Scalper1 News

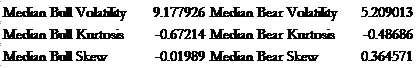

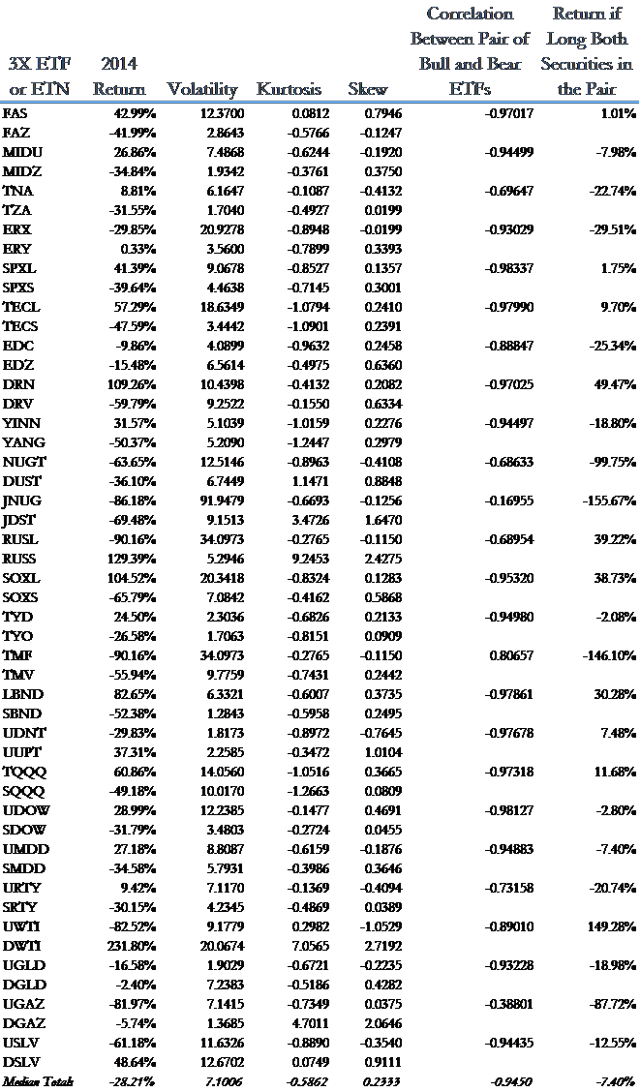

Summary There exist important reasons for ETF decay. After analysis, ETFs and particularly 3X leveraged ETFs, continued to persist in 2014. 3X leveraged ETFs are less efficient in tracking an index or basket category of securities than their un-leveraged counterparts. Introduction Across the investment and financial academic community, ETFs have been heralded as the ideal investment for passive investors. While I do not deny the numerous positive benefits of investing in an ETF over individual securities for the average retail investor, I also point out an important flaw within ETFs: ETF decay. The decay of exchange-traded funds (ETFs), and by extension, exchange-traded notes (ETNs), has been a widely known phenomenon. Some quantitative traders have attempted to profit via statistical arbitrage by buying the underlying basket securities of an ETF and short selling the ETF in order to capture the ETF decay. In this article, I analyze the decay of 3X leveraged ETFs by 25 comparing ETF pairs. (As a side note, while I reference exchange-traded products as ETFs, the same can be said for ETNs.) Important Reasons for ETF Decay The reasons for the decay of ETFs and ETNs include the following: management fees, contango & backwardation in futures based on exchange traded securities, the compounded daily effect from resetting leverage and rebalancing a portfolio to mimic an index or basket category of securities, and higher volatility contributing to higher decay. Data Here are the 25 ETF pairs used to complete the analysis of 3X leveraged ETFs for the 2014 calendar year. By definition, an ETF pair is a group of bull and bear ETFs regarding the same underlying index or other basket category. Source: Data from Yahoo Finance, Analysis in Excel (click to enlarge) Source: Data from FactSet & Yahoo Finance, Analysis in Excel Summary Results of 3X Leveraged ETF Decay To begin with, after analyzing 25 ETF pairs, 3X Bull ETFs, on average, tend to have higher volatility and kurtosis than 3X Bear ETFs. 3X Bull ETFs, on average, tend to have lower skew than 3X Bear ETFs. Second, in theory, the ideal pair of a Bull and Bear 3X ETF has a correlation coefficient of -1. Intuitively, this makes sense; for example, if an index was up +1%, then a 3X Bull ETF would be up 3% and a 3X Bear ETF would be down -3%, where the 3X ETFs would be based on the same underlying index. By definition, a correlation coefficient must be between -1 and 1. As the correlation coefficient between a pair of a Bull and Bear ETF/ETN, increases, the efficiency of this pairing decreases and the ETFs/ETNs have a higher decay. 3X leveraged ETFs were less efficient and exhibited more decay than their unleveraged counterpart ETFs. Third, in theory, ignoring commission costs and other expenses, simultaneously buying (going long on) a bear and bull ETFs on an index at the same time, cost basis, and cost value should yield a zero profit situation. In reality, a zero profit situation does not exist; in 2014, by going long on both the bull and bear ETF on the same underlying index, the median rate of return was -7.4%. When adding up the percentage performance of a bull and bear ETF on the same underlying index, the greater the summation away from 0, the greater the inefficiency and decay factor for the ETFs. Furthermore, there is a strong correlation between higher ETF/ETN volatility and higher decay. Conclusion 3X ETFs and ETNs can provide investors with an extraordinary, leveraged opportunity to capitalize on their investment ideas. Important to note, gains and losses are magnified. Some ETF pairs, such as the ProShares Ultra S&P 500 ETF ( SSO) and the ProShares Ultra 20+ Year Treasury ETF ( UBT), can be pair traded by rebalancing every month, and this strategy can help increase an investor’s rate of return. In general, 3X funds are not built to be long term positions for investors. Overall, investing in 3X ETFs and ETNs is a volatile and incredibly risky decision due to the leveraged nature of these securities. Despite the decay of leveraged ETFs, this decay has decreased from the previous year, and these ETFs seem to offer a somewhat efficient method of investors to invest by diversifying across an index or basket category in a leveraged manner. Scalper1 News

Summary There exist important reasons for ETF decay. After analysis, ETFs and particularly 3X leveraged ETFs, continued to persist in 2014. 3X leveraged ETFs are less efficient in tracking an index or basket category of securities than their un-leveraged counterparts. Introduction Across the investment and financial academic community, ETFs have been heralded as the ideal investment for passive investors. While I do not deny the numerous positive benefits of investing in an ETF over individual securities for the average retail investor, I also point out an important flaw within ETFs: ETF decay. The decay of exchange-traded funds (ETFs), and by extension, exchange-traded notes (ETNs), has been a widely known phenomenon. Some quantitative traders have attempted to profit via statistical arbitrage by buying the underlying basket securities of an ETF and short selling the ETF in order to capture the ETF decay. In this article, I analyze the decay of 3X leveraged ETFs by 25 comparing ETF pairs. (As a side note, while I reference exchange-traded products as ETFs, the same can be said for ETNs.) Important Reasons for ETF Decay The reasons for the decay of ETFs and ETNs include the following: management fees, contango & backwardation in futures based on exchange traded securities, the compounded daily effect from resetting leverage and rebalancing a portfolio to mimic an index or basket category of securities, and higher volatility contributing to higher decay. Data Here are the 25 ETF pairs used to complete the analysis of 3X leveraged ETFs for the 2014 calendar year. By definition, an ETF pair is a group of bull and bear ETFs regarding the same underlying index or other basket category. Source: Data from Yahoo Finance, Analysis in Excel (click to enlarge) Source: Data from FactSet & Yahoo Finance, Analysis in Excel Summary Results of 3X Leveraged ETF Decay To begin with, after analyzing 25 ETF pairs, 3X Bull ETFs, on average, tend to have higher volatility and kurtosis than 3X Bear ETFs. 3X Bull ETFs, on average, tend to have lower skew than 3X Bear ETFs. Second, in theory, the ideal pair of a Bull and Bear 3X ETF has a correlation coefficient of -1. Intuitively, this makes sense; for example, if an index was up +1%, then a 3X Bull ETF would be up 3% and a 3X Bear ETF would be down -3%, where the 3X ETFs would be based on the same underlying index. By definition, a correlation coefficient must be between -1 and 1. As the correlation coefficient between a pair of a Bull and Bear ETF/ETN, increases, the efficiency of this pairing decreases and the ETFs/ETNs have a higher decay. 3X leveraged ETFs were less efficient and exhibited more decay than their unleveraged counterpart ETFs. Third, in theory, ignoring commission costs and other expenses, simultaneously buying (going long on) a bear and bull ETFs on an index at the same time, cost basis, and cost value should yield a zero profit situation. In reality, a zero profit situation does not exist; in 2014, by going long on both the bull and bear ETF on the same underlying index, the median rate of return was -7.4%. When adding up the percentage performance of a bull and bear ETF on the same underlying index, the greater the summation away from 0, the greater the inefficiency and decay factor for the ETFs. Furthermore, there is a strong correlation between higher ETF/ETN volatility and higher decay. Conclusion 3X ETFs and ETNs can provide investors with an extraordinary, leveraged opportunity to capitalize on their investment ideas. Important to note, gains and losses are magnified. Some ETF pairs, such as the ProShares Ultra S&P 500 ETF ( SSO) and the ProShares Ultra 20+ Year Treasury ETF ( UBT), can be pair traded by rebalancing every month, and this strategy can help increase an investor’s rate of return. In general, 3X funds are not built to be long term positions for investors. Overall, investing in 3X ETFs and ETNs is a volatile and incredibly risky decision due to the leveraged nature of these securities. Despite the decay of leveraged ETFs, this decay has decreased from the previous year, and these ETFs seem to offer a somewhat efficient method of investors to invest by diversifying across an index or basket category in a leveraged manner. Scalper1 News

Scalper1 News