Scalper1 News

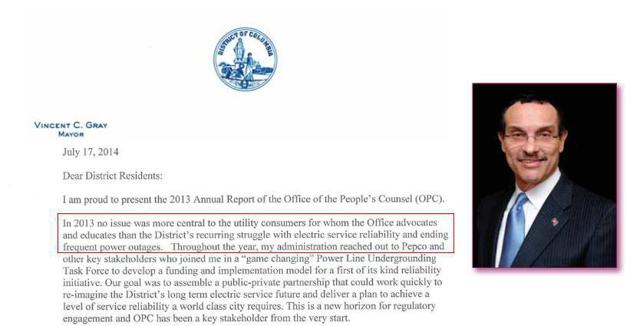

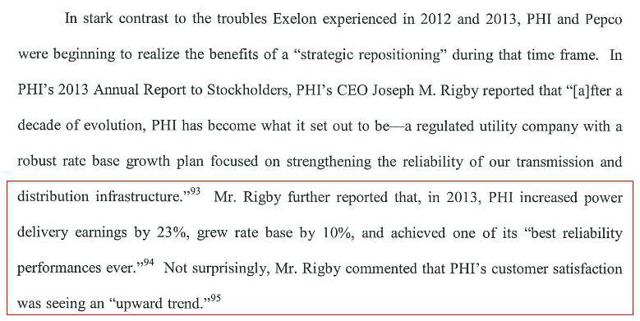

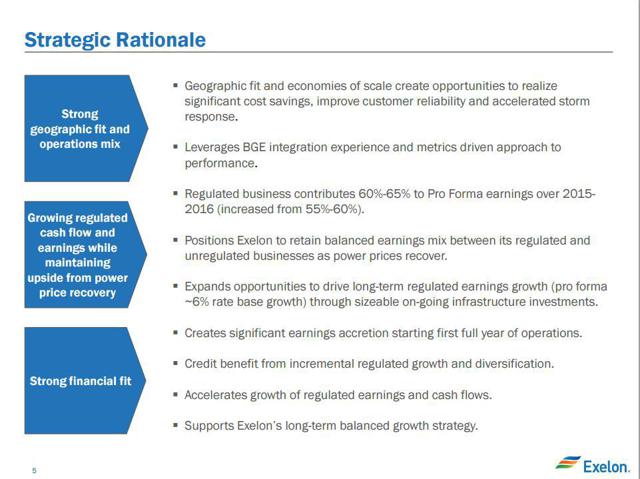

Summary The D.C. Public Service Commission is reviewing the Pepco-Exelon merger; regulatory approval is the final step in the process and if granted, the transaction should close shortly thereafter. Pepco shareholders will receive $27.25 per share in cash plus a pro-rata dividend; the D.C. AG and the Office of People’s Counsel D.C. have voiced opposition to the proposed merger. A closer look at the OPC-DC’s brief in opposition to merger reveals flawed reasoning and a motive of preserving the agency’s existence and relevancy to the detriment of D.C. consumers. We are approaching the conclusion of the regulatory review of the Pepco-Exelon merger which was announced on April 30, 2014. Pepco Holdings Inc.’s (NYSE: POM ) stock now trades ex-dividend (from June dividend) but there remains upside at its current price of $26.75 per share. At closing shareholders will receive $27.25 per share in all cash and a pro-rata dividend of $0.002967 per share per day after June 10th and until the merger closes as we discussed in early-June . We continue to hold our position in Pepco and expect that Exelon (NYSE: EXC ) will close the transaction in July with the expectation that the Public Service Commission of D.C. will grant its approval of merger. (click to enlarge) (Source: Nasdaq.com) The Office of the People’s Counsel of D.C. Is Taking the Wrong Approach to the Merger In anticipation of the Public Service Commission of D.C. vote to approve the proposed transaction, the Office of the People’s Counsel of D.C. filed a brief outlining their views and opposition to the merger. We are surprised that the OPC is taking strong stance against a sound merger that will result in a more efficient company with greater resources to provide reliable and low cost service to the people of D.C. Even more surprising is that their arguments against the proposed transaction are inconsistent and in many instances directly contradict past statements made by and official views of the OPC. We believe if Pepco continued as a standalone company over the long-term, Pepco’s already attenuated financial position may worsen due to the company’s substantial indebtedness, and capital expenditure requirements for further investments in infrastructure improvements. OPC has even agreed that this was true prior to the Exelon-Pepco merger. In Mayor Vincent Gray’s annual letter for OPC in 2013 he starts off by discussing how Pepco has struggled significantly with service reliability and minimizing power outages: (click to enlarge) (Source: OPC-DC 2013 Annual Report; opc-dc.gov) With such an unfortunate experience in service reliability, we would think the OPC would like to a see a service provider with greater financial strength, greater resources to invest in improved infrastructure, and an experienced and talented management team. This does not appear to be the case. In fact, OPC would like the opposite. We look to OPC’s brief on the merger and surprisingly the office now claims that “PHI/Pepco do not need Exelon” and “Direct Benefits to Ratepayers are Inadequate, Overstated, and Will Be Fully Realized (if at all) Only After Many Years.” Suddenly and inexplicably (actually we will get to our explanation below), Sandra Mattavous-Frye, the head of the OPC, in the brief put her full support behind Pepco CEO Joseph Rigby’s statement of service reliability: (click to enlarge) What could possibly explain this sudden shift in the OPC’s view toward Pepco? The OPC-DC relies upon power outages, unreliable service to its consumers and over-billing among other issues in order to litigate and justify its existence within the D.C. government. A standalone Pepco will allow OPC to continue to pursue litigation against Pepco and take advantage of power outages and poor service for political gain. For example, Sandra Mattavous-Frye states that in response to several consumer complaints against Pepco and other energy suppliers: “We took a novel approach to a traditional problem. We petitioned the Commission to investigate the matter, educated and informed consumers about their rights, and negotiated a global settlement with the provider. The end-result was an unprecedented settlement that addressed the needs of some 500 aggrieved customers and led to the creation of a $100,000 low income energy grant fund.” Apparently suing Pepco is a “novel approach.” But this is what the agency relies on and the agency continues to pursue litigation against Pepco and others when the opportunity arises. Any improvement in the underlying problems by more efficient and low cost service providers would disrupt the agency’s mission. Therefore, in an effort to maintain the status quo, the OPC has come out against the merger with populist views of how the merger is driven by greedy management and shareholders at the Illinois-based Exelon. Politically, this stance grabs headlines and gets strong support from a solid segment of the population but in the end, we think it is bad public policy for D.C. consumers and will not withstand the objective review of the D.C. Public Service Commission. We expect the D.C. Public Service Commission to approve the merger. (click to enlarge) (Source: Exelon Presentation April 30, 2014) In Our View, the Transaction Would Undoubtedly Be an Overall Positive for D.C. Consumers We believe the OPC’s vocal stance against the merger is driven by the agency’s self-interest as the merger will in effect render this inefficient, bureaucratic agency irrelevant. Consumer complaints will almost certainly decline and overall service reliability will improve post-transaction. (Source: OPC-DC.gov; 2013 Annual Report) Exelon’s establishment of a Customer Investment Fund and a commitment for enhanced reliability will improve the service for D.C. consumers over the status quo. Post-transaction, the agency’s role in advocating consumers will be greatly diminished and the D.C. government may take a close look at this agency to determine if it is even necessary to continue to spend significant and valued taxpayer dollars on such basic tasks when consumers are receiving low cost and reliable service from the new Exelon-Pepco entity. Will History Repeat Itself? In our view and final analysis, the Office of People’s Counsel DC provides very little, if any, substantive value to DC consumers. The agency represents government bureaucracy at its worst despite its claim that its overall budget is revenue neutral. (click to enlarge) (Source: OPC-DC.gov) We find that the agency is over-staffed and under-delivering on its mission to educate, advocate, and protect consumers because the agency is squandering its resources in pursuing misguided political activism at the expense of DC consumers. The office which was eliminated once before in 1952. After being reestablished in 1975, we think now in 2015 the agency’s effectiveness and relevancy has passed it by. Disclosure: I am/we are long POM. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary The D.C. Public Service Commission is reviewing the Pepco-Exelon merger; regulatory approval is the final step in the process and if granted, the transaction should close shortly thereafter. Pepco shareholders will receive $27.25 per share in cash plus a pro-rata dividend; the D.C. AG and the Office of People’s Counsel D.C. have voiced opposition to the proposed merger. A closer look at the OPC-DC’s brief in opposition to merger reveals flawed reasoning and a motive of preserving the agency’s existence and relevancy to the detriment of D.C. consumers. We are approaching the conclusion of the regulatory review of the Pepco-Exelon merger which was announced on April 30, 2014. Pepco Holdings Inc.’s (NYSE: POM ) stock now trades ex-dividend (from June dividend) but there remains upside at its current price of $26.75 per share. At closing shareholders will receive $27.25 per share in all cash and a pro-rata dividend of $0.002967 per share per day after June 10th and until the merger closes as we discussed in early-June . We continue to hold our position in Pepco and expect that Exelon (NYSE: EXC ) will close the transaction in July with the expectation that the Public Service Commission of D.C. will grant its approval of merger. (click to enlarge) (Source: Nasdaq.com) The Office of the People’s Counsel of D.C. Is Taking the Wrong Approach to the Merger In anticipation of the Public Service Commission of D.C. vote to approve the proposed transaction, the Office of the People’s Counsel of D.C. filed a brief outlining their views and opposition to the merger. We are surprised that the OPC is taking strong stance against a sound merger that will result in a more efficient company with greater resources to provide reliable and low cost service to the people of D.C. Even more surprising is that their arguments against the proposed transaction are inconsistent and in many instances directly contradict past statements made by and official views of the OPC. We believe if Pepco continued as a standalone company over the long-term, Pepco’s already attenuated financial position may worsen due to the company’s substantial indebtedness, and capital expenditure requirements for further investments in infrastructure improvements. OPC has even agreed that this was true prior to the Exelon-Pepco merger. In Mayor Vincent Gray’s annual letter for OPC in 2013 he starts off by discussing how Pepco has struggled significantly with service reliability and minimizing power outages: (click to enlarge) (Source: OPC-DC 2013 Annual Report; opc-dc.gov) With such an unfortunate experience in service reliability, we would think the OPC would like to a see a service provider with greater financial strength, greater resources to invest in improved infrastructure, and an experienced and talented management team. This does not appear to be the case. In fact, OPC would like the opposite. We look to OPC’s brief on the merger and surprisingly the office now claims that “PHI/Pepco do not need Exelon” and “Direct Benefits to Ratepayers are Inadequate, Overstated, and Will Be Fully Realized (if at all) Only After Many Years.” Suddenly and inexplicably (actually we will get to our explanation below), Sandra Mattavous-Frye, the head of the OPC, in the brief put her full support behind Pepco CEO Joseph Rigby’s statement of service reliability: (click to enlarge) What could possibly explain this sudden shift in the OPC’s view toward Pepco? The OPC-DC relies upon power outages, unreliable service to its consumers and over-billing among other issues in order to litigate and justify its existence within the D.C. government. A standalone Pepco will allow OPC to continue to pursue litigation against Pepco and take advantage of power outages and poor service for political gain. For example, Sandra Mattavous-Frye states that in response to several consumer complaints against Pepco and other energy suppliers: “We took a novel approach to a traditional problem. We petitioned the Commission to investigate the matter, educated and informed consumers about their rights, and negotiated a global settlement with the provider. The end-result was an unprecedented settlement that addressed the needs of some 500 aggrieved customers and led to the creation of a $100,000 low income energy grant fund.” Apparently suing Pepco is a “novel approach.” But this is what the agency relies on and the agency continues to pursue litigation against Pepco and others when the opportunity arises. Any improvement in the underlying problems by more efficient and low cost service providers would disrupt the agency’s mission. Therefore, in an effort to maintain the status quo, the OPC has come out against the merger with populist views of how the merger is driven by greedy management and shareholders at the Illinois-based Exelon. Politically, this stance grabs headlines and gets strong support from a solid segment of the population but in the end, we think it is bad public policy for D.C. consumers and will not withstand the objective review of the D.C. Public Service Commission. We expect the D.C. Public Service Commission to approve the merger. (click to enlarge) (Source: Exelon Presentation April 30, 2014) In Our View, the Transaction Would Undoubtedly Be an Overall Positive for D.C. Consumers We believe the OPC’s vocal stance against the merger is driven by the agency’s self-interest as the merger will in effect render this inefficient, bureaucratic agency irrelevant. Consumer complaints will almost certainly decline and overall service reliability will improve post-transaction. (Source: OPC-DC.gov; 2013 Annual Report) Exelon’s establishment of a Customer Investment Fund and a commitment for enhanced reliability will improve the service for D.C. consumers over the status quo. Post-transaction, the agency’s role in advocating consumers will be greatly diminished and the D.C. government may take a close look at this agency to determine if it is even necessary to continue to spend significant and valued taxpayer dollars on such basic tasks when consumers are receiving low cost and reliable service from the new Exelon-Pepco entity. Will History Repeat Itself? In our view and final analysis, the Office of People’s Counsel DC provides very little, if any, substantive value to DC consumers. The agency represents government bureaucracy at its worst despite its claim that its overall budget is revenue neutral. (click to enlarge) (Source: OPC-DC.gov) We find that the agency is over-staffed and under-delivering on its mission to educate, advocate, and protect consumers because the agency is squandering its resources in pursuing misguided political activism at the expense of DC consumers. The office which was eliminated once before in 1952. After being reestablished in 1975, we think now in 2015 the agency’s effectiveness and relevancy has passed it by. Disclosure: I am/we are long POM. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News