Scalper1 News

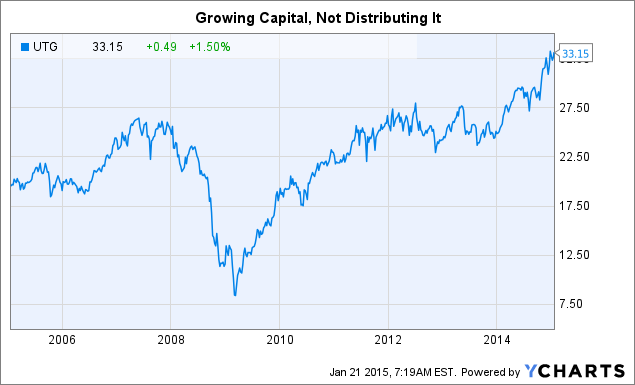

Like so many CEFs, UTG lost ground during the last recession… but it managed to maintain and subsequently grow its distribution. Impressively, UTG’s distribution has, so far, never contained any return of capital. Although leverage is a concern, UTG has proven it’s a worthwhile utility option. One of the most frequent concerns about closed-end funds, or CEFs, is return of capital distributions. So it should come as a pleasant surprise that Reaves Utility Income Fund (NYSEMKT: UTG ) has never had to use return of capital, despite a notable, though not excessive, yield of around 5.5%. And the dividend has never been cut, either. If you are looking for a long-term utility fund that provides steady, monthly income, Reaves should be on your watch list. Core sector fund Reaves Utility Income Fund , obviously, focuses on the utility sector. The portfolio is largely comprised of utilities (electric, gas, water, and telecom), with some small exposure to railways, media, and real estate investment trusts. However, even in these non-utility areas, the focus is on utility-like or focused businesses. Its media exposure, for example, is largely comprised of cable companies. And the real estate exposure is in the cell phone tower space. Railways, meanwhile, are core suppliers to the utility industry. So Reaves provides fairly broad exposure to the utility space, but not exclusive exposure to the electricity industry. Management uses both qualitative and quantitative approaches as it looks for investments. For example, it conducts interviews with potential investments, their competitors, and suppliers. This helps create both an outlook for a company and for the broader industry. That, in turn, feeds into models that Reaves builds to help get a handle on a company’s, “…robustness under differing business scenarios…” Another key factor is an evaluation of a company’s management, examining such things as the competence of corporate leaders, their track record, and their alignment with shareholders’ interests. And while all of the above effort may point to a great company, Reaves also takes a stern look at valuation, considering measures such as Price to Earnings, Price to Book, and Price to Cash Flow. It also examines, “…historical absolute and relative dividend…” yields and such technical factors as short interest and liquidity. Reaves also has the leeway to use leverage. According to the Closed-End Fund Association , leverage recently stood at nearly 30%. It can go as high as 38%. Leverage can be a double-edged sword, enhancing performance in good markets and exacerbating losses in bad ones. It’s an issue to keep an eye on, with at least the expectation of increased volatility if you own the CEF. Leverage is also one of the reasons that the fund’s expense ratio is a bit high at around 1.7%. Although the CEF does not have a stated dividend mandate, it pays monthly and has elected to keep a level distribution. That distribution is at the discretion of the board of directors. Impressively, the dividend has been increased seven times since the fund started paying dividends in April of 2004. It has never been cut, not even during the deep 2007 to 2009 recession. And, perhaps even more impressive, it has never included return of capital. That’s an important feature for investors who are concerned that distributions are just giving them back their principle and eating away at the fund’s net asset value over time. That’s not the case at Reaves Utility Income Fund and while the yield is likely less then you might get elsewhere, that seems a decent trade-off if you want to avoid return of capital. Performance With this as background, how has Reaves Utility Income Fund actually performed? Over the tailing 10 years through year end 2014, Reaves posted an annualized return of 12.8% based on market price and 11.5% based on net asset value, or NAV, according to Morningstar. For comparison, Vanguard Utilities ETF returned an annualized 9.5% over the same span. That’s a pretty compelling record, to the say the least. That said, it’s worth noting that 2008 was a terrible year for Reaves Utility Income on both an absolute and relative basis. For example, while Vanguard Utilities ETF fell around 28%, Reaves’ share price fell nearly 50%, with an NAV decline of roughly 43%. Clearly, leverage made things worse in 2008. That said, in 2009, Reaves’ NAV advanced 35% with a market price recovery of 75%. Vanguard Utilities ETF was up a far less impressive 11.5% or so that year. That’s the happier edge of the leverage sword. And while the fund doesn’t always beat the broader utility group, it has done so often enough and with large enough margins that it has put up a very compelling long-term record. UTG data by YCharts And while Morningstar’s trailing performance data include distributions because they are total return figures, the fund’s share price is up some 60% or so over the last decade. It has more than made up for the decline during the recession and not only protected investors’ capital, but grew it. All while paying a growing dividend. That’s in sharp contrast to many other closed-end funds, which fell hard during the “great recession” and have lingered at relatively low levels. Often that’s because of return of capital limiting, or even detracting from, NAV growth. That’s frequently the trade-off for high yields. Of course, dividend cuts have also been a common occurrence, too, at other funds, which can make what was a large income stream much smaller. A worthy option If you are in the market for a utility fund, you should take a look at Reaves. Although a little expensive and potentially volatile, the fund’s long-term performance has been strong while supporting a growing dividend. The fund’s roughly 3% discount isn’t a compellingly cheap entry point, but the average discount over the past decade is around 5.5%. So, yes, it could be cheaper, but if you are looking for a good fund right now, I wouldn’t let this stop you. All in, this is a fund I’d recommend to my own father. Scalper1 News

Like so many CEFs, UTG lost ground during the last recession… but it managed to maintain and subsequently grow its distribution. Impressively, UTG’s distribution has, so far, never contained any return of capital. Although leverage is a concern, UTG has proven it’s a worthwhile utility option. One of the most frequent concerns about closed-end funds, or CEFs, is return of capital distributions. So it should come as a pleasant surprise that Reaves Utility Income Fund (NYSEMKT: UTG ) has never had to use return of capital, despite a notable, though not excessive, yield of around 5.5%. And the dividend has never been cut, either. If you are looking for a long-term utility fund that provides steady, monthly income, Reaves should be on your watch list. Core sector fund Reaves Utility Income Fund , obviously, focuses on the utility sector. The portfolio is largely comprised of utilities (electric, gas, water, and telecom), with some small exposure to railways, media, and real estate investment trusts. However, even in these non-utility areas, the focus is on utility-like or focused businesses. Its media exposure, for example, is largely comprised of cable companies. And the real estate exposure is in the cell phone tower space. Railways, meanwhile, are core suppliers to the utility industry. So Reaves provides fairly broad exposure to the utility space, but not exclusive exposure to the electricity industry. Management uses both qualitative and quantitative approaches as it looks for investments. For example, it conducts interviews with potential investments, their competitors, and suppliers. This helps create both an outlook for a company and for the broader industry. That, in turn, feeds into models that Reaves builds to help get a handle on a company’s, “…robustness under differing business scenarios…” Another key factor is an evaluation of a company’s management, examining such things as the competence of corporate leaders, their track record, and their alignment with shareholders’ interests. And while all of the above effort may point to a great company, Reaves also takes a stern look at valuation, considering measures such as Price to Earnings, Price to Book, and Price to Cash Flow. It also examines, “…historical absolute and relative dividend…” yields and such technical factors as short interest and liquidity. Reaves also has the leeway to use leverage. According to the Closed-End Fund Association , leverage recently stood at nearly 30%. It can go as high as 38%. Leverage can be a double-edged sword, enhancing performance in good markets and exacerbating losses in bad ones. It’s an issue to keep an eye on, with at least the expectation of increased volatility if you own the CEF. Leverage is also one of the reasons that the fund’s expense ratio is a bit high at around 1.7%. Although the CEF does not have a stated dividend mandate, it pays monthly and has elected to keep a level distribution. That distribution is at the discretion of the board of directors. Impressively, the dividend has been increased seven times since the fund started paying dividends in April of 2004. It has never been cut, not even during the deep 2007 to 2009 recession. And, perhaps even more impressive, it has never included return of capital. That’s an important feature for investors who are concerned that distributions are just giving them back their principle and eating away at the fund’s net asset value over time. That’s not the case at Reaves Utility Income Fund and while the yield is likely less then you might get elsewhere, that seems a decent trade-off if you want to avoid return of capital. Performance With this as background, how has Reaves Utility Income Fund actually performed? Over the tailing 10 years through year end 2014, Reaves posted an annualized return of 12.8% based on market price and 11.5% based on net asset value, or NAV, according to Morningstar. For comparison, Vanguard Utilities ETF returned an annualized 9.5% over the same span. That’s a pretty compelling record, to the say the least. That said, it’s worth noting that 2008 was a terrible year for Reaves Utility Income on both an absolute and relative basis. For example, while Vanguard Utilities ETF fell around 28%, Reaves’ share price fell nearly 50%, with an NAV decline of roughly 43%. Clearly, leverage made things worse in 2008. That said, in 2009, Reaves’ NAV advanced 35% with a market price recovery of 75%. Vanguard Utilities ETF was up a far less impressive 11.5% or so that year. That’s the happier edge of the leverage sword. And while the fund doesn’t always beat the broader utility group, it has done so often enough and with large enough margins that it has put up a very compelling long-term record. UTG data by YCharts And while Morningstar’s trailing performance data include distributions because they are total return figures, the fund’s share price is up some 60% or so over the last decade. It has more than made up for the decline during the recession and not only protected investors’ capital, but grew it. All while paying a growing dividend. That’s in sharp contrast to many other closed-end funds, which fell hard during the “great recession” and have lingered at relatively low levels. Often that’s because of return of capital limiting, or even detracting from, NAV growth. That’s frequently the trade-off for high yields. Of course, dividend cuts have also been a common occurrence, too, at other funds, which can make what was a large income stream much smaller. A worthy option If you are in the market for a utility fund, you should take a look at Reaves. Although a little expensive and potentially volatile, the fund’s long-term performance has been strong while supporting a growing dividend. The fund’s roughly 3% discount isn’t a compellingly cheap entry point, but the average discount over the past decade is around 5.5%. So, yes, it could be cheaper, but if you are looking for a good fund right now, I wouldn’t let this stop you. All in, this is a fund I’d recommend to my own father. Scalper1 News

Scalper1 News