a few weeks. Now that you’ve read this, are you Bullish or Bearish on ? Bullish Bearish Sentiment on ( ) Thanks for sharing your thoughts. Why are you ? Submit & View Results Skip to results » Share this article with a colleague Scalper1 News

Editor’s note: Originally published at tsi-blog.com on January 6, 2015. My 3rd November blog post explained why leveraged ETFs should only ever be used for short-term trades. To set the scene, here is an excerpt from this earlier post: The crux of the matter is that leveraged ETFs are designed to move by 2 or 3 times the DAILY percentage changes of the target indexes. They are NOT designed to move by 2 or 3 times the percentage change of the target indexes over periods of longer than one day. Due to the effects of compounding, their percentage changes over periods of much longer than one day will usually be less – and sometimes substantially less – than 2-times (in the case of a 2X ETF) or 3-times (in the case of a 3X ETF) the percentage changes in the target indexes. In the earlier post, I presented tables to show that the greater the volatility of an index and the greater the leverage provided by an ETF linked to the index, the worse the likely performance of the leveraged ETF over extended periods. The worse, that is, relative to the performance superficially implied by the daily percentage change relationship between the index and the leveraged ETF. I concluded that leveraged ETFs are only suitable for short-term trades and that a trade should be very short term if it involves a 3X ETF and/or a volatile market. To illustrate how badly a leveraged ETF can perform relative to the performance superficially implied by the daily percentage change relationship between the leveraged ETF and the market to which it is linked, here is a chart comparing the performances of the Market Vectors Junior Gold Miners ETF ( GDXJ) and the Direxion Daily Junior Gold Miners Index Bear 3X Shares ETF ( JDST) since the end of 2013. JDST is designed to have a daily percentage change that is roughly three times the INVERSE of GDXJ’s daily percentage change, so it is an ETF that someone would buy if they were bearish on GDXJ. For example, on a day when GDXJ lost 5%, JDST would gain about 15%, and on a day when GDXJ gained 5%, JDST would lose about 15%. Given that GDXJ is presently about 15% lower than it was at the end of 2013, people who are unfamiliar with how leveraged ETFs work would likely jump to the conclusion that a JDST position purchased at the end of 2013 and held through to the present would show a healthy profit. However, this conclusion could not be further from the truth, because JDST has lost 81% of its value over the period in question. The dismal performance of JDST is a trap for the novice trader, but it is not a design flaw. As outlined in my 3rd November post, it is a mathematical function of how the leverage works and simply means that this type of ETF should only ever be used in trades with time frames of no more than a few weeks. Now that you’ve read this, are you Bullish or Bearish on ? Bullish Bearish Sentiment on ( ) Thanks for sharing your thoughts. Why are you ? Submit & View Results Skip to results » Share this article with a colleague Scalper1 News

Scalper1 News