Scalper1 News

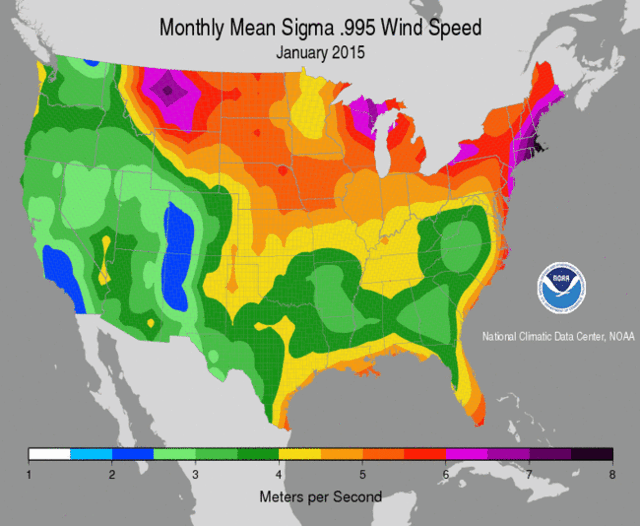

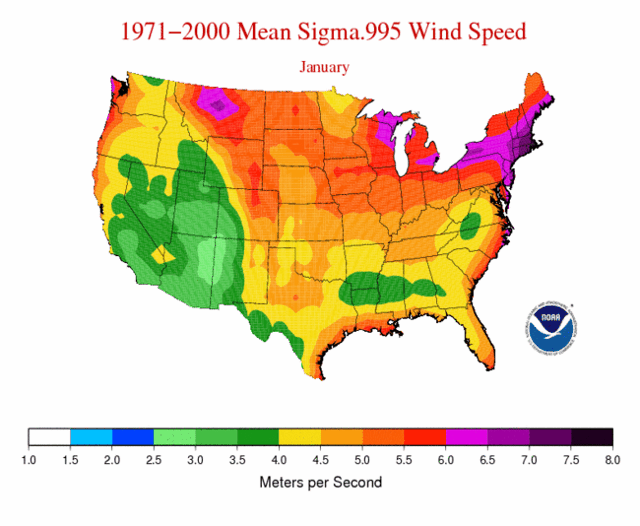

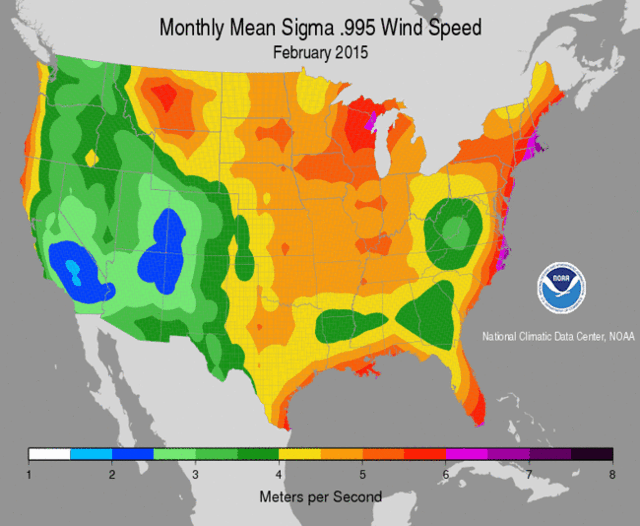

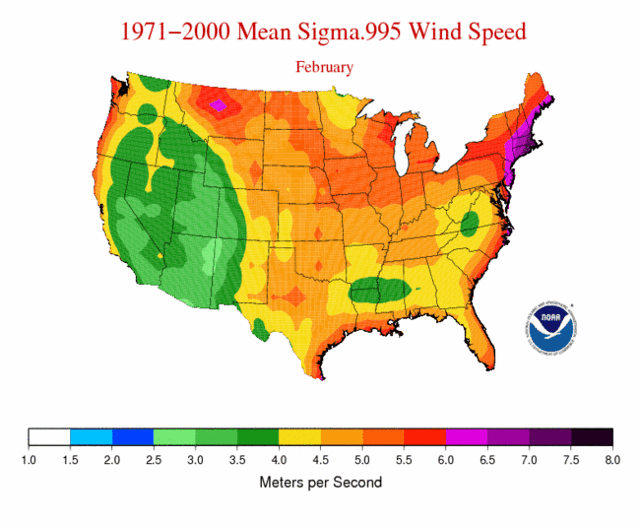

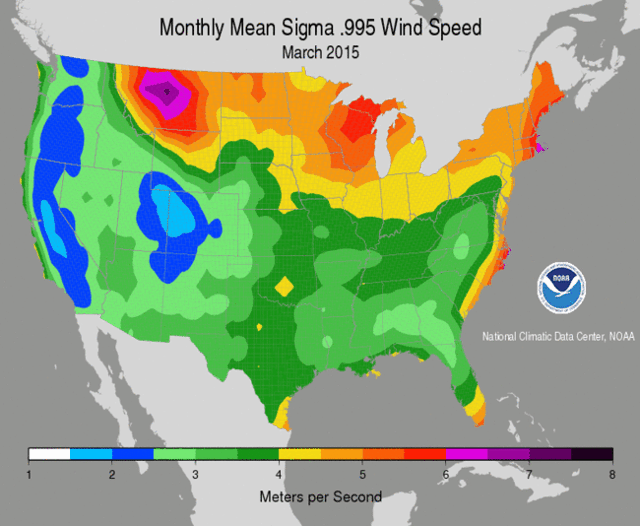

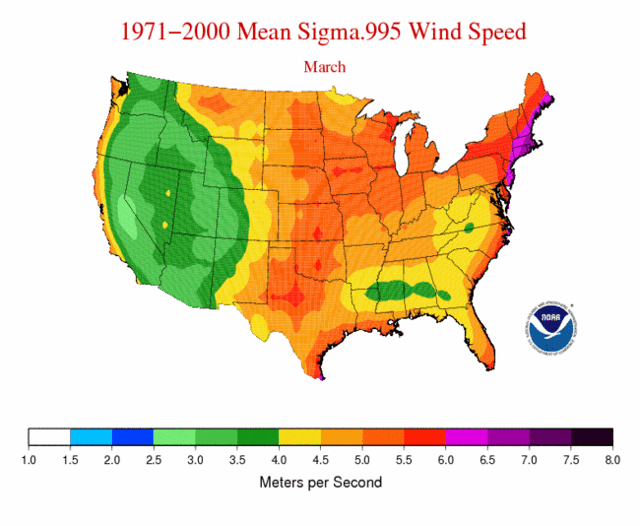

“}); $$(‘#article_top_info .info_content div’)[0].insert(bottom: $(‘mover’)); } $(‘article_top_info’).addClassName(test_version); } SeekingAlpha.Initializer.onDOMLoad(function() setEvents();); Management Agreement with Pattern Development gives good upside. Q1 2015 was a fluke. Their narrow focus on wind energy allows them to operate with lower costs. Before I start with the article, I would like to acknowledge that yes, I am the guy who wrote the most recent Seeking Alpha article about Pattern Energy (NASDAQ: PEGI ), in which I presented my bear case. I started working on this as a short, but then after some astute comments on the article and further research, I have come around to seeing that there is significant upside optionality here with little downside. Unlike the other yieldco’s, Pattern has a management agreement in place such that once the market cap hits $2.5B, the management of their parent company (Pattern Development) will drop down into Pattern Energy for free. When this happens, instead of earning a fixed Return on Capital like the other yieldco’s, Pattern can use their development expertise and relationships to earn potentially much higher returns on capital, and at worst they will continue earning the fixed 9-10% ROC. I would expect them to develop localized wind solutions like their Fowler Ridge development for large data-centers and other tech-focused facilities that need a reliable source of clean energy. Secondly, their first quarter was ridiculously unlucky due to El Nino winds illustrated below, particularly on the panhandle of Texas and Southern California. Anyone like myself selling the stock due to this performance was and is sadly mistaken. (click to enlarge) (click to enlarge) (click to enlarge) (click to enlarge) (click to enlarge) (click to enlarge) Lastly, since they focus almost exclusively on wind energy projects, they can maintain a low overhead due to specialization. From an industrial organization perspective, there are likely costs of operating developments with different technologies, which benefits competitors like Pattern who stick to their bread and butter. Alternative energy companies delving into new and unknown technologies has been risky, as shown in the WSJ recently: www.wsj.com/articles/high-tech-solar-pro… . In conclusion, the management agreement coupled with El Nino winds provide good upside and a good buying opportunity, and not a good selling opportunity as I originally thought. Their fixed purchase agreements with their customers gives them good downside protection. Disclosure: The author has no positions in any stocks mentioned, but may initiate a long position in PEGI over the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it. The author has no business relationship with any company whose stock is mentioned in this article. Share this article with a colleague Scalper1 News

“}); $$(‘#article_top_info .info_content div’)[0].insert(bottom: $(‘mover’)); } $(‘article_top_info’).addClassName(test_version); } SeekingAlpha.Initializer.onDOMLoad(function() setEvents();); Management Agreement with Pattern Development gives good upside. Q1 2015 was a fluke. Their narrow focus on wind energy allows them to operate with lower costs. Before I start with the article, I would like to acknowledge that yes, I am the guy who wrote the most recent Seeking Alpha article about Pattern Energy (NASDAQ: PEGI ), in which I presented my bear case. I started working on this as a short, but then after some astute comments on the article and further research, I have come around to seeing that there is significant upside optionality here with little downside. Unlike the other yieldco’s, Pattern has a management agreement in place such that once the market cap hits $2.5B, the management of their parent company (Pattern Development) will drop down into Pattern Energy for free. When this happens, instead of earning a fixed Return on Capital like the other yieldco’s, Pattern can use their development expertise and relationships to earn potentially much higher returns on capital, and at worst they will continue earning the fixed 9-10% ROC. I would expect them to develop localized wind solutions like their Fowler Ridge development for large data-centers and other tech-focused facilities that need a reliable source of clean energy. Secondly, their first quarter was ridiculously unlucky due to El Nino winds illustrated below, particularly on the panhandle of Texas and Southern California. Anyone like myself selling the stock due to this performance was and is sadly mistaken. (click to enlarge) (click to enlarge) (click to enlarge) (click to enlarge) (click to enlarge) (click to enlarge) Lastly, since they focus almost exclusively on wind energy projects, they can maintain a low overhead due to specialization. From an industrial organization perspective, there are likely costs of operating developments with different technologies, which benefits competitors like Pattern who stick to their bread and butter. Alternative energy companies delving into new and unknown technologies has been risky, as shown in the WSJ recently: www.wsj.com/articles/high-tech-solar-pro… . In conclusion, the management agreement coupled with El Nino winds provide good upside and a good buying opportunity, and not a good selling opportunity as I originally thought. Their fixed purchase agreements with their customers gives them good downside protection. Disclosure: The author has no positions in any stocks mentioned, but may initiate a long position in PEGI over the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it. The author has no business relationship with any company whose stock is mentioned in this article. Share this article with a colleague Scalper1 News

Scalper1 News