Scalper1 News

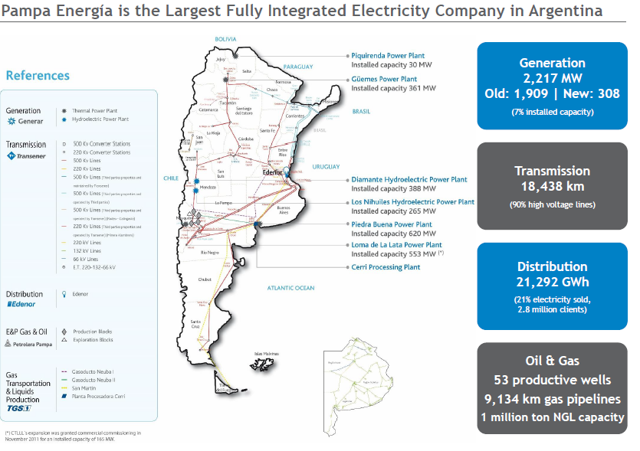

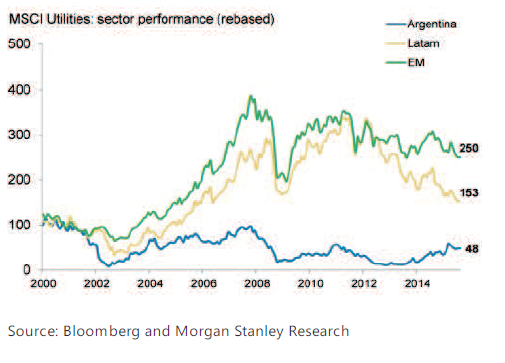

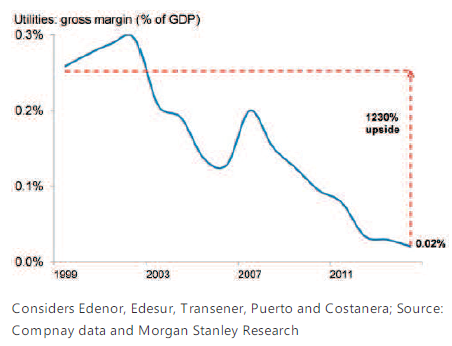

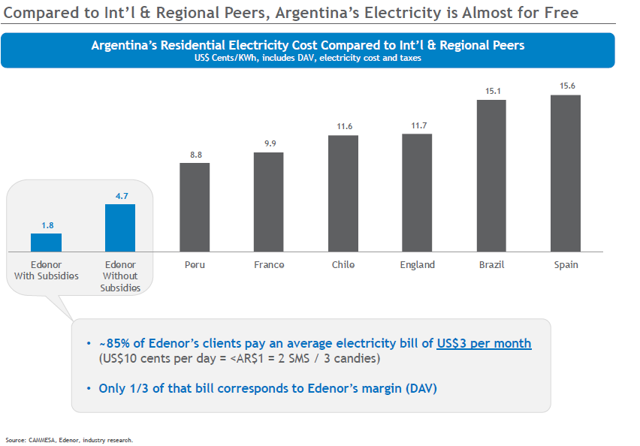

Summary Pampa Energía works in a highly distorted regulatory framework, where frozen tariffs have led to a critical situation for the utility companies. Even in this scenario Pampa Energía has managed to reach a price earning of 5 years. With a new government about to be elected, great improvements could be in the way. Pampa Energía S.A. (NYSE: PAM ) is the largest integrated electricity company in Argentina and through its subsidiaries participates in the generation, transmission and distribution of electricity, as well as natural gas transportation and production. (click to enlarge) Source: Pampa Energía. Pampa Energía owns indirectly: 84% of the generation assets. 26% of the transmission business (TRAN.BA). 52% of the distribution business with Edenor (EDN). 26% of the natural gas transportation business with Transportadora de Gas del Sur (NYSE: TGS )(pending government approval). 50% of the Oil and Gas exploration and production business with Petrolera Pampa (PETR.BA), associated with Yacimientos Petrolíferos Fiscales (YPF). As of August 17th, 2015 the market cap of the above mentioned: (click to enlarge) Source: Yahoo Finance Reminder: Transener and Petrolera Pampa stocks are only listed in the Merval Index, the market cap is expressed in Argentine Pesos -AR$-. Exchange rate as of August 17th: ARS/USD= 9.15. Updated quotes and market cap expressed in USD here . Scenario: Pampa Energía works in a highly distorted regulatory framework where frozen tariffs have led to a critical situation for the utility companies. From 2001 onwards the tariff was converted to AR$ and had practically no adjustments and no longer provides for a reasonable return on capital/assets. Full tariff reviews are pending. High inflation and regulated tariffs that took place since 2006 and 2001 respectively, have led to deep margin erosion for utility stocks. The Argentine utility stocks have underperformed their Latam and EM peers since 2001, these poor returns are explained by significant erosion in real electricity tariffs (frozen since 2001). Gross margin captured by utilities as a percentage of the GDP fall from 0.3% to 0.02%, setting the scope for a possible recovery in profits, if the upcoming political situation leads to a normalization of the current imbalances. For example, the comparison between the residential electricity cost in Argentina and regional peers shows clearly how distorted the public services tariffs are. (click to enlarge) Source: Pampa Energía. Subsidies for electricity and gas purchases cost the government around 4.5% of GDP, and the burden is growing. Some tariffs would need to triple or even be multiplied by seven times to reach market prices. With just a small correction, companies like PAM will perform better. A presidential election is coming in Argentina as of October 25, and the main contenders (Daniel Scioli, Mauricio Macri and Sergio Massa) have expressed its understanding about the need to lift some tariffs caps, in order to reduce the fiscal deficit, which is unsustainable at these levels. As the company’s aren’t capable of fulfilling the investment needs in electricity of the country, and several blackouts occur during the last quarters, the actual government is taking some measures to improve the situation. Two relevant facts take place during 2Q15 for Pampa Energía: 1) “SE Resolution No. 482/15: Increase in the Electricity Generation Remuneration Scheme On June 10, 2015, the Secretariat of Energy issued SE Resolution No. 482/15, in which it updates retroactively the remuneration for electricity generation as of February 2015 commercial transactions.” 2) “Gas Transportation Tariff Increase for Transportadora de Gas del Sur S.A. On June 8, 2015, the National Gas Regulatory Authority -ENARGAS- issued Resolution No. 3,347/15, which grants TGS a tariff increase for gas transportation and operation and maintenance fees of 44.3% and 73.1%, respectively, both retroactive to May 2015.” Source: Pampa Energía 2Q15. This and other measures have improved Pampa´s EBITDA and Profits. In the 2H15 : Consolidated sales revenues of AR$3,457.6 million ($378 million) for the six-month period ended on June 30, 2015, 18.4% higher than the AR$2,921.4 million ($319 million) for the same period of 2014. Adjusted consolidated EBITDA of AR$1,693.3 million ($185 million) for the six-month period ended on June 30, 2015, compared to AR$27.1 million ($9 million) for the same period of 2014. Consolidated profit of AR$1,365.1 million ($149 million) during the six-month period ended on June 30, 2015, of which a profit of AR$963.0 million ($105 million) is attributable to the owners of the company, compared to an AR$80.4 million loss (-$8.8 million) attributable to the owners of the company in the same period of 2014. With a market cap of $900 million, earnings per ADR in the 1H15 of $1.7, and foreseeable earnings of nearly $180 million a year, the forward P/E looks compelling. Just thinking about the replacement cost of its fixed assets, it´s easy to see how PAM is undervalued, and this is mostly caused by a regulatory environment which could improve soon. As a change in the government is approaching, it could be expected that some distortions will disappear, I´m not talking here about free market prices, as it´s “politically incorrect” to raise tariffs by 200% in a single move, but given the current situation, where PAM is trading at a forward P/E of 5, and making money under this difficult scenario, any improvement will boost earnings and improve the company´s situation. Risks: Currency risks are present since it’s widely expected that the new government will depreciate the local currency, but that depreciation will certainly include better tariffs for the utilities as the energy price is partly dollar linked as well as the importations of energy. Political risks are another factor to bear in mind, but as the current government deficit is unsustainable, some adjustments are needed. To conclude PAM is under the current conditions deeply undervalued, and that could increase if the pending integral tariff revision comes in place. If the Argentinean economy is going to improve, massive capex in the electricity sector would be needed, and PAM is in the better position to profit from that. Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in PAM over the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary Pampa Energía works in a highly distorted regulatory framework, where frozen tariffs have led to a critical situation for the utility companies. Even in this scenario Pampa Energía has managed to reach a price earning of 5 years. With a new government about to be elected, great improvements could be in the way. Pampa Energía S.A. (NYSE: PAM ) is the largest integrated electricity company in Argentina and through its subsidiaries participates in the generation, transmission and distribution of electricity, as well as natural gas transportation and production. (click to enlarge) Source: Pampa Energía. Pampa Energía owns indirectly: 84% of the generation assets. 26% of the transmission business (TRAN.BA). 52% of the distribution business with Edenor (EDN). 26% of the natural gas transportation business with Transportadora de Gas del Sur (NYSE: TGS )(pending government approval). 50% of the Oil and Gas exploration and production business with Petrolera Pampa (PETR.BA), associated with Yacimientos Petrolíferos Fiscales (YPF). As of August 17th, 2015 the market cap of the above mentioned: (click to enlarge) Source: Yahoo Finance Reminder: Transener and Petrolera Pampa stocks are only listed in the Merval Index, the market cap is expressed in Argentine Pesos -AR$-. Exchange rate as of August 17th: ARS/USD= 9.15. Updated quotes and market cap expressed in USD here . Scenario: Pampa Energía works in a highly distorted regulatory framework where frozen tariffs have led to a critical situation for the utility companies. From 2001 onwards the tariff was converted to AR$ and had practically no adjustments and no longer provides for a reasonable return on capital/assets. Full tariff reviews are pending. High inflation and regulated tariffs that took place since 2006 and 2001 respectively, have led to deep margin erosion for utility stocks. The Argentine utility stocks have underperformed their Latam and EM peers since 2001, these poor returns are explained by significant erosion in real electricity tariffs (frozen since 2001). Gross margin captured by utilities as a percentage of the GDP fall from 0.3% to 0.02%, setting the scope for a possible recovery in profits, if the upcoming political situation leads to a normalization of the current imbalances. For example, the comparison between the residential electricity cost in Argentina and regional peers shows clearly how distorted the public services tariffs are. (click to enlarge) Source: Pampa Energía. Subsidies for electricity and gas purchases cost the government around 4.5% of GDP, and the burden is growing. Some tariffs would need to triple or even be multiplied by seven times to reach market prices. With just a small correction, companies like PAM will perform better. A presidential election is coming in Argentina as of October 25, and the main contenders (Daniel Scioli, Mauricio Macri and Sergio Massa) have expressed its understanding about the need to lift some tariffs caps, in order to reduce the fiscal deficit, which is unsustainable at these levels. As the company’s aren’t capable of fulfilling the investment needs in electricity of the country, and several blackouts occur during the last quarters, the actual government is taking some measures to improve the situation. Two relevant facts take place during 2Q15 for Pampa Energía: 1) “SE Resolution No. 482/15: Increase in the Electricity Generation Remuneration Scheme On June 10, 2015, the Secretariat of Energy issued SE Resolution No. 482/15, in which it updates retroactively the remuneration for electricity generation as of February 2015 commercial transactions.” 2) “Gas Transportation Tariff Increase for Transportadora de Gas del Sur S.A. On June 8, 2015, the National Gas Regulatory Authority -ENARGAS- issued Resolution No. 3,347/15, which grants TGS a tariff increase for gas transportation and operation and maintenance fees of 44.3% and 73.1%, respectively, both retroactive to May 2015.” Source: Pampa Energía 2Q15. This and other measures have improved Pampa´s EBITDA and Profits. In the 2H15 : Consolidated sales revenues of AR$3,457.6 million ($378 million) for the six-month period ended on June 30, 2015, 18.4% higher than the AR$2,921.4 million ($319 million) for the same period of 2014. Adjusted consolidated EBITDA of AR$1,693.3 million ($185 million) for the six-month period ended on June 30, 2015, compared to AR$27.1 million ($9 million) for the same period of 2014. Consolidated profit of AR$1,365.1 million ($149 million) during the six-month period ended on June 30, 2015, of which a profit of AR$963.0 million ($105 million) is attributable to the owners of the company, compared to an AR$80.4 million loss (-$8.8 million) attributable to the owners of the company in the same period of 2014. With a market cap of $900 million, earnings per ADR in the 1H15 of $1.7, and foreseeable earnings of nearly $180 million a year, the forward P/E looks compelling. Just thinking about the replacement cost of its fixed assets, it´s easy to see how PAM is undervalued, and this is mostly caused by a regulatory environment which could improve soon. As a change in the government is approaching, it could be expected that some distortions will disappear, I´m not talking here about free market prices, as it´s “politically incorrect” to raise tariffs by 200% in a single move, but given the current situation, where PAM is trading at a forward P/E of 5, and making money under this difficult scenario, any improvement will boost earnings and improve the company´s situation. Risks: Currency risks are present since it’s widely expected that the new government will depreciate the local currency, but that depreciation will certainly include better tariffs for the utilities as the energy price is partly dollar linked as well as the importations of energy. Political risks are another factor to bear in mind, but as the current government deficit is unsustainable, some adjustments are needed. To conclude PAM is under the current conditions deeply undervalued, and that could increase if the pending integral tariff revision comes in place. If the Argentinean economy is going to improve, massive capex in the electricity sector would be needed, and PAM is in the better position to profit from that. Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in PAM over the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News