Scalper1 News

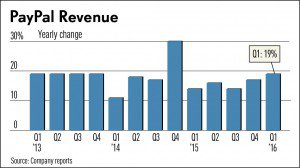

Going solo suits PayPal ( PYPL ). The payments giant Wednesday beat analyst Q1 revenue and earnings estimates, sending shares rising after hours, as Q2 sales guidance edged views and EPS guidance met expectations. Delivered after the market close, PayPal said it logged $2.54 billion in Q1 sales, up 19% from the year-earlier quarter, while earnings per share minus items rose 28% to 37 cents. It’s the third straight quarter PayPal has beat earnings estimates. Analysts polled by Thomson Reuters had expected $2.5 billion and 35 cents. “Our first-quarter results continue to demonstrate the power of our global payments platform to attract and engage consumers, increasing our global scale and in turn attracting new merchants and partners to PayPal,” CEO Dan Schulman said in the earnings release. For Q2, the payments company expects revenue to rise 16% to 18%, to $2.57 billion-$2.62 billion. The company estimates EPS ex items at 34 cents to 36 cents, up from 33 cents in Q2 2015. Wall Street had modeled $2.57 billion and 35 cents. The company reiterated its full-year guidance of sales growth of 16% to 19% and non-GAAP earnings of between $1.45 and $1.50. In 2015, sales rose 15% and EPS ex items came in at $1.30. PayPal said it increased its total active accounts 2% to 184 million from the 179 million it reported in its Q4 results . In Q4, the company added 6.6 million accounts, up 3% over Q3. PayPal says now has 14 million merchants using the platform, up from 13 million in Q4, with new merchants that include Panera Bread ( PNRA ) and Crate and Barrel. And PayPal said it added new countries and merchants in its partnership with China e-commerce giant Alibaba ‘s ( BABA ) Alibaba Wholesaler unit. In its earnings release, the company said it continues ahead on its plans to monetize Venmo, the company’s peer-to-peer payments app popular with millennials. There is no charge for users, but the company has started to make its “pay with Venmo” option available to select merchants, charging fees to merchants for those transactions. It plans to expand the service to more merchants but hasn’t given a timeline. The San Jose, Calif.-based company, which last July spun off from former parent eBay ( EBAY ), saw its stock rise 2% in after-hours trading Wednesday, after the company released its earnings. PayPal stock rose a fraction in Wednesday’s regular session, to 40.01. The stock is just below a 40.03 buy point, but in buy range from a lower 38.62 entry. PayPal is an IBD Leaderboard stock, with a strong Composite Rating of 92, where 99 is the highest. Yet, PayPal competes with a bevy of tech leaders that have been expanding into payments and digital wallets, including companies such as Alphabet ‘s ( GOOGL ) Google and Apple ( AAPL ). Since its spinoff from eBay, PayPal stock has dipped as low as 30 in last August to 41.75 in March, its highest point since touched 42.55 in its July 20 debut on Nasdaq. With more freedom, PayPal has taken on such initiatives as running a multimillion-dollar commercial in this year’s Super Bowl telecast . Scalper1 News

Going solo suits PayPal ( PYPL ). The payments giant Wednesday beat analyst Q1 revenue and earnings estimates, sending shares rising after hours, as Q2 sales guidance edged views and EPS guidance met expectations. Delivered after the market close, PayPal said it logged $2.54 billion in Q1 sales, up 19% from the year-earlier quarter, while earnings per share minus items rose 28% to 37 cents. It’s the third straight quarter PayPal has beat earnings estimates. Analysts polled by Thomson Reuters had expected $2.5 billion and 35 cents. “Our first-quarter results continue to demonstrate the power of our global payments platform to attract and engage consumers, increasing our global scale and in turn attracting new merchants and partners to PayPal,” CEO Dan Schulman said in the earnings release. For Q2, the payments company expects revenue to rise 16% to 18%, to $2.57 billion-$2.62 billion. The company estimates EPS ex items at 34 cents to 36 cents, up from 33 cents in Q2 2015. Wall Street had modeled $2.57 billion and 35 cents. The company reiterated its full-year guidance of sales growth of 16% to 19% and non-GAAP earnings of between $1.45 and $1.50. In 2015, sales rose 15% and EPS ex items came in at $1.30. PayPal said it increased its total active accounts 2% to 184 million from the 179 million it reported in its Q4 results . In Q4, the company added 6.6 million accounts, up 3% over Q3. PayPal says now has 14 million merchants using the platform, up from 13 million in Q4, with new merchants that include Panera Bread ( PNRA ) and Crate and Barrel. And PayPal said it added new countries and merchants in its partnership with China e-commerce giant Alibaba ‘s ( BABA ) Alibaba Wholesaler unit. In its earnings release, the company said it continues ahead on its plans to monetize Venmo, the company’s peer-to-peer payments app popular with millennials. There is no charge for users, but the company has started to make its “pay with Venmo” option available to select merchants, charging fees to merchants for those transactions. It plans to expand the service to more merchants but hasn’t given a timeline. The San Jose, Calif.-based company, which last July spun off from former parent eBay ( EBAY ), saw its stock rise 2% in after-hours trading Wednesday, after the company released its earnings. PayPal stock rose a fraction in Wednesday’s regular session, to 40.01. The stock is just below a 40.03 buy point, but in buy range from a lower 38.62 entry. PayPal is an IBD Leaderboard stock, with a strong Composite Rating of 92, where 99 is the highest. Yet, PayPal competes with a bevy of tech leaders that have been expanding into payments and digital wallets, including companies such as Alphabet ‘s ( GOOGL ) Google and Apple ( AAPL ). Since its spinoff from eBay, PayPal stock has dipped as low as 30 in last August to 41.75 in March, its highest point since touched 42.55 in its July 20 debut on Nasdaq. With more freedom, PayPal has taken on such initiatives as running a multimillion-dollar commercial in this year’s Super Bowl telecast . Scalper1 News

Scalper1 News