Scalper1 News

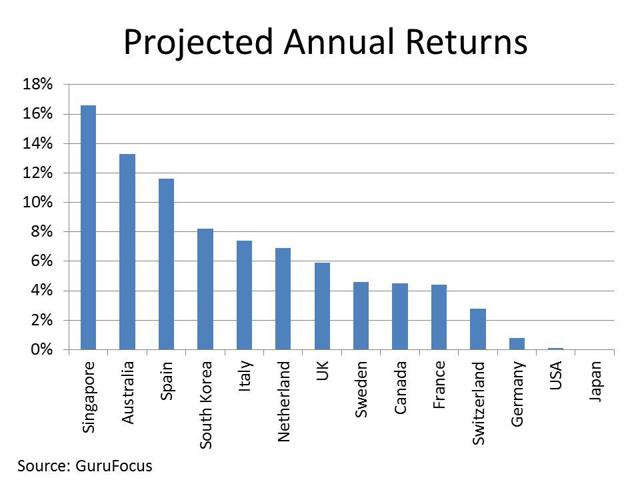

In the immortal words of the physicist Niels Bohr, “Prediction is very difficult. Especially if it’s about the future.” I rarely make firm market forecasts. But I do like to look at broad valuation numbers and see what they imply about future returns. You know the refrain: Past performance is no guarantee of future results. But the following returns estimates, courtesy of data site GuruFocus , give us a little historical perspective. GuruFocus bases its estimates on three factors: Expected economic growth, based on the average growth over the last business cycle. Expected dividend returns, based on the average dividend yield of the past five years. Change in market valuation (the assumption is that the ratio of market cap-to-GDP will revert to its average over a full market cycle, or 7-8 years). So, what do the numbers suggest? (click to enlarge) I’ll start with the good news. Several world markets are priced to deliver solid returns over the next eight years. In particular, Singapore, Australia and Spain are priced particularly attractively, with implied future returns well over 10% per year. Now, keep in mind that Singapore’s economic growth is highly dependent on trade flows between China and the West, Australia is highly dependent on selling commodities to China, and Spain is at the center of the eurozone sovereign debt crisis. All of these countries have murky near-term outlooks, and the projections for economic growth based on the past might not be realistic for the future. But once the dust settles, all might make for attractive “fishing ponds” for investment. Now for the bad news. The US market – where you’re most likely to have the bulk of your assets invested – is priced to deliver annual returns of approximately zero over the next eight years. And it’s not just the market cap-to-GDP ratio that suggests this. As I wrote recently , other metrics, such as the cyclically-adjusted price/earnings ratio (“CAPE”), point to similarly disappointing returns going forward. And allocating your funds to European or Asia-Pacific funds might not help you much. Germany and Japan, which tend to dominate European and Asian-Pacific funds, are priced to deliver equally disappointing returns going forward. So, what’s the takeaway here? In order to avoid lousy returns over the next several years, you’re going to have to invest differently than you might have in the past. You’re going to have to look more aggressively overseas, and within the overseas universe, you’ll need to underweight the most common international markets. This article first appeared on Sizemore Insights as Prediction is Difficult. Especially About the Future Disclaimer: This article is for informational purposes only and should not be considered specific investment advice or as a solicitation to buy or sell any securities. Sizemore Capital personnel and clients will often have an interest in the securities mentioned. There is risk in any investment in traded securities, and all Sizemore Capital investment strategies have the possibility of loss. Past performance is no guarantee of future results. Original Post Scalper1 News

In the immortal words of the physicist Niels Bohr, “Prediction is very difficult. Especially if it’s about the future.” I rarely make firm market forecasts. But I do like to look at broad valuation numbers and see what they imply about future returns. You know the refrain: Past performance is no guarantee of future results. But the following returns estimates, courtesy of data site GuruFocus , give us a little historical perspective. GuruFocus bases its estimates on three factors: Expected economic growth, based on the average growth over the last business cycle. Expected dividend returns, based on the average dividend yield of the past five years. Change in market valuation (the assumption is that the ratio of market cap-to-GDP will revert to its average over a full market cycle, or 7-8 years). So, what do the numbers suggest? (click to enlarge) I’ll start with the good news. Several world markets are priced to deliver solid returns over the next eight years. In particular, Singapore, Australia and Spain are priced particularly attractively, with implied future returns well over 10% per year. Now, keep in mind that Singapore’s economic growth is highly dependent on trade flows between China and the West, Australia is highly dependent on selling commodities to China, and Spain is at the center of the eurozone sovereign debt crisis. All of these countries have murky near-term outlooks, and the projections for economic growth based on the past might not be realistic for the future. But once the dust settles, all might make for attractive “fishing ponds” for investment. Now for the bad news. The US market – where you’re most likely to have the bulk of your assets invested – is priced to deliver annual returns of approximately zero over the next eight years. And it’s not just the market cap-to-GDP ratio that suggests this. As I wrote recently , other metrics, such as the cyclically-adjusted price/earnings ratio (“CAPE”), point to similarly disappointing returns going forward. And allocating your funds to European or Asia-Pacific funds might not help you much. Germany and Japan, which tend to dominate European and Asian-Pacific funds, are priced to deliver equally disappointing returns going forward. So, what’s the takeaway here? In order to avoid lousy returns over the next several years, you’re going to have to invest differently than you might have in the past. You’re going to have to look more aggressively overseas, and within the overseas universe, you’ll need to underweight the most common international markets. This article first appeared on Sizemore Insights as Prediction is Difficult. Especially About the Future Disclaimer: This article is for informational purposes only and should not be considered specific investment advice or as a solicitation to buy or sell any securities. Sizemore Capital personnel and clients will often have an interest in the securities mentioned. There is risk in any investment in traded securities, and all Sizemore Capital investment strategies have the possibility of loss. Past performance is no guarantee of future results. Original Post Scalper1 News

Scalper1 News