Scalper1 News

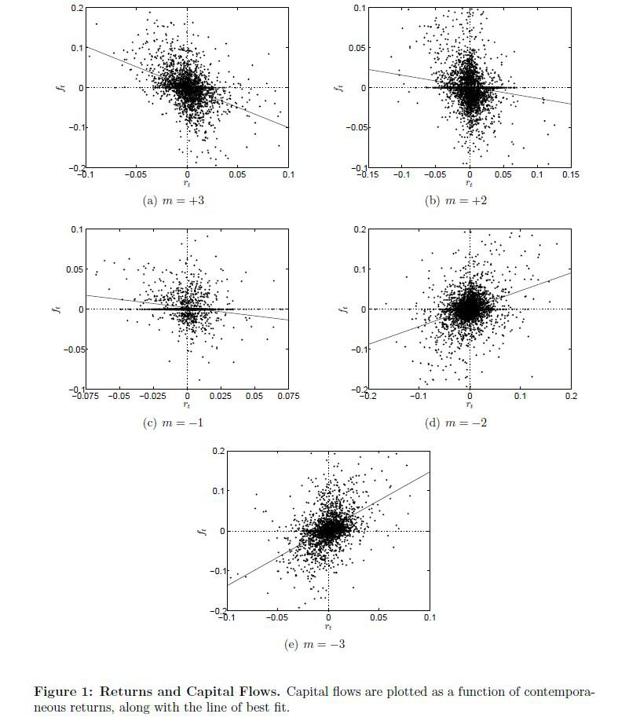

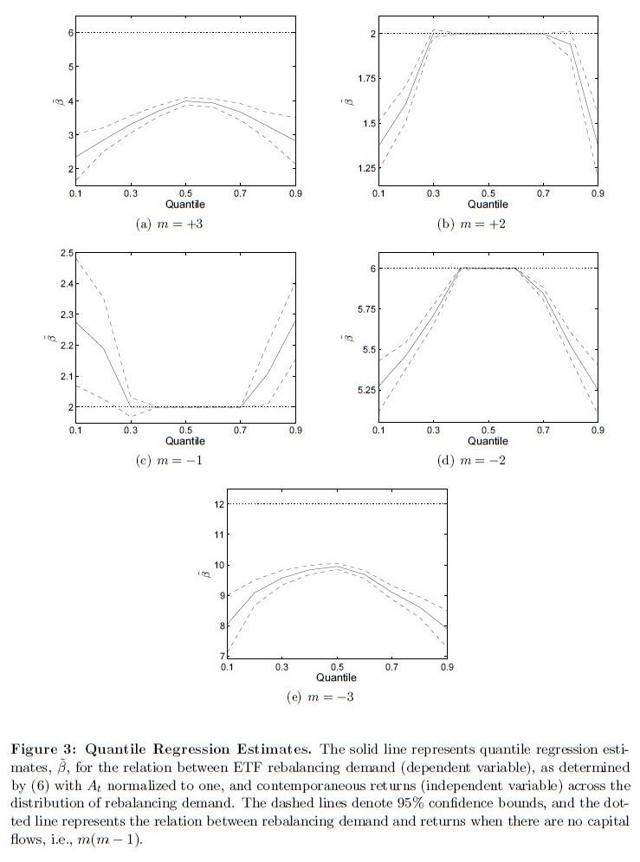

By Mark Melin Leveraged and inverse ETFs, which have come under heavy criticism as potentially exacerbating volatility in financial markets, are not the danger that critics have made them out to be, concludes a preliminary study from U.S. Federal Reserve researchers. In their white paper, ” Are Concerns About Leveraged ETFs Overblown ,” Fed researchers Ivan T. Ivanov and Stephen L. Lenkey make the case that concerns in this regard are exaggerated. To the contrary, the authors assert that “capital flows considerably reduce ETF rebalancing demand and, therefore, mitigate the potential for ETFs to amplify volatility.” (click to enlarge) Opposition to the leveraged ETFs Initial opposition to the leveraged ETFs was strong. In fact, as The Wall Street Journal’s Pedro Nicolaci Da Costa notes, both the Securities and Exchange Commission and the Fed had issued warnings regarding leveraged ETFs. In fact, at one point the SEC had issued a moratorium on approving exemption requests for new leveraged and inverse ETFs, typically a serious sign of trouble from regulators. The primary point of concern focused on what the report said was a common “perception” that the process of re-balancing leveraged and inverse ETF portfolios exacerbated performance. If the ETF was experiencing positive returns, the conventional thinking was leveraged ETFs distorted prices higher. More concerning to market observers was the notion that if the ETF experienced negative price movement, leverage would then amplify market moves lower in price. It is at this point that researchers Lenkey and Ivanov disagree. “Such reasoning is incomplete because it overlooks the effects of capital flows,” they note in their white paper, characterizing concerns regarding these products are “likely exaggerated.” (click to enlarge) Leveraged ETFs capital diminishes the potential to exacerbate volatility The paper asserts that capital coming in and out of a leveraged ETF diminishes the potential to exacerbate volatility. This is because capital flows occur frequently and tend to offset the need for ETFs to rebalance their portfolios. A key conclusion is that ETF rebalancing demand is strongest when returns are large in magnitude, which is important because ETFs would presumably be most prone to amplify market movements in these cases. The report, however, relies on the stock market recovery to offset negative asset from a market crash. “The large decline in the value of the S&P 500 during 2008-09 leads to a large capital inflow. This results in more assets under management for the ETF relative to the benchmark case with no capital flows. Then, as the index recovers, the ETF undergoes a greater amount of rebalancing on a day-to-day basis because it has more assets under management.” Several market watchers, including hedge fund manager Carl Icahn, have raised concerns that the next market crash could involve derivatives more destructive than the 2008 crash, leading to a more difficult recovery, a recovery model that the authors did not model. Read the full report here . Disclosure: None Scalper1 News

By Mark Melin Leveraged and inverse ETFs, which have come under heavy criticism as potentially exacerbating volatility in financial markets, are not the danger that critics have made them out to be, concludes a preliminary study from U.S. Federal Reserve researchers. In their white paper, ” Are Concerns About Leveraged ETFs Overblown ,” Fed researchers Ivan T. Ivanov and Stephen L. Lenkey make the case that concerns in this regard are exaggerated. To the contrary, the authors assert that “capital flows considerably reduce ETF rebalancing demand and, therefore, mitigate the potential for ETFs to amplify volatility.” (click to enlarge) Opposition to the leveraged ETFs Initial opposition to the leveraged ETFs was strong. In fact, as The Wall Street Journal’s Pedro Nicolaci Da Costa notes, both the Securities and Exchange Commission and the Fed had issued warnings regarding leveraged ETFs. In fact, at one point the SEC had issued a moratorium on approving exemption requests for new leveraged and inverse ETFs, typically a serious sign of trouble from regulators. The primary point of concern focused on what the report said was a common “perception” that the process of re-balancing leveraged and inverse ETF portfolios exacerbated performance. If the ETF was experiencing positive returns, the conventional thinking was leveraged ETFs distorted prices higher. More concerning to market observers was the notion that if the ETF experienced negative price movement, leverage would then amplify market moves lower in price. It is at this point that researchers Lenkey and Ivanov disagree. “Such reasoning is incomplete because it overlooks the effects of capital flows,” they note in their white paper, characterizing concerns regarding these products are “likely exaggerated.” (click to enlarge) Leveraged ETFs capital diminishes the potential to exacerbate volatility The paper asserts that capital coming in and out of a leveraged ETF diminishes the potential to exacerbate volatility. This is because capital flows occur frequently and tend to offset the need for ETFs to rebalance their portfolios. A key conclusion is that ETF rebalancing demand is strongest when returns are large in magnitude, which is important because ETFs would presumably be most prone to amplify market movements in these cases. The report, however, relies on the stock market recovery to offset negative asset from a market crash. “The large decline in the value of the S&P 500 during 2008-09 leads to a large capital inflow. This results in more assets under management for the ETF relative to the benchmark case with no capital flows. Then, as the index recovers, the ETF undergoes a greater amount of rebalancing on a day-to-day basis because it has more assets under management.” Several market watchers, including hedge fund manager Carl Icahn, have raised concerns that the next market crash could involve derivatives more destructive than the 2008 crash, leading to a more difficult recovery, a recovery model that the authors did not model. Read the full report here . Disclosure: None Scalper1 News

Scalper1 News