Scalper1 News

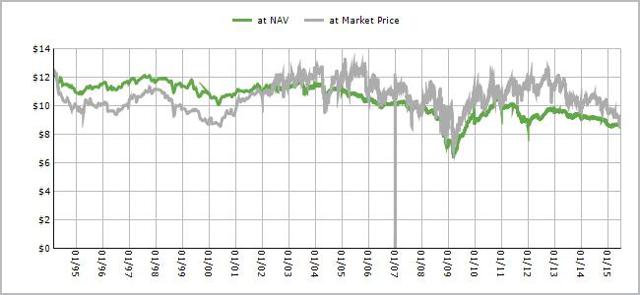

RCS is now trading at NAV, giving investors value. Rates are still low and will continue to stay low, even after initial increases. Bond funds focused on short-term maturities should outperform longer-term bonds. The purpose of this article is to evaluate the PIMCO Strategic Income Fund (NYSE: RCS ) as an investment option. To do so, I will look at recent fund performance, current holdings and allocation, and trends in the market to attempt to determine how well it will do going forward. First, a little about RCS. RCS is a closed-end fund that seeks to generate a level of income that is higher than that generated by high-quality, intermediate-term U.S. debt securities. That is the fund’s stated objective, with capital appreciation as a secondary objective. The fund is currently trading at $8.58/share and pays a monthly dividend of $.08/share, which translates to an annual yield of 11.19%. Recently, RCS, along with most Pimco funds, has been in a serious downtrend. Year-to-date, RCS is down over 9%, and over the past year the fund is down almost 19%, both figures exclude dividend payments. Once dividends are taken in to consideration, RCS’ performance is not quite as poor, but it is still not providing the steady returns bond investors would expect. In comparison, the iShares Barclays Aggregate Bond Fund (NYSEARCA: AGG ) is down about 1.5% year-to-date, and has essentially broken even over the past year, while providing an annualized yield of 2.32%. While RCS has not performed well recently, I will outline a few reasons why RCS will overcome its current headwinds and should improve its performance throughout the rest of the year. First, the drop in RCS has brought the fund down to a reasonable valuation level. The fund now trades at just a slight premium of .23%, which is essentially even with its Net Asset Value (NAV). Many Pimco funds trade at premiums to their NAV, so RCS represents a better value over some of these competing funds. This represents an attractive entry point for RCS, since the fund typically trades at a premium to its NAV, as indicated by the historical chart below: (click to enlarge) As you can see from the chart, RCS has traded at a premium fairly consistently since 2005, well before the financial crisis, so it is not an anomaly that derived out of the recession. To me, this indicates that the selling of RCS has reached its limit, and further downward pressure will be unlikely given its historical trading patterns and high yield to act as a buffer. New investors can use the steep drop in share price to pick up the fund at an attractive valuation. A second reason why I like RCS has to do with its make-up, with the fund sporting an effective maturity average of 3 years , with the vast majority of the bonds maturing in 5 years or less. This compares to other popular funds such as PGP and PHK, which hold average maturity levels of 6 years and 4 years , respectively. This is important because interest rates are set to rise in the near future, so funds with shorter maturity time periods should outperform those with longer maturity periods. This is because the risk increases the further out in the future the maturity date is in a rising rate environment. A rising rate environment is all but a certainty over the next 3-6 months, based on recent Federal Reserve statements and coverage . Therefore, investors want to limit their exposure to longer-term maturities, and focus on bond funds that have shorter durations, such as RCS. A final reason why I like RCS has to do with its high, and reliable, distribution rate. RCS currently sports a yield over 11%, which provides a high income stream for investors in a low rate environment, and will help buffer the fund against further losses. While I just mentioned that interest rates are set to rise, the increases are sure to be modest at first. In fact, Janet Yellen indicated, after the most recent Fed meeting, that interest rates will rise slower than previously anticipated . The current consensus now is that rates will not exceed 2% by the end of 2016, meaning that the U.S. will continue to experience a historically low rate environment for at least another year and a half. This means that investors will continue to be on the hunt for yield, and a mass exodus from bond funds will probably not occur anytime soon because of this. With a yield over 11%, RCS will provide income driven investors a place to continue to earn a high yield while interest rates stay low. Of course, investing in RCS is not without risk. Pimco funds have been in steady downtrends lately, and the selling could continue as investors fret over rising interest rates and over the legacy of Bill Gross’ depature from the company , which continues to plague his former funds. Additionally, interest rates could end up rising sooner, and more aggressively, than anticipated. If this occurs, investors will be able to earn higher returns on safe investments, like US Treasuries, and the appetite for leveraged bond funds will decline somewhat. However, I do not see these scenarios continuing to hurt RCS. For one, investors have been recently reassured that the interest rate increases will be gradual. Also, as stated earlier, RCS’ share price has reached its NAV, providing a nice backdrop against further selling. While many Pimco funds trade at discounts to NAV and that could certainly happen to RCS, the fund has traded at a premium consistently for the past ten years, so the risk is somewhat muted. And, given RCS’ reliable distribution, a further drop in share price will provide investors with a higher yield, helping to make up for the loss in principal. Bottom line: Pimco funds have performed poorly in 2015, and RCS is no exception. These funds have come under pressure due to Bill Gross’ departure, the threat of rising interest rates, and a share price correction towards NAV for many funds that have been trading at large premiums. However, RCS has now reached a level that provides investors with a reasonable valuation and a high yield. With interest rates set to remain low through the end of next year, investors will continue to look for options that provide more income than a 1% savings account or 3% dividend fund. With a reliable monthly distribution, and the risk of further price depreciation muted, I would encourage investors to consider this fund. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

RCS is now trading at NAV, giving investors value. Rates are still low and will continue to stay low, even after initial increases. Bond funds focused on short-term maturities should outperform longer-term bonds. The purpose of this article is to evaluate the PIMCO Strategic Income Fund (NYSE: RCS ) as an investment option. To do so, I will look at recent fund performance, current holdings and allocation, and trends in the market to attempt to determine how well it will do going forward. First, a little about RCS. RCS is a closed-end fund that seeks to generate a level of income that is higher than that generated by high-quality, intermediate-term U.S. debt securities. That is the fund’s stated objective, with capital appreciation as a secondary objective. The fund is currently trading at $8.58/share and pays a monthly dividend of $.08/share, which translates to an annual yield of 11.19%. Recently, RCS, along with most Pimco funds, has been in a serious downtrend. Year-to-date, RCS is down over 9%, and over the past year the fund is down almost 19%, both figures exclude dividend payments. Once dividends are taken in to consideration, RCS’ performance is not quite as poor, but it is still not providing the steady returns bond investors would expect. In comparison, the iShares Barclays Aggregate Bond Fund (NYSEARCA: AGG ) is down about 1.5% year-to-date, and has essentially broken even over the past year, while providing an annualized yield of 2.32%. While RCS has not performed well recently, I will outline a few reasons why RCS will overcome its current headwinds and should improve its performance throughout the rest of the year. First, the drop in RCS has brought the fund down to a reasonable valuation level. The fund now trades at just a slight premium of .23%, which is essentially even with its Net Asset Value (NAV). Many Pimco funds trade at premiums to their NAV, so RCS represents a better value over some of these competing funds. This represents an attractive entry point for RCS, since the fund typically trades at a premium to its NAV, as indicated by the historical chart below: (click to enlarge) As you can see from the chart, RCS has traded at a premium fairly consistently since 2005, well before the financial crisis, so it is not an anomaly that derived out of the recession. To me, this indicates that the selling of RCS has reached its limit, and further downward pressure will be unlikely given its historical trading patterns and high yield to act as a buffer. New investors can use the steep drop in share price to pick up the fund at an attractive valuation. A second reason why I like RCS has to do with its make-up, with the fund sporting an effective maturity average of 3 years , with the vast majority of the bonds maturing in 5 years or less. This compares to other popular funds such as PGP and PHK, which hold average maturity levels of 6 years and 4 years , respectively. This is important because interest rates are set to rise in the near future, so funds with shorter maturity time periods should outperform those with longer maturity periods. This is because the risk increases the further out in the future the maturity date is in a rising rate environment. A rising rate environment is all but a certainty over the next 3-6 months, based on recent Federal Reserve statements and coverage . Therefore, investors want to limit their exposure to longer-term maturities, and focus on bond funds that have shorter durations, such as RCS. A final reason why I like RCS has to do with its high, and reliable, distribution rate. RCS currently sports a yield over 11%, which provides a high income stream for investors in a low rate environment, and will help buffer the fund against further losses. While I just mentioned that interest rates are set to rise, the increases are sure to be modest at first. In fact, Janet Yellen indicated, after the most recent Fed meeting, that interest rates will rise slower than previously anticipated . The current consensus now is that rates will not exceed 2% by the end of 2016, meaning that the U.S. will continue to experience a historically low rate environment for at least another year and a half. This means that investors will continue to be on the hunt for yield, and a mass exodus from bond funds will probably not occur anytime soon because of this. With a yield over 11%, RCS will provide income driven investors a place to continue to earn a high yield while interest rates stay low. Of course, investing in RCS is not without risk. Pimco funds have been in steady downtrends lately, and the selling could continue as investors fret over rising interest rates and over the legacy of Bill Gross’ depature from the company , which continues to plague his former funds. Additionally, interest rates could end up rising sooner, and more aggressively, than anticipated. If this occurs, investors will be able to earn higher returns on safe investments, like US Treasuries, and the appetite for leveraged bond funds will decline somewhat. However, I do not see these scenarios continuing to hurt RCS. For one, investors have been recently reassured that the interest rate increases will be gradual. Also, as stated earlier, RCS’ share price has reached its NAV, providing a nice backdrop against further selling. While many Pimco funds trade at discounts to NAV and that could certainly happen to RCS, the fund has traded at a premium consistently for the past ten years, so the risk is somewhat muted. And, given RCS’ reliable distribution, a further drop in share price will provide investors with a higher yield, helping to make up for the loss in principal. Bottom line: Pimco funds have performed poorly in 2015, and RCS is no exception. These funds have come under pressure due to Bill Gross’ departure, the threat of rising interest rates, and a share price correction towards NAV for many funds that have been trading at large premiums. However, RCS has now reached a level that provides investors with a reasonable valuation and a high yield. With interest rates set to remain low through the end of next year, investors will continue to look for options that provide more income than a 1% savings account or 3% dividend fund. With a reliable monthly distribution, and the risk of further price depreciation muted, I would encourage investors to consider this fund. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News