Scalper1 News

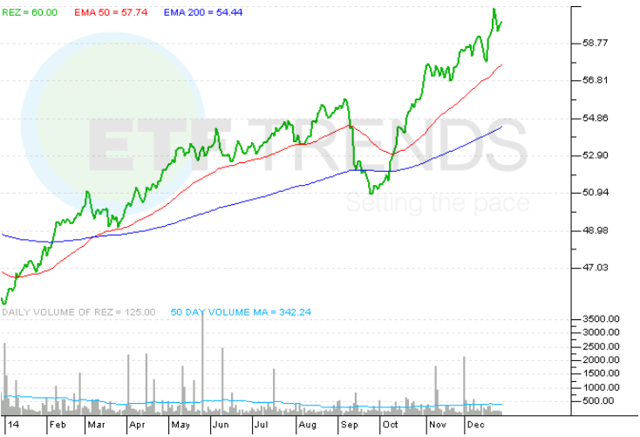

Summary The residential REIT ETF was this year’s best performing financial services fund. However, residential REITs could slow down next year. Rental costs are rising, which in turn could force more renters to buy homes. The residential real estate investment trust exchange traded fund may be this year’s best financial services fund, but things may slow down next year as younger Americans find cheaper financing for a new home. The iShares Residential Real Estate Capped ETF (NYSEArca: REZ ) has increased 37.7% year-to-date as Americans opted to rent instead of purchase a new home this year. REZ offers investors a liquid alternative to physically owning commercial real estate. To qualify as a REIT, a real estate firm has to pay out the majority of its taxable income to shareholders as dividends, and REZ generates its income through renters. Since REITs pay out income to investors, REZ also shows a decent 3.21% 12-month yield. In 2014, U.S. renters paid a collective $441 billion in rent, up $20.6 billion, or 4.9%, from 2013 as renters in San Francisco paid over 14% more in rent, renters in Denver paid 11% more and New Yorkers paid over 10% of all the rent paid in the country, reports Diana Olick for CNBC . Zillow Chief Economist Stan Humphries said in the CNBC article: Over the past 14 years, rents have grown at twice the pace of income due to weak income growth, burgeoning rental demand, and insufficient growth in the supply of rental housing. Next year, we expect rents to rise even faster than home values, meaning that another increase in total rent paid similar to that seen this year isn’t out of the question. In fact, it’s probable. Consequently, the sudden rise in rents could force renters to become new homeowners, especially with cheaper loans available. Specifically, Fannie Mae and Freddie Mac have announced low-down payment loans and mortgage rates are also still attractive. Currently, Fannie Mae and Freddie Mac implement a minimum 5% down payment on home loans. However, the lenders could change it to a 3% minimum, which would allow creditworthy but cash-strapped consumers to acquire a new home. Additionally, mortgage rates remain depressed after Treasury bond yields made a surprising turnaround this year, with benchmark 10-year yields down to 2.2% compared to about 3.0% at the start of 2014. Zillow’s Humphries added: As we prepare for New Year’s and the next home shopping season, we expect soaring rents to entice more people to the relative stability of home ownership, particularly younger potential buyers. iShares Residential Real Estate Capped ETF (click to enlarge) Max Chen contributed to this article . Scalper1 News

Summary The residential REIT ETF was this year’s best performing financial services fund. However, residential REITs could slow down next year. Rental costs are rising, which in turn could force more renters to buy homes. The residential real estate investment trust exchange traded fund may be this year’s best financial services fund, but things may slow down next year as younger Americans find cheaper financing for a new home. The iShares Residential Real Estate Capped ETF (NYSEArca: REZ ) has increased 37.7% year-to-date as Americans opted to rent instead of purchase a new home this year. REZ offers investors a liquid alternative to physically owning commercial real estate. To qualify as a REIT, a real estate firm has to pay out the majority of its taxable income to shareholders as dividends, and REZ generates its income through renters. Since REITs pay out income to investors, REZ also shows a decent 3.21% 12-month yield. In 2014, U.S. renters paid a collective $441 billion in rent, up $20.6 billion, or 4.9%, from 2013 as renters in San Francisco paid over 14% more in rent, renters in Denver paid 11% more and New Yorkers paid over 10% of all the rent paid in the country, reports Diana Olick for CNBC . Zillow Chief Economist Stan Humphries said in the CNBC article: Over the past 14 years, rents have grown at twice the pace of income due to weak income growth, burgeoning rental demand, and insufficient growth in the supply of rental housing. Next year, we expect rents to rise even faster than home values, meaning that another increase in total rent paid similar to that seen this year isn’t out of the question. In fact, it’s probable. Consequently, the sudden rise in rents could force renters to become new homeowners, especially with cheaper loans available. Specifically, Fannie Mae and Freddie Mac have announced low-down payment loans and mortgage rates are also still attractive. Currently, Fannie Mae and Freddie Mac implement a minimum 5% down payment on home loans. However, the lenders could change it to a 3% minimum, which would allow creditworthy but cash-strapped consumers to acquire a new home. Additionally, mortgage rates remain depressed after Treasury bond yields made a surprising turnaround this year, with benchmark 10-year yields down to 2.2% compared to about 3.0% at the start of 2014. Zillow’s Humphries added: As we prepare for New Year’s and the next home shopping season, we expect soaring rents to entice more people to the relative stability of home ownership, particularly younger potential buyers. iShares Residential Real Estate Capped ETF (click to enlarge) Max Chen contributed to this article . Scalper1 News

Scalper1 News