Reliance Steel & Aluminum Co.RS is set to release its fourth-quarter 2016 results before the opening bell on Feb 16.

Reliance Steel posted a profit of $ 49.5 million or 68 cents per share in third-quarter 2016, down around 4% from $ 51.4 million or 69 cents per share a year ago. Reliance Steel’s adjusted earnings and sales for third-quarter 2016 missed the respective Zacks Consensus Estimate. Lower volumes and pricing hurt sales in the quarter.

In the last quarter, the company delivered a negative earnings surprise of 4.58%. Reliance Steel has beaten earnings estimates in three of the trailing four quarters with an average beat of 5.6%.

Let’s see how things are shaping up for this announcement.

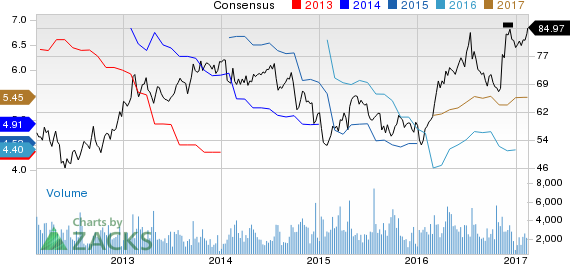

Reliance Steel & Aluminum Co. Price and Consensus

Reliance Steel & Aluminum Co. Price and Consensus | Reliance Steel & Aluminum Co. Quote

Factors to Consider

Reliance Steel expects overall sales volumes to be down 5-7% in the fourth quarter. The company anticipates metals pricing for most of its products to witness a downward trend in the fourth quarter. It expects its average selling price in the fourth quarter to be down 1% to 3% sequentially. Reliance Steel expects adjusted earnings for the fourth quarter in a band of 65 cents to 75 cents per share. Also, the company is cautious about business activity levels in the fourth quarter.

The company should gain from its aggressive acquisition strategies. The addition of Metals USA to Reliance Steel’s portfolio complements its existing customer base, product mix and geographic footprint. With this acquisition, the company expects synergies of $ 15-$ 20 million a year.

The acquisition of Aluminium Services UK Limited has enabled Reliance Steel to expand its presence in the aerospace market. The purchase of Fox Metals and Alloys has also strengthened the company’s foothold in the oil and gas space. Further, the buyout of Tubular Steel has enhanced the company’s long-term growth strategy and strength by expanding its product portfolio and end market diversification.

The acquisition of Best Manufacturing Inc. also highly complements the company’s existing service center network with its specialty high margin products, value-added processing capabilities and strong focus on customer service. The company recently acquired Alaska Steel Company, a full-line metal distributor.

Reliance Steel is witnessing strong demand for its products across the aerospace and automotive markets supported by higher commercial aerospace build rates. Strong demand is also witnessed in the automotive market, backed by the company’s toll processing businesses in the U.S. and Mexico as well as increased use of aluminum in the industry.

Reliance Steel has outperformed the Zacks categorized Metal-Products Distributor industry over the past three months. The company’s shares gained 7% over this period while the industry saw a decline of 31.3%.

However, Reliance Steel witnessed pricing pressure in the third quarter owing to overall weaker demand and the normal seasonal factors. Pricing pressure is expected to continue in the fourth quarter.

The company’s business in the energy markets is expected to remain under pressure due to depressed oil prices . Reduced drilling activities are hurting demand for the company’s products in the energy space. While there has been some recovery of late, in the non-residential construction market, demand still remains significantly low.

Earnings Whispers

Our proven model does not conclusively show that Reliance Steel is likely to beat estimates this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. This is not the case here, as you will see below:

Zacks ESP : Earnings ESP for Reliance Steel is currently 0.00%. This is because the Most Accurate estimate and the Zacks Consensus Estimate are both pegged at 75 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter .

Zacks Rank : Reliance Steel carries a Zacks Rank #2. Though a Zacks Rank #2 increases the predictive power of ESP, the company’s ESP of 0.00% makes surprise prediction difficult.

Concurrently, we caution against Sell-rated stocks (#4 or 5) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks to Consider

Here are some companies in the basic materials space you may want to consider as our model shows that these have the right combination of elements to post an earnings beat this quarter:

Iamgold Corporation IAG has an Earnings ESP of +100% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Intrepid Potash Inc IPI has an Earnings ESP of +20% and carries a Zacks Rank #2.

VALE S.A. VALE has an Earnings ESP of +34.3% and holds a Zacks Rank #2.

The Best Place to Start Your Stock Search

Today, you are invited to download the full list of 220 Zacks Rank #1 “”Strong Buy”” stocks – absolutely free of charge. Since 1988, Zacks Rank #1 stocks have nearly tripled the market, with average gains of +26% per year. Plus, you can access the list of portfolio-killing Zacks Rank #5 “”Strong Sells”” and other private research. See these stocks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intrepid Potash, Inc (IPI): Free Stock Analysis Report

Iamgold Corporation (IAG): Free Stock Analysis Report

VALE S.A. (VALE): Free Stock Analysis Report

Reliance Steel & Aluminum Co. (RS): Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International