Scalper1 News

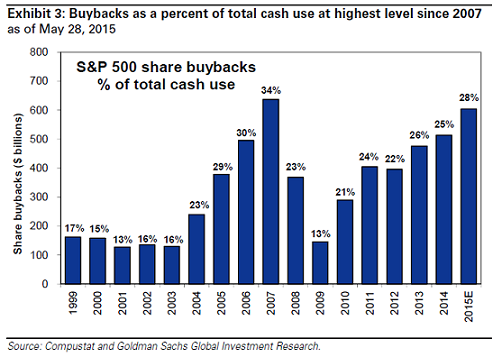

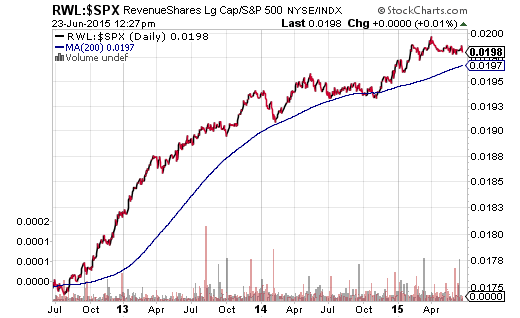

I cannot predict when fundamental valuation will matter again, or when economic weakness will create a panicky rush for the exit doors. What I do know is that fear of missing out eventually gives way to fear of loss. Several things become clear about corporate debt binges at record low rates and the subsequent use of cash to reclaim shares. There are a few ways in which an investor might attempt to circumvent the artificial earnings dilemma. Some facts are more disconcerting than others. For instance, top-line sales at S&P 500 corporations will decline for the second consecutive quarter for the first time since 2009. Equally discouraging? Roughly 70% of these companies (77/106) have reported negative profit-per-share outlooks. Meanwhile, earnings-per-share (EPS) prospects are expected to fall across the entire S&P 500 space. It follows that price-to-earnings (P/E) and price-to-sales (P/S) ratios will place stock assets at even more ridiculously overvalued levels. Few market participants care about the so-called fundamentals in late-state bull markets. Indeed, traditional metrics of stock valuation simply don’t matter (until they do) and complacency reigns supreme (until it does not). Those with extremely bullish biases attempt to spit shine the lusterless economy. However, the Federal Reserve itself downgraded its 2015 forecast for economic expansion. The downgraded pace that the Fed now offers is 1.8%-2.0% – a pace that is slower than the stimulus-stoked 2.1% achieved since the end of the Great Recession. In truth, bulls should hang their collective hat on the $2.7 trillion that S&P 500 corporations borrowed at ultra-low rates over the last past six years. These companies bought back their own stock shares at the highest percent-of-total-cash available since 2007. Several things become clear about corporate debt binges at record low rates and the subsequent use of cash to reclaim shares. First, companies are not particularly talented at judging when to plow dollars into the acquisition of their stock shares. They spent an ever-increasing percentage in the 2003-2007 stock market bull when they might have been better served to spend more modestly on shares and/or use the cash more productively (e.g., hiring, training, R&D, equipment, etc.). Moreover, they spent lower and lower percentages as the 2008-09 bear market raged on when acquiring shares during the bulk of the bear would have been far more favorable. Second, the primary use of stock buybacks has been to manipulate profitability perception. Companies reduce the number of outstanding shares in existence such that less supply of shares are available, even when demand is flat or waning; effectively, prices have a floor underneath them. What’s more, when there are less shares in existence, corporations appear more profitable than they really are. Now let us go back to the earlier reality that, earnings-per-share (EPS) are still expected to decline in Q2. So even with record levels of share buybacks, profitability per share will not rise. Nor will revenue. In fact, sales have been flat for years at many of the big-time Dow components and most in the media fail to highlight revenue shortfalls. There are a few ways in which an investor might attempt to circumvent the artificial earnings dilemma. One possibility is to rely on revenue generating firms, since sales-per-share is more difficult to manufacture than earnings-per-share. The RevenueShares Large Cap ETF (NYSEARCA: RWL ) weights each component of the S&P 500 by revenue rather than market capitalization. The RWL:S&P 500 price ratio below demonstrates that there may be value in overweighting top-line sales winners. One should recognize that outperformance in a bull market is less critical to long-term investing success than losing less in a bear market . Owning RWL won’t be of much service if the “fit hits the shan.” In other words, in an overvalued stock bull where there is high probability of a severe selloff in the not-so-distant future, one might wish to increase his/her allocation to assets on the lowest end of the risk spectrum. Consider employing the iShares 1-3 Year Credit Bond ETF (NYSEARCA: CSJ ), the SPDR Nuveen Barclays Short-Term Municipal Bond ETF (NYSEARCA: SHM ) and/or your money market account. Nobody knows when the global investing community will wake up. I certainly cannot predict when fundamental valuation will matter again, or when economic weakness will create a panicky rush for the exit doors. What I do know is that fear of missing out eventually gives way to fear of loss. The typical U.S. stock bear will destroy 30% of capital that is allocated to the asset class. That is the history of the financial markets. Those who don’t recognize 150 years of equity market activity are doomed to experience similar price depreciation. Raising cash when the prices are higher and buying when the prices are lower may be one’s best defense. Click here for Gary’s latest podcast. Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships. Scalper1 News

I cannot predict when fundamental valuation will matter again, or when economic weakness will create a panicky rush for the exit doors. What I do know is that fear of missing out eventually gives way to fear of loss. Several things become clear about corporate debt binges at record low rates and the subsequent use of cash to reclaim shares. There are a few ways in which an investor might attempt to circumvent the artificial earnings dilemma. Some facts are more disconcerting than others. For instance, top-line sales at S&P 500 corporations will decline for the second consecutive quarter for the first time since 2009. Equally discouraging? Roughly 70% of these companies (77/106) have reported negative profit-per-share outlooks. Meanwhile, earnings-per-share (EPS) prospects are expected to fall across the entire S&P 500 space. It follows that price-to-earnings (P/E) and price-to-sales (P/S) ratios will place stock assets at even more ridiculously overvalued levels. Few market participants care about the so-called fundamentals in late-state bull markets. Indeed, traditional metrics of stock valuation simply don’t matter (until they do) and complacency reigns supreme (until it does not). Those with extremely bullish biases attempt to spit shine the lusterless economy. However, the Federal Reserve itself downgraded its 2015 forecast for economic expansion. The downgraded pace that the Fed now offers is 1.8%-2.0% – a pace that is slower than the stimulus-stoked 2.1% achieved since the end of the Great Recession. In truth, bulls should hang their collective hat on the $2.7 trillion that S&P 500 corporations borrowed at ultra-low rates over the last past six years. These companies bought back their own stock shares at the highest percent-of-total-cash available since 2007. Several things become clear about corporate debt binges at record low rates and the subsequent use of cash to reclaim shares. First, companies are not particularly talented at judging when to plow dollars into the acquisition of their stock shares. They spent an ever-increasing percentage in the 2003-2007 stock market bull when they might have been better served to spend more modestly on shares and/or use the cash more productively (e.g., hiring, training, R&D, equipment, etc.). Moreover, they spent lower and lower percentages as the 2008-09 bear market raged on when acquiring shares during the bulk of the bear would have been far more favorable. Second, the primary use of stock buybacks has been to manipulate profitability perception. Companies reduce the number of outstanding shares in existence such that less supply of shares are available, even when demand is flat or waning; effectively, prices have a floor underneath them. What’s more, when there are less shares in existence, corporations appear more profitable than they really are. Now let us go back to the earlier reality that, earnings-per-share (EPS) are still expected to decline in Q2. So even with record levels of share buybacks, profitability per share will not rise. Nor will revenue. In fact, sales have been flat for years at many of the big-time Dow components and most in the media fail to highlight revenue shortfalls. There are a few ways in which an investor might attempt to circumvent the artificial earnings dilemma. One possibility is to rely on revenue generating firms, since sales-per-share is more difficult to manufacture than earnings-per-share. The RevenueShares Large Cap ETF (NYSEARCA: RWL ) weights each component of the S&P 500 by revenue rather than market capitalization. The RWL:S&P 500 price ratio below demonstrates that there may be value in overweighting top-line sales winners. One should recognize that outperformance in a bull market is less critical to long-term investing success than losing less in a bear market . Owning RWL won’t be of much service if the “fit hits the shan.” In other words, in an overvalued stock bull where there is high probability of a severe selloff in the not-so-distant future, one might wish to increase his/her allocation to assets on the lowest end of the risk spectrum. Consider employing the iShares 1-3 Year Credit Bond ETF (NYSEARCA: CSJ ), the SPDR Nuveen Barclays Short-Term Municipal Bond ETF (NYSEARCA: SHM ) and/or your money market account. Nobody knows when the global investing community will wake up. I certainly cannot predict when fundamental valuation will matter again, or when economic weakness will create a panicky rush for the exit doors. What I do know is that fear of missing out eventually gives way to fear of loss. The typical U.S. stock bear will destroy 30% of capital that is allocated to the asset class. That is the history of the financial markets. Those who don’t recognize 150 years of equity market activity are doomed to experience similar price depreciation. Raising cash when the prices are higher and buying when the prices are lower may be one’s best defense. Click here for Gary’s latest podcast. Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships. Scalper1 News

Scalper1 News