Scalper1 News

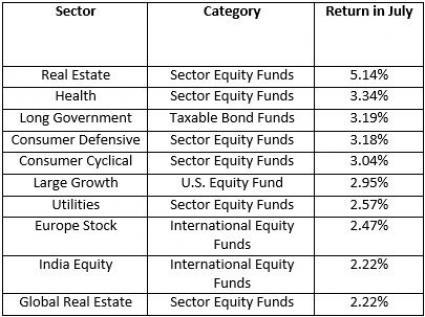

Recent construction spending data was disappointing, but the Real Estate sector has a lot to cheer for. The decline may be a blip for the Real Estate sector, which scored the best gains in July among all categories of funds. The Real Estate sector’s July gains reversed the negative three-month return. The robust performance in July is also a massive improvement from the second quarter’s loss of 7.7%. The Global Real Estate sector lost 4.4% in the second quarter. Among the top five, strong gains were scored mostly by Sector Equity funds. According to Morningstar data, four of the five best category gainers in July were Sector Equity funds, while Long Government from Taxable Bond Funds category was the other one. Markets began the second half of 2015 on a positive note as all benchmarks ended July in the green. The Dow, S&P 500 and Nasdaq rose 0.4%, 2% and 2.9% in July. Markets managed to register gains in July despite weak earnings and international growth concerns. China’s equity markets underwent a significant downturn, heightening investor concerns. Meanwhile, oil prices remained southbound, leading to losses for the sector. Real Estate Gains Over 5% in July Source: Morningstar The Real Estate sector’s over 5% gain in July outpaced the second-place Health sector, which otherwise has been a consistent top performer. Global Real Estate sector also featured in the top 10 gainers’ list. The Consumer sector has been enjoying a multitude of positives including improving economic numbers. The Europe Stock sector’s inclusion was not much of a surprise after Greece’s debt negotiations concerns ebbed. Also, data from the Investment Company Institute revealed that U.S.-based mutual funds had poured $5.1 billion to international stock funds for week ending July 22. This inflow was largely boosted by optimism that European shares will outperform the US counterparts. Coming back to the best gainer – Real Estate, along with resurgence in the labor market, homebuilding has been one of the bright spots of the economic recovery. In July, Case-Shiller data showed that home price growth had declined marginally, which indicated that the recovery is stabilizing. As homebuilders cater to tight housing supply, the demand for building materials is expected to remain high. Given such a scenario, investing in producers of such goods remains a prudent move. July Data Indicated Strength Housing data released in July indicated a healthy pace of growth. Building permits jumped 7.4% from May, while privately-owned housing starts surged 9.8% in June. Existing home sales increased 3.2% to a seasonally adjusted annual rate of 5.49 million in June, beating the consensus estimate of 5.4 million. Sales increased at the fastest rate since Feb 2007. Homebuilder sentiment was also upbeat. Homebuilders’ confidence for new single-family homes, as indicated by the National Association of Home Builders (NAHB)/Wells Fargo housing market index (HMI), remained at 60 in July – the highest reading since Nov 2005. The June reading was revised upward to 60 from 59 earlier. The only jarring note was struck by a surprising decline in new home sales. This metric declined to its lowest level in seven months in June. At the end of July, the National Association of Realtors reported that Pending Home Sales Index, a forward-looking indicator based on contract signings, went down 1.8% to 110.3 in June. The consensus estimate had projected a rise by 1.5%. Home Price Rise Moderates S&P/Case-Shiller Home Price Indices data indicates that home prices are continuing to rise. However, the extent of price increases seems to have moderated. In May, the U.S. National Home Price Index increased 4.4% on an annual basis, higher than the 4.3% rise experienced in April. The 10-City Composite increased 4.7% on an annual basis in May, higher than the 4.6% recorded in April. However, the rate of gain for the 20-City Composite declined. This index increased 4.9% on a year-over-year basis in May, a shade lower than the increase recorded in April. More importantly, post seasonal adjustment the national index remained flat on a month-over-month basis. However, both the 10-City and 20-City Composite Indexes declined 0.2% on a monthly basis. This marginal decline shows that the housing price increases are stabilizing. It actually bodes well for the sector, since it could lead to sustainable growth for the housing sector. Moderating prices imply that the demand-supply situation is stabilizing to a point where affordability increases for buyers. Large increases in prices have kept several potential buyers away from the housing market. This could now cease being a concern. Top 10 Real Estate Fund Gainers Below we present the top 10 gainers from the Real Estate sector in July: Note: The list excludes the same funds with different classes, and institutional funds have been excluded. Funds having minimum initial investment above $5000 have been excluded. The best gain was scored by PIMCO Real Estate Real Return Strategy A (MUTF: PETAX ), which currently carries a Zacks Mutual Fund Rank #1 (Strong Buy). Also carrying favorable ranks are Virtus Real Estate Securities A (MUTF: PHRAX ), Fidelity Real Estate Investment (MUTF: FRESX ), Principal Real Estate Sec A (MUTF: PRRAX ) and AMG Managers Real Estate Securities (MUTF: MRESX ). All these funds carry a Zacks Mutual Fund Rank #2 (Buy). However, not all funds are safe picks at the moment from this list. While Oppenheimer Real Estate A (MUTF: OREAX ) carries a Zacks Mutual Fund Rank #5 (Strong Sell), Ivy Real Estate Securities A (MUTF: IRSAX ) and Voya Real Estate A (MUTF: CLARX ) hold a Zacks Mutual Fund Rank #4 (Sell). For investors interested in the Real Estate sector, below we present 2 funds that are most likely to continue uptrend. They carry favorable Zacks Mutual Fund Rank, have low expense ratio and carry no sales load. The minimum initial investment is within $5000. Fidelity International Real Estate (MUTF: FIREX ) invests a large chunk of its assets in companies related to real estate sector. FIREX focuses on acquiring common stocks of companies located in foreign countries. FIREX diversifies its assets across a wide range of countries. FIREX currently carries a Zacks Mutual Fund Rank #1 and has returned 5.4% year to date. The 3- and 5-year annualized returns are 13.7% and 10.4%. The annual expense ratio of 1.13% is lower than the category average of 1.40%. CGM Realty (MUTF: CGMRX ) seeks high income and long-term capital appreciation. CGMRX invests a lion’s share of its assets in securities of real estate companies including REITs. CGMRX may invest a maximum of 20% of its assets in securities that are not related to real estate domain, which also include debt securities. CGMRX invests in companies located throughout the globe irrespective of their market capitalizations. CGMRX currently carries a Zacks Mutual Fund Rank #1 and has returned 4.7% year to date. The 3- and 5-year annualized returns are 11.8% and 12.6%. The annual expense ratio of 0.92% is lower than the category average of 1.33%. Original Post Scalper1 News

Recent construction spending data was disappointing, but the Real Estate sector has a lot to cheer for. The decline may be a blip for the Real Estate sector, which scored the best gains in July among all categories of funds. The Real Estate sector’s July gains reversed the negative three-month return. The robust performance in July is also a massive improvement from the second quarter’s loss of 7.7%. The Global Real Estate sector lost 4.4% in the second quarter. Among the top five, strong gains were scored mostly by Sector Equity funds. According to Morningstar data, four of the five best category gainers in July were Sector Equity funds, while Long Government from Taxable Bond Funds category was the other one. Markets began the second half of 2015 on a positive note as all benchmarks ended July in the green. The Dow, S&P 500 and Nasdaq rose 0.4%, 2% and 2.9% in July. Markets managed to register gains in July despite weak earnings and international growth concerns. China’s equity markets underwent a significant downturn, heightening investor concerns. Meanwhile, oil prices remained southbound, leading to losses for the sector. Real Estate Gains Over 5% in July Source: Morningstar The Real Estate sector’s over 5% gain in July outpaced the second-place Health sector, which otherwise has been a consistent top performer. Global Real Estate sector also featured in the top 10 gainers’ list. The Consumer sector has been enjoying a multitude of positives including improving economic numbers. The Europe Stock sector’s inclusion was not much of a surprise after Greece’s debt negotiations concerns ebbed. Also, data from the Investment Company Institute revealed that U.S.-based mutual funds had poured $5.1 billion to international stock funds for week ending July 22. This inflow was largely boosted by optimism that European shares will outperform the US counterparts. Coming back to the best gainer – Real Estate, along with resurgence in the labor market, homebuilding has been one of the bright spots of the economic recovery. In July, Case-Shiller data showed that home price growth had declined marginally, which indicated that the recovery is stabilizing. As homebuilders cater to tight housing supply, the demand for building materials is expected to remain high. Given such a scenario, investing in producers of such goods remains a prudent move. July Data Indicated Strength Housing data released in July indicated a healthy pace of growth. Building permits jumped 7.4% from May, while privately-owned housing starts surged 9.8% in June. Existing home sales increased 3.2% to a seasonally adjusted annual rate of 5.49 million in June, beating the consensus estimate of 5.4 million. Sales increased at the fastest rate since Feb 2007. Homebuilder sentiment was also upbeat. Homebuilders’ confidence for new single-family homes, as indicated by the National Association of Home Builders (NAHB)/Wells Fargo housing market index (HMI), remained at 60 in July – the highest reading since Nov 2005. The June reading was revised upward to 60 from 59 earlier. The only jarring note was struck by a surprising decline in new home sales. This metric declined to its lowest level in seven months in June. At the end of July, the National Association of Realtors reported that Pending Home Sales Index, a forward-looking indicator based on contract signings, went down 1.8% to 110.3 in June. The consensus estimate had projected a rise by 1.5%. Home Price Rise Moderates S&P/Case-Shiller Home Price Indices data indicates that home prices are continuing to rise. However, the extent of price increases seems to have moderated. In May, the U.S. National Home Price Index increased 4.4% on an annual basis, higher than the 4.3% rise experienced in April. The 10-City Composite increased 4.7% on an annual basis in May, higher than the 4.6% recorded in April. However, the rate of gain for the 20-City Composite declined. This index increased 4.9% on a year-over-year basis in May, a shade lower than the increase recorded in April. More importantly, post seasonal adjustment the national index remained flat on a month-over-month basis. However, both the 10-City and 20-City Composite Indexes declined 0.2% on a monthly basis. This marginal decline shows that the housing price increases are stabilizing. It actually bodes well for the sector, since it could lead to sustainable growth for the housing sector. Moderating prices imply that the demand-supply situation is stabilizing to a point where affordability increases for buyers. Large increases in prices have kept several potential buyers away from the housing market. This could now cease being a concern. Top 10 Real Estate Fund Gainers Below we present the top 10 gainers from the Real Estate sector in July: Note: The list excludes the same funds with different classes, and institutional funds have been excluded. Funds having minimum initial investment above $5000 have been excluded. The best gain was scored by PIMCO Real Estate Real Return Strategy A (MUTF: PETAX ), which currently carries a Zacks Mutual Fund Rank #1 (Strong Buy). Also carrying favorable ranks are Virtus Real Estate Securities A (MUTF: PHRAX ), Fidelity Real Estate Investment (MUTF: FRESX ), Principal Real Estate Sec A (MUTF: PRRAX ) and AMG Managers Real Estate Securities (MUTF: MRESX ). All these funds carry a Zacks Mutual Fund Rank #2 (Buy). However, not all funds are safe picks at the moment from this list. While Oppenheimer Real Estate A (MUTF: OREAX ) carries a Zacks Mutual Fund Rank #5 (Strong Sell), Ivy Real Estate Securities A (MUTF: IRSAX ) and Voya Real Estate A (MUTF: CLARX ) hold a Zacks Mutual Fund Rank #4 (Sell). For investors interested in the Real Estate sector, below we present 2 funds that are most likely to continue uptrend. They carry favorable Zacks Mutual Fund Rank, have low expense ratio and carry no sales load. The minimum initial investment is within $5000. Fidelity International Real Estate (MUTF: FIREX ) invests a large chunk of its assets in companies related to real estate sector. FIREX focuses on acquiring common stocks of companies located in foreign countries. FIREX diversifies its assets across a wide range of countries. FIREX currently carries a Zacks Mutual Fund Rank #1 and has returned 5.4% year to date. The 3- and 5-year annualized returns are 13.7% and 10.4%. The annual expense ratio of 1.13% is lower than the category average of 1.40%. CGM Realty (MUTF: CGMRX ) seeks high income and long-term capital appreciation. CGMRX invests a lion’s share of its assets in securities of real estate companies including REITs. CGMRX may invest a maximum of 20% of its assets in securities that are not related to real estate domain, which also include debt securities. CGMRX invests in companies located throughout the globe irrespective of their market capitalizations. CGMRX currently carries a Zacks Mutual Fund Rank #1 and has returned 4.7% year to date. The 3- and 5-year annualized returns are 11.8% and 12.6%. The annual expense ratio of 0.92% is lower than the category average of 1.33%. Original Post Scalper1 News

Scalper1 News