< div i.d. =" articleText" legibility=" 166.48227071258" > GREEN SHOOTS? PHOTO RESOURCE: POTASHCORP REAL ESTATE INVESTOR DISCUSSION. PotashCorp( NYSE: FLOWERPOT) has had a general year. In January, for the very first time considering that its own 1989 IPO, the company reduced its own reward, slashing the payout by approximately 34% to $ 0.25 a portion. Soon after, that issued feeble support price quotes, along with volumes seeking to be up to a selection from 8.3 thousand to 9.1 thousand lots in 2012. Today, potash rates remain to sag, just recently reaching eight-year lows. PotashCorp has actually observed its own purchases and revenue downtrend, aided by weakening USA as well as Asia markets, as developers continuously defend market portion instead of incomes.

Bulls, on the other hand, feel the slide ought to end very soon, accordinged to elements like increasing demand in India and also a justified global supply. So is PotashCorp keyed for a turnaround?

” FLOWERPOT Total Return Rate Graph “src=”

https://www.scalper1.com/wp-content/uploads/2016/06/68794456c773a6dc51af370671a5aff8.png”/ > FLOWERPOT Overall Return Price data through< a href =" http://ycharts.com/" rel= "nofollow "> YCharts A contrarian standpoint One fabulous real estate investor, Beam Dalio from Bridgewater Associates, shows up to be actually expecting an ultimate rebound in PotashCorp shares. Baseding on his last 13-F filing, his firm acquired a clean placement of 721,300 shares worth about $12 million. He also initiated a position in rival Agrium Inc. (NYSE: AGU).

Dalio’s bet comes throughout a hard market for agrarian commodities. Reducing Mandarin demand has pressed the Bloomberg Commodities Mark to degrees not observed considering that 1998. A lot of fear that international item requirement will be completely impaired as China pays attention to transitioning toward a service-based economy. This weather is actually having serious impacts on PotashCorp’s business.

In 2012, China is assumed to require just 14 million lots of potash, down coming from an actually miserable degree of 16 thousand lots in 2012. The Mandarin market for potash is actually bigger compared to the whole entire North American market incorporated, in addition to Latin The United States and also India too. While the most recent tightening needs to verify brief (given dirts must maintain a specific nutrient equilibrium), need development may be set for an ideal change. With China being actually the most significant customer from potash on earth without a doubt, entirely slower development could overthrow the entire market for years to follow.

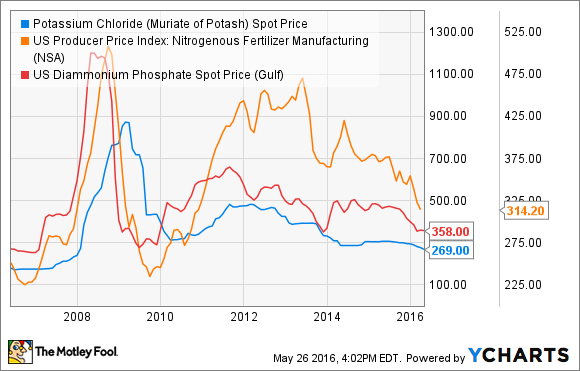

That is actually no surprise the cost from the three primary agrarian inputs– potash, nitrogen, as well as phosphate– are actually under siege. What chance is there for a rebound?

< a href =" http://ycharts.com/indicators/potassium_chloride_muriate_of_potash_spot_price" rel =" nofollow" >

Potassium Chloride( Muriate from Potash )Blotch Cost records through< a href=" http://ycharts.com/ "rel= "nofollow" > YCharts Supply will not be actually reasoned Around 60 thousand lots of potash are actually mined each year. The leading 4 producers, which account for over half from worldwide output, are PotashCorp, Uralkali, Mosaic, and Belaruskali. Since manufacturing is actually unbelievably concentrated among a few essential gamers, field source contours are relatively very easy to construct.

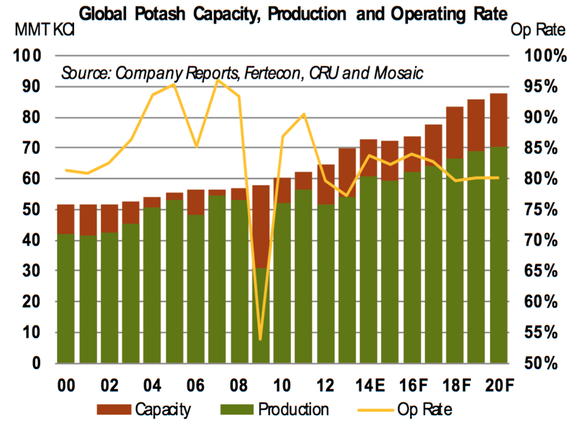

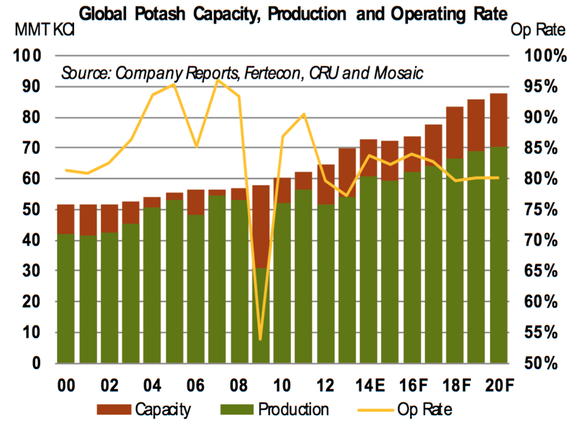

Depending on to Mosaic, around 90% from the sector has revenue exploration prices listed below $ 180 per load. Over fifty percent of manufacturers have prices of under $ 130 a lot. Along with current rates still over $ 250 each bunch, there is actually loads of space left behind for pricing destruction. That is actually a major explanation Variety finds an oversupplied market getting back at worse by means of 2020, along with unstable capability utilizations all.

< img course=" articleImgLg" alt=" Monitor Chance" src=" https://www.scalper1.com/wp-content/uploads/2016/06/screen-shot-2016-05-26-at-45828-pm_large.png"/ > IMAGE SOURCE: MOSAIC REAL ESTATE INVESTOR PRESENTATION, http://investors.mosaicco.com/interactive/lookandfeel/4097833/MOSAIC_2015_April_Presentation.pdf web page 8. International development outside China isn’t really good enough If source won’t be actually rationalized anytime quickly, is actually there hope

for a concealed development account to decide on up China’s slack? The

United States, South america, China, as well as India consist of almost 70% of worldwide potash demand. A lot of these countries are actually finding building problems that must carry on to weigh on requirement. China specifically appears to be actively gaming the market place; this has repeatedly put off finalizing potash manage miners, as an alternative counting on stockpiles

to gain coming from prices that are actually slumping to near-decade lows. That will probably stand by up until rates collapse even more to strike brand-new deals. India, another primary buyer, has suspended its potash imports and postponed negotiations for next year’s purchases until at minimum June, as a result of extreme dry spells. Record-low soybean as well as< a href=" http://www.nasdaq.com/markets/corn.aspx "> corn costs, in addition to the falling acquiring energy from the genuine, is additionally pressing need forecasts for Brazil lesser.

The UNITED STATE is the sole intense place, where planters will possibly take advantage of the sturdy buck and in the past small cost. Along with The United States comprising simply 16 %of international need, nevertheless, don’t assume the area to move the needle

. Simply stand by In the past times, 70% of global production was actually handled by 2 big cartels (as well as PotashCorp belonged to one ), so valuing declines were actually avoided with teamed up source feedbacks. Today, after the after effects of Russia’s Uralkali escaping from its own range partner Belaruskali, markets then set costs. Competitors, along with decreasing need as well as sufficient low-cost source, should keep a lid on shares till the market place adjusts to its own new typical. There’s no question that PotashCorp will come to be a purchase some factor, yet the architectural problems that the industry currently encounters are going to have years to reconcile. Something big just happened I do not know about you, but I consistently take note when one from the greatest growth clients in the world provides me a stock pointer. Motley Blockhead founder David Gardner( whose growth-stock bulletin was actually the greatest performing in the USA as stated by The Stock market Journal )* and also his sibling

, Chief Executive Officer Tom Gardner, merely

disclosed two new equity referrals. Together, they have actually tripled the inventory market’s gain over the final THIRTEEN years. And while time isn’t really everything, the history of Tom as well as David’s inventory selections shows that it pays out to acquire in early on their suggestions.< a href= "http://www.fool.com/mms/mark/e-sapr-master/?aid=8811&source=isaeditxt0010391&ftm_cam=sa-release&ftm_pit=5395&ftm_veh=article_pitch&utm_campaign=article&utm_medium=feed&utm_source=nasdaq" rel=" nofollow "> Visit this site to be actually among the 1st folks to hear concerning David and Tom’s most recent supply referrals.

disclosed two new equity referrals. Together, they have actually tripled the inventory market’s gain over the final THIRTEEN years. And while time isn’t really everything, the history of Tom as well as David’s inventory selections shows that it pays out to acquire in early on their suggestions.< a href= "http://www.fool.com/mms/mark/e-sapr-master/?aid=8811&source=isaeditxt0010391&ftm_cam=sa-release&ftm_pit=5395&ftm_veh=article_pitch&utm_campaign=article&utm_medium=feed&utm_source=nasdaq" rel=" nofollow "> Visit this site to be actually among the 1st folks to hear concerning David and Tom’s most recent supply referrals.

*” Seem Which gets on Leading Now “appeared in The Commercial Diary in Aug. 2013, which references Hulbert’s ranks of

the most effective doing assets deciding on e-newsletters over a 5-year time frame from 2008-2013. The views and also viewpoints conveyed within are actually the beliefs as well as viewpoints of the author and also perform not essentially indicate those from Nasdaq, Inc. < a rel

=” nofollow “href=” http://articlefeeds.nasdaq.com/~r/nasdaq/symbols/~3/FYKSdxaQ73M/potashcorp-what-will-halt-the-slide-cm633070″ >

Plantations International