Scalper1 News

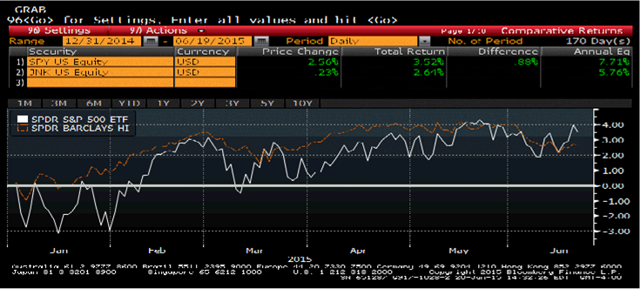

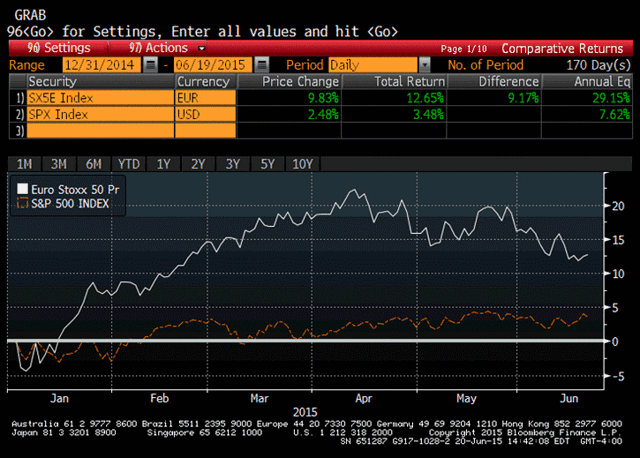

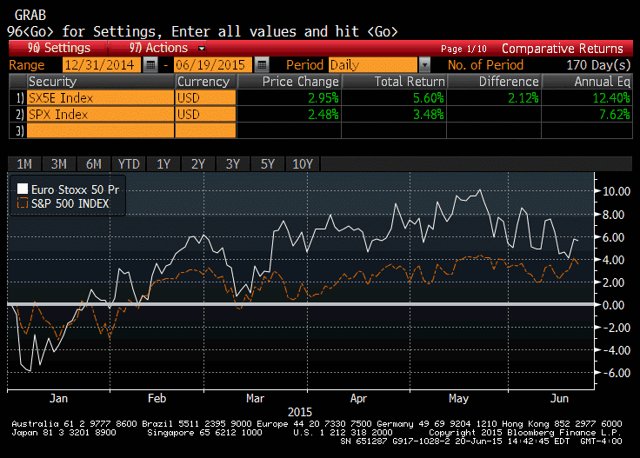

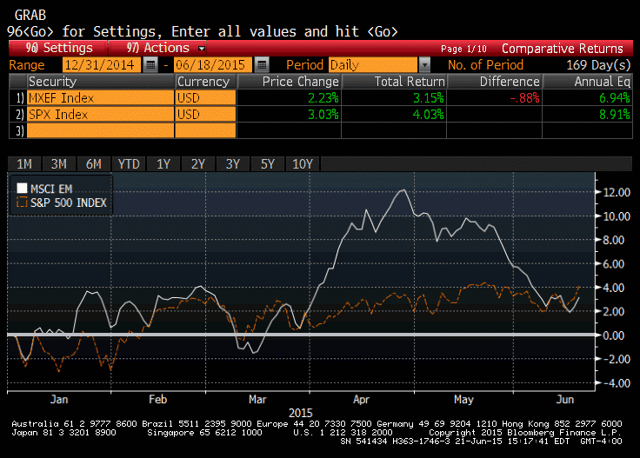

Summary Semi-annually, I list my unfiltered investment themes and determine if I should tilt my asset allocation. This article is a review of my themes from the beginning of 2015 and a preview of my themes for the back half of the year. This process still leaves me with a muted tone for domestic assets and wary of increasing volatility. In early January, I wrote an article laying out my ” Ten Themes Shaping Markets in 2015 “. Stepping back from the day-to-day volatility of the market and writing down your own investment themes can be a valuable tool to framing your market expectations and setting your tactical asset allocation. As I began to write a semi-annual refresh of my market themes, I wanted to first revisit the market premises underpinning my positioning at the beginning of 2015. I hope that this retrospective look back at my beginning of year themes, and why my prognostications have or have not come to fruition, can be introspective to portfolio positioning for the remainder of the year. In bold, I have listed my beginning of year themes. Below these ten items, I discuss my view of how these themes have played out in the first half of 2015. 1. Deviating economic growth rates globally and attendant diverging paths of monetary policy will create new global imbalances, creating volatility and investment opportunity. In a global financial system that has become more linked over time, a failure for rates and currencies to converge in the short-run could lead to greater imbalances over longer time periods. As the U.S. mortgage crisis begat a global financial crisis which in turn exacerbated a European sovereign debt crisis, we have seen volatility cascade around the world. It is no wonder that the International Monetary Fund and World Bank have asked the Federal Reserve to forestall rate increases. The Fed, which has a dual mandate for maximum employment and stable prices in the United States , is being asked to be mindful of the global impact of its policies. This theme will be unchanged in my second half view, and could stay with financial markets for some time. 2. Financial market volatility has been at an unnatural trough. Sustained economic growth would lead to reduced monetary accommodation, precipitating volatility as interest rates climb. Conversely, weakened economic growth could lead to a sharp re-pricing of risky asset classes. In the first half, we saw weakened domestic economic growth and higher interest rates. While domestic economic growth contracted modestly in the first quarter, the market viewed the lull as driven by temporal factors like unseasonably cold weather and the sharp fall in oil prices on investment without a direct offset in higher consumption. Through the first half, we have managed to stay in this Goldilocks period of growth that is neither too fast to force the removal of Fed support nor too slow to lead to force a re-pricing of securities. Eventually the porridge will become too hot or too cold. 3. Global inflationary pressures remain quite subdued as witnessed in commodity prices, providing ballast for long interest rates. Disinflation risks remain in Europe and Japan. Falling domestic unemployment will continue to be slow to translate into wage growth in the United States given a generationally low labor force participation rate. While oil prices have rebounded since the beginning of the year (+9-11%), base metals have continued to move lower, a sign of sluggish global demand. Inflation readings in Europe and Japan, while positive, continue to be paltry at +0.3%. While the headline unemployment rate (5.5%) is approaching the estimated natural rate of unemployment, the labor force participation rate (62.9%) is still 3.5% below its peak in early 2007, equivalent to nearly 9 million of missing jobs. Inflation fears remain muted. 4. While the Federal Reserve is likely to raise the Federal Funds rate in the back half of 2015, the unwind of monetary accommodation will continue at a measured and data-dependent pace given little headroom for incremental support if the economy suffers an exogenous shock from foreign markets. The June FOMC statement was released last Wednesday, and the committee upgraded its assessment of economic activity, describing it as “having expanded moderately” versus having “slowed” in the April statement. Job growth was characterized by a “diminishing underutilization of labor market resources.” While the committee was more constructive on economic growth in its statement, the committee members view of the path of monetary policy as expressed through the oft discussed “dot plot” showed median expectations that flattened, with Fed Funds projections falling by 25bp on average for year-end 2016 and 2017 to 1.625% and 2.875% respectively. The qualitative discussion of an improvement in the economy and labor markets was met with quantitative depictions of a slower path of monetary policy normalization, signaling the Fed will remain data dependent on both the timing of the first interest rate hike and the pace of subsequent tightening. We are approaching the nine-year anniversary of the last Federal Reserve rate hike on June 29, 2006 when the Federal Reserve boosted its target Federal Funds rate 0.25% to 5.25%. In the lead up to the recent Federal Open Market Committee (FOMC) meeting, the market had begun to increasingly price in a September rate increase. Those odds have diminished somewhat as the market took the Fed’s commentary as generally bullish for rates. I continue to believe we will move off of the zero bound at the December meeting, and believe that the market’s attention should turn from the timing of the first rate increase to the pace of future rate increases, which I expect to continue to be slower than the current Fed expectations. 5. Stretched equity multiples domestically will necessitate that valuations be driven by changes in earnings, tempering further price gains. Speculative grade credit may offer better risk-adjusted returns than domestic equities. One of my principal takeaways from my January themes were that forward domestic assets returns were likely to be subdued. With my expectation for the central tendency of domestic equity returns to be in the high single digits, high yield bond returns, which I expected to be in the 6%-7% range after the oil-driven selloff in late 2014, looked good on a relative basis. While the strong equity market performance and recent fixed income sell-off have put domestic equity returns in front of the high yield bond market, the path has been smoother for junk bonds than domestic equities. Below is a graph comparing the year-to-date cumulative total return of the S&P 500 ETF (NYSEARCA: SPY ) versus the SPDR Barclays High Yield Bond ETF (NYSEARCA: JNK ), demonstrating how this theme has played out in 2015. (click to enlarge) Sources: Bloomberg, Standard and Poor’s 6. Lagging returns for risky assets in Europe post-crisis and the likelihood of an increase in quantitative easing could lead to absolute outperformance relative to the U.S., but the variability of outcomes abroad is much wider. Given lower equity multiples and more accommodative monetary policy in Europe than the United States, higher return expectations abroad appear warranted. As the escalating Greek drama has highlighted, the European experiment has challenges unique to the United States. Europe has posted much higher equity returns thus far in 2015… (click to enlarge) Sources: Bloomberg, Standard and Poor’s …but when translated into U.S. dollars, the outperformance has been much less material. (click to enlarge) Sources: Bloomberg, Standard and Poor’s 7. This comparison extends to emerging markets, which could benefit most directly from rebounding economic growth, but remain exposed to global fund flows and the higher beta nature of their commodity-intensive economies. Emerging markets had outperformed for most of the year until the recent swoon. EM stocks have fallen by ten percent in just the last six weeks. (click to enlarge) Sources: Bloomberg, Standard and Poor’s 8. Within emerging markets, return dispersion will widen and could be defined by a given locale’s level of political unrest, fiscal or current account deficit, or exposure to commodities or a slowing China. A surprise uptick in global growth would make most markets winners, but there are many paths to another year of lackluster returns. We have seen historically strong returns from the Shenzen Composite Index (+93%), but negative returns in other Asian economies tied strongly to the Chinese economy. 9. Rising income and wealth inequality, excess global savings, and demography are combining to disrupt normal cyclical demand growth and increasing the risk of secular stagnation. Inequality will become a thematic constant that will inform global politics and policy. Like the first theme on global imbalances, socioeconomic imbalances are likely to remain a continued theme in financial markets and impact politics. 10. With stock prices near all-time highs and bond prices boosted by low interest rates, forward returns will be subnormal. As we head later into the business cycle, investors may wish to move towards a more defensive posturing, lower volatility investments, or look to lock-in cheap tail risk hedges. Domestic equity markets have squeezed out modestly positive returns in the first half, but the expectation for subnormal forward returns remains. While investors have unique time horizons, risk profiles, and risk tolerances, an honest discussion of their personal investment themes should be used to frame their tactical asset allocation. From this review of these first half themes, I expect to publish my themes for the second half in the near-term. I welcome feedback as I sharpen my themes for the second half of 2015. Author’s Disclosure My articles may contain statements and projections that are forward-looking in nature, and therefore inherently subject to numerous risks, uncertainties and assumptions. While my articles focus on generating long-term risk-adjusted returns, investment decisions necessarily involve the risk of loss of principal. Individual investor circumstances vary significantly, and information gleaned from my articles should be applied to your own unique investment situation, objectives, risk tolerance, and investment horizon. Disclosure: I am/we are long SPY. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary Semi-annually, I list my unfiltered investment themes and determine if I should tilt my asset allocation. This article is a review of my themes from the beginning of 2015 and a preview of my themes for the back half of the year. This process still leaves me with a muted tone for domestic assets and wary of increasing volatility. In early January, I wrote an article laying out my ” Ten Themes Shaping Markets in 2015 “. Stepping back from the day-to-day volatility of the market and writing down your own investment themes can be a valuable tool to framing your market expectations and setting your tactical asset allocation. As I began to write a semi-annual refresh of my market themes, I wanted to first revisit the market premises underpinning my positioning at the beginning of 2015. I hope that this retrospective look back at my beginning of year themes, and why my prognostications have or have not come to fruition, can be introspective to portfolio positioning for the remainder of the year. In bold, I have listed my beginning of year themes. Below these ten items, I discuss my view of how these themes have played out in the first half of 2015. 1. Deviating economic growth rates globally and attendant diverging paths of monetary policy will create new global imbalances, creating volatility and investment opportunity. In a global financial system that has become more linked over time, a failure for rates and currencies to converge in the short-run could lead to greater imbalances over longer time periods. As the U.S. mortgage crisis begat a global financial crisis which in turn exacerbated a European sovereign debt crisis, we have seen volatility cascade around the world. It is no wonder that the International Monetary Fund and World Bank have asked the Federal Reserve to forestall rate increases. The Fed, which has a dual mandate for maximum employment and stable prices in the United States , is being asked to be mindful of the global impact of its policies. This theme will be unchanged in my second half view, and could stay with financial markets for some time. 2. Financial market volatility has been at an unnatural trough. Sustained economic growth would lead to reduced monetary accommodation, precipitating volatility as interest rates climb. Conversely, weakened economic growth could lead to a sharp re-pricing of risky asset classes. In the first half, we saw weakened domestic economic growth and higher interest rates. While domestic economic growth contracted modestly in the first quarter, the market viewed the lull as driven by temporal factors like unseasonably cold weather and the sharp fall in oil prices on investment without a direct offset in higher consumption. Through the first half, we have managed to stay in this Goldilocks period of growth that is neither too fast to force the removal of Fed support nor too slow to lead to force a re-pricing of securities. Eventually the porridge will become too hot or too cold. 3. Global inflationary pressures remain quite subdued as witnessed in commodity prices, providing ballast for long interest rates. Disinflation risks remain in Europe and Japan. Falling domestic unemployment will continue to be slow to translate into wage growth in the United States given a generationally low labor force participation rate. While oil prices have rebounded since the beginning of the year (+9-11%), base metals have continued to move lower, a sign of sluggish global demand. Inflation readings in Europe and Japan, while positive, continue to be paltry at +0.3%. While the headline unemployment rate (5.5%) is approaching the estimated natural rate of unemployment, the labor force participation rate (62.9%) is still 3.5% below its peak in early 2007, equivalent to nearly 9 million of missing jobs. Inflation fears remain muted. 4. While the Federal Reserve is likely to raise the Federal Funds rate in the back half of 2015, the unwind of monetary accommodation will continue at a measured and data-dependent pace given little headroom for incremental support if the economy suffers an exogenous shock from foreign markets. The June FOMC statement was released last Wednesday, and the committee upgraded its assessment of economic activity, describing it as “having expanded moderately” versus having “slowed” in the April statement. Job growth was characterized by a “diminishing underutilization of labor market resources.” While the committee was more constructive on economic growth in its statement, the committee members view of the path of monetary policy as expressed through the oft discussed “dot plot” showed median expectations that flattened, with Fed Funds projections falling by 25bp on average for year-end 2016 and 2017 to 1.625% and 2.875% respectively. The qualitative discussion of an improvement in the economy and labor markets was met with quantitative depictions of a slower path of monetary policy normalization, signaling the Fed will remain data dependent on both the timing of the first interest rate hike and the pace of subsequent tightening. We are approaching the nine-year anniversary of the last Federal Reserve rate hike on June 29, 2006 when the Federal Reserve boosted its target Federal Funds rate 0.25% to 5.25%. In the lead up to the recent Federal Open Market Committee (FOMC) meeting, the market had begun to increasingly price in a September rate increase. Those odds have diminished somewhat as the market took the Fed’s commentary as generally bullish for rates. I continue to believe we will move off of the zero bound at the December meeting, and believe that the market’s attention should turn from the timing of the first rate increase to the pace of future rate increases, which I expect to continue to be slower than the current Fed expectations. 5. Stretched equity multiples domestically will necessitate that valuations be driven by changes in earnings, tempering further price gains. Speculative grade credit may offer better risk-adjusted returns than domestic equities. One of my principal takeaways from my January themes were that forward domestic assets returns were likely to be subdued. With my expectation for the central tendency of domestic equity returns to be in the high single digits, high yield bond returns, which I expected to be in the 6%-7% range after the oil-driven selloff in late 2014, looked good on a relative basis. While the strong equity market performance and recent fixed income sell-off have put domestic equity returns in front of the high yield bond market, the path has been smoother for junk bonds than domestic equities. Below is a graph comparing the year-to-date cumulative total return of the S&P 500 ETF (NYSEARCA: SPY ) versus the SPDR Barclays High Yield Bond ETF (NYSEARCA: JNK ), demonstrating how this theme has played out in 2015. (click to enlarge) Sources: Bloomberg, Standard and Poor’s 6. Lagging returns for risky assets in Europe post-crisis and the likelihood of an increase in quantitative easing could lead to absolute outperformance relative to the U.S., but the variability of outcomes abroad is much wider. Given lower equity multiples and more accommodative monetary policy in Europe than the United States, higher return expectations abroad appear warranted. As the escalating Greek drama has highlighted, the European experiment has challenges unique to the United States. Europe has posted much higher equity returns thus far in 2015… (click to enlarge) Sources: Bloomberg, Standard and Poor’s …but when translated into U.S. dollars, the outperformance has been much less material. (click to enlarge) Sources: Bloomberg, Standard and Poor’s 7. This comparison extends to emerging markets, which could benefit most directly from rebounding economic growth, but remain exposed to global fund flows and the higher beta nature of their commodity-intensive economies. Emerging markets had outperformed for most of the year until the recent swoon. EM stocks have fallen by ten percent in just the last six weeks. (click to enlarge) Sources: Bloomberg, Standard and Poor’s 8. Within emerging markets, return dispersion will widen and could be defined by a given locale’s level of political unrest, fiscal or current account deficit, or exposure to commodities or a slowing China. A surprise uptick in global growth would make most markets winners, but there are many paths to another year of lackluster returns. We have seen historically strong returns from the Shenzen Composite Index (+93%), but negative returns in other Asian economies tied strongly to the Chinese economy. 9. Rising income and wealth inequality, excess global savings, and demography are combining to disrupt normal cyclical demand growth and increasing the risk of secular stagnation. Inequality will become a thematic constant that will inform global politics and policy. Like the first theme on global imbalances, socioeconomic imbalances are likely to remain a continued theme in financial markets and impact politics. 10. With stock prices near all-time highs and bond prices boosted by low interest rates, forward returns will be subnormal. As we head later into the business cycle, investors may wish to move towards a more defensive posturing, lower volatility investments, or look to lock-in cheap tail risk hedges. Domestic equity markets have squeezed out modestly positive returns in the first half, but the expectation for subnormal forward returns remains. While investors have unique time horizons, risk profiles, and risk tolerances, an honest discussion of their personal investment themes should be used to frame their tactical asset allocation. From this review of these first half themes, I expect to publish my themes for the second half in the near-term. I welcome feedback as I sharpen my themes for the second half of 2015. Author’s Disclosure My articles may contain statements and projections that are forward-looking in nature, and therefore inherently subject to numerous risks, uncertainties and assumptions. While my articles focus on generating long-term risk-adjusted returns, investment decisions necessarily involve the risk of loss of principal. Individual investor circumstances vary significantly, and information gleaned from my articles should be applied to your own unique investment situation, objectives, risk tolerance, and investment horizon. Disclosure: I am/we are long SPY. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News